Revenue cycle technology budgets rise to meet need for automation, AI and robotics, says new survey

Technology budgets are increasing to support the need for more automation and artificial intelligence (AI) at hospitals and healthcare organizations, according to results of a new survey by Parallon conducted at HFMA’s 2022 Annual Conference.

Most healthcare finance professionals who participated in the survey recognized that using automation and AI in the revenue cycle benefited healthcare organizations by helping them continue to deal with issues such as staffing challenges, dwindling margins and increased denial rates.

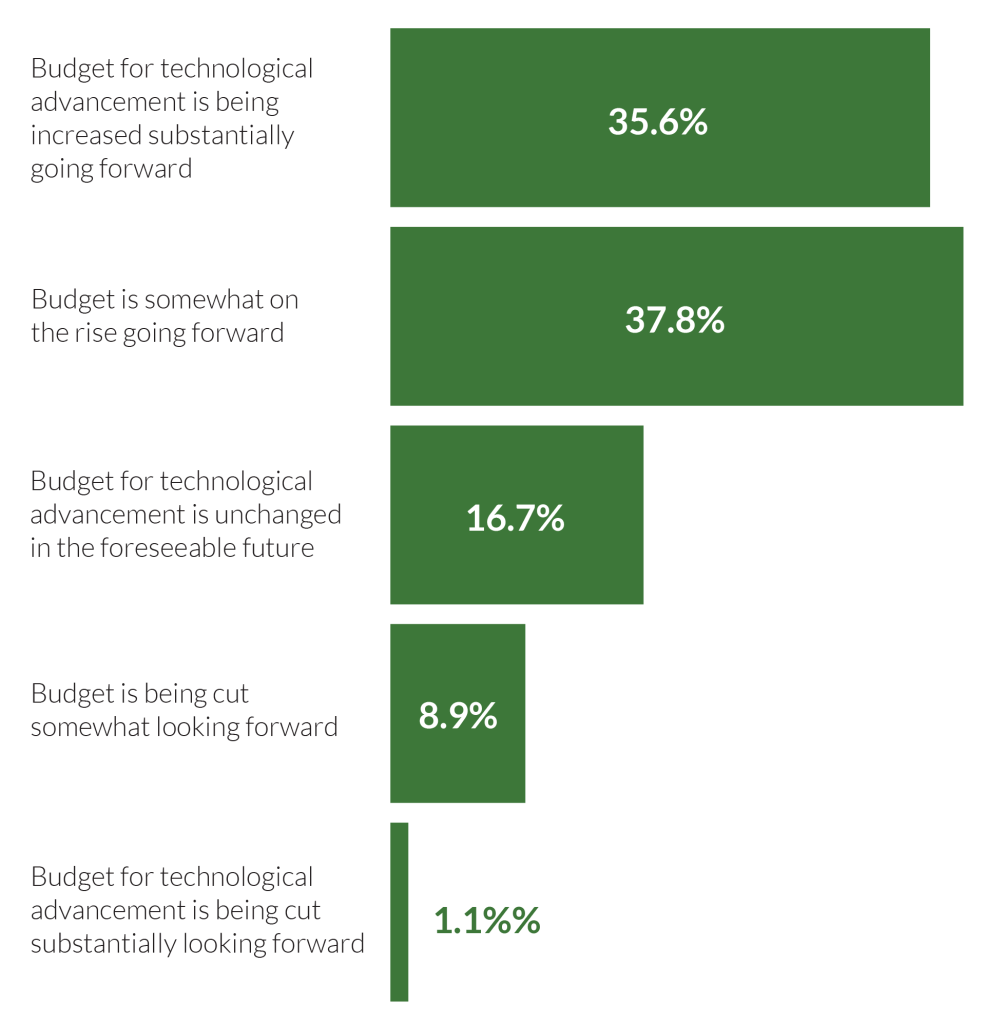

Nearly 91% of respondents said they expected strong budgets for technological advancement going forward at their respective organizations.

Almost 36% indicated substantial increases for it in their companies’ budgets, another 38% saw it rising somewhat, and about 17% said it would remain unchanged. Additionally, 10% said they’re looking to cut such budgets, with 8.9% indicating a small cut and 1.1% substantial cuts.

“What we’re hearing here is, ‘The writing is on the wall,’ ‘It’s the way to go,’ ‘It’s not debatable,’” said industry consultant Bill Voegeli, who conducted and analyzed the survey. It’s not so much a question of when, but rather “for the majority of people that answered this survey,” they’re already using both, he added.

