How healthcare organizations navigate claims processing

Effective revenue cycle management relies on accurate, timely claims processing to sustain administrative and clinical functions.

A complex system of multiple steps and dependencies from submission to payment, the life cycle of a claim demands a robust process handled by well-trained staff. Considering the interconnectedness of the revenue cycle, claims processing also relies on other elements such as ongoing data management and front-end tasks, including insurance eligibility and authorization.

Breakdowns within claims processing and across other parts of the revenue cycle can have consequences ranging from cash flow issues to negative patient experience. Healthcare leaders must weigh the costs of investment in resources against the risks of an inefficient, error-prone process.

When examining claims processing and revenue cycle performance, healthcare leaders consider their organizational environment to determine opportunities for improvement in reviewing, tracking, analyzing and resolving claims. The information below is based on a survey of healthcare leaders conducted by HFMA and sponsored by Sage.

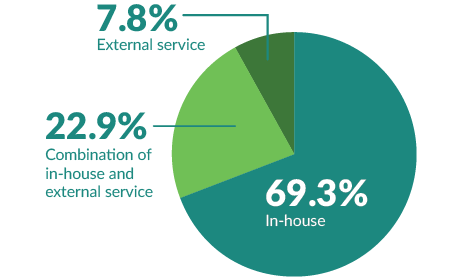

Percent of healthcare organizations primarily managing new claims in-house

Slightly more (71.2%) hospitals and health systems use an in-house approach to new claims management than other healthcare organizations – practices, clinics, facilities and labs – that use it (65%).

Electronic medical records and practice management systems are preferred tools to track and analyze claims

The majority (85.4%) of healthcare organizations use electronic medical records (EMR) and practice management systems to track claims while 63.4% use that same technology to analyze claims. Hospitals and hospital systems are more likely to use EMR systems to track and to analyze claims than other types of healthcare organizations, which are more likely to use practice management software.

Additionally, nearly 27% of all respondents rely on accounting systems and external billing services, which can deepen an organization’s understanding of claims management in relation to revenue cycle performance.

Organization-built dashboards tend to incorporate live data

Some 61.1% of survey respondents create dashboards and report using purpose-built software that accesses system data.

Dashboards created by organizations using purpose-built software – more common in health systems and hospitals – are more likely to utilize live data than dashboards created by end users. Software that pulls in data from multiple sources across an organization provides a comprehensive view of a given scenario that supports cross-functional, enterprise-aware decisions.

Larger organizations with higher new claims volume realize certain efficiencies

Organizations with the most employees and locations have the highest monthly new claims volume. Demonstrating low average days sales outstanding (DSO) compared to organizations with lower new claims volume, organizations with higher new claims volume write-off the highest total dollar value in claims each year.

Average DSO indicates success rate of claims resolutions

$3,128

Average outstanding claim

amount for all survey

respondents

49.95

Average DSO for all survey respondent

claims

Respondents from organizations with the lowest DSO had a higher number of new claims submissions each month, a high first pass claims rate and a low average value of each outstanding claim.

Staff and technological resources impact effective revenue cycle management

When given up to three choices, healthcare leaders believe significant factors that hold them back from effectively managing their revenue cycles are:

- Lack of staff

- Limitations of EMR or practice management system

- Inadequate staff training or knowledge

More than 70% of respondents said staff resources were a primary cause of ineffective revenue cycle management, including 41.2% citing lack of staff and 33% inadequate training or knowledge. The limitations of their EMR or practice management system were a concern for 34.6% of respondents.

About the survey

- Conducted online from Sept. 23 to Oct. 9, 2022

- 627 HFMA members responded

- Revenue cycle, finance, patient financial services and accounting leaders participated

- Nearly 60% of respondents were at organizations with more than 1,000 employees

- Hospitals, health systems, medical groups and other providers were among those represented

About Sage

Sage helps healthcare organizations focus on strategic initiatives, increase efficiency and drive growth by delivering a depth of healthcare capabilities you won’t find in a traditional enterprise accounting software suite. The company’s cloud-based, HIPAA-compliant financial management system, Sage Intacct, provides healthcare finance leaders the visibility, flexibility, and efficiency to manage finances, operations, and people across acute, ambulatory, and post-acute organizations.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.