Providers explore new territory with health plan ownership

There is renewed interest among U.S. health systems in launching provider-sponsored health plans (PSHPs), despite the rocky start that many organizations experienced with this strategy over the past decade. New factors and circumstances have emerged to create an environment much more conducive to success.

Historical perspective

Health systems that were first to test the PSHP waters shared one thing in common: They were pioneers embarking on a bold strategy, with hard-to-predict challenges ahead. Not surprisingly, from 2010 to 2017 there were more failures than successes.

Plans that had little understanding of the levers required for success. Often, their leadership had limited experience in running a health plan. As a result, PSHPs largely were encumbered by low margins and unrealistic expectations. They faced challenges in understanding how to effectively manage utilization and drive greater efficiency as their organization operated in a largely fee-for-service environment. They also struggled to meet enrollment thresholds that would better position them for success, largely because they didn’t have the scale to price premiums lower than their competitors.

Some PSHPs also lacked the analytical capability to extract insights from claims data to stratify and manage member populations. This led to their revenue suffering because of their limited ability to demonstrate to Medicare that certain enrollees were more expensive to cover. Most PSHPs also were not highly skilled in negotiating rates and establishing truly high-performing, quality-driven networks.

These and other factors put these plans at a competitive disadvantage relative to large commercial plans. Just four of the PSHPs launched from 2010 to 2015 posted a profit in 2015, while some recorded heavy losses and five went out of business.[1]

Given the tremendous challenges confronting healthcare organizations that wish to take on a PSHP, what accounts for renewed and emerging interest? Key factors include the following.

The example set by leading health systems

Successes of leading PSHPs prompt leaders to ask, “What if?” In 2016, Geisinger Health Plan, founded in 1984, made a bold promise: If its members weren’t happy with the quality of care or service they received, they could receive a refund of up to $2,000 in out-of-pocket costs. Geisinger’s success as a PSHP — including a 28% decrease in emergency department visits for congestive heart failure patients, a 13% decrease in total health spending among Geisinger Health employees and a 19% decrease in per-member-per-month costs through reduced acute inpatient stays — positioned the health plan to stand by its guarantee of a phenomenal patient experience.[2]

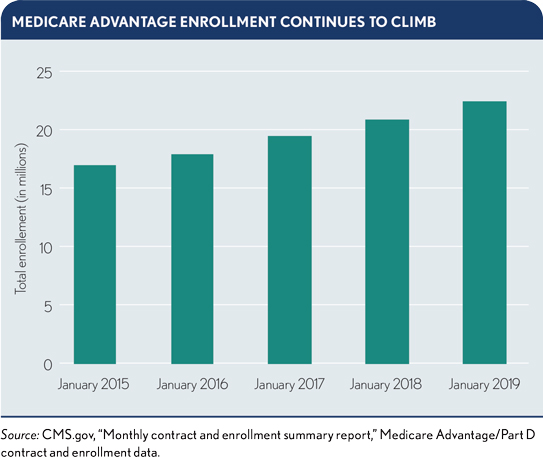

A surge in enrollments in MA plans

Managing a Medicare Advantage (MA) population is considered key to success at a time when one-in-six Americans will be age 65 or older by 2020 and margins for these plans average 4% to 5%. Beneficiaries that grew up with and are used to managed care are now aging into and more willing to sign up for MA. As a result, one-third of Medicare enrollees are currently covered under MA plans, and half of Medicare enrollees could be in an MA plan by 2023. Meanwhile, policy changes have made MA plans more attractive to administer.

Health systems’ interest in MA plans also are being fueled by regulatory changes such as the phase-out of Medigap plans, a final rule that that expands access to telehealth as a basic benefit for MA members in 2020, Medicare initiatives that have slowly pushed providers into risk-bearing arrangements and continued bipartisan support that has led to annual increases in revenue funding. Among not-for-profit hospitals, in particular, MA plans offer the opportunity to drive increased revenue while providing seniors with new opportunities for care.

