Boston Children’s Journey to a Better Healthcare Payment Experience

Adopting a completely electronic payment system helped one hospital improve the patient payment experience.

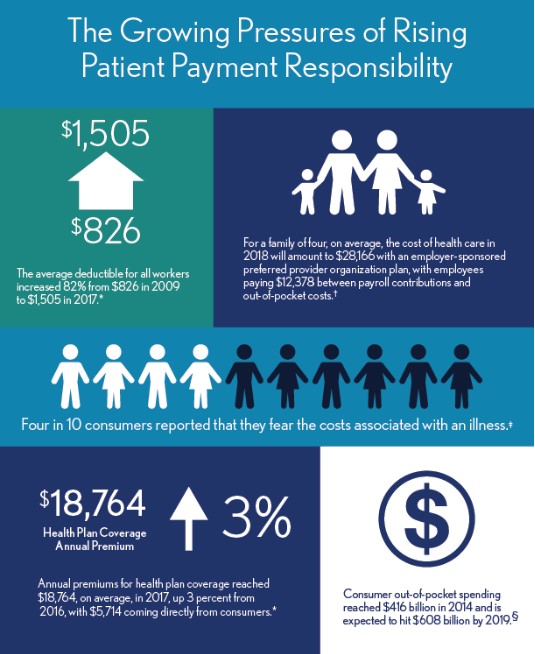

As healthcare consumers take on a greater payment responsibility for their care, research shows they are also looking at those costs with trepidation. According to a recent study, four in 10 consumers reported that they fear the costs associated with an illness, which is more than the number of consumers who actually fear the illness itself. a In other words, it is very likely that patients coming in are thinking about how they will pay for that visit instead of the reason for the visit.

The Current State of Patient Financial Responsibility

High deductibles, copayment, and coinsurance, in addition to rising health insurance premiums, have patients paying more for their care than ever before. Consider the following:

- According to Kaiser Family Foundation’s 2017 Employer Health Benefits Survey, the average deductible for all workers increased 82 percent from $826 in 2009 to $1,505 in 2017. b

- Consumer out-of-pocket spending reached $416 billion in 2014 and is expected to hit $608 billion by 2019. c

- Annual premiums for health plan coverage reached $18,764 in 2017, up 3 percent from 2016, with $5,714, on average, coming directly from consumers, the Kaiser Family Foundation survey says.

When looking at the entire financial picture for a family of four, the cost of health care this year will amount to $28,000 with an employer-sponsored preferred provider organization plan, with employees paying $12,378 between payroll contributions and out-of-pocket costs. d

The Growing Pressures of Rising Patient Payment Responsibility

†Girod, C.S., Hart, S.K., and Weltz, S.A., 2018 Milliman Medical Index , Milliman, May 2018.

‡National Opinion Research Center at the University of Chicago, “Americans’ Views of Healthcare Costs, Coverage, and Policy ,” March 2018.

§ Kalorama Foundation, Out-of-Pocket Healthcare Expenditures in the United States , April 17, 2017.

Widening Divide Between Confused Patients and the Healthcare Industry

The effects of this upswing in patient payment responsibility are just now coming into view for the industry. One troubling trend is that consumer understanding of payment responsibility is not keeping pace with the responsibility itself. Only 9 percent of patients could successfully define all four basic healthcare payments concepts: plan premium, deductible, co-insurance, and out-of-pocket maximum. e This statistic is doubly startling when one considers that the percentage of Americans working in the healthcare industry also is about 9 percent, leading to the conclusion that the average patient is completely in the dark about healthcare payments. f

A major contributor to this alarming trend could be how the industry communicates with patients about their payment responsibility. On that point, documents such as explanations of benefits (EOBs) and medical bills typically still have the same look and feel that have been used for decades. Instead of redesigning the forms to be more readable, the industry has poured endless resources in trying to educate patients on how to read these documents. This is a mistake as these efforts have not caused patient confusion to be abated—72 percent are confused by EOBs, and 70 percent are confused by medical bills. g This confusion results in a widening divide between healthcare organizations and the patients they serve.

Case Study: Boston Children’s Hospital

For Boston Children’s Hospital, the trends around healthcare payments could not be ignored. Realizing that the communication methods around payment were ineffective in helping patients understand their responsibility, Boston Children’s decided to evaluate its patient statements in 2015. The hospital’s Family Advisory Council— an in-person council consisting of parents of Boston Children’s patients as well as Boston Children’s employees— reviewed new statement layouts and voted on the designs that were easiest to understand.

