Ripple effects of the pandemic on the move toward value

Sponsored by InterSystems

Insight from an HFMA executive roundtable shows that COVID-19 could be a “triggering event” that accelerates adoption of value-based payment.

What happens when provider revenue largely depends on patients receiving in-person treatment, but patients can no longer walk into a healthcare facility for care?

It’s a situation most hospitals and health systems have struggled with during the pandemic.

Because the majority of healthcare payment continues to be based on a fee-for-service payment model, “when demand for in-person care dries up, fee-for-service presents challenges for providers, financially,” said Lynda Rowe, senior advisor, Value-Based Markets, InterSystems.

Although the percentage of value-based payments from commercial insurers rose to 53% in 2017 — up from 10.9% in 2012 — most of these payments were based on a fee-for-service model. Just 6% came from value-based models in which providers take on downside risk.a

Now, as healthcare organizations navigate their “next normal” following the coronavirus outbreak this past springb, some leaders have begun to wonder: Will the pandemic accelerate the shift to value-based payment?

“COVID-19 really left healthcare organizations that relied on fee-for-service payment with very little in terms of incoming revenue streams,” Rowe said. As providers that participated in per member per month models continued to record cash flow during the first months of the pandemic, “The rest said, ‘It really would have helped our margin if we had seen continuous funding coming in through a capitated model.’”

In this HFMA executive roundtable, seven executives for health systems and health plans share how the pandemic has impacted their organization’s move toward value — and what it will take to foster transparency and trust under these models.

Has the COVID-19 pandemic changed your organization’s plans around participating in or offering value-based payment models?

Michael Funk, Vice President, Office of the CMO, Humana: I think the COVID-19 pandemic has the potential to be that propellant to perhaps push value-based payment model adoption much more aggressively than the government has up to this point. One of the things that we may be underestimating is that Medicare insolvency could occur as early as 2023 — three years earlier than projected by the Medicare trustees — due to the financial impact of COVID-19, according to recent reports. Given the national debt, once we come outside of this pandemic and we realize the spending that has taken place, I think there is going to be an extreme amount of pressure on the federal government to do something. The other thing that we have seen is the split between the cash flow that our capitated providers saw under risk-based arrangements during the first months of the pandemic, when patients were unable to receive elective care and the struggle that many of our fee-for-service providers faced. There is a better realization of the benefits of a capitated model, and we have found more interest from our providers on that front.

The other thing that we saw emerge from the pandemic was greater recognition of the importance of addressing social determinants of health. During the pandemic, disparities in health outcomes often occurred when social determinants of health, such as inability to access food or struggles with loneliness, were not addressed. When the COVID-19 outbreak occurred, providers under risk-based arrangements immediately reached out to their vulnerable populations to address patients’ holistic care needs. That is not to say that these efforts weren’t taking place in the fee-for-service world, but providers under risk-based arrangements understand their most vulnerable populations very well and were especially effective in designing care interventions that met their needs.

Kelly Hamilton, CEO, The Ohio State University Health Plan: What I’ve seen is that there was so much change that the pandemic brought about, operationally, in a short period, especially in getting telehealth services established. There’s an enthusiasm around taking the lessons learned from this experience and changing care delivery for the better. As we look at our expenses during the pandemic and consider ways that care can be delivered more efficiently, there are new opportunities to engage a lot of people in the discussion around value and a desire for change, especially when it comes to addressing disparities in care and social determinants of health.

Tripp Shubert, Vice President, Bon Secours Mercy Health: Prior to the pandemic, the pace of the shift toward value-based payment models was described as “glacial” by another leader in the field. I don’t know the extent to which the pandemic or other economic events will be a burning platform to accelerate the pace of change, but I expect that the pandemic will lead to increased adoption of value-based payment models. I’m curious to hear other providers’ thoughts on whether this could be a triggering event.

Martin D’Cruz, Vice President, Managed Care and Value-Based Care, Baptist Health System — Kentucky & Indiana: We’re doubling down on value-based care initiatives with attributed lives from Medicare Advantage plans. I think one of the biggest challenges we faced because of COVID-19 was that so much was put on hold. Now, we’re trying to accelerate initiatives with our patients around health and wellness. We’re actively reaching out to chronically ill patients with multiple comorbid conditions so that we can really manage this population after two months of more limited programming.

Mark Meyer, CFO, UT Southwestern Medical Center: One of the things we’re looking at is how to expand our reach virtually using telehealth, both to drive expansion and improve value. By and large, our patients like telehealth: We ranked in the 99th percentile for patient satisfaction relative to telehealth visits during the pandemic. What we haven’t determined is whether telehealth results in the same amount of inpatient or outpatient procedures. Since our ambulatory clinics have opened back up, we are running about 100% of our previous volume, but 25% of the work is now virtual. In terms of using telehealth to manage vulnerable populations, we have a Next Generation ACO that is jointly owned with our partner in Dallas-Fort Worth. We’ve got a lot of ideas, but we’re still gathering data, so a lot of our decisions are still up in the air.

