How to develop a winning pricing strategy in the post-COVID-19 consumer market

Price transparency mandates imposed by the U.S. Department of Health & Human Services will require providers and health plans to develop comprehensive pricing strategies tailored to their specific market positions, financials and operational objectives.

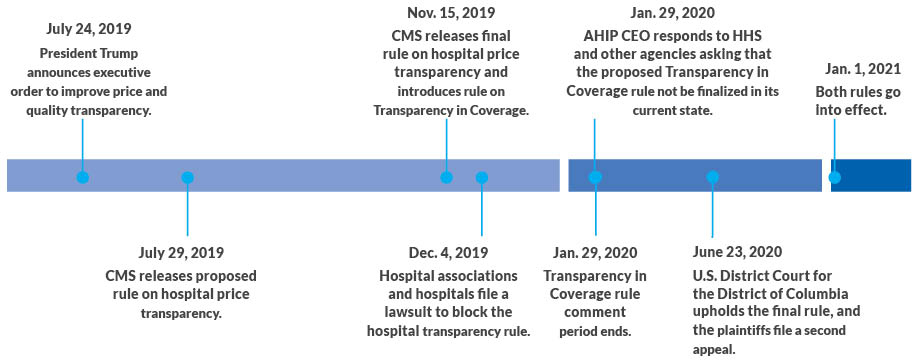

Healthcare is on the verge of a new era of price transparency and a value revolution for providers, health plans and patients. On Nov. 15, 2019, the Department of Health and Human Services (HHS) posted a final rule on Hospital Price Transparency and a proposed rule on Transparency in Coverage for health plans, which are set to take effect Jan. 1, 2021.a These new rules require unprecedented levels of transparency of negotiated rates, which will have far-reaching impacts on the healthcare system now and in the post-COVID-19 healthcare market. Providers and health plan executives should fully understand how their organizations will be affected and how best to prepare to take advantage of this looming disruption.

Timeline of events

Source: BDC Advisors, 2020

It is important to note that the hospital price transparency rule has faced a legal challenge, which as of Aug. 28, 2020, was continuing through an appeals process after a federal court ruled in favor of the rule on June 23.b And there may be legal challenges to the insurance coverage transparency rule, as well. Whether or not one of these challenges is successful, however, the market is moving toward greater transparency of price, quality and service, so providers and health plans should proactively prepare.

By developing a thoughtful, comprehensive approach to strategic pricing, providers and health plans can solidly position themselves to grow market share and achieve long-term success in this new era of consumerism and transparency

Implications for providers

The new rules and general market trends have six important implications for providers.

1. Increased pricing visibility will expose substantial price variations among providers. This creates a need for hospitals and health systems to focus on defining and communicating their consumer value proposition. News stories will likely present providers in a negative light across major metro markets. Health plans will be motivated to portray providers as the cause of this situation. Therefore, as they make their negotiated rates publicly available, health systems will need to focus on sharpening and delivering on their value propositions for consumers, including individuals and employers.

Marketing and branding teams will need to develop their organization’s value story, which will likely center on the key attributes of clinical quality for overall performance and specific episodes, patient service and experience and price position. Further, health systems will need to increase their focus on and potentially redefine their consumer value proposition and develop plans to execute on this promise.

2. Health systems will need to deploy strategic pricing to maintain and strengthen their market position. Health systems will have to develop a more nuanced pricing strategy to address the issue of significant price variability among providers in their area and ensure continued success in an increasingly value-focused market.

For example, a health system with a 20% overall unit rate premium in a market is likely to have certain services that are priced close to market averages and other services that are priced well above market averages. As a result, the health system will need to make strategic decisions on which services should be priced at market and which services should be priced above market. How effectively the health system recalibrates price by services — based on size, growth potential, price relative to market and price elasticity — will help decide who wins and loses market share in the coming years.

3. Providers will experience unit rate compression, and most of this rate movement will be price declines. With the veil of negotiated rates lifted, health plans will be able to show how their payment rates compare with those of competing health plans in the market. As a result, health systems with rates above the market average will be under pressure to accept lower prices during negotiations and will likely experience unit rate compression. Select health systems with prices below market averages will have an opportunity to negotiate rate increases depending on local market dynamics. All providers should pursue strategic pricing to mitigate rate compression and to take advantage of volume growth opportunities.

