How to promote patient loyalty by improving network integrity

A health system will miss out on revenue necessary for sustaining its enterprise if its physicians are referring patients to receive care outside its care network.

To achieve enduring financial stability, health systems must pursue initiatives to improve margins. And a particular priority for them is to focus on improving the integrity of their provider networks, with the goal of building patient loyalty to the larger healthcare organization. The first step in such an effort should be to perform a network integrity analysis.

Network integrity describes a health system’s ability to keep patients within the organization’s defined provider network. Performing a network integrity analysis helps hospital leaders understand their market share, service-line volume and potential revenue-generating opportunities. The process uses claims data to track patients through the continuum of care. (For additional details about data requirements and areas of focus for such an analysis see the sidebars “Data requirements for a network integrity analysis” and “Key areas of focus for a network integrity analysis” below.)

To understand what drives patient loyalty, the analysis should address two key considerations:

- Which access points patients are using to enter the health system

- Why and how patients choose where they go

The primary focus of the analysis is to assess the extent to which physicians, both employed and non-employed, refer patients to other providers either exclusively within the organization’s care network or both within and outside (to various degrees) of the care network.

Hospital network integrity typically starts with a focus on primary care, but it should also extend to all of a health system’s service lines. As a basis for the assessments, in addition to examining referral patterns, the following factors should be considered for each department:

- Revenues driven by volume

- Expenses

- Productivity

- Supply inefficiencies

Deeper dives into staffing models and scheduling dynamics can provide further insight for leaders to understand the service-line business.

Ultimately, a network integrity analysis can provide a basis for health system leaders to collaborate with physicians to refine their referral process. The primary objective of the conversations should be to direct referrals to employed providers as a primary choice and, secondarily, to engaged non-employed medical staff, thereby improving both growth and patient retention within the health system.

Case study: VHC health

Healthcare finance leaders can gain insight into the processes for a network integrity analysis from the experience of Arlington, Va.-based VHC Health as it worked to build a strategic plan that would enable it to expand its service-line market share, minimize leakage and address questions about the need for specialties not currently being offered.

To support the assessment, VHC Health embarked on the process of gathering data required to build an all-payer database that would provide insight into the leakage recovery opportunity potentially to be gained from identifying which physicians were referring largely outside of the health system’s network.

VHC Health began its network integrity assessment by looking at primary care, because patients most often start their journey through healthcare delivery in this area. An important initial step was to define the health system’s provider community by identifying all of its employed providers and their national provider identifiers. This step provided the baseline for the analysis.

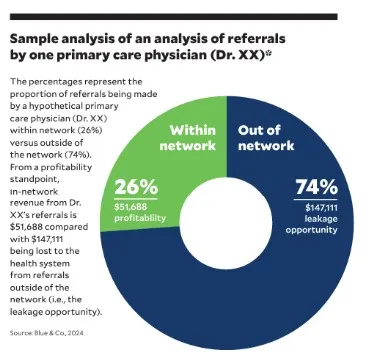

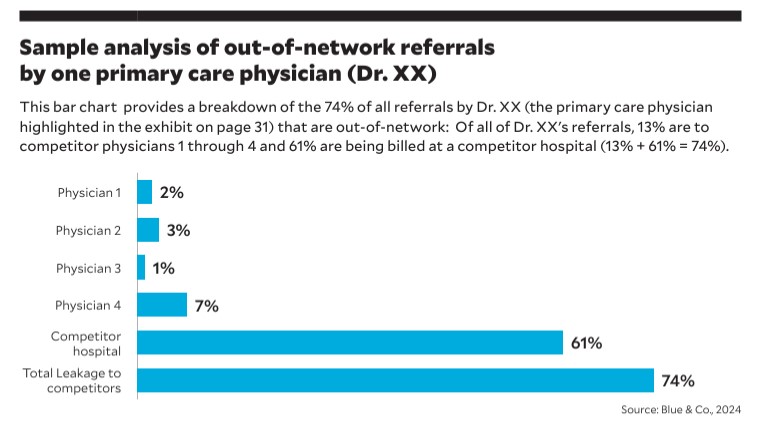

Then, VHC Health analyzed all employed and contracted primary care physicians using a trailing-12-months lookback to determine when patients were referred to other providers within a 30-day period after the primary care visit. This initial data dive established the extent to which the physicians were referring to specialty and ancillary providers within VHC’s system (in-network providers) and which were referring outside of the network to various extents (multi-network providers). These results offered an initial picture of each physician’s ability to drive specialty and ancillary services within the health system. (See the exhibits below for findings of a sample analysis of referrals by one physician.)

