HFMA’s Outlook quarterly reports monitor important healthcare finance trends and identify new topics for discovery.

This report shares results gathered in June 2022. For some questions, respondents were asked to provide their projections for the upcoming three months, comprising the third quarter of 2022. Approximately 1,077 HFMA members submitted responses.

HFMA will continue to plot the quarterly movement of specific metrics and highlight changes in the healthcare finance environment and how those changes may affect healthcare finance professionals in the future.

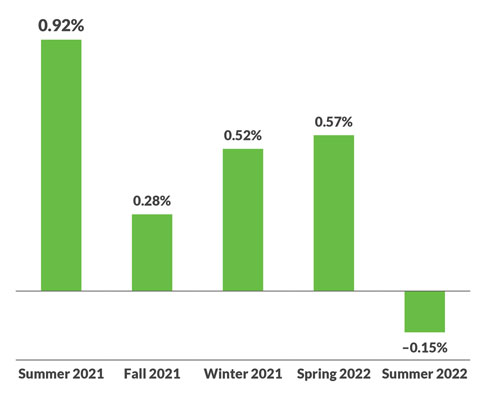

Net patient revenue decidedly declines

Net patient revenue has declined by 0.15% in the third quarter of 2022, as compared to increases in each quarter since the third quarter of 2021. The declines were reported across hospitals and health systems.

Net patient revenue projected to decline in third quarter of 2022

Healthcare providers recognize staffing as an important future challenge

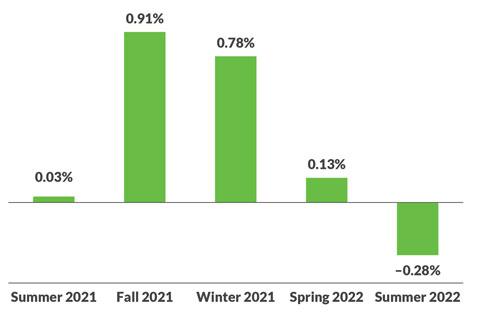

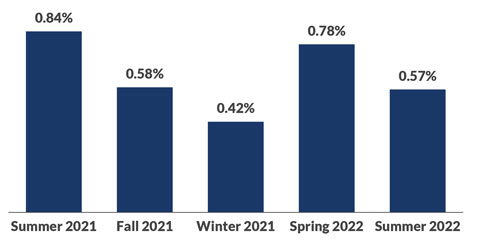

Hiring of contract clinical workers continued to decline with a 0.28% decline, while employed clinical FTE hiring changed slightly from a 0.78% increase in the second quarter of 2022 to 0.57% projected increase in the third quarter. Projected hiring of contracted clinical staff declined across hospitals and health systems.

Full-time administrative hiring also declined noticeably, especially in headquarters and corporate offices.

Projected hiring of clinical contractors continues to decline

Full-time employed clinical staff hiring is projected to increase by 0.57% in the third quarter of 2022, while the increase for the second quarter was higher at 0.78%. But the trend line is for FTE clinical staffing to continue its rise.

Projected hiring of full-time clinical staff continues to rise

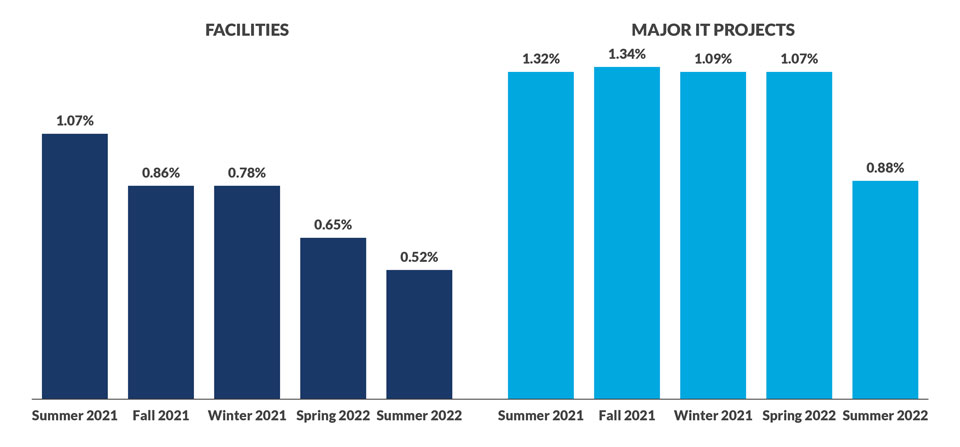

Investments in facilities and major IT projects continue to decline

With net patient revenue down significantly, healthcare providers are projecting that investments in facilities and major IT projects will decline slightly but still remain stable. These findings are similar across hospitals and health systems.

Projected investment in facilities and major IT projects

Other survey findings:

- As a response to COVID, more hospitals and health systems are recognizing that clinical staff cross training and supply chain collaboration are important strategies for pandemic preparedness as well as good practices for efficient operations.

- A majority of hospitals and health systems report good or very good price transparency measures across the last four quarters.

- Technology is the only area where ability to measure cost of care has improved consistently since the pandemic began.

- Hospitals and health systems consistently rate the following as their top technology implementation challenges: determining cost, predicting implementation outcomes based on a fixed cost, and length of time to decide on technology implementations.