Navigant Consulting, Inc.: Hospitals and Health Systems Prepare to Assume More Risk

Discussions about emerging payment models have flourished in recent years, however many providers are still rooted in conventional fee-for-service options. Although hospitals and health systems have acknowledged industrywide emphasis on quality-based reimbursement, it has been somewhat unclear how willing and ready they are to move away from traditional payment models and take on higher degrees of risk.

To learn more about providers’ interest in and capabilities for assuming risk, the Healthcare Financial Management Association (HFMA) surveyed a group of HFMA members about the topic. The survey was in the field for two weeks during May 2019 and involved 170 hospital and health system senior financial executives. This HFMA Research Highlight, sponsored by Navigant, discusses key takeaways from the survey.

Providers are poised to act

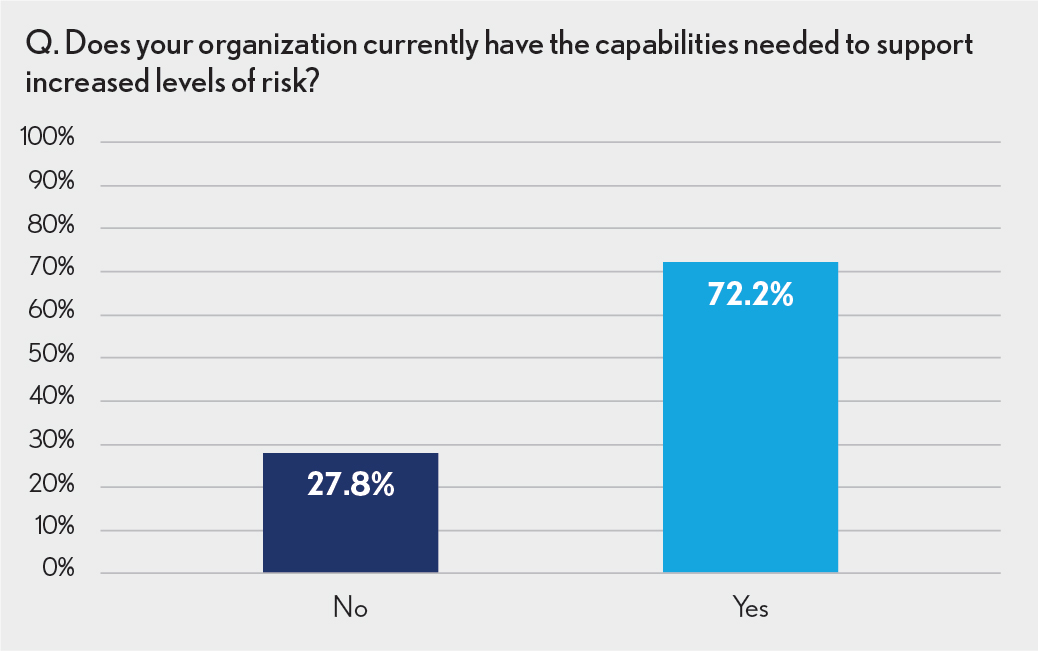

Nearly three out of four healthcare executives (72%) believe their organizations have the necessary capabilities to support increased levels of risk and plan to take on additional risk in the next one to three years. Health system leaders were more certain of their organization’s abilities, with 81% of them expressing confidence versus 68% of leaders in stand-alone hospitals.

“The Affordable Care Act left many providers assuming that risk-based models would be the new normal, but the transition has not been as successful or widespread as anticipated,” says Richard Bajner, Navigant managing director and healthcare value transformation practice leader. “With most health system leadership teams anticipating continued downward pressure on margins, accepting risk can represent a lever for revenue growth, as long as providers commit enough of their revenue and resources to risk-based models. The results of this survey show the value-based movement may be coming full circle, and this time providers will benefit from previous experiences in designing their approaches.”

Despite the general willingness to pursue value-based options, there are still organizations that are hesitant to move in this direction: Fully 28% of respondents indicated they had no plans to take on more risk. Of these individuals, more than half (56%) cited a lack of local-market demand as the reason.

“Making the switch to outcomes-driven reimbursement requires a substantial, organizationwide commitment in terms of infrastructure, resources and the overall strategy,” says Chad Mulvany, director of healthcare finance policy, strategy and development for HFMA. “If there isn’t the market demand from employers, individual market plans, or government payers, or it’s difficult to negotiate mutually-agreeable terms, then it’s easy to see why an organization may refrain from making significant investments.”