Staffing challenges among the leading factors in automation growth

The survey also revealed the main drivers spurring the expansion of budgets for technological advancement in hospitals and healthcare systems.

Nearly 23% of respondents indicated they are moving to more use of automation/AI, and 20% said they realized the need for it. Offsetting staffing challenges, organizations having multiple priorities and the economy were other leading factors spurring budget growth for technological advancement, according to survey results.

Having staffing challenges among the key influencers of rising technology budgets was “a sign of the times,” according to Voegeli, who noted that such challenges “weren’t quite such a thing a while back.”

Tom Yoesle, chief experience officer at Parallon, said: “All across our industry, we’re being challenged with staffing issues, including in the provider and in the server space. We have to change our approach; we have to evolve closer to a reality where we are less dependent on staff to perform rote functions and more ability to focus our staff on high complexity tasks. This not only increases staff’s value to an organization, it reflects the value an organization sees in their team.”

He noted that process automation and AI are two distinct methods to reduce healthcare organizations dependence on the staffing model they have long used and move them toward a model that “both challenges and engages team members and improves the organization’s bottom line.”

Leaning on automation and AI to boost productivity has become more common in the past year due to both clinical and administrative staffing shortages plaguing healthcare organizations.

Automation and AI in the news

HFMA National Chair Aaron Crane, for instance, wrote in his October 2022 hfm magazine column: “It’s time for us to realize fully that our workforce problems will not now, or ever, be solved by better recruitment strategies, stronger engagement efforts or wage increases. … While these are important and cannot be ignored, there aren’t enough capable people willing to fill this need. There is, however, tremendous opportunity to be gained from more urgently embracing technology, including robotics, artificial intelligence and everything else in this space.”

In an online article, Nick Hut, senior editor with HFMA, revealed the results of a “2021 HFMA Outlook Survey,” including the potential of technology ushering in substantial changes in upcoming years.

“Technology-based changes are seen as the ‘next big thing’ that will revolutionize healthcare finance, according to responses to an open-ended question, with 25% of respondents naming innovations such as machine learning, AI, paperless and cashless transactions, and robotic process automation,” wrote Hut.

How important is technological advancement as a portion of your budget?

The majority of revenue cycle professionals indicated their organizations’ budgets for technological advancement are slated to increase going forward, according to a survey conducted by Parallon at HMFA’s 2022 Annual Conference.

AI’s popularity in the RCM space soars

The overall response to the need for AI in revenue cycle management (RCM) was extremely positive, with the open-ended question on the topic eliciting “some great responses,” Voegeli said.

“Survey participants obviously see multiple applications for AI within the revenue cycle,” he said, noting that they understand that AI has the capability for “identifying problems from the past, identifying mistakes and being able to use predictive analytics to understand what decisions [need to be made] to avoid the same mistakes.”

Nearly 87% of survey respondents saw more adoption of AI in RCM going forward. Just 12.2% of respondents said they were unsure if AI had a place in RCM (see the sidebar “RCM’s continuous evolution should be celebrated not feared”), and only 1.1% said it probably did not have a place.

The top reasons for use of AI in RCM were predictive analysis/better preparation (26%), broad use in the revenue cycle (22.1%), speeding up basic functions (19.5%), learning from past transactions (18.2%) and improving efficiency (18.2%), according to survey results.

Additionally, other AI functions were deemed as noteworthy by 10% to nearly 16% of respondents, and included better accuracy, helping staff keep up, ease of data mining, and an ability to help staff focus on specific accounts and do more with a leaner staff.

Yoesle said the responses were on point.

“All of the top responses to where hospitals and health systems could apply AI in RCM are directionally solid, and each provider organization will need to make an educated selection of what makes sense for them as a starting point,” said Yoesle.

Because AI has such a broad application in the revenue cycle space, it’s easy to be overwhelmed with where to start, what to do and to understand what your ROI will be, according to Yoesle.

“For some, the thought of predictive analysis through a standard approach layered with an AI learning touch could help shore up a deficiency in their analytical reporting abilities,” he said.

“Other providers may have a rock-solid analytics system and multiple RCM leaders who leverage the toolsets. But they may also have grown stagnant in their use of those tools and lack the bandwidth to dig into trended data for more business insight beyond the raw data routinely reviewed every day/week/month.

