COVID-19 deals a severe blow to hospital performance

Performance improvement efforts met an historic challenge with the COVID-19 pandemic.

For the past three years, Kaufman Hall has surveyed hospitals and health systems on their performance improvement and cost transformation efforts. In a year unlike any other, the survey moved away from the questions of earlier years to focus on the impacts of COVID-19 on hospital and health system performance. Here, we provide a summary of the survey findings, based on responses from 64 health system executive and finance leaders and interviews with seven of the survey respondents.a

State of the pandemic

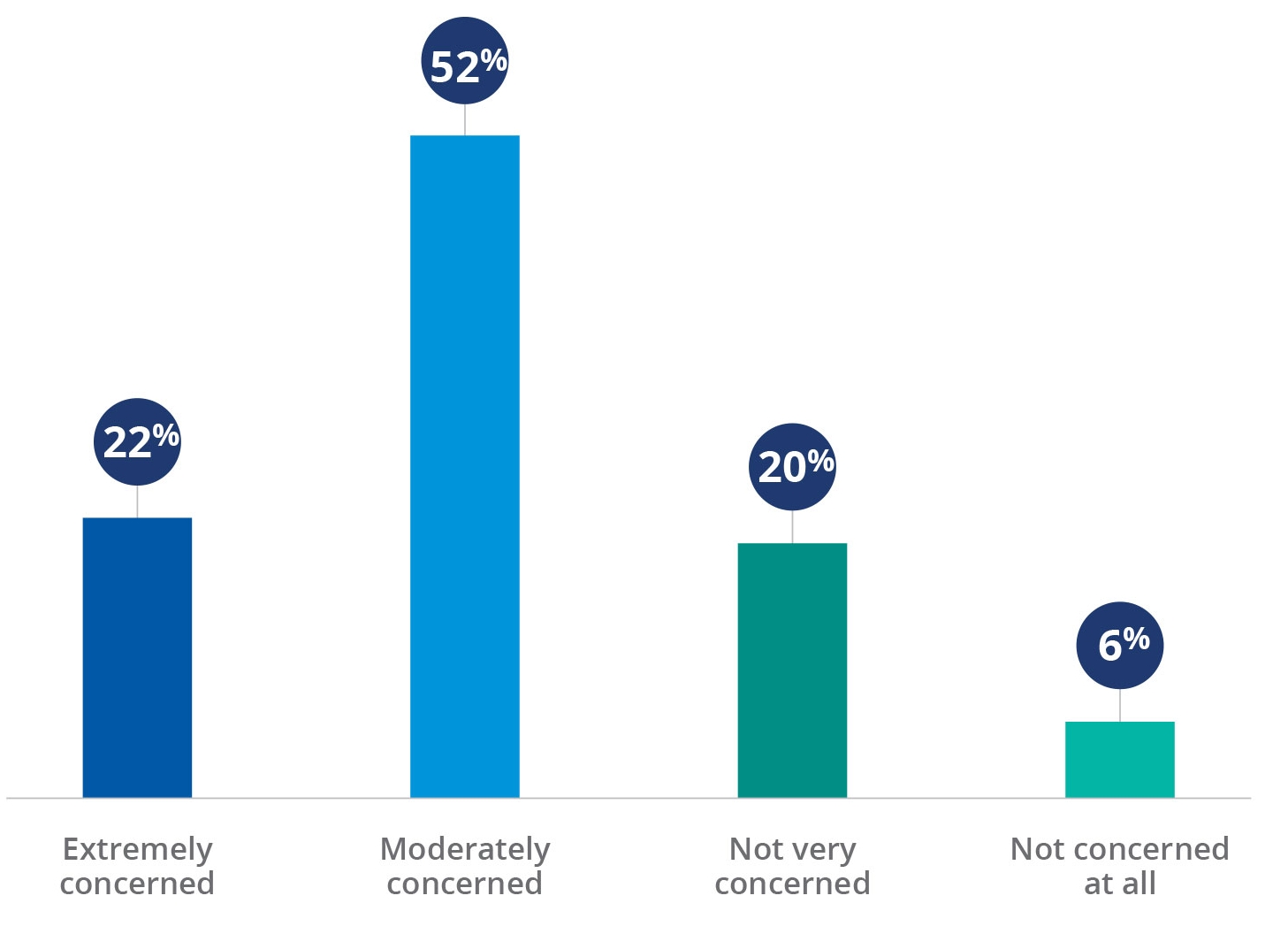

At the time of the survey, fielded in August 2020, almost twice as many respondents (41%) said COVID-19 cases were climbing in their market as said case numbers were declining (23%). Without an effective vaccine or treatment for COVID-19, about three fourths of survey respondents are either moderately concerned (52%) or extremely concerned (22%) about the future financial viability of their organizations.

Concern about organization’s financial viability over the coming year without an effective vaccine or treatment

Source: Kaufman Hall 2020mPerfomance improvement Survey

Impact on volume and operating margins

The shutdown of non-emergency procedures in many markets was coupled with consumers’ fear of seeking medical care and risking exposure to COVID-19 from other patients. With a dramatic fall-off in volumes, one-third of survey respondents (33%) saw operating margin declines in excess of 100% in year-over-year comparisons of Q2 2020 with Q2 2019. And only one service area, oncology, did more than half the respondents say they have seen volumes recover to more than 90% of pre-pandemic levels.

All interviewees noted that emergency department (ED) utilization is down, and most expect it to stay down for the long term. “We might finally be seeing ED utilization shift to where it should be, with true emergencies,” said one interviewee. “But it will require adjustments to our business model.”

