Healthcare leaders grapple with deferred care crisis

Ezra Mehlman

Dan Mendelson

As COVID-19 began to sweep the country, healthcare leaders raced to expand capacity and stay ahead of the demand curve by canceling elective procedures. The financially deleterious effects of this decision on our nation’s hospitals are well-documented, but the longer-term implications for our delivery system remain far more uncertain.

Early domestic and international data suggests that these decisions may have a profound effect on patients and the delivery system. Dramatic reductions in cancer detection and increases in diabetic foot amputations during COVID-19 are two narrow, but perhaps emblematic, examples of the damaging effects of deferring care. But beyond clinical care, the pandemic also has forced providers to make decisions about investments and operations that may not contribute to improving the U.S. healthcare system over the long term.

The major clinical, financial and operational implications of COVID-19-related care deferrals for those who pay for, deliver and consume healthcare are reflected in the perspectives of healthcare leaders who are shaping their organizations’ tactical and strategic responses to the post-COVID-19 care delivery reality. The comments of these leaders, gleaned from dozens of conversations and research conducted between March and September, shed light on the early successes that leading organizations have achieved in preparing to address these issues. They also provide practical advice to other healthcare executives in responding to what will likely be the defining healthcare theme of 2021.

The 3 phases of the pandemic

Speaking at a roundtable in July, Norman Sharpless, MD, the director of the National Cancer Institute, projected that there would likely be 10,000 additional deaths related to breast and colorectal cancer over the next 10 years due to decreases in screening and prevention during the pandemic.

Elaborating on this topic, John Carpten, PhD, professor and department chair at the University of Southern California Keck School of Medicine, said, “If you had to put off your diagnosis by even six months, that cancer could grow and progress and maybe even metastasize in that time frame.”a

The concerns that Carpten and Sharpless voiced are hardly unique: Throughout our discussions with leaders across the country, the prospect of managing a wave of medically complex care that was deferred due to COVID-19 is a key consideration permeating the mentality of executives.

In many ways, though, the implications of the issues that affect individuals so profoundly are amplified in the context of how healthcare organizations have had to redeploy capital and respond to adversity. As executives rebuild their enterprises from the initial shock of coronavirus, the increasing focus on the impacts of COVID-19-deferred care can be seen as the beginning of what may be defined as a new phase in this crisis — one that creates unique financial, operational and strategic challenges for payers, providers and employers. Synthesizing findings of our executive surveys, we have broken the past seven months into three distinct phases, which roughly follow the virus’ progression. These phases, each of which is defined by a set of common, stakeholder-specific questions and imperatives, can be grouped along a temporal scale, as described and illustrated below.

Phase 1: First responses. Beginning in the second week of March 2020, this period is marked by the decision to cancel elective procedures, deploy personal protective equipment and re-configure clinical space to respond urgently to the pandemic. As new surges in COVID-19 incidence occur, as we hace seen since November 2020, first responses are likely to recur.

Phase 2: Stabilizing the clinical enterprise. The second phase began as elective procedures were resumed in early June. The phase is characterized by reconstructing the delivery system and preparing for a “new normal,” featuring new trends in demand, treatment setting and payer mix.

Phase 3: Navigating the post-COVID-19 reality. This phase begins with leaders seeking to maintain business integrity while preparing for a future with a persistent virus, a higher-acuity population, shifting patient preferences on how to consume care and an uncertain economic environment. Providers and payers now have an urgent need to get back to their focus on care management, minimally invasive surgery, improvements in health IT infrastructure and other critical imperatives. This phase begins roughly at present time and looks toward the future.

Three phases of the pandemic

Phase 1: Initial COVID-19 hit |

Phase 2: Rebuild the clinical enterprise |

Phase 3: Navigate the post-COVID-19 world |

|

| Elective procedures are canceled nationwide to expand capacity for anticipated COVID-19 surge. | Health systems begin in June to phase back in elective procedures and commence campaigns to restore volume. | All stakeholder brace for the impact of COVID-19-deferred care, and prepare to operate with a persisting virus. |

|

Providers |

|

|

|

Payers |

|

|

|

Employers |

|

|

|

Source: Health Enterprise Partners LP

Key perspectives and approaches from the field

Our conversations with healthcare leaders elicited a broad range of comments on how they have responded to the challenge of COVID-19-deferred care. Following are key takeaways.

