Ensuring the Revenue Cycle Gets a Clean Bill of Health

Taking preventive action to create clean claims and reduce the incidence of denied claims is essential for keeping the cash flowing.

Claims matter, and anyone who has been involved in the process knows that filing and managing them can be tedious. Although no one would suggest the day-in, day-out routine of claim generation, transmission, and reconciliation is the most exciting part of healthcare organization’s financial universe, there is no denying the importance of this routine to an organization’s fiscal prosperity. The chief source of revenue for most hospitals is still payment for claims. Whether payment is fee-for-service or value-based, made by a government or third-party payer or the patient, creating claims and processing them accurately and quickly is essential work.

The object in this process should always be to produce clean claims—i.e., claims that are immediately reimbursable. Doing so is an important factor in reducing cost-to-collect, especially in an environment where the growth of costs (7.5 percent) is outpacing revenue growth (6.6 percent). a Some denials may be inevitable, but most are avoidable, so reducing their number is doubly important, because a denial is both an interruption in cash flow and a drain on expenses in the many instances when it must be investigated and corrected or appealed. Estimates put the cost of reworking denied claims as high as 20 percent of an organization’s revenue cycle expenses, because these claims are four times more expensive to process, on average, than the initial claim.

The topic of claims and denials may feel tired, and an organization may think it has done all that it can to optimize this segment of its revenue cycle. However, in this industry of continually changing standards, practices, and regulations, there always is room for effective process improvement. Given that an ounce of prevention is still worth at least a pound of cure, it can be instructive to explore the opportunities available through preventive action to create clean claims and reduce the incidence of denied claims.

Key Metrics

An organization’s clean claim rate (CCR) measures the number of claims passing claim-processing edits, such as on intake into the electronic claims management tool or claim scrubber, that do not require manual intervention. A high CCR suggests that the data collected and processed within the electronic health record (EHR) are of high-quality, which may mean claim production processes in the EHR are highly accurate or incoming claim data undergo a meticulous routine of conversions within the claim processing tool to overcome EHR shortcomings. Realistically, both factors may be in play. Regardless of how a high CCR is achieved—whether through greater initial accuracy or through custom claim intake routines—the effect is faster time to payment with reduced manual labor for reduced operational expense.

Another important metric is the first-pass rate (FPR)—i.e., the percentage of claims that are accepted for adjudication by payers on the first attempt. This measure indicates the reliability of the claim scrubber, or claim processing tool, and specifically, the quality of its claim editing routines. By catching missing or incorrect data on a claim, which are the most common reasons claims are denied, and perhaps by permitting automated handling of such errors, a claim scrubber with a high FPR also contributes to faster time to payment and lowers manual labor expense by reducing manual correction and resubmission. For a provider processing 100,000 claims per month, a variance as small as 1 percent in the FPR can mean an additional 1,000 claims that must be manually reviewed.

Some organizations choose to abandon the pursuit of an exceptionally high CCR in favor of moving claims out the door as quickly as possible, and then mobilizing follow-up staff to handle denials and the resulting rejections that are bounced back to the clearinghouse with errors flagged, never having made it into the payer’s adjudication system. Other organizations choose to weight the process at the billing stage, examining every claim prior to release to head off the potential for follow-up work down the road. An imbalance favoring such manual effort either during the billing stage or in response to denials is likely to add to the cost of claims management. Greater value can be realized by balancing quality and quantity with a holistic approach to creating cleaner claims and reducing denials that incorporates intelligent efficiency and automation. Such an approach is required because technology cannot succeed in isolation, and the key to such an approach is to employ high-quality technology while also focusing on continuous process improvement.

Quality and Flexibility Paramount

To achieve clean claims and prevent denials, an organization must first have an effective claims management tool for scrubbing claims, reflecting a combination of technology and intelligence. The tool must be able to dependably scrub claims with high-quality edits—that is, accurate and up-to-date rules with which to confirm nearly every data element prior to claim submission. Medical necessity policies published by Medicare, for example, must be both accurate and current, because local coverage determinations (LCDs), in particular, can change frequently. The tool’s flexibility to allow custom processing rules is also important to advance claims quickly through to payer submission.

Even the best claims management tool will be ineffective, however, without the intelligence driving a rules-based claims management process. The rules for claim processing are constantly evolving, requiring dedicated ongoing focus, including research and development of claim edits, to maintain a comprehensive, accurate library of edits.

