Transforming Accounts Payable: Opportunities, Challenges, and Next Steps

Streamlining accounts payable can help hospitals and health systems better manage their cash flow and working capital, increase ROI, and improve operational efficiencies while enhancing relationships with vendors and suppliers. Optimizing this business area also allows organizations to better allocate team members to focus on more value-added activities and other strategic initiatives. This HFMA Education Report, sponsored by GHX, discusses the advantages of revamping accounts payable and the underlying reasons why leveraging technology to better enable this effort could be critical to future success and staying ahead of the competition.

The current healthcare landscape

As hospitals and health systems make the shift from fee-for-service to value-based care, many are struggling to find their footing, looking for ways to become more financially nimble while improving patient outcomes. To weather changes, seize opportunities, and remain open to whatever unknowns come next, organizations must seek and implement ways to improve the financial bottom line. One approach is to optimize cash flow into the organization by strengthening payer reimbursement and patient payment. On the other side, organizations can also ensure that any cash leaving the organization is well-timed and well-spent. This second strategy requires an in-depth examination of accounts payable processes. Organizations should look for ways to pay vendors, suppliers, and other partners more efficiently while fostering stronger relationships. This combination of efficiency and strong partnerships can support a more effective and reliable supply chain. At the same time, accounts payable departments must be careful to remain in compliance with regulations because missteps in this area can lead to payment delays, penalties, and other issues that can negatively affect payment.

For many healthcare organizations, accounts payable remains a mostly paper-based endeavor. According to a recent survey by PayStream Advisors—in which hundreds of payables practitioners and C-suite executives from across different industries weighed in on payables trends—healthcare organizations receive nearly three-quarters of their invoices on paper or via email and rely heavily on manual invoice processes. 1 If they do use an electronic invoicing system, it is often difficult to configure or outdated—coming as a built-in part of their enterprise resource planning (ERP) tools.

On the payment side, the use of paper continues. According to the same survey, more than 50 percent of healthcare organizations use checks to make supplier payments. Even though some organizations have embraced electronic payments, the number has stagnated over recent years. Part of this could be due to the different kinds of healthcare organizations that exist. Although larger hospitals and health systems typically lead the charge in adopting automated solutions, smaller entities—especially those with a lot of direct spend—frequently lag behind.

The problems with paper

There are several drawbacks of paper-based accounts payable processes. First, when there are high volumes of paper invoices, accounts payable departments can get overwhelmed with manual entry, leading to input errors, problems matching invoices with purchase orders, and the risk of noncompliance with reporting regulations—not to mention delays and frustrated suppliers.

Second, there are several disadvantages to paper checks. Not only must an organization spend money on paper for printing, but staff must issue and mail the checks using postage. This is a resource-heavy endeavor, and it slows down the payables process. The chances of fraudulent activity also go up because checks can be easily intercepted, rerouted, and duplicated. Lost checks are also a frequent challenge, causing staff to redo the work of generating and mailing the check.

Although some organizations may opt to use checks to extend their days payable outstanding (DPO), this may not be the most strategic way to optimize cash flow. In some cases, when organizations delay cutting checks, they wait too long and miss out on early payment discounts or run the risk of jeopardizing vendor relationships. According to PayStream Advisors’ research, duplicate payments, late payments, missed discounts, and high processing costs are the most prevalent challenges faced by payment management teams in health care.

Manual processes also don’t allow organizations to gain insight into their payables data over time, which prevents them from identifying trends and pinpointing performance opportunities. Without data, organizations are unable to plan strategically, which can negatively affect their ability to navigate new payment models or sustain robust financial health.

The supplier perspective

As with hospitals and health systems, healthcare vendors and suppliers are under pressure to improve cash flow and working capital amid rising interest rates and intensifying competition, making the improvement of order-to-cash cycle times a top priority. According to a recent survey by the Thought Leadership Studio, nearly 90 percent of finance executives at healthcare suppliers indicated that these pressures are likely to increase over the next year, and 89 percent say their teams expect to spend much more time and attention in this area going forward. 2

Amid competition in the marketplace, suppliers frequently are put in the difficult position of accepting less-than-optimal payment terms and arrangements to attract and retain business. The survey indicates that 87 percent of healthcare suppliers believe the pressure to tolerate longer payment cycles has increased in recent years, and another 83 percent say that it will likely increase further over the next year.

Suppliers also wrestle with healthcare organizations’ manual accounts payable processes. For example, they may have to wait on overdue receivables or commit time to following up on late or incorrectly allocated payments. There are also reams of paper to manage, which compounds if each of their healthcare partners engages in manual processes. Moreover, each hospital or health system has its own way of doing things, and the supplier must respond to those various needs, adding to the complexities and resource intensiveness of managing incoming payments. Finally, a paper process does not give the supplier any insight into its performance against agreed payment terms or allow it to identify opportunities for better financial results.

