- The U.S. Supreme Court was scheduled to hear oral argument Nov. 10 in California v. Texas.

- Even conservative legal scholars have questioned the merits of the case. And the law has functioned just fine with a $0 tax penalty for failing to comply with the individual mandate.

- While each individual ratings area within a state or federal marketplace is unique, the general trend is that requested premium increases are relatively low (on average 2.1%) and more plans have either entered the ACA market or expanded the ratings areas in which they offer products for plan year 2021.

This is the third potentially existential challenge to the ACA to make it to the high court, with oral arguments held Nov. 10.

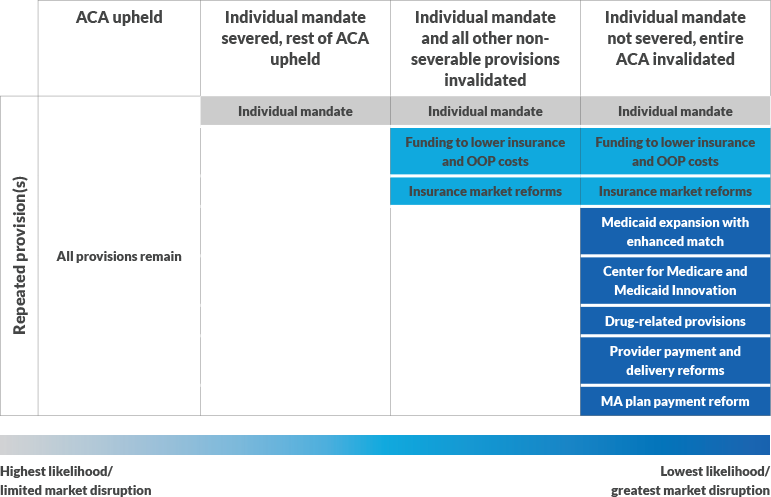

The potential outcomes in this case range from:

- Benign: The case is bounced on a technical issue (e.g. the parties involved don’t have standing), the justices determine Texas’s argument frivolous, or the individual mandate is found to be unconstitutional but severable from the rest of the law.

- Something less benign: The individual mandate is unconstitutional and not severable from the insurance market reform provisions.

- Catastrophic: The individual mandate is unconstitutional and inseverable so the entirety of the law to is overturned.

The exhibit below from Avalere simply illustrates the range of possibilities.

Potential California v. Texas Outcomes and At-Risk ACA Provisions

MLR: Medical Loss Ratio; EHB: Essential Health Benefit.

Source: Avalere Health, used with permission.

Takeaway

This Health Affairs blog post does an excellent job summarizing the potential outcomes of the California v. Texas case. I tend to agree with Avalere’s analysis that the highest probability outcomes are also the least, in relative terms, disruptive.

Even conservative legal scholars have questioned the merits of the case. And the law has functioned just fine with a $0 tax penalty for failing to comply with the individual mandate.

While each individual ratings area within a state or the federal marketplace is unique, the general trend is that requested premium increases are relatively low (on average 2.1%) and more plans have either entered the ACA market or expanded the ratings areas in which they offer products for plan year 2021.

Even if the worst-case, lowest-probability scenario occurs — the court invalidates the individual mandate and finds it inseverable from the entirety of the ACA — there is, in theory, a relatively simple fix. Congress would need to pass, and the President sign into law, a small tax penalty for failing to comply with the individual mandate.

President-elect Biden would (assuming he survives legal challenges from President Trump’s campaign as many experts anticipate) sign a bill reinstituting some tax penalty for not having coverage that satisfies the individual mandate. However, whether or not the votes for such a solution will be available in the Senate is an open question.