4 Strategies to Unlock Healthcare Performance Management Constraints

Hospitals and health systems are confronted with unprecedented challenges in managing performance in the current business environment, yet all too many organizations have limited understanding of how best to meet these challenges.

When asked about their organizations’ readiness to manage performance in today’s environment, a majority of respondents to a recent survey said, “Not so much.”

a Based on responses from more than 350 senior finance executives of U.S. hospitals and health systems, the January 2018 survey report identified three realities that are cause for concern:

- Only 25 percent of the respondents are “very confident” in their team’s ability to quickly and easily adjust strategies and plans.

- Only 15 percent say their organization is “very prepared” to manage evolving payment and delivery models with current financial planning processes and tools.

- A slim 8 percent are “very satisfied” with the performance management reporting at their organization, yet 73 percent think that performance management “plays a critical role in the finance team’s partnership with the broader organization to meet strategic goals.”

An organization’s readiness and ability to manage performance affect its operating risks, and by extension, overall enterprise risk. Finance leaders have a pivotal role to play in reducing such risks, and that role centers on building organizational agility, defined as the ability to nimbly operate in the current business while preparing for changing/new conditions. b

Agility is enhanced through high-quality enterprise performance management processes and tools that enable finance professionals to develop scenarios, set targets, track and communicate progress toward goals, and respond to problems in a timely fashion. In the current healthcare environment, with dual challenges related to changing payment and delivery models, robust performance management is essential to the required organizational transformation.

Additional 2018 survey findings suggest the following four performance management strategies that can boost agility and transformation readiness.

Increase Use of Data and Analytics to Improve Strategic Decision Making

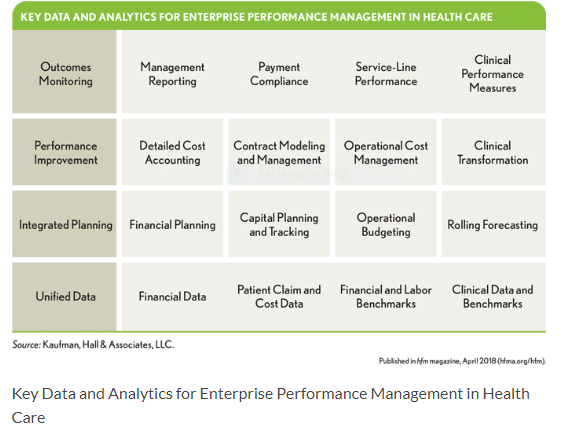

Constant changes in the healthcare industry have placed an increased emphasis on improving performance across the clinical, financial, and operational performance management areas shown in the exhibit below. According to 2018 survey findings, 90 percent of the CFOs and other senior finance executives think their organization should be doing more to leverage data to inform strategic decisions. When trustworthy data are lacking, however, which 56 percent of CFOs cite as the reality, improved analytics and reporting for strategic decision making are effectively out of reach.

Key Data and Analytics for Enterprise Performance Management in Health Care

Benchmark-rich databases and analytic tools are now critical elements in the successful operation of a healthcare business. Using such tools, hospital and health system executives and clinicians can assess strategic performance that will drive the required transformation of care quality, costs, and patient experience. Because 94 percent of survey respondents use spreadsheets to supplement their core systems, recommended software tools should provide finance teams with an interface that supports spreadsheet-like analytics. But access to an extensible, robust data model for sophisticated modeling and analysis also is strongly recommended. Healthcare organizations with comprehensive data sets that are consistently analyzed and used to monitor outcomes, improve performance, and leverage a broad array of planning processes are in the best position to successfully establish and execute strategic plans.

Improve Cost Measurement and Related Tools

Senior finance executives regard identifying and managing cost-reduction initiatives as themost important performance management activity. This priority is consistent with September 2017 survey results focused on gauging industry efforts to reduce total cost of care, in which 96 percent of senior finance executives said that cost transformation is a “significant” or “very significant” need for their organizations today. c

Although finance executives recognize the specific urgency of cost improvements, it is evident from both surveys that executives are struggling with data, processes, and tools that lack structure, transparency, accuracy, and hence, credibility. Indeed, leveraging data and analytics to know where to focus cost efforts was the most commonly cited impediment to achieving cost-reduction goals in the 2017 survey findings.

Further, 70 percent of respondents to that survey said their cost measurement tools are too simplistic or provide inaccurate data that cannot be trusted; or worse yet, they have no tools in place at all. Only 25 percent expressed confidence in the accuracy of results provided by their existing cost accounting systems. Developing a plan to improve the validity and reliability of cost information is a must, as is executing the plan on a timely basis.