Prioritize high-value care in the face of the pandemic. As health system leaders began rebuilding their most important clinical programs, many grappled with fundamental questions of the order, magnitude and form by which service lines should be reinstated. To make this endeavor more complicated, with an uncertain forecast for future virus waves, health systems also needed to ensure inpatient capacity for COVID-19 patients and position for long-term financial success.

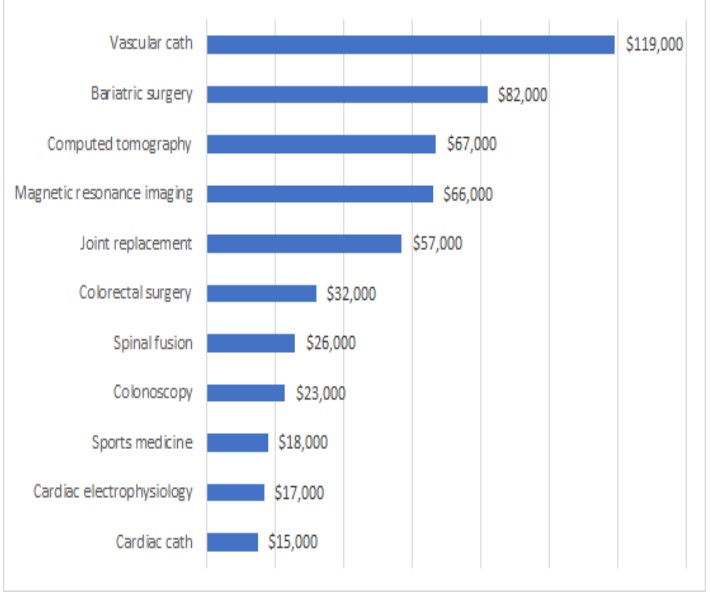

To respond, one mid-sized health system in the Northeast began by analyzing estimated weekly deferred revenue by procedure to prioritize which service lines to reinstate. The output of this exercise, captured in the exhibit below, was balanced against factors rating complexity, availability of staff and availability of venue, to inform the decision on which clinical areas to open and in what order.