4. Providers should prepare for expanded efforts to implement reference pricing. Given the impact of COVID-19 on the economy, employers will grow increasingly willing to pursue reference pricing strategies as part of business recovery plans to control healthcare costs.c

Reference pricing is a well-established tool with significant medical expense savings potential and well-understood implementation pathways. The California Public Employees’ Retirement System (CalPERS) and the grocery chain Safeway have both had success with these approaches. Employers that pursue reference pricing across only the set of services included in the CalPERS and Safeway programs could drive a 2.5% to 3.0% reduction in commercial medical expense.d It is imperative that providers understand the scope of services likely to be subject to reference pricing. Such information will be an important factor in developing a strategic pricing strategy.

5. Highly profitable commercial volume and market share will shift, likely from higher-priced organizations to lower-priced ones. This shift will depress the financial performance of many health systems. Health system financial performance is highly dependent on maintaining the right proportion of commercial business. With commercial lives shrinking as a share of population in most markets nationally, largely because of the COVID-19 crisis, the competition for commercial lives has become more intense. Price transparency may help it reach a fever pitch. Market shifts in commercial volume from higher-priced to lower-priced health systems will deteriorate the financial performance of health systems on the wrong side of the volume shifts. Academic health systems may find these moves particularly challenging as they rely on clinical revenue to fuel research and educational missions. According to our internal analysis, for the average health system, a 4% to 7% drop in commercial volume will result in a one percentage point reduction in operating margin (e.g., an operating margin of 2.0% moves to 1.0%).

6. Centers of Excellence (COE) strategies will become an important vector for volume growth. Publicly available pricing data will accelerate the development and adoption of COE programs. Employers will recognize competitive price points of high-quality providers and demand COE programs on a regional and national basis. COE strategies will be a key enabler for providers seeking to secure increases in commercial volume. The organizations that win with COE strategies will likely do so by:

- Engaging clinical leadership to quickly gain experience in developing bundled payments

- Developing the foundational cost and quality analytics to demonstrate and communicate results

- Aligning benefit design with the COE program

- Cultivating strong business relationships with leading employers and health plans

Hospital price transparency final rule requirements

1. Publicly disclose all standard charges

- Standard charges must be disclosed for each item and service, as well as service packages.

- “All standard charges” includes gross charges, payer-specific negotiated charges, discounted cash prices and both minimum and maximum negotiated charges.

- Information required includes code for the item or service, a description of the service, the service setting (e.g., hospital, outpatient hospital department) and each hospital location if the standard charges differ.

- Disclosure must be updated annually into a single digital file that is in a machine-readable format and displayed on a publicly available website.

2. Publicly display shoppable services

- Shoppable services must be separately reported from the standard charge disclosure.

- Standard charges (except for gross charges) must be reported for 300 shoppable services, including ancillary services that the hospital customarily provides in conjunction with the primary shoppable service.

- CMS specifies 70 of the 300 services; the remaining 230 are left to the provider’s discretion.

- Hospitals can choose their consumer-friendly format.

- Disclosure must be updated annually and displayed on a publicly available website.

Compliance

- If CMS finds noncompliance with one or more of the requirements to make standard charges public, it can impose a monetary penalty of up to $300 a day.

- CMS will publicly display the hospital’s noncompliance on a CMS website.

Source: BDC Advisors, 2020

Implications for health plans

Many of the considerations for providers in responding to the mandate for price transparency apply similarly to health plans. With negotiated rates publicly available, health plans also will need to focus on sharpening and delivering on their value propositions. In short, they will need to pursue differentiated consumer value propositions focused on all aspects of the quadruple aim (access, cost, quality and experience). Here are six key implications for health plans of the regulatory move to transparency.

1. Employers will be galvanized by the variability in negotiated rates, which will motivate health plans to negotiate more stiffly with providers. It will also sharpen the health plans’ focus on their value proposition for purchasers and members. In addition to being galvanized to action by price differentials for providers within plans and across health plans, employers will demand a more rational pricing structure for services. Health plans will likely seek to frame this as an issue they have been unable to address, despite their best efforts, because of the providers who are essential for their networks. Health plans will be able to effectively renegotiate with providers, and the pricing variability for specific services will compress to more reasonable bands. Successful health plans will be able to develop a strong and differentiated consumer value proposition. The role health plans play in supporting patients navigating a complex healthcare system will be emphasized as points of differentiation.

2. Health plans will need to deploy strategic pricing and alternative sites of care to ensure continued success. Health plans will need to understand how each of their providers’ negotiated rates compare with those of their competitors in the market. This foundational information will enable health plans to make critical decisions in pricing strategy. The essential guardrails for health plans in negotiations will be determining which services they should push for lower rates and which services they would pay a premium for by provider. Opportunities to guide patients to high-value, alternative sites of care using benefit design and patient incentives will need to be well-understood.