Cost benchmarking is particularly important, given industry pressures for dramatic improvement. Although about half of CFOs say their organizations benchmark costs to external peer groups, 18 percent do not perform any cost benchmarking. Nonethelesss, all organizations should be benchmarking quality and cost performance to understand their competitive position. Historical trend analytics allow a hospital’s or health system’s leadership team to assess the performance of the organization using its own data in multiple ways—e.g., by hospital, service line, department, physician, treatment type, patient diagnosis, or other relevant consideration. Data from public and commercial sources enable risk-adjusted comparisons of the organization’s performance with that of an appropriate peer group, defined as of similar type with like functions, services, operating revenue, or other factors.

Using benchmark-based reports and scorecards, hospital executives and managers can observe patterns of performance that impact utilization, cost, quality, outcomes, and patient experience based on factors such as diagnosis, comorbidities, treatment type, department, and physician. Areas of undesirable variation can be explored and targeted for improvement; development of best practices can be considered for areas of outstanding performance.

Two caveats of benchmarking warrant mention.

First, organizations that are in the top quartile of national or regional benchmarks cannot afford to be complacent. Being at the highest level of efficiency in an industry that has an overwhelming need for dramatic cost improvement, for example, means only that the organization has less far to travel than its peers. It does not mean that the organization has completed its journey.

Second, leaders should keep in mind that substantial reporting lags may occur with published benchmarks. Older numbers for the external comparative group may have shifted materially in the organization’s current comparative period, so directional as well as specific benchmark movement should be considered.

Redesign Financial Planning Processes for Enhanced Integration

The 2018 survey findings point to considerable room for improvement in the integration of plans and budgets. More than one-fourth of represented organizations do not include the financial impact of large strategic and capital initiatives in their long-range plans. Organizations cannot ensure these initiatives will be affordable or fully understand their financial impact if the initiatives are not covered within long-term financial planning forecasts.

An additional concern is that, among survey respondents, 37 percent are attempting to manage performance in organizations that do not integrate long-range and capital planning; and 31 percent are doing so in organizations that lack integration of operational budgeting and capital planning. The first year of a long-range plan should directly establish the performance targets for the current year’s operational budget. Rolling forecasting can bridge gaps between the long-range plan and operational budget through quarterly forecasts extending out one to two years.

Survey responses related to long-range planning are both encouraging and discouraging. Seventy-five percent of respondents have a two- to five-year long-range plan; 17 percent have a six- to 10-year plan; 6 percent do not develop a long-range plan. The fact that three-quarters of CFOs say their organizations have two- to five-year plans is a positive finding, but the good news in that finding is limited to organizations whose plans cover the long end of that time range. A two-or even three-year plan is insufficient to meet organizational planning needs in the current business environment, and a minimum of a five-year plan with regular updates is recommended as best practice. Even better is a six- to 10-year planning horizon, which is common today in large health systems.

The 6 percent of organizations without any long-range plan must be “driving” with only an annual budget. Given the almost impossible challenge of ensuring that an annual budget accounts for the organization’s long-term strategic financial interests, piloting without a long-range plan is a dangerous practice. It offers limited visibility for what is ahead. Seeing the horizon and navigating a changing environment clearly require longer-term forecasts well beyond an annual budget.

Many hospitals and health systems could strongly benefit from redesigning their financial planning processes for better integration of data sources and analytics across their organizations. They should do so with the firm and well-documented belief that a continuous and integrated strategic, financial, and capital planning process is essential to thrive in a dynamic environment. d Through this process, hospital and health system leadership teams can identify the strategies that will best advance their organizations’ missions and objectives, ensure the viability of such strategies through scenario analyses and other analytics, and then support the selected strategies with needed capital. This process gives leaders the ability to balance what they wantto spend for strategic needs, and what they actually can spend. Continuous measurement of performance ensures that the strategies meet expectations.

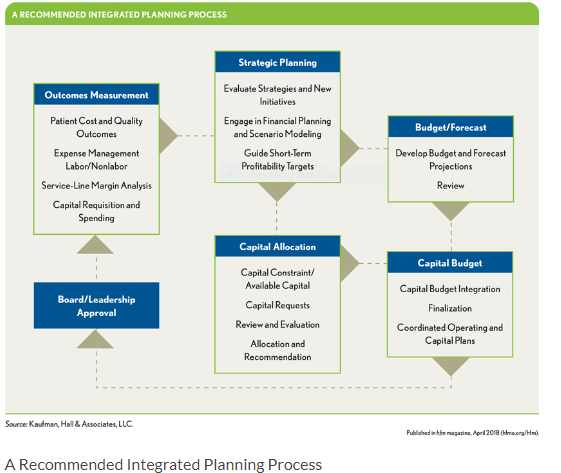

A Recommended Integrated Planning Process

An integrated planning model, such as that depicted in the exhibit above allows leadership teams to quantify the financial impact of business strategies and tie those strategies to specific capital plans and operating budgets. The process begins in the top middle box, with identifying, through solid financial testing and planning, the strategies best able to achieve the organization’s purposes. Through comparative review of consistently prepared capital requests for these strategies, spending decisions are prioritized by a structured capital allocation process. Coordinated annual operating and capital budgets, which reflect the strategic-financial-capital plan, are reviewed by the leadership team and board, and if approved, are implemented. Outcomes measurement of implemented initiatives includes clinical, financial, and other performance management data and analytics as identified in the earlier exhibit above. Feedback and control mechanisms exist to ensure proper integration of all planning stages.