Health system elective procedure prioritization schedule

Estimated weekly deferred revenue for top sub-service lines

Source: Array Analytics

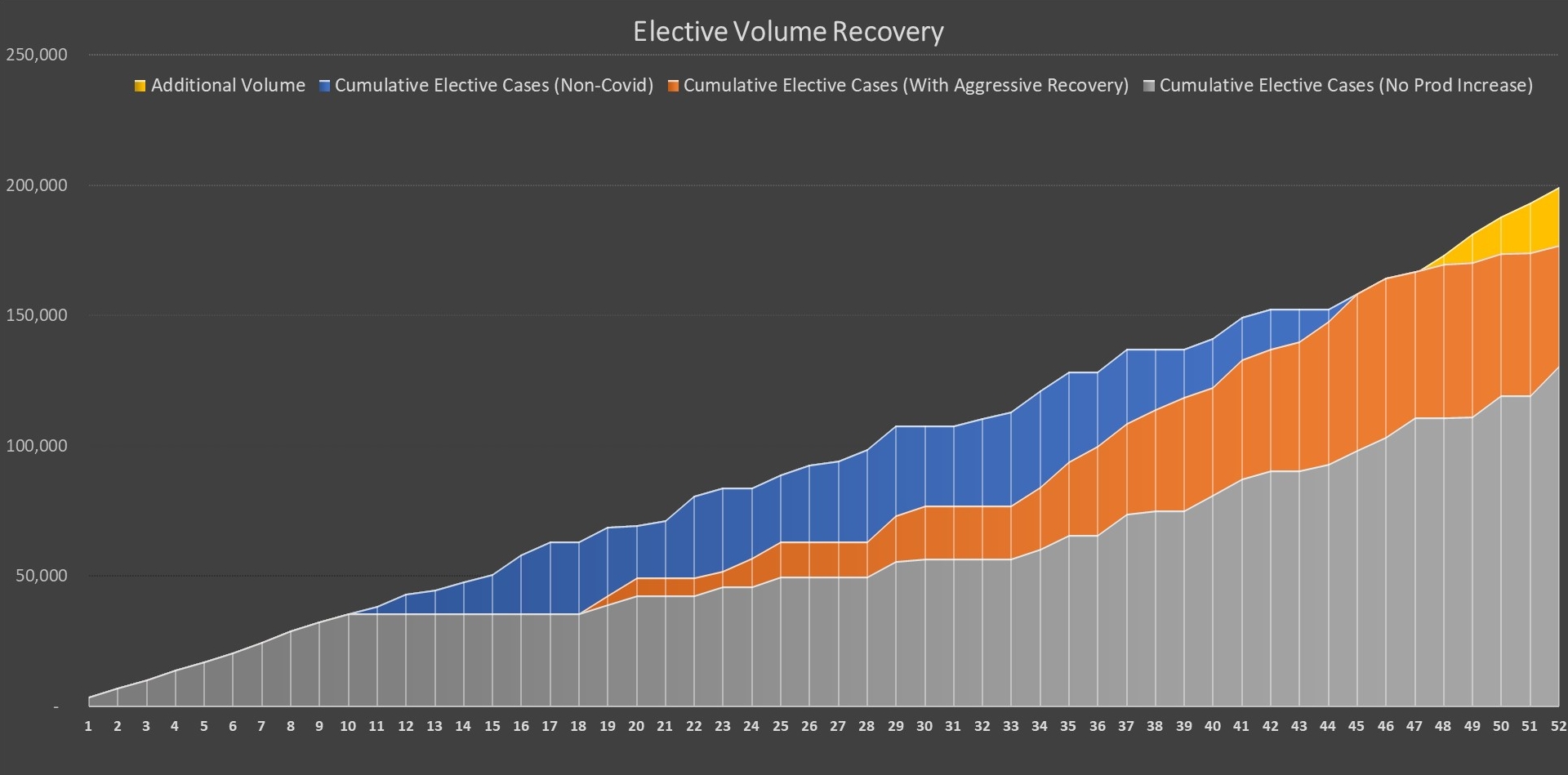

Equipped with this redeployment schedule and an understanding of the health system’s historic volumes, management was able to forecast a number of scenarios for a financial recovery. In the chart below, the grey area represents 2020 actual volumes, impacted by the required elective care deferrals, while the blue line represents a normal volume curve, based off of 2019 actuals, adjusted for expected growth and then projected into 2020. The orange line represents an aggressive recovery strategy, where cases are distributed to appropriate venues across the integrated care platform, operational hours are stretched where possible, scheduling is thoroughly examined and blocks filled and access is enhanced through significant physician outreach and engagement. The yellow line at the year’s end represents the target “additive” volume the system hopes to realize through better practices, enhanced access and an expanded telehealth platform. This exercise, while specific to a particular delivery system’s resource base and demand, reflects the type of bottoms-up rigor many leaders are applying in rebuilding their surgical enterprises.

Health system financial recovery strategy

Source: Array Analytics

Leveraging predictive analytics to identify untreated diseases and COVID-19-deferred care. As payer executives prepare to manage a wave of pent-up demand, concerns around the costs of providing more intensive care for patients whose conditions worsened during the pandemic abound. With major drops in diagnostic catheterization (down 65% in the last two weeks of March 2020 compared with the same period in 2019), percutaneous coronary intervention (down 45%), and general diagnostics (down 60%), it is no surprise that 80% of payers anticipate an increase in claims as stay-at-home orders are eased.