We’re also looking at accelerating the shift toward non-hospital-based activities — enabling patients to receive care in the home, for example, and empowering them to receive care in their community rather than having to drive to Dallas for care. This will expand our reach and our presence and the way in which we provide care. Payers are directing patients to these models for obvious reasons. What we don’t know — and we have competing theories around this — is whether the pandemic will accelerate the shifting toward non-hospital-based activities.

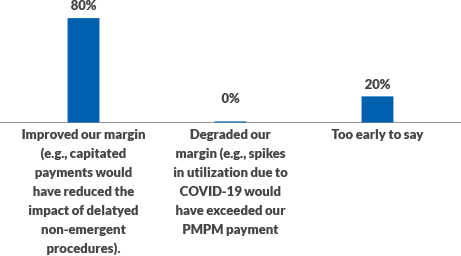

Estimating the Impact of Value-Based Payment During COVID-19

If capitation comprised a greater proportion of your payment mix, what impact would this have had on your operating margin during the first months of the pandemic?

Source: InterSystems poll of HFMA executive roundtable participants.

What are the biggest challenges today having an open dialogue with your payer or provider partner when it comes to risk-based contracting?

Carla Neiman, CFO, Clark Fork Valley Hospital: We’re a small critical access hospital in a rural area. We don’t have the financial resources or the population in our area to absorb risk on our own. So when we look at value-based care, we’re doing it in a consortium. We actually participate with the National Rural ACO right now and are preparing to move to the risk-based track in that model, and that is successful for us.

We also participate with a PHO. I’m on their board, and we’ve had discussions with one of our in-state insurance companies about trying to move toward clinical integration and value-based contracting. And that’s been really difficult. The biggest challenge I see in these discussions is that this particular player doesn’t really seem prepared to make that transition to value-based payment. They are still more focused on the price variation in the market and bringing down their costs in a discounted fee-for-service world. I think that’s probably just the nature of our undeveloped market in Montana.

Funk: I would say probably the greatest challenge is the magnitude of the distraction going on around the pandemic. Beyond that — to be completely transparent — there’s still a great deal of trust that stands in the way of formulating value-based arrangements, along with the need for education. Then there’s the human capital required to implement and manage these models as well as to monitor the impact from a clinical and financial perspective. That’s clearly an issue.

We also have to think about the ways in which the magnitude of this pandemic changes people’s views on how they wish to interact with healthcare professionals going forward. I know for my own self, I’ve become very uncomfortable in crowds, especially if the people around me aren’t wearing masks. This raises the question: How do we begin to think about alternative care settings, where the environment is less congested and offers easy-in, easy-out service? The explosion of telehealth adoption is a triggering event for alternative settings and a focus on the value that can be delivered when care is more convenient to access.

Hopefully, it’s going to be cheaper and more efficient to deliver better outcomes for patients. In a fee-for-service world, that could be an incentive to move to a value-based model of care.

Rowe: Payers and providers talk a lot about trust: “Do I trust my partner to work with me on this?” That is probably one of the biggest obstacles to overcome when it comes to the shift toward risk-based contracting.

Chad Mulvany, Director, Healthcare Finance Policy, Strategy, and Perspectives, HFMA: I think one of CMS’s greatest missed opportunities through the pandemic are in regard to the expansion of telehealth services and the fact that CMS didn’t go all the way with a hospital-at-home model. We’ve seen some integrated systems that have Medicare Advantage plans associated with them, like Marshfield, Presbyterian and Mount Sinai, experiment with hospitals in this area, and I think it’s probably not coincidental. We’ve also seen Intermountain announce that it will roll out an expanded in-home care offering — Intermountain obviously has a large health plan, with a corporate umbrella — and Mayo Clinic just announced it will do something similar. So I suspect that folks aren’t going to wait for things like the payment system to catch up and try to figure out where they can structure relationships that improve value.

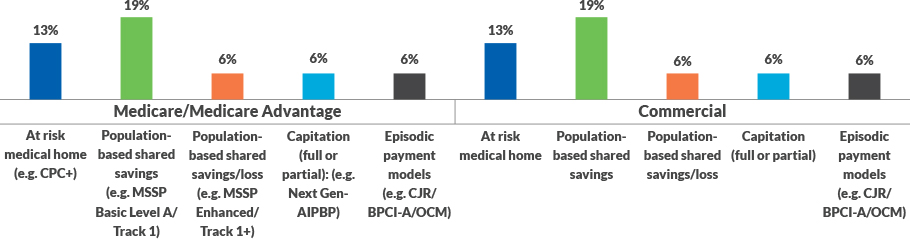

Measuring the Penetration of Various Value-Based Models

Today, what type of risk-based contracts is your organization engaged in? Select all that apply.