Among respondents to a recent survey, 56% of health systems and 48% of hospitals say they have faced barriers to collaboration with national and local payers in their market.[3] Nearly one-third cite lack of alignment in goals or strategies as a barrier to collaboration. One-in-four say challenges around data sharing and transparency hold them back from payer-provider partnership.

These barriers to partnership come at a time when commercial and government payers, as well as employers, are ramping up efforts to shift financial risk to healthcare organizations. The move toward value-based payment models, with penalties for high readmission rates and low scores on quality and cost of care, poses significant financial and reputational risk for hospitals and health systems. Among the competencies it requires are care coordination, network design and administration, contract negotiation and performance measurement. Because these competencies are similar to those required to sponsor a health plan, some healthcare boards and leaders are exploring whether their organizations could reduce reliance on commercial payer contracts through health plan ownership.

Impact of health plan consolidation on hospitals and health systems

Health insurers are again rapidly consolidating, with Centene’s planned acquisition of its rival, WellCare, strengthening its position in the Medicare managed care market. A 2018 American Medical Association study shows half of all health insurance markets are now highly concentrated.[4] Competition levels dropped in health insurance markets across 25 states, with Anthem holding the position of the largest insurer in more metropolitan statistical areas than any other insurer. The result: an increase in consumer premiums for healthcare insurance, according to economists, and more limited contracting power for providers. Increased premiums also can prompt consumers to forgo health insurance and delay needed healthcare services, heightening the potential for bad debt when they do seek care.

To compete in an era of disruption, new PSHPs must develop bold strategies that redefine what it means to manage member health. Both providers and health plans should pay attention to the innovations of technology-led disruptors like Oscar Health and Devoted Health, which are poised to reshape the consumer experience for MA enrollees.

Oscar Health. Backed by $1.3 billion in funding, including private equity and venture fund capital, Oscar will enter the MA space in 2020. The company uses technology to simplify the healthcare experience, with apps that enable members to consult with a physician at any time, get prescriptions without leaving home, track their health history and earn incentives for healthy behaviors. Oscar was one of the first companies to offer telemedicine services free of charge to members.[5] The company also offers concierge care teams and the ability to book appointments from a mobile device and continually uses data analytics to design new services. While Oscar currently serves individuals and small businesses in 10 states, its expansion into the MA market could position the plan to become the “Uber of healthcare.”

Devoted Health. With $300 million in venture capital funding in 2018, Devoted has become what it calls “a payvidor”: managing the cost of member care, partnering with providers to provide the right services at the right time and launching its own healthcare services — including a medical group that makes member house calls. Devoted also uses data science to determine the highest-value providers in the communities it serves and direct members to those providers. Its goal: to make healthcare more personal and less fragmented for seniors.[6]

These moves require that health systems think carefully about how they will compete with disruptors before launching a PSHP, including what investments they are willing to make to support a technology-enabled member experience and how the PSHP will engage physicians in providing complex populations with a member-centric experience.

Footnotes

[1] Baumgarten, A., Analysis of Integrated Delivery Systems and New Provider-Sponsored Health Plans, Robert Wood Johnson Foundation, June 2017.

[2] Venkataraman, R., “Geisinger Health Plan’s Commitment to Heart Health,” AHIP blog, Feb. 15, 2018; and Navigant, Building Payer-Provider Partnerships for Care Management, October 2018.

[3] HFMA/Navigant survey, “Providers Prepared to Increase Risk Model Participation,” Infographic, June 19, 2019.

[4] Competition in Health Insurance: A Comprehensive Study of U.S. Markets, American Medical Association, American Medical Association, Nov. 28, 2018.

[5] Thompson, N., “Health Care Is Broken. Oscar Health Thinks Tech Can Fix It,” Wired, Aug. 14, 2018.

[6] Tindera, M., “Devoted Health, New Medicare Advantage Business, Raises $300 Million,” Forbes, Oct. 16, 2018.