To proactively target patient populations who are at-risk of a costly medical event before it occurs, many health plans have invested in predictive analytics. By pinpointing a community’s “outlier” patients whose conditions are most likely to deteriorate, payers can affect targeted interventions and more intelligently deploy their care management resources.

For example, a Midwestern payer used Jvion’s platform to accurately identify 50% of all members in the top 5% of the population who had an inpatient admission, based on 15 months of historical data. Thus, for 100,000 people, 5,000 members would be accurately identified to be at risk of an inpatient admission, allowing for an intervention to prevent that outcome. Some health plans also have deployed predictive tools and are working collaboratively with health systems to assist in this next phase of pandemic response. This accelerated use of prescriptive analytics promises to better position population management initiatives moving forward.

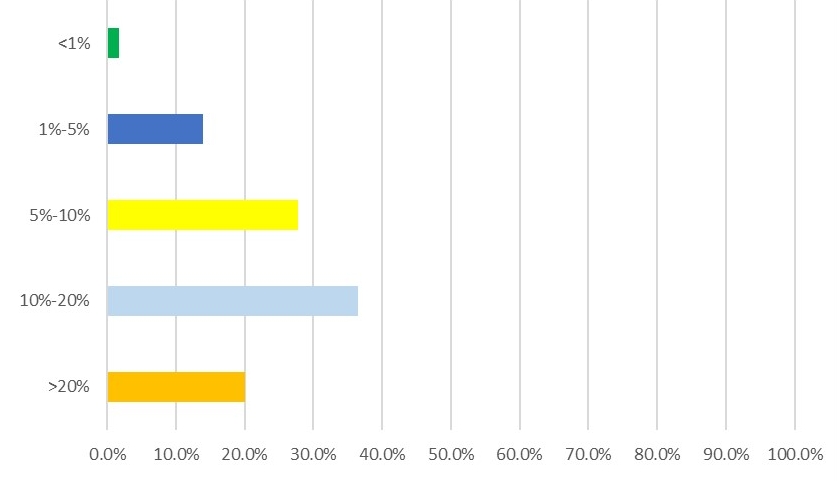

Pursuing virtual care for diagnosis and prevention. As part of our research, we conducted a survey in September in which more than 60% of responding healthcare executives said they believe virtual visits will represent between 5% and 20% of 2021 hospital encounter volume.

Executive predictions on telehealth

In 2021, what percentage of total hospital encounter volume do you expect virtual vists will represent?

Source: Health Enterprise Partners LP

Regardless of one’s perception of what portion of medical encounters will be conducted via telemedicine versus in-person moving forward, the fact that virtual care will be inextricably woven into the fabric of our delivery system is generally accepted. Yet much of the discourse on virtual care still focuses on two dimensions: access expansion and revenue enhancement.

In COVID’s immediate wake, many healthcare organizations and employers have been turning to outbound virtual care programs for the purpose of mitigating some of the effects of COVID-19-deferred care (see the sidebar below, for example).

In the wake of COVID-19’s impact, several employers have leveraged virtual checkups through the national preventive care practice Catapult Health, based in Dallas. By transmitting blood samples and physical measurements from their homes to Catapult, patients can discuss health history, analyze past and current symptoms, conduct depression screening, review medication adherence review and receive a Personal Action Plan with a nurse practitioner. Ultimately, employers and payers can use this avenue as a referral into sponsored health improvement programs and other cost containment initiatives. By agreeing to pay for virtual visits in many areas, and in allowing for virtual home care to count toward risk adjustment calculations, the Medicare program also has substantially embraced these changes, which are likely to continue after the pandemic.