Impact on expenses

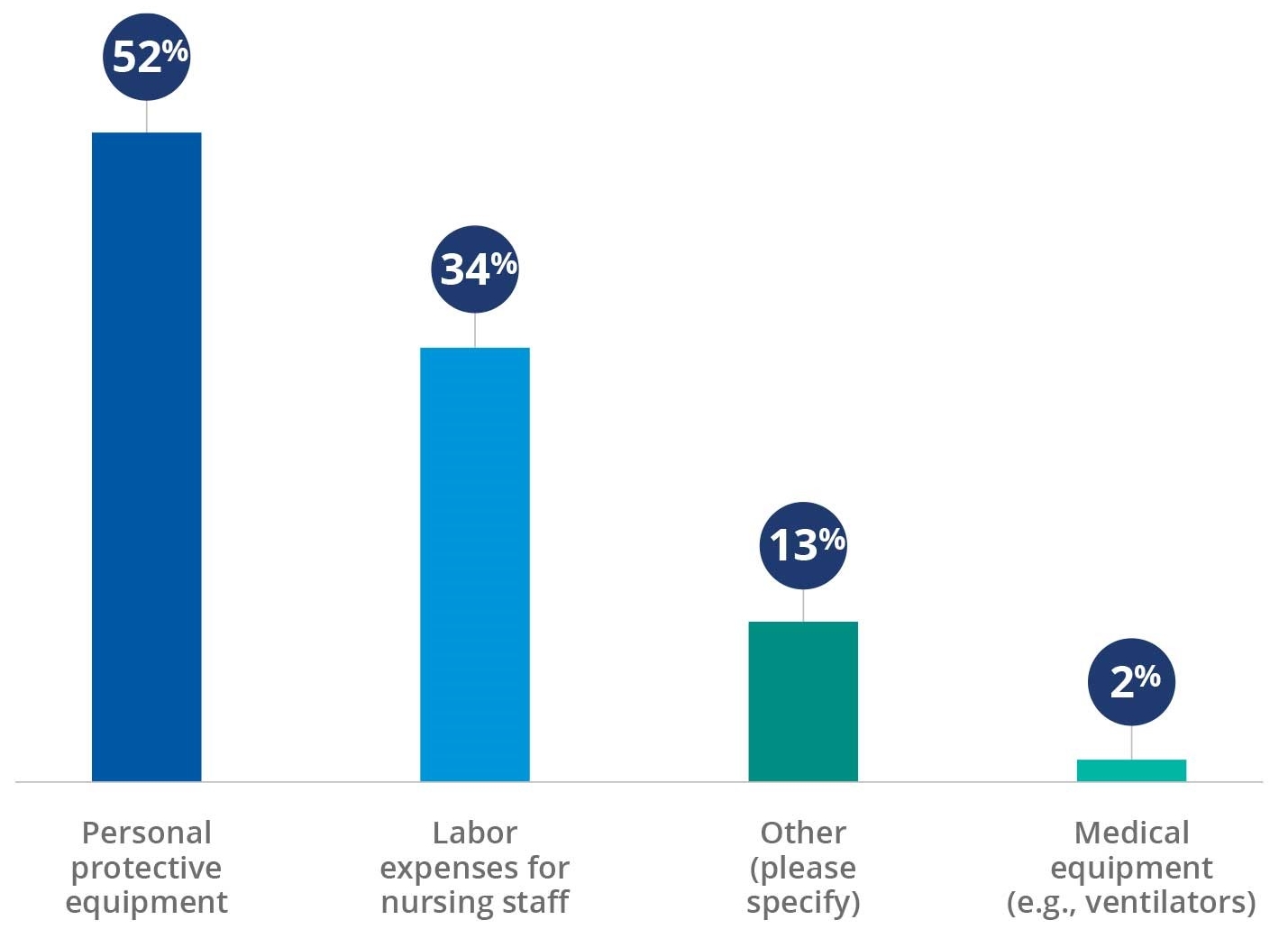

Even as volumes have fallen, expenses have risen as healthcare organizations equip themselves to protect the safety of patients and staff and struggle to ensure that adequate numbers of front-line staff are available to care for patients. Survey respondents have seen the greatest and second greatest percentage increase in expenses for personal protective equipment (PPE) and nursing staff labor, respectively. More than one in five respondents (22%) saw expense increases of more than 50%.

Areas of greatest percentage increases in expenses

Source: Kaufman Hall 2020mPerfomance improvement Survey

The rise in expenses for PPE was compounded by what, for many organizations, was a breakdown in the supply chain. Several interviewees noted that they have gone from just-in-time inventory systems before the pandemic to renting air-conditioned warehouse space to keep nine-month inventories of supplies on hand.

The pandemic also has introduced a whole new safety-related set of expenses for hospitals and health systems. Almost all survey respondents (95%) had worked to minimize exposure to other patients in waiting rooms. Most respondents (73%) had established designated “clean” facilities or units for non-COVID patients. And as an indication of the pandemic’s toll on healthcare workers, 75% of respondents had increased monitoring and resources to mitigate staff burnout and address issues of mental health.

Supply reprocessing, furloughs and salary reductions have been the most commonly used cost-containment measures to date, having been implemented at more than half of the survey respondents’ organizations. Health system leaders also are considering restructuring physician contracts, making permanent reductions in force, changing employee health plan benefits and retirement plan contributions, and merging with another health system among various additional cost reduction measures.