The scope of standard edits incorporates thousands of specific data elements and millions of code combinations to evaluate rules governing payer-specific payment policies such as Medicare LCDs and national coverage determinations (NCDs); medically unlikely edits (MUE); correct coding initiative (CCI), outpatient code editor (OCE), and commercial medical necessity policies; ANSI standards; and specific data element requirements by payer. However, a truly comprehensive library also must enable processing rules specific to the provider institution or practice and allow for the user-friendly creation of additional rules as needed. It must also enable suppressing or ignoring payer rules where there is a tactical, strategic, or contractual reason for doing so.

A claims management tool should be highly configurable, fitting the policies, methodologies, and business goals of the provider organization rather than forcing them into a preset mold. The workflow engine should allow the provider organization to route work among staff members and departments within the hospital or practice to facilitate collaboration in a fraction of the time that would ordinarily be required to obtain input from other functional areas. As the organization works to improve the accuracy and completeness of the claims it transmits, the tool also should enable cross-departmental teams to collaborate on claim corrections, thereby circumventing first-pass rejections or denials and informing upstream process improvements that eliminate manual work for similar claims in the future.

The claims processing tool also should be capable of applying custom programming to file intake protocols, claim edits, and claim data conversions, thereby overcoming EHR limitations and improving both CCR and the overall efficiency in the patient financial services office. For complex tasks, clearinghouse-driven programming should be completed in days, rather than weeks or months.

Continuous Process Improvement

No matter what tool a provider organization adopts for claims processing, the tool will be ineffective if it is not supported by a culture of ongoing process improvement featuring collaboration, analysis, and productive action with clear accountability.

Design for collaboration. Meeting the goal of optimal claim production with denial reduction requires teamwork among all contributing departments, both financial and clinical. A team therefore should be assembled that includes stakeholders from patient access, clinical departments, coding, compliance, IT, and billing. Sponsorship of this team by executive leadership is important to obtain buy-in from all parties and to establish cohesion, with an understanding that every group will benefit from improved financial performance.

An initial goal of this cross-departmental collaboration should be to instill in all stakeholders an appreciation of the balance of responsibility. The weight of revenue cycle optimization cannot be borne by the patient accounting office alone; likewise, revenue capture must not be viewed as being at cross-purposes with care delivery.

Designing strong revenue cycle processes and establishing accountability for continual improvement may offer healthcare leaders renewed analytical clarity, enabling them to see both the big picture and the critical details as well.

It is important to have all the details with which to work to assess current state and monitor progress moving forward. The provider organization’s clearinghouse should provide automated claim status in every case possible, recording claim acknowledgment, payer acceptance, payment amount, and scheduled date for payment, thereby helping to paint the picture of where and why roadblocks are occurring. Claim status also enables the follow-up teams to manage their workflow by exception, researching only those claims that require action while avoiding time wasted on claims where no action is possible.

Providing a comprehensive business intelligence toolset ties the cross-departmental teams together with a truthful accounting of what is really happening in the revenue cycle. Such a toolset will be valuable at every step in a provider’s optimization effort:

- In gathering initial data and recording baseline benchmarks

- In comparing current performance with peer benchmarks

- In understanding what questions to ask

- In tracking data for analysis, uncovering trends, and identifying root causes

- In mapping accountability and providing key performance indicators by which to define success

- In prioritizing efforts and driving decisions

- In reviewing progress and making adjustments

Collecting relevant data to form a clear picture of current state is an appropriate way to begin designing for collaboration, followed by setting measurable goals for a first phase, second phase, and so on. Industry-standard calculations of important metrics, such as HFMA’s MAP Keys, can be helpful in this regard.

Throughout the continuous improvement process, the multidisciplinary team should meet regularly to discuss what’s working—and celebrate the wins—as well as what’s not working, and other things to consider.

Analyze and identify root causes, and prioritize. A healthcare organization can make extensive use of its business intelligence tools, including its claims management and denial management reporting systems, for analysis and ongoing monitoring only to the extent that its leaders and other stakeholders fully grasp the tools’ full capabilities. Making use of automation for workflow, alerts/notifications, and report generation will greatly enhance the team’s ability to progress efficiently toward established goals.