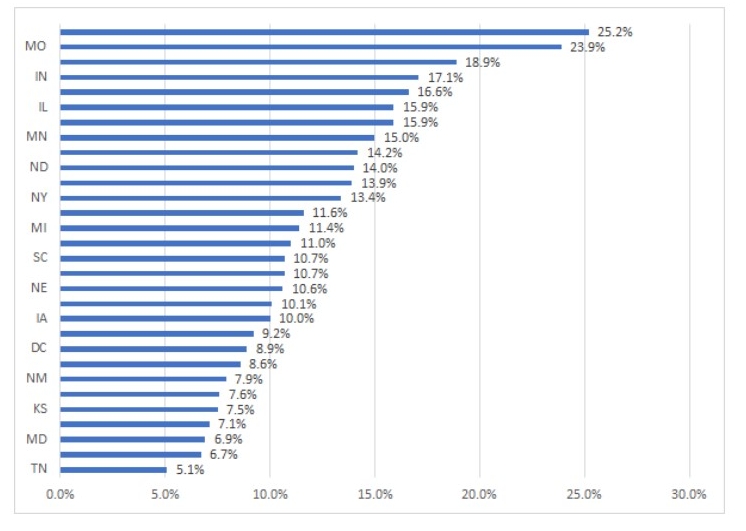

Doubling down on Medicaid lines of business. With unemployment rising in the wake of COVID-19’s initial hit, many states began to experience increases in their Medicaid ranks. Between March and September 2020, , the 27 states reporting data for this period all reported Medicaid growth with an aggregate enrollment increase of 4.1%, with Nevada and Missouri reporting the greatest increases, at 25.2% and 23.9%%, respectively.

Rising Medicaid ranks

Percentage increase in Medicaid MCO enrollment: March-September 2020

Source: “Stolyar, L., Hinton, E., Singer, N., and Rudowitz, R., “Growth in Medicaid MCO enrollment during theCOVID-19 pandemic,” Kaiser Family Foundation, Dec. 1, 2020.

This pattern, which reverses a previous decline in Medicaid over the prior years due to a strengthening of the economy, has major implications for health systems and health plan executives. As leaders prepare for a patient mix with higher rates of poverty, chronic illness and disability, they must assimilate the best practices from those organization with the most extensive experience managing Medicaid patients. This includes re-evaluating whether the existing digital front door is sufficient for a changing patient mix, focusing on high-risk pregnancy reduction, ensuring the adequate provision of social services and preparing for a new payment cyde.

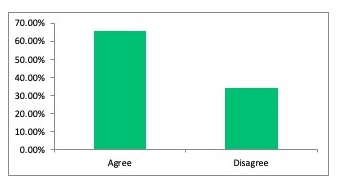

A painful necessity?

When state governments and healthcare leaders opted to cancel elective procedures in March 2020, it was widely regarded as a necessary step to prevent the type of mass casualty event that was feared, where available bed supply would fall short of anticipated demand. Indeed, even today, a survey of healthcare executive we conducted found that nearly two-thirds believe canceling elective procedures was a responsible choice. And more canceled procedures are expected as new surges occur this winter. But while necessary, these decisions come at a cost, creating a “crisis within the crisis,” as healthcare leaders prepare to tackle an array of hurdles thrown up by screening, diagnosis and treatment gaps created by COVID-19.

Executive opinions on the cancelation of elective procedures

Canceling elective procedures in March and April 2020 was a good idea?