Further, future reference pricing opportunities will need to be considered in negotiating rates with providers. Health plans with existing unit-rate advantages in their markets, such as most major Blues plans, should expect these differentials to narrow and will need to find new ways to differentiate with purchasers.

3. The medical loss ratio (MLR) rebate exemption presents an important opportunity for creating value. The Transparency in Coverage proposed rule would allow health plans to count patient incentive payments provided for shopping for low-cost, high-value providers against their MLR rebates. This policy change further motivates health plans to pursue a strategic initiative most are already pursuing by amplifying the ROI from these incentive programs for plans close to the MLR thresholds. In many markets, health plans are already aggressively leveraging procedures requiring prior authorizations as an opportunity to efficiently direct patients to high-value providers. Health plans will be able to couple the required standard-charge disclosures with quality information and patient-incentive programs to enable patients to identify high-value providers and receive the high-value care they can deliver.

4. Health plans will likely compress provider rates, and the majority of this movement will be in rate reductions. Health plans will now be able to compare their provider-negotiated rates with those of competing health plans in the market. Providers will need to justify significant price differentials or see them dissipate. In many situations, health plans will seek and obtain reduced rates for providers with higher-than-market-average rates. Although, as noted previously, price transparency will enable most health plans to compress provider rates to more reasonable ranges for various services, health plans with the most competitive payment rates may experience upward pressure on rates, which will cause their favorable unit-rate position to deteriorate.

5. Reference pricing will be an important tool to develop and deploy as employers grow more receptive. Reference pricing has been a successful approach to reduce healthcare spending and improve quality. Despite successful examples, employers are often reticent to adopt reference pricing because of the inherent constraint it puts on employee choice. When the business cycle turns and employers grow more receptive to reference pricing, health plans should be prepared to pursue such initiatives. From a strategic pricing perspective, health plans should identify service segments where they are likely to use reference pricing in the future and be more willing to give higher rates in these segments in the short term. Over the longer term, health plans will be able to optimize rates in these segments through reference pricing strategies.

6. Health plans will need to develop the right infrastructure to take customer service to the next level. The proposed coverage transparency rule requires health plans to have online price search tools that inform members of their out-of-pocket costs for healthcare services. Health plans will need first to ensure their existing tools are compliant with CMS regulations, which may require substantial infrastructure development. Payers also should be prepared for an increase in customer service inquiries related to the ‘new information’ available on financial responsibility. To truly take advantage of this regulatory change and the MLR rebate exemption, health plans will want to enable members to seek high-quality, cost-effective care using tools that include price and quality information as well as streamlined scheduling and administrative functions for patients accessing high-value providers’ COEs.

Transparency in Coverage rule requirements for health plans

1. Provide information to participants, beneficiaries and enrollees

Health plan are required to provide patients with the following as both an internet tool and a paper document:

- Cost-sharing liability, including deductibles, coinsurance and copayments, for a “covered item or service”

- Accumulated amounts toward deductible and/or out-of-pocket limits

- Negotiated rate (if it has an impact on the patient’s cost-sharing liability)

- Out-of-network allowed amount

- Items-and-services content list when the information is for items and service

subject to a bundled payment - Notice of prerequisites to coverage (e.g., concurrent review, prior authorization)

- Disclosure notice regarding what out-of-network providers may bill

2. Publicly disclose health insurance coverage information

Health plans are required to provide:

- The name and identifier of the health plan

- Billing codes

- Negotiated in-network rates

- Out-of-network allowed amounts

CMS expects that third-party companies will help to aggregate and leverage this data.

3. Proposed amendment to the Medical Loss Ratio Program

Health plans that encourage consumers to shop for services from low-cost, high-quality providers can include incentive payments to members as medical expense in their MLRs.

This option provides a finance incentive for health plans to implement patient incentive programs.

Source: BDC Advisors, 2020

Implications for patients and consumers

The new CMS price transparency rules represent a critical first step in providing price transparency for patients. The market environment is ripe for change, and health plans are poised to support patients interested in shopping for high-quality, cost-effective care. First, however, providers and health plans must make necessary changes that enable patients to access high-value care.

