Research shows that hospitals delivering a better patient experience are more profitable. As a result, it is critical for providers to continually improve all elements of the patient journey (Betts, D. “Better patient-reported experiences = more hospital profitability,” MedCityNews, May 31, 2017).

Patient experience was once shaped primarily by clinical interactions. Now, as patients pay more out-of-pocket healthcare costs, financial services also influence patient experience, perceptions and actions. Patients who have an engaging financial experience, including services such as cost estimation, appointment reminders, financial counseling and payment options, are more likely to pay their bills in full and rate the overall episode of care in a positive light

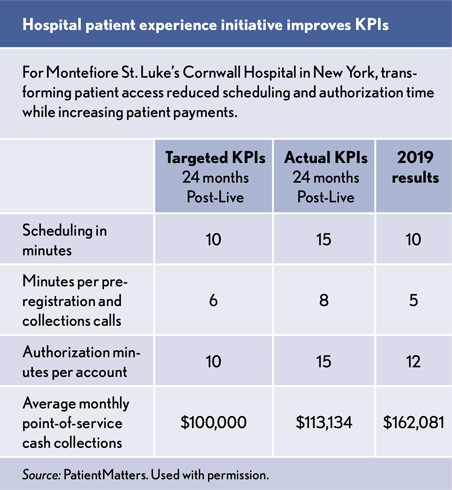

For example, Montefiore St. Luke’s Cornwall Hospital in New York had a large share of self-pay patients. By improving patient experience and payment processes, the hospital went from collecting about $400,000 in timely payments annually to increasing payments by nearly $2 million in 2019, a five-fold increase (LaPointe, J., “Pre-Access Center Collects More Patient Financial Responsibility,” RevenueCycleIntelligence, May 20, 2019).

The hospital adopted centralized scheduling, cost estimates, prior authorizations, insurance verification and payment planning before care. Scheduling, preregistration and authorization times dropped significantly, patients got to their clinical destinations faster, and payments increased.