Downgrades topple upgrades: 5 key takeaways from rating activity in 2023

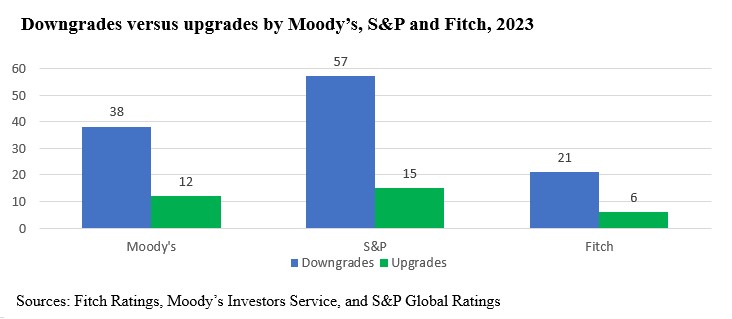

The ratio of rating downgrades to upgrades was at a high level for all three rating agencies in 2023.

As expected, 2023 saw a material increase in downgrades over 2022 while the number of upgrades declined from the prior year. Volume showed favorable growth for many hospitals during 2023, although some indicators remained below prepandemic levels. Other hospitals reported a payer mix shift toward more Medicare as the U.S. population continued to age and Medicare Advantage plans gained momentum at the expense of commercial revenues.

Continued labor challenges drove expense growth, even as many organizations were reporting reductions in temporary labor, as permanent hires pressured salary and benefit expenses. Some of the downgrades reflected pronounced operating challenges that led to covenant violations, while others were due to a material increase in leverage viewed to be too high for the rating category.

Here are five key takeaways:

- The ratio of downgrades to upgrades reached a high level for all three rating agencies: Moody’s, 3.2 to 1; S&P: 3.8 to 1; and Fitch: 3.5 to 1. In 2022, the ratio crested just above 2.0 to 1 at the highest among the three firms.

- Downgrades covered a wide swath of hospitals, ranging from single-site general acute care facilities to academic medical centers as well as large regional and multistate systems. Many of the hospital downgrades were concentrated in New York, Pennsylvania, Ohio and Washington. All rating categories saw downgrades, although the majority were clustered in the Baa/BBB and lower categories.

- Multi-notch downgrades were mainly relegated to ratings that were already deep into speculative grade. Multi-notch upgrades were due to mergers or acquisitions where the debt was guaranteed by or added to the legal borrowing group of the higher-rated system.

- Upgrades reflected fundamental improvement in financial performance and debt service coverage along with strengthening balance sheet indicators. Like the downgraded organizations, upgraded organizations ranged from single-site hospitals to expansive, super-regional health systems. Some of the upgrades reflected mergers into higher-rated systems.

- The wide span between downgrades to upgrades in 2023 would suggest that the credit gap between highly rated hospitals (say, the A or Aa/AA category) and those with a Baa/BBB and speculative grade is widening. That said, given that rating affirmations remain the predominant rating activity annually, the rating agencies reported in October only a subtle shift in the overall distribution of ratings since the beginning of the pandemic (during their panel discussion at Kaufman Hall’s October 2023 Healthcare Leadership Conference).

One person’s prediction for 2024? It’s a safe bet that downgrades will outpace upgrades given the persistent challenges, although the ratio may narrow if the improvement in current performance holds. That said, the rating agencies are maintaining mixed views for 2024. S&P and Fitch are sticking with negative and deteriorating outlooks, respectively, while Moody’s has revised its outlook to stable, anticipating that the rough times of 2022 are behind us. All three rating agencies predict that we are not out of the woods yet when it comes to covenant challenges, especially in the lower rating categories and for those organizations that report a second year of covenant violations.