Problems with Paper

- Labor intensive

- Error prone

- Costly

- Inefficient

- Increased chance of theft or fraud

- Lack of data for strategic planning

Suppliers are dealing with paper not only when receiving checks from healthcare organizations, but also when sending out invoices. According to the Thought Leadership Studio survey, the majority of suppliers say their companies distribute 20 percent or more of their invoices on paper, and more than three-quarters of respondents (76 percent) say that fewer than half of the invoices they deliver are paid electronically.

Automation presents an opportunity

One effective method for overcoming paper’s disadvantages is to transition to automated payable processes. There are a number of benefits to this approach. For hospitals and health systems, electronic options can accelerate invoice approval and improve accounts payable efficiency, allowing managers to shift staff from low-level tasks such as cutting and mailing checks to focusing on more strategic efforts.

More specifically, automation allows providers to match, approve, and pay invoices electronically, promoting a shorter and more cost-effective transaction cycle. This approach can virtually eliminate reliance on paper, printing, and postage. Electronic solutions also give organizations greater visibility into the payment process, letting them track where a payment is and run reports to spot trends and opportunities.

Depending on the automated solution, organizations also can take advantage of rebates, early payment discounts, and extended payment options that drive revenue into the department. Accounts payable traditionally has been a cost center for organizations, however, through automation, the department can become one that generates revenue instead.

Not only can electronic options assist hospitals and health systems, but they also can be beneficial for vendors and suppliers. An automated solution that offers incentives and helps vendors and suppliers better collaborate with providers could address some of the abovementioned challenges that vendors and suppliers face, getting them onboard with a more streamlined, standardized, and efficient electronic process.

Resisting change

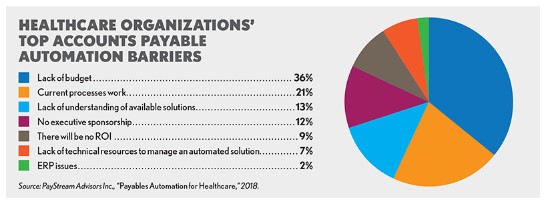

Despite the benefits of automated systems, some healthcare organizations continue to resist changing their existing accounts payable processes. According to PayStream Advisors, absence of a budget, the perception that current processes are working, and lack of understanding about available solutions are the chief barriers to adoption. Organizations may perceive the price tag for fully automating an accounts payable system to be cost-prohibitive and the work involved too disruptive, especially when there is the perception that the current processes are working just fine. Upgrading the accounts payable system may also not be as top-of-mind as other financial priorities, taking a back seat to efforts such as revamping patient collections and streamlining payer reimbursement.

However, as suppliers and vendors start demanding more streamlined payment options and rejecting commercial cards to minimize interchange fees, a hospital or health system may likely be left in a situation where it needs to make a switch. If the organization delays this important change, it could miss out on key revenue opportunities such as rebates and early payment rewards. It could also continue to spend money on outdated processes that are inefficient and quite likely unreliable. As the broader financial landscape evolves toward digital solutions, healthcare organizations will need to rethink how they approach payment processes and embrace the idea of electronic options.

Leveraging different automated options

Once an organization commits to an automated approach for procurement and payables, it must then decide which of the myriad options to pursue. There is not one payment solution that’s best for all payments. Having a mix of options can yield the greatest efficiencies and strongest cash flow.

Some of the more common payment options include automated clearing house (ACH) systems and bank-provided P-card programs. These are a step beyond checks, yielding moderate improvements in payment visibility and additional revenue through rebate programs. They give vendors flexibility in how they receive payments, which can foster better relationships, and they also reduce reliance on paper, making the accounts payable function somewhat more efficient, effective, and compliant. P-cards can be especially beneficial for small dollar-amount purchases or one-time charges because they eliminate some of the paperwork associated with small checks. This approach also cuts down on petty cash reimbursements. With a purchase card, staff members complete transactions at the point of sale, and the accounts payable department does not have to touch payments multiple times.

Virtual cards are the next step along the evolutionary path, and they have been popular among both providers and suppliers for the past 10 years. These cards involve a one-time use, auto-generated credit card number that the accounts payable department sends to the supplier. The supplier then logs into the system to redeem payment. This option also offers rewards and rebates and is known to be a secure method for exchanging payment. It constrains the purchase to a given amount and is not susceptible to being physically lost or stolen.

Having flexible options allows the accounts payable department to optimize its automated payment process for the greatest ROI. For example, although a credit card is good for a heavy volume of small transactions, for a one-time, $1 million payment, it doesn’t make sense to incur a credit card fee. If the fee is 1.5 percent, for example, that adds up to real money that the organization is not going to get.

More recent technology in the form of electronic payables (e-payables) solutions lets healthcare organizations pay using a variety of electronic payment options, including ACH, commercial cards, virtual cards, and international payments. By using an e-payables solution, organizations can capitalize on the best method for a particular vendor. Through these programs, hospitals and health systems can take advantage of rebates, early payment discounts, and other significantly valuable benefits that drive revenue back into the organization. Accounts payable departments can standardize approval workflow and reconciliation for all payment types, so that staff can seamlessly receive, process, and pay invoices with just a few clicks.