The team charged with denials management should examine data for the top errors regularly flagged by the claims processing tool, considering both high-frequency and high-impact errors in terms of dollars being delayed. Identifying low-hanging fruit for process improvement can foster cross-department collaboration, setting the stage to start “peeling the onion” for more complex denial trends.

Tracking denials and analyzing them from various points of view frequently uncovers trends. For example, tracking by procedure, by physician, by financial class, by payer, and by revenue department can help better identify points of failure and the impact they have on the organization’s bottom line. Examining partial denials as well as full denials also can help in understanding the full potential for process improvement.

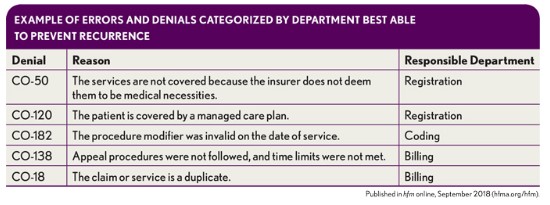

Categorize denials by department. Errors and denials should be categorized according to the department with the greatest ability to prevent future recurrence, as illustrated in the exhibit below.

This type of categorization will point to the root causes in most cases. However, it is important to avoid making quick assumptions before the underlying causes are determined. The questions should keep coming until the root cause is found and until every “why” has been answered.

Statistically speaking, most errors and denials stem from issues related to patient access. Failures for eligibility, prior authorization/precertification, and medical necessity combine to account for nearly 80 percent of denials, according to Advisory Board. b Given the potential consequences of breakdowns in patient access, demonstrated in dollars lost or delayed, this area can be a top priority for corrective action. Issues arising here may demonstrate, for example, a need for better training, greater accountability, better communication between teams, better interfaces/integration between technologies, or some combination of these improvements.

Focus on Medicare. Because Medicare claims typically represent a significant proportion of volume yet are denied at a higher rate than those to commercial payers, it is critical to implement best practices focused on ensuring that these claims are clean.

Beneficiary name mismatch is a common problem because the name on the claim must precisely match the name in Medicare’s system. If a name is mistyped or abbreviated, or a nickname is entered at registration, payment will be delayed while the rejected claim is corrected. Provider organizations should consider using a service prior to billing that checks Medicare’s HIPAA Eligibility Transaction System (HETS) for the exact beneficiary name. Such services also can provide information on frequency restrictions, determine hospice enrollment and therapy caps, and capture SNF, hospital, and lifetime reserve day limits. An effective way to avoid preventable rejections and denials and expedite Medicare claims is to have such details verified automatically during processing as claims enter a claim scrubber system.

If an organization is being plagued by Medicare denials for services deemed to lack medical necessity, the organization should audit its registration process for Medicare patients to determine whether staff have ready access to a reliable medical necessity policy checking tool and whether they have been trained to use it every time. The organization also should consider establishing a channel for communicating with referring physicians to confirm diagnoses. Another element in effective auditable systems and procedures is the proper capture of advanced beneficiary notices (ABNs)—with a mechanism in place for both documenting that they were collected and flagging them so charges are coded accordingly.

Higher denial rates for Medicare Advantage plan claims may occur if validation rules are not applied effectively during claim scrubbing. For example, if claim edits are applied based on the Payer ID, the default for a payer such as Aetna or UnitedHealthcare will likely be edits for the commercial product from those payers. However, the Medicare Advantage products under the Aetna or UnitedHealthcare umbrella, having the same Payer ID, will require a different set of edits: those edits accounting for Medicare rules. To accommodate this anomaly, some mechanism should be in place to permit the application of Medicare edit routines to commercial claims as appropriate.

If an organization’s Medicare billing staff is accustomed to correcting claims in the Medicare online system rather than addressing a claim rejection in the claim scrubber and retransmitting, it is missing an opportunity to learn from those errors. When correcting errors in CMS’s Fiscal Intermediary Standard System (FISS) is the organization’s preferred policy, efforts to document the errors and corrections will be beneficial for augmenting the error data that appear in the claims management performance dashboard for business intelligence reporting.

The key is to be able to derive insights from the business intelligence platform and turn them into action.