Meanwhile, other RCM providers or even service providers may apply AI in customer-facing areas to drive consistent responses, improve basic throughput and provide a higher level of self-service.”

Virtual agents, for instance, can replace decades-old interactive voice response telephony systems and are able “to enhance a call center environment’s ability to connect with all patients who need assistance,” said Yoesle.

“Pushed even further, this technology can learn when to contact consumers and proactively pull data to have an intelligent conversation, walking a consumer through upcoming appointments or resolving an [explanation of benefits] EOB issue seconds after an EOB-related denial is received,” Yoesle said. “That speed to action can shorten our revenue cycle time and improve the patient experience with one effort … and that just scratches the surface of possibilities for our industry.”

How robotics and technology will drive future RCM strategy

The positive impact of robotics and technology is the main driver (35.7%) of revenue cycle management strategies going forward, according to survey results.

Other significant ways robotics and technology would influence future RCM strategies, according to respondents are:

- More resources for automation (28.6%)

- Streamlining processes (24.3%)

- Improved staffing (10%)

Just 22% of respondents indicated robotics and technology had minimal influence on their organization’s RCM strategies.

Other factors seen as positive but of lesser impact were higher data quality (5.7%), more investments (4.3%) and better ROI (4.3%).

5 top uses of automation in the revenue cycle

When asked about their willingness to add more automation to the revenue cycle management process, 99% of responses were positive, indicating healthcare finance professionals understand the ways it can be used to improve their revenue cycle’s accuracy and efficiency.

Most survey respondents (52.2%) are unequivocally open to adding more automation while 35.9% would do so if it were going to be helpful and nearly 10.9% would if there was a compelling case for it. Only 1.1% indicated there was no need for it.

Respondents indicated the top five areas where there is room for additional automation are:

- Repetitive process/workflows (42.7%)

- Claims (35.5%)

- Revenue cycle (24.4%)

- Denials (23.2%)

- AR/payments (22%)

Yoesle said, “The top five categories mentioned by respondents likely also represent where providers have the most of their RCM labor-force focused, thus they are seen as an area ripe for automation.”

Although staff reduction is often seen as a solid ROI for automation, it is important not to overlook the cost savings tied to increasing effectiveness by removing errors tied to variables within a process performed by multiple team members. “Removing or reducing variables in a process creates an inherent lift from increased accuracy and a reduced volume of rework, which may have been causing a delay in account resolution,” Yoesle said.

“Processing denials through a standard operating process (SOP) is a great way to leverage automation, and while you may not be able to automate 100% of the SOP, even impacting half of the functional steps with automation creates improved accuracy and efficiency,” he said.

RCM’s continuous evolution should be celebrated not feared

The constant evolution of the healthcare revenue cycle space may be the reason the majority of respondents (71%) to a Parallon survey said they “were uncertain of technology” when asked to provide a reason for questioning the use of AI in revenue cycle management.

The vast majority (86.7%) of respondents approved of AI use in RCM, but 12.2% of respondents questioned it’s use, according to the survey conducted at HFMA’s Annual Conference in June. Just 1.1% indicated AI probably did not have a place in RCM.

“The healthcare revenue cycle space is always evolving, sometimes because we’re forced (think federal regulations) and sometimes because we’re curious how we can improve organizational financial outcomes and reduce the financial harm we cause our patients,” said Tom Yoesle, chief experience officer at Parallon.

Either way, we’re moving toward a new, different, scary and hopefully better state of revenue cycle operations.

“Change is inevitable, and we have the opportunity to be the driver of change related to AI,” Yoesle said.

“The knowledge RCM professionals possess is immense, he added. If we could transform just 1% of that overall knowledge into an AI source that drives a basic tried-and-true methodology to course-correct an identified negative trend all without our intervention … that would be a game-changer. If AI can help deliver on that, it will be a step forward in evolving our industry.”

About Parallon

Parallon is a leading provider of healthcare revenue cycle management services. With a long track record of operational excellence, Parallon brings extensive knowledge and a broad portfolio of custom solutions to every partnership. Parallon enables providers to care for and improve the health of their communities by optimizing financial performance, navigating regulatory challenges, providing operational best practices and leveraging the latest technology. Parallon has 17,569 colleagues and serves 959 hospitals and 2,979 physician practices. Parallon is headquartered in Nashville, Tennessee, with operational locations across the country. For more information about Parallon, visit parallon.com.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.