Benefits of Electronic Payment Automation

- Increase rebate opportunities and improve profit margins

- Save accounts payable time and effort

- Improve efficiencies in finance

- Shift accounts payable teams into more value-added activities

- Reduce payment costs

- Limit or eliminate reliance on paper

- Improve cash management

- Ensure compliance with regulations

- Improve visibility into spend and identify opportunities to optimize payment mix

- Reduce payment fraud

With an e-payables solution, the technology provider handles most of the back-end supplier management, recruiting and onboarding various vendors over time. As part of this process, the solution provider uses a variety of communication means, including email, phone, and postal campaigns, to reach out and transition vendors to the technology. The company may offer a support center to handle supplier questions and payment issues and assign a dedicated supplier enablement team to facilitate buy-in and onboarding. With the technology provider doing most of the heavy lifting, this type of option requires minimal involvement from the healthcare organization to get everyone participating.

Because of the wide variety of solutions they offer, many e-payables providers guarantee the success of every payment. Add to this the fact that organizations can take advantage of potential rebates and early payment discounts, and an e-payables platform can help an organization transition its accounts payable department from a cost center to a revenue generator, capable of providing insight through detailed reporting. This technology also lets an organization leverage payment data in procurement conversations and negotiations. For example, if an organization knows on the back-end how it is going to pay for something, it can build any associated costs into pricing discussions and negotiations up front. In the end, the purpose of these solutions is to optimize payments so an organization can receive the greatest benefit.

Implementing e-payables systems does not have to be costly or time consuming. Best-in-class programs offer hosted plug-and-play solutions, cloud-based technology, and a relatively nondisruptive implementation process. They don’t require extensive training and the vendor handles supplier recruitment. Because the technology is cloud-based, the need for internal IT involvement is minimized—organizations don’t have to be involved in frequent upgrades or complex installations. Many solutions also seamlessly integrate with ERP systems, requiring little downtime to connect automated payables solutions with existing systems.

Getting started

As a first step in moving toward an optimized accounts payable function, organizations should spend time evaluating their current state and seeing where opportunities may lie. Such an analysis gauges existing performance and allows an organization to benchmark itself against industry standards. The more detail a hospital or health system can generate about its current invoice-to-payment process, the more knowledgeable it will be when identifying shortfalls, pinpointing improvement opportunities, and determining whether automation is the right choice. Going forward, this effort can also lay the groundwork for selecting the right technology provider.

If an organization decides to adopt an automated solution, it must promote enthusiasm among stakeholders and identify a champion for the technology. This individual or group can make sure there is interest, engagement, and commitment for the project, as well as sufficient budget. They also will want to drill down into specific user needs and how resources will be allocated before, during, and after implementation.

Paper-based payment systems are longer an option

As the healthcare industry continues to evolve, holding on to paper in the accounts payable department is no longer a sustainable strategy. Not only can it potentially hold an organization back, but the inefficiencies and extra costs associated with paper-based processes go against the broader mission of healthcare organizations—to deliver high-value, cost-effective care. By embracing automation, organizations can transform their accounts payable departments and navigate what’s next. Electronic options such as e-payment solutions can streamline processes, cut costs, and execute payments in a timely manner, benefiting both the organization and its suppliers. These improvements can further collaboration between providers and their suppliers, cultivate strong supply chain relationships, and enable better patient care.

Footnotes

1. PayStream Advisors Inc., “Payables Automation for Healthcare,” 2018.

2. Institutional Investor LLC, “Driving Performance Through Automation: Finance executives at healthcare suppliers reveal their cash and working capital priorities, plans, and aspirations for 2017,” 2017.

About Global Healthcare Exchange

Global Healthcare Exchange (GHX) is a healthcare business and data automation company, empowering healthcare organizations to enable better patient care and maximize industry savings through a cloud-based supply chain technology exchange platform, solutions, analytics, and services. By leveraging GHX ePay, organizations can streamline their payment process allowing providers to put an end to costly, tedious and ineffective paper check processing. Healthcare providers will gain measurable financial benefits by reducing AP costs and adding revenue through increased rebate capture with pre-established discount terms applied with participating vendors. The company currently brings together more than 4,100 healthcare providers and 600 manufacturers and distributors in North America and another 1,500 providers and 350 suppliers in Europe. These organizations rely on GHX’s secure healthcare-focused technology and comprehensive data to automate their business processes and make more informed, timely, and fact-based decisions. Through collaboration with healthcare providers and suppliers, GHX takes more than a billion dollars out of the cost of delivering healthcare every year. GHX employs more than 600 people worldwide. In the United States, it has corporate headquarters in Louisville, Colo., with additional offices in Atlanta, Ga., and Omaha, Neb.