Inflation threat leads hospital investment managers to proceed with caution

Investments often take a double hit from inflation, lowering stock market performance and raising interest rates.

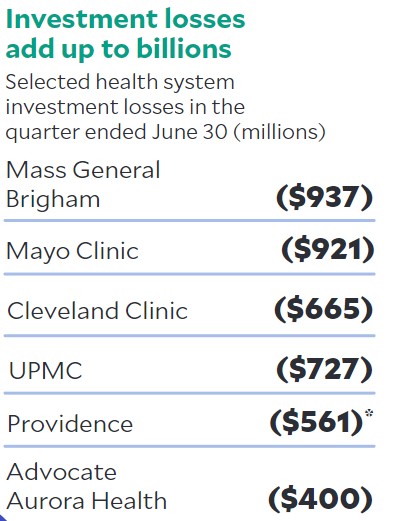

The emergence of price inflation is giving health systems trouble beyond rising supply and wage expenses in the form of negative investment returns and higher borrowing costs.

The CARES Act, a rising stock market and low borrowing costs for a time helped shield hospitals’ investments from the pandemic to a degree. However, as inflation drags on, those balance sheet gains are eroding, and hospital leaders are forced to invest and borrow with greater caution.

“Inflation is negatively affecting non-operating revenue, which is based largely on market returns,” said Brian Esser, principal for the Skokie, Illinois-based consultancy Sg2. “It is also causing hesitancy among hospital leadership to deploy capital on strategic initiatives, as it’s unclear where claims on capital may come from given the frothy environment.”

June 30 and three-month results for period ended March 30.

Source: Health system financial statements

Maintaining resiliency through the current inflationary environment will mean that most hospitals need to rethink their investment strategies. Investment performance this year has been poor, with the S&P 500 stock index returning a negative 17% year-to-date through August, which is reflected in some large health systems’ latest financial filings.

Many hospitals now are working to establish gains on the operations side to help recoup any losses on the investment side, said Kerry Jessani, head of healthcare, higher education and non-profit banking for the middle market banking and specialized industries business at New York-based JPMorgan Chase. But inflation continues to make that prospect difficult.

At MedStar Health, making decisions about building renovations or equipment replacement has become a stringent process of ranking projects.

“We’ve always had a good process of prioritizing, but it’s tighter now,” said Susan K. Nelson, CFO at MedStar Health. “Available capital is tight, and with long delays, undertaking capital projects can cost more and take longer. We think it’s still important to grow and expand in areas of community need, but we have to be very deliberate about the projects in which we choose to invest.”

For example, it will be important for hospital systems to preserve liquidity in order to keep operations going in the event of a downturn, Esser said. Those with strong balance sheets may be able to take advantage of opportunities to invest in distressed assets such as physician groups, real estate and digital tools that might be available at a discount.

Rethinking investment strategy should be done in concert with a risk-return exercise to define what portion of capital should be deployed for alternative revenue-creation efforts and how much risk the organization is willing to assume within that portfolio of work.

which is based largely on market returns.”

— Brian Esser

Credit effects

Credit rating agencies are paying attention. The impact of ongoing inflation on hospitals’ bottom lines could eventually affect bond ratings.

“Inflation will definitely be part of the conversation about credit ratings, specifically around margins,” Jessani said. “As the margin gets squeezed, hospitals lose their investment dollars that they could invest back into the hospital.”

Borrowing costs have risen along with the Federal Reserve’s interest rate hikes. Yields on the municipal bond benchmark 30-year municipal market data climbed 150 basis points to 2.89%, according to Kaufman Hall.

Fitch Ratings said that the vast majority of its rated hospitals and health systems have strong balance sheets that will offset lower margins for a time, according to a news release from the credit rating agency.a Fitch also noted, however, “Without more substantial changes to the current business model, or with additional coronavirus surges this fall or winter, this balance sheet cushion could eventually erode, which would lead to negative rating actions.”

investment dollars that they could invest back into

the hospital.”

— Kerry Jessani

While a change to bond ratings is eventually possible, it is not imminent for most hospital systems.

“Everyone takes a long-term view because hospitals have successfully weathered so many crises in the past, such as COVID and the economic downturn,” Jessani said. “No one is going to say, ‘Oh, you missed a quarter or two, so we’re dropping your rating.’ Nobody’s rushing to that because hospitals have shown resiliency and the ability to alter their cost structures when needed.”

Hospital investments include those that drive nonoperating revenue, such as equity positions or real estate, as well as those the system intends to make in footprint-, digital- or workforce-related assets, Esser said. And inflation is having a negative impact on both types of investments.

“Utilization interruptions, coupled with higher wage demand and unpredictable events like cybersecurity breaches, make a conservative capital deployment strategy prudent at this time,” Esser said. To minimize the risk of inflation on nonoperating revenue, Esser recommended that hospitals focus on what is needed to recover their margins. It may be valuable to focus on operational improvements and invest in alternative services to increase revenue diversification.

“Doing so will lessen dependency on equity or real estate returns, which are outside the systems’ control, while diversifying revenue streams away from the clinical core, which will continue to be at the mercy of payer mix degradation, pricing pressure or utilization interruptions,” Esser said.