Source: Health Enterprise Partners LP

Footnotes

a Owens, C., Axios Vitals, Sept. 18, 2020

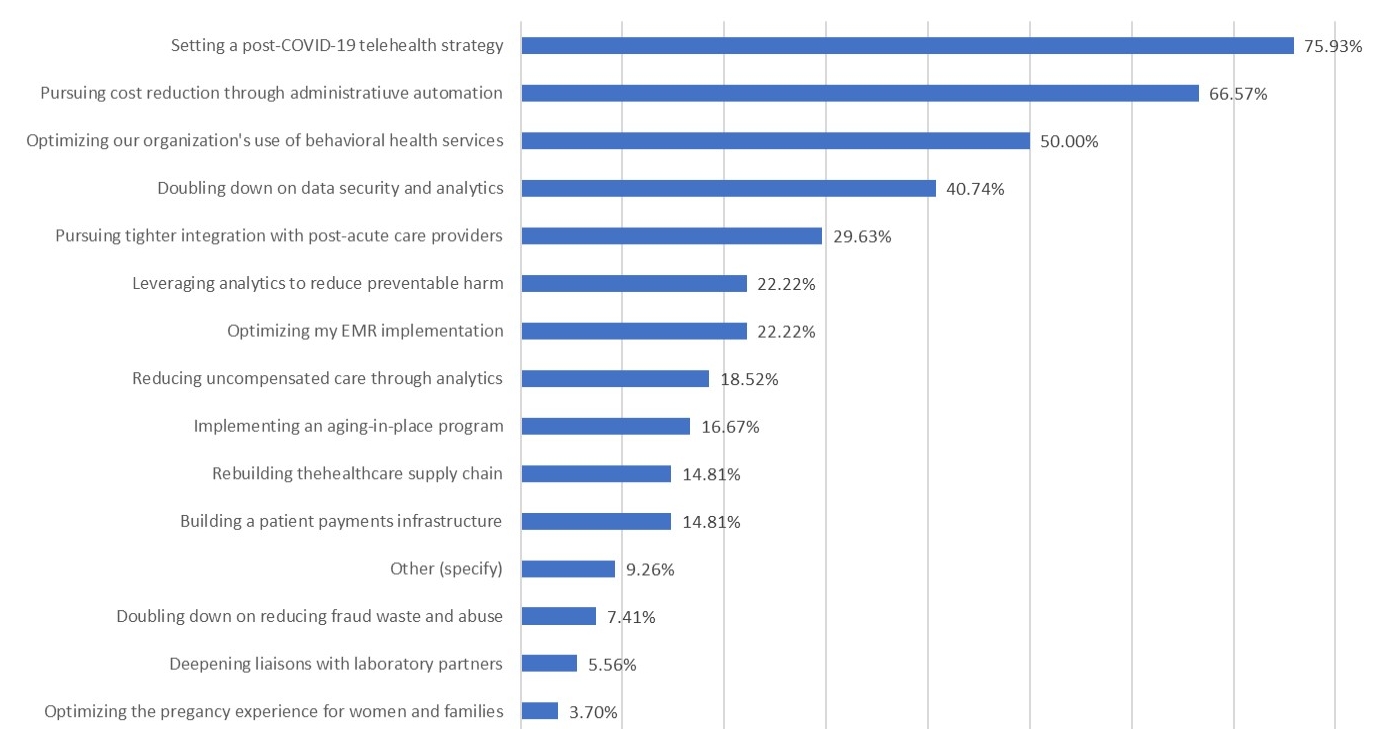

Setting a sustainable behavioral health strategy

Beyond underscoring the need for a new set of approaches to deal with the wave of deferred medical procedures and screenings, the pandemic has accelerated a broad array of behavioral issues related to loneliness, social isolation and distress. These problems have manifested themselves in increased rates of substance abuse (13.3% of adults reported new or increased substance use as a way to manage stress), higher rates of suicidal ideation (10.7% reported thoughts of suicide in the past 30 days), and a surge in those reporting symptoms of anxiety or depressive disorder (weekly average for July 40.5%).a The exacerbation of behavioral health issues is likely to worsen the burden for the 47 million adults that reported having a mental illness prior to the pandemic. These trends require new approaches. It is perhaps unsurprising that over 50% of payer and provider executives we surveyed identifying optimizing their respective organization’s use of behavioral health services as a Top 5 strategic priority.

Executive priorities in the midst of COVID-19

Percentage of payers and providers identifying objective as a Top 5 issue for their organization

Source: Health Enterprise Partners LP

The following strategies color many of the efforts we see from executives in this climate:

- Increasing investment in teletherapy as a means to improve access

- Refocusing care management efforts on the comorbid behavioral problems that frequently accompany medical diagnoses

- Bolstering substance use disorder infrastructure

Footnote

aKaiser Family Foundation. The Impact of COVID-19 for Mental Health and Substance Use. August 21, 2020.