The statement changes were effective, but the payment experience at Boston Children’s was still somewhat complicated to navigate. For example, the methods by which patients could pay depended on the specific interaction point that they were being asked for payment. Families with more than one child receiving treatment or a child visiting multiple departments encountered many different payment options during any given visit, making it difficult to come prepared to pay. These disparate practices left many unable to use their preferred payment method.

Guaranteeing a uniformed payment experience across all departments and locations became the priority in improving the payment experience at Boston Children’s. Industry data support an emphasis on payment options: For example, 80 percent of patients responding to a recent survey on this issue said that payment channel choices were very or somewhat important to their medical bill payment experience. h

Consistency also was necessary for internal billing processes. On the back end, there were numerous merchant accounts, tax IDs and billing services associated with Boston Children’s billing, all requiring separate fees and payment devices. Eventually, managing the different systems would no longer be sustainable to maintain from an operational prospective.

The hospital implemented a centralized billing system to consolidate billing throughout the organization. The rollout of this system meant that every point of interaction offered patients electronic options to make a payment, including credit and debit payment cards.

A Cashless Initiative

Once the centralized billing system was in place, Boston Children’s saw an opportunity to introduce a cashless initiative by exclusively promoting the electronic payment options now consistently available to all patients. Data show that consumers across industries prefer to pay by credit or debit card: 77 percent of consumers compared with only 12 percent who prefer cash. i

To ensure a successful launch of the system, the hospital conducted comprehensive staff training on how to integrate payments into the normal routine for patient check-in. Daily reports also were created to track the success of these efforts. Every stakeholder in the cashless initiative, from enterprise-level executives to the front desk, were sent these reports in an effort to promote transparency and encourage team members to help each other adjust to the new method.

The Family Advisory Council at Boston Children’s also was included in the preparation and delivery of the electronic payment initiative to ensure a smooth execution. Processes and communications were developed to prepare families for the change and maintain the positive atmosphere of the organization, where the focus would remain on the patient, not the payment. Signage, text messages, emails, and voicemail prompts alerted families to the launch date of upcoming electronic payment initiative and highlighted their new options to make a payment.

Patients who were not prepared to make a payment at the time of service were simply billed later or referred to a patient financial counselor based on patient need.

With the launch of the electronic payment initiative, payment at the time of service increased 93 percent, from 44 percent to 85 percent. The hospital sourced feedback from focus groups and the Family Advisory Council and overwhelmingly found that the up-front payment option was not only welcomed but also actually preferred over the usual scenario of having to wait weeks for a paper statement. The hospital also was able to save the cost of printing and mailing paper statements, as well as staff time that had previously been spent on follow-up and payment processing.

Strengthening Patient Payment Options the Future

The initial success of the electronic payment initiative validated that families valued an easy and convenient payment experience. Consequently, Boston Children’s has since built on that initiative by rolling out new features and functionality such as adding Apple Pay and Google Wallet as payment options. The hospital currently is working on integrating payment into its welcome kiosks and online patient portal. Families will have the ability to schedule appointments, check-in to their visit, and make a payment at their convenience without any staff intervention. Mirroring similar experiences in other settings such as the airline industry, the goal is to offer a completely autonomous experience that focuses on convenience and reduces wait times.

Optimizing patient payment gave families a more convenient experience, allowing them to focus on their children’s health and minimizing the stress of treatment.

Kevin Pawl, MS, FACMPE is the enterprise senior director of patient access, Boston Children’s Hospital, Boston.

Footnotes

a. National Opinion Research Center at the University of Chicago, “Americans’ Views of Healthcare Costs, Coverage, and Policy,” March 2018.

b. Henry J. Kaiser Family Foundation, 2017 Employer Health Benefits Survey, Sept. 19, 2017.

c. Kalorama Foundation, Out-of-Pocket Healthcare Expenditures in the United States, April 17, 2017.

d. Girod, C.S., Hart, S.K., and Weltz, S.A., 2018 Milliman Medical Index, Milliman, May 2018.

e. UnitedHealthcare, 2017 UnitedHealthcare Consumer Sentiment Survey, October 2017.

f. Henry J. Kaiser Family Foundation, “Health Care Employment as a Percent of Total Employment,” State Health Facts, May 2017.

g. Instamed, Trends in Healthcare Payments Eighth Annual Report: 2017, May 2018.

h. Trilli, M., U.S. Medical Bill Payments: Support for the Health Plan Model, Aite, March 14, 2018.

i. TSYS, 2017 TSYS U.S. Consumer Payment Study , March 2018.