Increase Enterprise Performance Management Resources

Today is not a time for “business as usual” in health care, where incremental change suffices. For most hospitals and health systems, a transformational shift involving capital-intensive IT, delivery system redesign, and human resources is required to meet community needs under health care’s new imperatives. Capital requests have increased not only for traditional items such as clinical and management technologies, but also for nontraditional items such as partnerships related to managed care, networks, and post-acute care services. These expenditures introduce higher financial risk because the ROI often is not quantifiable or is difficult to determine.

New needs notwithstanding, two-thirds of surveyed CFOs whose responses were included in the 2018 report say their organization is experiencing resource constraints, up from 55 percent reported in the 2017 survey results. About half (49 percent) of CFOs indicate that their organization has outdated processes and insufficient tools for effective financial planning and analysis.

To succeed in today’s environment, organizations must pivot from a siloed, micro-view of disconnected financial management processes and tools to a macro-view. The macro-view integrates information and analytics to inform (versus simply document) the development of strategies across healthcare systems and continuum-of-care partners. e

In addition, significant new talent is needed with expertise in such areas as:

- Value-based care delivery and payment models and associated risks

- Clinical, business, and consumer intelligence

- Innovation

- Performance optimization

- Advanced data analytics and supporting technology to transform organizational costs

In particular, cost accounting teams with the time and expertise to accurately and efficiently identify sources of disproportionate costs, and the right systems and tools to do so, are no longer optional. f Leadership must ensure that the data, analytics, and software platform is in place to develop, execute, and achieve the organization’s strategic and financial goals. Depth of expertise is needed to understand and reshape underperforming management processes and systems.

At a minimum, leaders should consider a “reimplementation” of a current underperforming system. The right processes and the right team may be able to offset system shortcomings. Leaders should not allow complex and capital-intensive processes, systems, and tools to become unwieldy or underfunded, which can slow progress, but new technology might not be required in every situation. An organization may be able to reimplement the current systems and adopt more effective and efficient processes to capture their value. The most important of all are the people using the systems and how leadership leverages the information.

The Central Role for Finance

To effectively manage organizational risk, hospitals and health systems should establish high-level teams, with financial leaders playing a key oversight role as performance improvement executives. The improvement efforts of these teams might include activities such as:

- Developing and implementing credit and interest rate risk-mitigation plans to improve the probability of meeting or exceeding bond covenants

- Enhancing the management of quality performance indicators to reduce care variation, thereby lowering costs and improving patient outcomes

- Performing detailed, data-rich analyses to support well-informed decisions for capital investments and partnerships that will improve market share or minimize the risk of market- share disruption

Some hospitals and health systems are in a position today where they are not achieving strong enough financial performance to warrant the level of risk they are incurring. These organizations can better manage performance while mitigating operational risk by applying the four survey findings-based approaches described here. By helping to remove common performance management constraints, these approaches constitute an important step on an organization’s path toward effectively addressing risk within the changing healthcare landscape. Better processes and integrated systems yield better financial planning, analysis, and reporting, all of which lower organizational risk.

By assuming a leadership role on a team armed with skills and tools across the components of enterprise performance management, finance leaders can ensure that their organizations’ response to the question of whether they are manage performance will be “yes.”

Daniel Seargeant, DrPH, is vice president and product manager of decision support solutions, Software Division, Kaufman, Hall & Associates, LLC, Skokie, Ill., and a member of HFMA’s First Illinois Chapter.

Jay Spence is vice president of healthcare solutions, Kaufman, Hall & Associates, LLC, Skokie, Ill.

Footnotes

a. Kaufman, Hall & Associates, LLC, 2018 CFO Outlook: Performance Management Trends and Priorities in Healthcare, January 2018.

b. Krakovsky, M., “Charles O’Reilly: Why Some Companies Seem to Last Forever,” Stanford Business Magazine, May 31, 2013.

c. Kaufman, Hall & Associates, LLC, 2017 State of Cost Transformation in U.S. Hospitals: An Urgent Call to Accelerate Action, September 2017.

e. Arlotto, P., “Technology for Population Health Management,” California Hospital Association and Kaufman, Hall & Associates, LLC, 2015.

f. Seargeant, D., Savage, C., “Cost Accounting Talent and Resources: The Missing Link to Support Cost Transformation,” Healthcare Cost Containment, December 2017.