HFMA’s Outlook quarterly reports monitor important healthcare finance trends and identify new topics for discovery.

This report shares results gathered in April 2022. For some questions, respondents were asked to provide their projections for the upcoming three months, comprising the second quarter of 2022. Approximately 1,200 HFMA members submitted responses.

HFMA will continue to plot the quarterly movement of specific metrics and highlight changes in the healthcare finance environment and how those changes may affect healthcare finance professionals in the future.

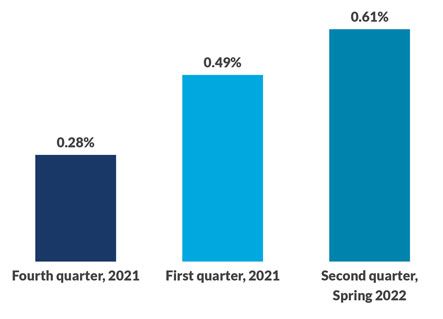

Projected net patient revenue rose over the last three quarters

Net patient revenue has increased each quarter since the fourth quarter of 2021, rising from a projected increase of 0.28% at that time to a 0.81% projected increase in the second quarter of 2022. Those increases were reported across hospitals and health systems. The highest projected net patient revenue increase reported over the last year was projected for the summer of 2021 timeframe at approximately 0.92% across hospitals and health systems.

Projected net patient revenue rose over the last three quarters

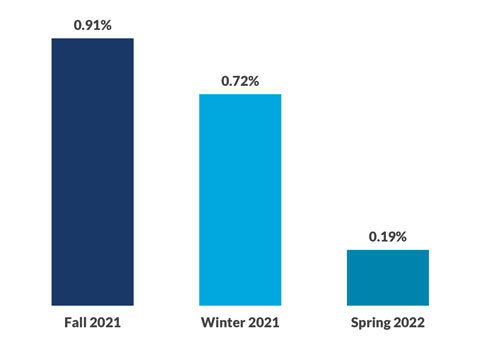

Contractor staffing falls from first quarter of 2022

Hiring of contract workers declined from a projected increase of 0.72% in the first quarter of 2022 to 0.19% in the second quarter. Contracted staffing was projected to increase by 0.91% in the fourth quarter of 2021, a significant increase from the prior months at 0.03%. The reduction in contracted staff hiring in the first half of 2022 was reported across hospitals and health systems.

Hiring of contractors decreasing

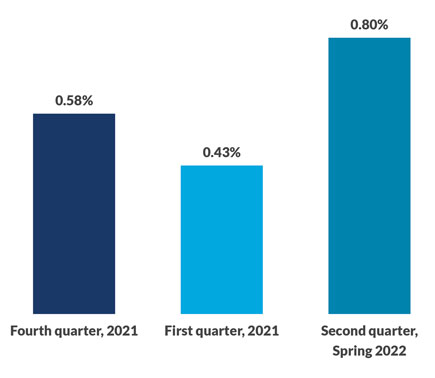

Full-time employed clinical staff hiring is projected to increase from 0.43% in the first quarter of 2022 to 0.80% in the second quarter of 2022. There was a slight reduction in projected hiring between the fourth quarter of 2021 and the first quarter of 2022, but clinical staffing appears to be rebounding I the first half of 2022 across hospitals and health systems.

Hiring of full-time clinical staff is on the rise

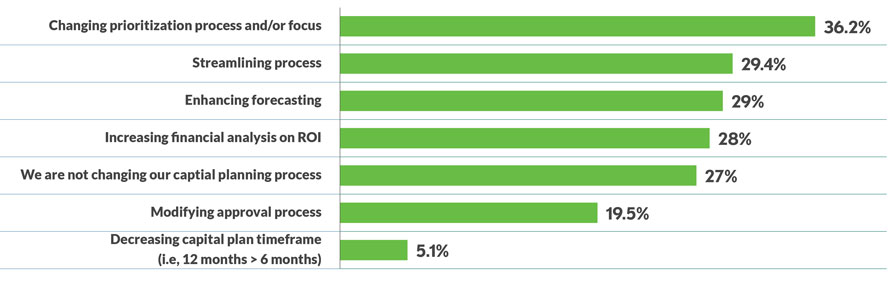

Prioritization is key area for capital planning process change

When asked about how the capital planning process might change, 36% of Outlook survey respondents said the prioritization process and focus were areas to target. Streamlining was chosen by 29% of respondents and the same percentage said they were looking at enhancing forecasting as a way to improve their capital planning process.

Focus and forecasting are top ways that capital planning may change

Other important trends

- Overall, the ability to measure the cost of care is improving. HFMA’s Outlook Survey for the second quarter of 2022 asked about total cost of care related to technology, service rationalization, supply chain and other non-labor costs, service line efficiency, overhead/shared service synergies, labor cost/productivity and unwarranted clinical variations.

- The state of price transparency in hospitals and health systems was almost unchanged with 61% of Outlook survey respondents reporting an acceptable status for their efforts for both the first and second quarters of 2022. A slightly higher percentage described their price transparency efforts as very good with 24% reporting that status in the second quarter of 2022, while 19% reported in the first quarter that their efforts were very good.

- The top three changes that have become permanent as a result of COVID-19 remained the same: work-from-home technology, telemedicine capabilities and IT security.