Health plans: Provide information on quality. To support patients identifying and accessing high-value providers and care, health plans will need to go beyond the CMS rules and provide patients not only with pricing information (e.g., patient out-of-pocket responsibility) but also with relevant quality information (e.g., hospital, episode level). If patients receive only price information, many patients will be likely to use price as an indicator of quality.e

Health plans: Offer incentive plans for patients. Once the relevant price and quality information are available, employers and health plans can increase the likelihood that patients will shop for service through a range of patient incentive plans including patient rebates (e.g., cash payment or gift cards) to reference pricing strategies. The medical loss ratio (MLR) rebate policy is designed to support health plans in pursuing this type of strategy by including patient incentive payments as part of a health plan’s MLR.f Success will depend not only on having the right tools, but also on proactively seeking to engage with patients on these issues (e.g., outbound phone calls based on prior authorizations).

Health plans: Help patients access high-quality care. Patients stand to benefit significantly as health plans deploy strategies focusing on enabling them to find and access high-value care. Health plans will garner substantial financial benefit from patients accessing high-value care, which will be an important accelerant to this transition. Strategic pricing will play a critical role in this market change for health plans and providers.

Providers: Focus on managing costs and delivering lower-cost care. To be competitive in a market with price transparency, health systems must both aggressively manage their costs and accelerate transition of surgical and diagnostic services from the hospital campus to lower-cost ambulatory community settings. By not doing so, they risk losing market share to lower-cost providers or the disruptive, venture-backed ambulatory start-ups that are entering many markets.

Providers: Complete the transition to virtual care. Providers that have been perched on the edge of virtual care during the pandemic will need to make the transition permanent and adapt to the desires of consumers who are growing comfortable using virtual platforms for communications around routine well-care and uncomplicated sick-care. Primary care and cognitive specialties are likely to be organized differently, allowing physicians to leverage technology to effectively care for larger numbers of patients.

Strategic pricing approach

To realize the market opportunities in today’s consumer-driven healthcare industry, providers require a pricing strategy that gives them an advantage in appealing to consumers, who can now shop for health plan products and make choices among different providers for healthcare services. Similarly, to maintain competitive medical expense trends and enable the use of alternative sites of care, health plans require a pricing strategy that appropriately reimburses providers for the value they are delivering to patients at a specific service and location level.

Strategic pricing begins with both providers and health plans determining optimal pricing adjustments at a specific service level (i.e. service line, sub-service line, code level). The optimal pricing changes should achieve near-term financial targets for each payer or provider and preserve long-term financial performance. Strategic pricing allows an organization to address pressures both internally and externally across the market that could threaten its market position.

A healthcare organization’s success in a consumer-focused healthcare environment hinges on its ability to develop and execute on a strategic pricing strategy. An essential preliminary step is to conduct a strategic pricing assessment focused on ascertaining the organization’s relative ability to optimize prices for various services, providers and sites. As suggested previously, this evaluation includes four fundamental factors with respect to each service being analyzed (see the exhibit below).

- Size

- Growth

- Price elasticity and patient steerage

- Price positions

Strategic pricing factors for a healthcare providers and health plans

Factors |

Provider perspective |

Health plan perspective |

|

Size |

Value of the service to the provider in terms of revenue and margin |

Impact of service on medical cost |

|

Growth |

Expected growth of service for market and provider |

Expected growth of service for market and provider |

|

Price elasticity and patient steerage |

Price elasticity based on service “shoppability” and the provider’s distinctiveness |

Ability to steer patients to high-quality, cost-effective providers for service |

|

Price position |

Provider price position relative to market averages and key competitors |

Provider price position relative to competitors and alternative sites of care |

Source: BDC Advisors, 2020

Any comprehensive pricing strategy should be tailored to the organization’s specific market position, financial and operational objectives. Developing and implementing a pricing strategy requires foundational market analysis and financial analysis. The exhibit below describes the key actions providers should pursue in their work plan for developing a pricing strategy.

Pricing strategy workplan

Perform market analysis

- Profile health plan trends, including premium prices, network design, patient benefit design, patient incentive programs, reference pricing initiatives and financial performance.

- Evaluate provider trends, including market-volume growth by payer segment and payer, market-share trends by payer segment and payer, impact of new market entrants and financial performance.

- Assess price elasticity and patient steerability by service and location.

- Identify and prioritize consumer-driven market opportunities and threats.

Conduct financial analysis

- The goal for providers is to understand service and site-level financial data, including revenue, cost (variable and fixed) and margin.

- The goal for health plans is to determine the financial opportunity from alternative sites of care initiatives and reallocation of pricing services.

Develop pricing strategy

- Develop guiding principles for pricing strategy.