Impact on care delivery models

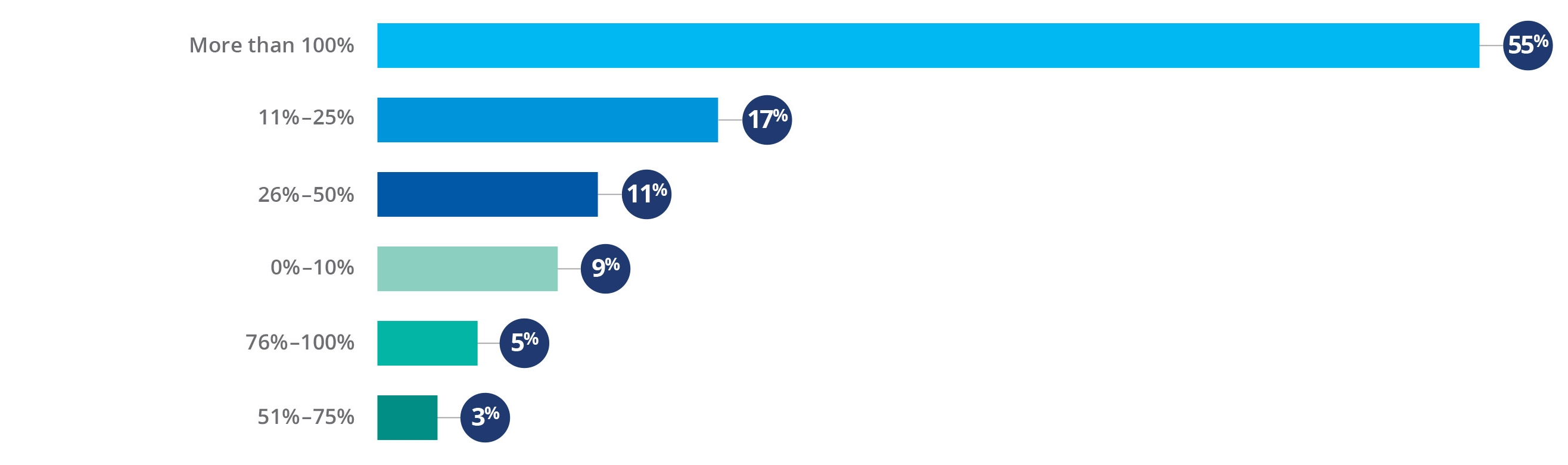

The pandemic’s greatest impact on care delivery has been the rapid movement of care delivery away from the hospital whenever possible, driven largely by consumer fears of exposure to the coronavirus. Fifty-six percent of respondents saw more than 100% growth in the number of telehealth visits that their organization provided. Although telehealth utilization has dropped somewhat as health systems have reopened, it remains well above pre-pandemic levels. For example, an interviewee said that

The next challenge is finding the right balance between telehealth and in-person visits, which may affect ambulatory strategies that were in place before the pandemic. Many interviewees noted that healthcare remains a high-touch industry and a significant portion of their patients prefer in-person visits. This preference was especially strong in areas with a rural footprint, where a visit to the physician’s office can be something to look forward to, especially for the Medicare population where relationships have been built over years or even decades. At the same time, it is increasingly difficult to recruit providers to work in rural areas, and digital health remains a promising alternative for lower-acuity services.

Percentage increase in the number of telehealth visits since March 2020

Source: Kaufman Hall 2020mPerfomance improvement Survey

Positive impacts of the pandemic

Although COVID-19 has dealt hospitals and health systems a serious blow, it also has produced some positive impacts. Interviewees shared their thoughts on ways the pandemic will change their organizations and, potentially, the healthcare industry. Frequently cited benefits are described below.

An enhanced sense of “systemness.” The pandemic generated new levels of collaboration among health system components. An interviewee from an academic medical center (AMC) said that the AMC worked much more closely with community hospitals as it responded to the pandemic. A goal moving forward is making this new sense of systemness stick.

A newfound nimbleness in adapting to rapid change. One health system stood up a digital health strategy in six days. Another system set up a temporary hospital at a conference center in eight days. “Once you’ve done it, it’s hard to go back to old ways or old excuses,” said one interviewee.

A realized ROI in analytics. One interviewee praised the ability of her analytics team to quickly pull together views of data that had not been created before, providing valuable information to inform decision-making when regular assumptions “went out the window.”

Strengthened relationships. Several interviewees commented on how well health systems within their market coordinated their response to the pandemic. Interviewees also noted how their relationships with schools, local and state governments, and community organizations grew even stronger.

A fresh look at different payment models. One interviewee observed that the pandemic has exposed weaknesses in a volume-driven fee-for-service model. The pandemic’s impact on health system revenues would have been far less on capitated or global payment structures.

Hospitals and health systems face multiple challenges in the coming months and years. Their ability to leverage the positive impacts of the pandemic as they work to mitigate its negative impacts will have a significant impact on their long-term health and the health of the communities they serve.

Footnote

a A complete copy the 2020 State of Healthcare Performance Improvement Report is available on the Kaufman Hall website.