Once multi-network physicians were identified, VHC Health’s leaders focused on understanding existing referral patterns. For next steps, VHC Health first focused on the multi-network physicians who the analysis showed were referring at least some of their patients within its network, as this group

would be more likely to convert patients back to VHC Health versus physicians who did not have referrals to VHC Health. Following the analysis, the team planned to meet with the individual providers.

Before meeting with the providers, the leaders considered the following questions:

- Is the provider new, coming from a recent trusted relationship or employment elsewhere?

- Is the provider’s service offered within VHC Health?

- How has the specialty or service line been marketed?

- What outreach has been done to encourage the provider to shift referrals to VHC Health employed specialists?

Understanding outmigration to ambulatory surgery centers

An important element of VHC Health’s analysis was a focus on examining referrals to out-of-network ambulatory surgery centers (ASCs).

The health system started this analysis by pulling claims from patients with ZIP codes in its primary and secondary service areas, the procedures the patients received and the provider rendering the service. The data was then analyzed by insurance, provider employment status and the ASC that billed for the procedure.

This analysis enabled VHC Health to identify the ASCs where contracted medical staff were sending patients. It also provided leaders with insight into procedures being performed outside of VHC Health that the health system was not currently performing within its network, giving them an opportunity to consider whether VHC Health might want to deliver those services.

9 steps for developing an improvement strategy

The reports generated through a network integrity analysis can provide an organization with data it can use to develop a road map for improving both market share and margins. As leaders formulate their strategies, they should consider the following nine areas of focus with the ultimate goal of strengthening relationships with referring physicians.

1 Engage with multi-network physicians. Health system leaders should initiate discussions with these physicians to explore out-migration patterns and why the physicians refer outside of the system. This information can provide insight into why they may be going to another system (for example, the health system’s operating room is always booked on Thursday, prompting the physicians to go elsewhere on that day). The discussions also provide a time for strengthening the relationship while making the physicians aware of services available in-house.

2 Review contracted provider relationships. Leaders should examine relationships with contracted providers to understand where they perform procedures and their patient referral patterns. Such a review should also confirm that the relationship is equitable and that payer mix sharing and adherence to contracts are reasonable.

3 Strategically position providers in markets experiencing leakage. This step may involve leasing or purchasing a building to establish a service line in the market or recruiting specialists to develop the market.

4 Enhance access to service lines. With an eye to improving access, leaders should evaluate current scheduling capacity, the service-line providers’ locations and how they are marketed.

5 Identify and remove referral barriers. Leaders should identify and address barriers that hinder seamless referrals. Providers should be educated about the organization’s specialists in the market and follow-up mechanisms should be established to ensure scheduling is completed.

6 Form strategic partnerships. Leaders should consider establishing strategic partnerships with physician groups that refer outside of the health system, and they should assess whether purchases, joint ventures or a reevaluation of contracts would be mutually beneficial.

7 Develop new service lines. Where there is an identified market need, leaders should create business cases for service lines that do not currently exist in the health system.

8 Enhance the patient experience. Leaders should explore strategies aimed at improving the patient experience in the referral process, assessing, for example, how patients are currently scheduled for specialist visits and post-visit communication and outreach.

9 Analyze competitors. Leaders should evaluate competitor data and devise a strategy to redirect leaked procedures back into the health system. This analysis should include evaluating provider relationships in the market and where they are providing their services.