Source: InterSystems poll of HFMA executive roundtable participants.

What type of data is most needed for your organization to receive from health plans or providers?

Hamilton: It isn’t necessarily just about data from the electronic medical record, but also about real-time access into the EMR. We currently have read-only access into Ohio State’s EMR for cases and visits where we are the payer. It took a couple of years to establish this, and it has been really amazing for us. There are a lot of efficiencies on both sides that have resulted from this, such as around authorizations and care coordination and the ability to avoid duplicating care, including in pharmacy. The ability to see things on the same system enables us to start conversations around social determinants of health and to avoid situations where patients are getting calls from multiple people. Real-time sharing of data is also a critical piece, as are bidirectional sharing of data and access to laboratory data. Additionally, the ability to augment each other’s data sets empowers payers and providers to work on solutions to health challenges together.

D’Cruz: When dealing with the risk-based contracting, I think the key to managing a population effectively is not only getting claims data, but also, getting it in a timely manner. I cannot really manage my population if the data are six to nine months old when I receive it. We have plans that provide data that are six to nine months old, but I think they are getting better at providing data on a more-timely basis. Integrating pharmacy data on a timely basis is also a challenge. Then there is the question of who is going to pay for a platform for data integration. We’re willing to at least split the costs to be able to manage our population more effectively

Meyer: In talking with physicians around the Southwest. I think one of the biggest problems we’ll face during the pandemic is determining the impact of delayed access to care. We’ve experienced a 40% to 60% decline in new cancer diagnoses in strokes and in heart attacks over the past three months [as of July 2020]. I know this because we’re reviewing this data as we put together our budgets for the coming fiscal year. As I talk with our medical staff leaders in these areas, I plan to ask: “What do we anticipate for the next fiscal year in terms of volume? Has there really been improvement in these areas? Or, will we see a catch-up in cases at some point?” Before you enter into a risk-based contract, you better have a good understanding of whether the cases you expected to see during the first three months of the pandemic are permanently off the table or whether they are coming back in some form or fashion.

What would good data sharing and transparency between a payer and provider look like?

Shubert: Getting actionable data, frankly, is a challenge. It’s difficult to get meaningful data from claims. To the extent that payers could provide a broader set of data beyond just clinical data on members, providers could gain greater understanding around where to drive targeted interventions. But it’s hard to get alignment around this.

Meyer: There are so many touchpoints within a system. If we had systemwide, communitywide, interoperable systems, I think we would go a long way toward eliminating gaps in knowledge and care. My question is always: When will this happen? Is it five years out? Is it 10 years out? When we get to a point of interoperability, that will be a big win for everybody.

Rowe: When it comes to data sharing, when you add the deep [clinical data] and the wide [claims data] together, you actually strengthen your ability to reach and engage a vulnerable member and strengthen the value of care and services provided.

What are your biggest concerns when it comes to sharing data with other organizations? What would mitigate those concerns?

Neiman: I feel like the biggest issue that we have is the credibility of the data that we’re getting back. I think payers have a wealth of information that we lack.

We’re a rural facility, and we’re transferring our patients out for complex and high-cost care, so we lack that information about the total cost of caring for that patient. In any kind of population health or value-based payment model, we need to see the data around total cost of care. We also need to be able to view any gaps in care.

We believe payers are in a position to provide that information back to us. When we’re taking data back to our physicians and trying to engage them in addressing gaps in care and improving quality, the credibility of that data is absolutely key. As anybody who has been in the position of providing data to a physician can tell you, if physicians don’t believe or trust the data or if they find something wrong with it, that sets efforts to engage physicians back a great deal.

Mulvany: Privacy is sometimes a concern. In some cases, I think privacy is a valid excuse; in other instances, it can be a knee-jerk reaction to not wanting to do something.

Rowe: I think the information-blocking rules coming from the Office of the National Coordinator for Healthcare Information are going to change the game in that regard.

Funk: Trust also continues to be an issue. If I show up in the ER down the street, I would like that ER team to know everything about me. The only way we’re going to get there is if we can get past this trust issue. We’ve got to trust that it will be in our best interest to be in an interoperable system from a healthcare perspective.

About InterSystems

Established in 1978, InterSystems is the leading provider of data technology for extremely critical data in the healthcare, finance, and logistics sectors. Its cloud-first data platforms solve scalability, interoperability, and speed problems for large organizations around the globe. InterSystems also develops and supports unique managed services for hospital EMRs, unified care records for communities and nations, and laboratory information management systems. InterSystems is committed to excellence through its award-winning, 24×7 support for customers and partners in more than 80 countries. Privately held and headquartered in Cambridge, Massachusetts, InterSystems has 25 offices worldwide. For more information, please visit InterSystems.com.

Footnotes:

a. Daly, R., “Upside-Only Pay Surges as Risk-Based Pay, Clinical Results Remain Flat, Scorecard Finds,” HFMA News, Dec. 4, 2019.