- Align pricing strategy with organizational goals (e.g., department and business-unit goals, strategic initiatives).

- Socialize pricing strategy and P&L specific budget impacts with key internal stakeholders.

- Define approach to reallocating revenues and medical expense based on outcomes of strategic pricing assessment.

- Define payer-/provider-specific rate actions.

- Generate contract rate sheets for each payer/provider.

Guiding questions

The final hospital price transparency rule and the proposed coverage transparency rule, combined with an increasing level of consumerism, will force providers and health plans to sharpen their focus on delivering value to patients/members to maintain and improve their market position. Even if these rules do not go into effect as planned on Jan. 1, 2021, increased transparency of price, quality and service is coming.

Providers and health plans will be best served by proactively refining their consumer value proposition and developing a strategic pricing strategy. The risk of being caught flat-footed amidst these changes is real and can quickly erode an organization’s market position and financial performance. As provider and health plan executives consider what actions their organizations need to pursue to ensure long-term success, they should consider a series of important questions:

Value proposition. What is our organization’s current value proposition, and how should it evolve in light of increased transparency? What capabilities do we need to develop to deliver on this value proposition? What is our game plan to articulate and deliver on this proposition to patients/members?

Strategic pricing. How do our prices compare with those of competitors at the service level? How should we adjust prices for specific services to optimize our organization’s market position and financial performance? How should this price adjustment vary across different sites of care?

Alternative sites of care. What is the trajectory of alternative sites of care in our market? How quickly will alternative sites of care grow because of patient choice and health plan steerage efforts? What price levels should be targeted for services at alternative sites of care and competing traditional sites of care?

Benefit Design. What is the trajectory of benefit design and patient incentive programs? What is the expected impact of these changes in driving patients to high-value sites of care and providers? How might health plans accelerate this shift, and what should providers do to respond?

Reference Pricing. What is the anticipated employer appetite for reference pricing in my local market? What services could be reference priced and how should we approach this set of services in establishing target prices for negotiations?

COEs. Does my organization have the capabilities needed to effectively pursue a COE strategy? How can such a strategy be leveraged to maintain or even grow commercial volumes regionally and nationally?

Footnotes

a Department of Health and Human Services (HHS), “Medicare and Medicaid Programs: CY 2020 Hospital Outpatient PPS Policy Changes and Payment Rates and Ambulatory Surgical Center Payment System Policy Changes and Payment Rates. Price Transparency Requirements for Hospitals To Make Standard Charges Public,” Federal Register, Nov. 27, 2019; and IRS, Department of the Treasury, and HHS, “Transparency in Coverage,” Federal Register, Nov. 27, 2019.

b Zimmerman, E., et al., “Federal district court upholds Hospital Price Transparency Rule; implementation and compliance questions remain,” The National Law Review, Aug. 18, 2020 .

c Reference pricing in healthcare is an insurance benefit design being extended into new patient populations and therapeutic categories in which an insurer or large self-insured employer or labor union group selects a price it is willing to pay a provider for a specific healthcare service, such as hip or knee replacement, or retail patient-administered drugs. Enrollees who obtain care from a provider at or below the negotiated reference price pay only the normally required cost sharing (e.g., deductibles and co-pays). Enrollees obtaining care from a higher-priced provider also pay the difference between the reference price and the allowed provider charge. Under reference pricing, consumers have access to low-cost drugs in each therapeutic category for nominal co-pays but are charged the full difference in price if they or their physicians select more expensive therapeutically equivalent products.

A reference pricing system is designed to encourage consumers to seek care at lower-cost providers, and it can exert pressure on providers to reduce their prices. According to data from the Health Care Cost Institute (2013-2015), “Shoppable Services” in which consumers are in a position to choose their provider based in part on price, account for 43% of all healthcare spending.

d Robinson, J.C., Brown, T.T. and Whaley, C., “Reference pricing changes the ‘choice architecture’ of health care for consumers,” Health Affairs, March 2017; Sinaiko, A.D. and Rosenthal, M.B., “Increased Price Transparency in Health Care – Challenges and Potential Side Effects,” New England Journal of Medicine, March 11, 2011; HealthCare Cost Institute, 2017 health care cost and utilization report, February 2017.

e Sinaiko, A.D, and Rosenthal, M.B., “Increased price transparency in health care — challenges and potential effects,” The New England Journal of Medicine, March 10, 2011.

f See IRS, “Medical loss ratio (MLR) FAQs,” Page last reviewed or updated on April 3, 2020.