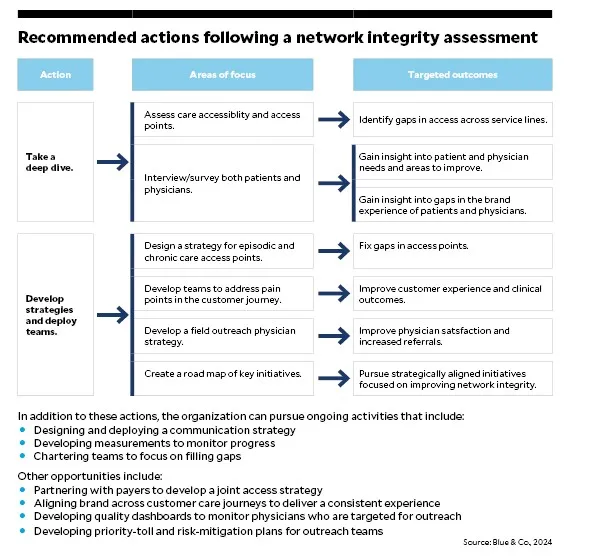

The exhibit below offers a road map of strategic steps and actions a health system can pursue after completing a network integrity analysis.

VHC Health’s takeaways

By reviewing the all-payer claims database, VHC Health’s executive team was able to identify significant market trends allowing them to identify appropriate strategic actions. Where they previously had identified trends through disparate information resources, with the updated, unified approach, they could refine their analysis and make it more specific, allowing for greater reliability in identifying appropriate actions.

The network analysis also provided VHC Health leaders with the confidence in their ability to fulfill the health system’s mission, “To Be the Best Health System” — and deliver on its promise to patients to be “For You. For Life” — by demonstrating excellence as the region’s preferred community-based healthcare system. And this confidence came from their ability to use data for informed relationship-building with the health system’s physicians.

Data requirements for a network integrity analysis

Data is required to develop strategies that incorporate patient charges and volume along a service line and provider.

Data sources

Key data can be pulled from patient and provider ZIP codes, allowing leaders to analyze the out-migration of patients in primary and secondary service areas.

Another valuable source for information is the electronic health record (EHR), which can generate referral reports that can provide insights into how healthcare providers are referring patients within the system.

Data required for analysis can be either drawn from other internal data sources or, in the absence of such sources, purchased from any of numerous vendors that sell database information through protected means.

Claims data considerations

The claims data is collected using secured data, with the goal of developing an all-payer database for the analysis.

It’s worth knowing that the lag time for Medicare data is about six to nine months, while the lag time for commercial, which includes Medicare Advantage, is three months (but can vary depending on the data source and/or vendor).

The claims are blinded to ensure the confidentiality of patient information and other HIPAA requirements with resulting variables for patients that can include charge data, a random patient identifier, procedure reflected as CPT code or MS-DRG, and the ZIP code.

The database allows management teams to analyze any hospital or individual physician based on a National Provider Identifier, the charges incurred based on date, procedure, geographic location and insurance payer (not an inclusive list).

Data integrity considerations

It is critical that the data be timely and from a reliable source, whether it is from public use cost report filings, purchased databases from other governmental sources and/or internal EHR information. Using data more than a year old, for example, can hinder modeling by not incorporating recent physician changes or new facility offerings or practice locations.

Key areas of focus for a network integrity analysis

A thorough integrity analysis typically will have these areas of focus.

- Referrals from primary care physicians to specialists. Examine the frequency and nature of referrals from primary care physicians to specialist providers within the organization.

- Referrals to employed versus non-employed providers. Distinguish between referrals made to providers employed by the organization and those to non-employed medical staff or external healthcare providers.

- Service gaps. Identify any gaps in services that the organization is capable of offering patients but is not currently providing.

- Referrals to non-employed specialists. Analyze referrals to non-employed specialists, and evaluate which of those referrals resulted in claims for procedures performed within the organization. This analysis can provide valuable information on which specialists are most likely to perform procedures within the organization so leaders can encourage employed primary care physicians to direct referrals to these specialists.