Potential partners run the gamut

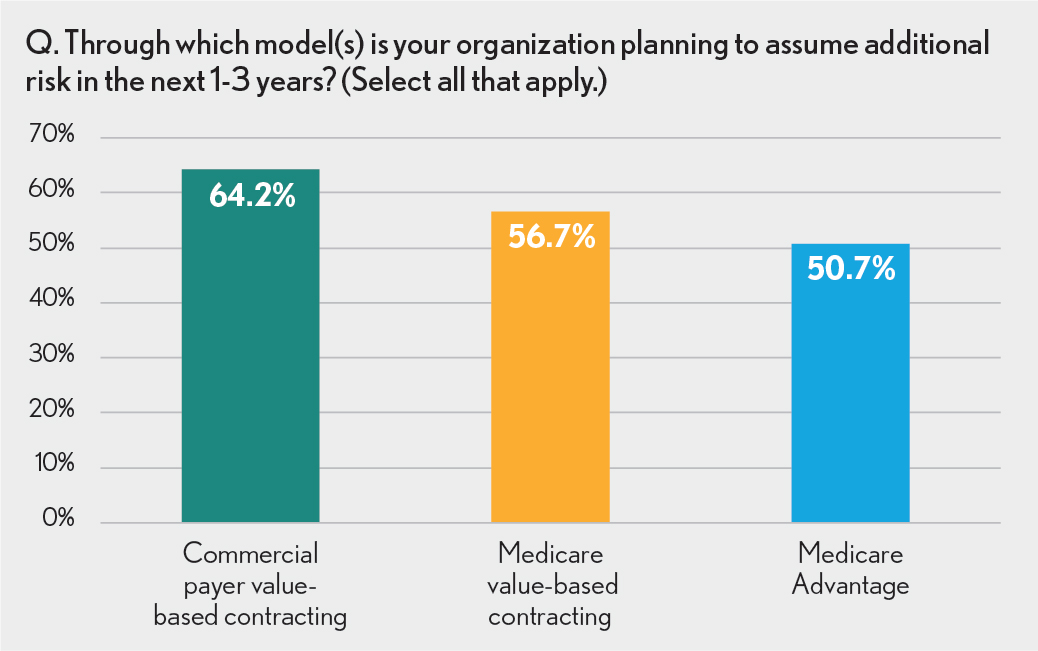

Respondents cited commercial payers as the most likely partners for risk-based arrangements in the future with 64% of survey participants predicting commercial-payer contracting models. Government plans were also potential partners with 57% of those surveyed anticipating Medicare Fee-for-Service risk arrangements and 51% anticipating Medicare Advantage (MA).

“It is rather surprising that people listed Medicare Advantage programs last,” says Mulvany. “MA models typically don’t have the issues with attribution that Medicare FFS models have, and there is flexibility to negotiate arrangements just like in commercial plans. Plus, the MA plans have a greater incentive to enter into risk-based deals with providers relative to the Administrative Service Only (ASO) programs running ERISA plans.”

The fact that providers are bullish on partnering with commercial payers is also unexpected, especially as 75% of health system executives predict an increase in this type of arrangement. “The response may be a little overly optimistic,” says Mulvany. “Oftentimes, providers find roadblocks to commercial risk-based arrangements, including when plans and employers want a steep per-unit price cut or aren’t willing to narrow the network or use creative-benefit design to prevent leakage. In some cases, organizations find the shared savings percentage to be insufficient, and there can be concerns about attribution models if it is an open-network alternative payment model. Also, if the provider perceives that a payer is disinclined or unable to share the necessary data to manage the population in a timely matter, it can derail efforts before they get started.”

The lack of progress with commercial programs is not all one-sided. “Commercial payers sometimes feel that providers want to keep too much of the savings or demand unnecessary carve-outs or exclusions,” continues Mulvany. “There is also a perception that providers want to narrow a network beyond what the market will bear, or they may want a base-rate increase to participate. There’s a bit of truth in both perspectives. It will be interesting to watch how organizations make headway with these plans going forward.”

Provider-sponsored health plans part of some providers’ strategies

In addition to working with commercial and government payers, 25% of respondents say their organizations are already part of a provider-sponsored health plan, and nearly 20% plan to launch one in the future. This means that almost half (44%) are turning to this type of program to facilitate their value-based care efforts.