Take action and establish and maintain accountability. Having a well-established sense of teamwork within the multidisciplinary team is always important, of course, but it is especially so when actions are taken to correct data inputs and workflow processes. Every resource must be engaged, and the importance of each facet of the revenue cycle—and each member of the team—must be affirmed to avoid antagonism among departments. A tribal mentality, pitting department against department, is counterproductive. For example, if a significant number of errors were attributed to registration practices, representatives from patient access may feel defensive, while other groups may be content to shift blame. The best results can be achieved when teams across the revenue cycle maintain a denial-prevention mindset and respect one another, understanding the vital role of each piece of the process.

Expectations should be clearly defined for everyone, so that some team members do not define themselves or others counterproductively as being the problem rather than a key part of the solution. Accountability also must be shared equally. An imbalance in accountability can result in resentment and lackluster outcomes. With effective teamwork, however, the organization can reap benefits not only from revenue cycle improvements that yield cleaner claims and fewer denials, but also from a better work environment for everyone. Effective teamwork has been linked to improved job satisfaction, more creativity and better productivity.

Workflow automation can yield significant improvements and should be used wherever possible: for communication and claim routing between departments—for automatic claim correction and for posting claim life-cycle events back to the EHR, for example. Removing the burden of paper production and exchange frees team members to be more proactive in their problem-solving.

As previously suggested, an exemplary clean claim strategy begins with accuracy and completeness in patient access. Registration staff will benefit from training on technology use and patient interaction best practices to ensure that the correct data are gathered and verified. This training should include underscoring the need to give attention to prior authorization and precertification, recertification, initial eligibility, coverage of specific services or procedures, limits of coverage (for maximum benefit reached), and frequency limitations.

In general, healthcare leaders can be most effective when they continue to move upstream in their tactics, handling rejections before they become denials; handling errors before they become rejections; and correcting data at the source. Also, engaging the organization’s clinical documentation improvement team can further ensure that this work yields financial benefits and organizational efficiency and improves patient care.

Review, rinse, and repeat. Continuous improvement doesn’t end, of course. Analysis must be iterative and relentless, continually informing refinements to strategic design throughout the revenue cycle for optimal claim processing and reimbursement. Continuing to review denials and designing edits to catch such issues for incorporation into the prebilling and billing process helps prevent future denials. So, too, does the ongoing process of analyzing results as strategic design is implemented and making adjustments as needed. A celebration of the wins, when appropriate, further unites all team members across the revenue cycle.

Going Further

Producing cleaner claims is foundational to reducing denials and improving revenue cycle performance. Top performing organizations build on that foundation with tools to further optimize their financial position: effective denial management, thorough contract management, and intelligent predictive analytics.

Whereas 90 percent of denials are preventable, according to Advisory Board, there will always be some volume of claim denials to be addressed. Being tenacious in recovery efforts is important, but so is having an effective denial management tool and program. A high-quality system will make the job easy by capturing both full and partial denials, providing convenient access to all relevant documents, facilitating appeal letters with ready-to-use templates, and tracking key performance data, including closure reasons.

Although denials may garner greater attention, a hospital’s cash flow can take a significant, albeit less obvious, hit from underpayments. One oft-cited Medical Group Management Association statistic notes that 7 to 11 percent of claims are underpaid relative to the terms of payer contracts. Pursuing revenue integrity with an efficient contract management system helps to flag payments that fall short of contractual obligations.

Going beyond traditional analytics patterns based on historical review and analysis is the next frontier in the revenue cycle, powered by predictive analytics and machine learning-based artificial intelligence. In a recent article, Gartner Research urges revenue cycle leaders to explore these advanced technology solutions because they represent health care’s new frontier for process optimization and automation. c

In the end, the more things change, the more they stay the same. Even as the industry changes daily, producing clean claims and avoiding denials remains a fundamental practice for every healthcare organization. Claims still matter. By taking preventive action to make those claims immediately payable, with a holistic approach that employs state-of-the-art technology with a focus on continuous process improvement, a healthcare organization can streamline cash flow and reduce expense, and thereby achieve enduring financial success.

Footnotes

a. Moody’s Investors Service, “ Moody’s: Preliminary FY 2016 US NFP Hospital Medians Edge Lower on Revenue, Expense Pressure,” press release, May 16, 2017.

b. Advisory Board, “The 2015 Revenue Cycle Benchmarking Initiative,” Dec. 1, 2015.

c. Gartner, Inc., “Healthcare Provider Revenue Cycle Technology Is Underutilized in Tackling Industry Claims Denial Problem,” Sept. 26, 2017.