“Standing up a provider-sponsored plan requires a strong balance sheet, analytical capabilities and technical skills that aren’t native in most health systems,” says Mulvany. “And once you’ve launched one, you have to manage the inherent tension between the plan and provider businesses. However, if you can overcome these barriers, it creates the best opportunity for value-based alignment and produces an opportunity to increase market share if you can offer a competitive product. So, it’s understandable why health systems are pursuing a provider-sponsored plan strategy to accelerate the transition.”

Laying the groundwork is key

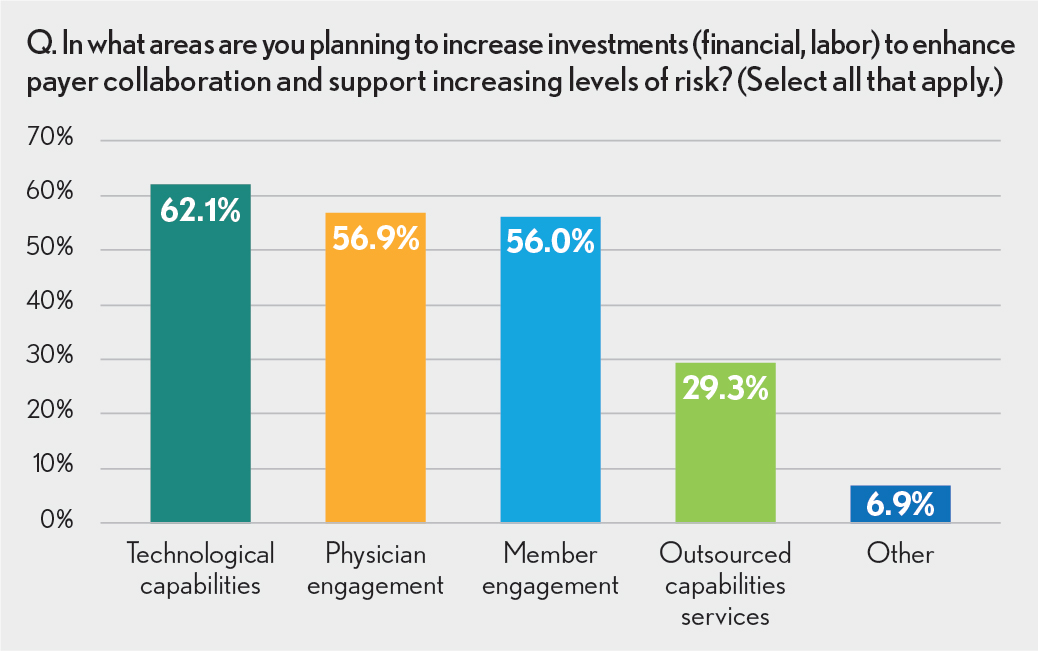

To enable greater collaboration between providers and payers and foster a smoother shift to risk-based models, survey participants indicated the need to shore up their infrastructures. When asked where they were planning to increase investments, more than 60% said they would devote resources to improving information technology capabilities. More integrated and advanced systems will allow for seamless information exchange across the continuum and better access to critical data to support more proactive and informed decision-making.

Physician and patient engagement were also cited as critical areas of focus. The more patients and providers are committed to and involved in a risk-based program, the more successful an organization will be at improving patient outcomes while keeping costs in check.

“Even with their increased risk-assumption interest, providers will inevitably continue to operate in a market primarily driven by fee-for-service payments,” says Kai Tsai, managing director, Navigant. “But the path forward does not have to be an either-or scenario. Hospitals and health systems can drive revenue and margin growth in both FFS and value-based worlds through strategies focused on engaging physicians on clinical standardization, targeted cost-of-care reductions in areas such as post-acute care and building tight provider network relationships.”

Providers also anticipate some hurdles as they pursue new models. More than 40% of executives suggested operational processes, such as contract execution and care coordination and management, will be the top challenges with maintaining risk-based capabilities.

About Navigant Consulting, Inc.

Navigant Consulting, Inc. (NYSE: NCI) is a specialized, global professional services firm that helps clients take control of their future. Navigant’s healthcare segment is comprised of consultants, former provider administrators, clinicians, and other experts with decades of strategy, operational/clinical consulting, managed care services, digital health, revenue cycle management, and outsourcing experience. Professionals collaborate with hospitals and health systems, physician enterprises, payers, government, and life sciences entities, providing performance improvement and business process management solutions that help them meet quality and financial goals.