Financial impacts of Medicare expansion proposals on hospitals appear daunting

An analysis reinforces hospital and health system concerns about the likely impact of Medicare expansion as proposed by several lawmakers and candidates running in the 2020 Presidential election.

The next Presidential election is over a year away, but it already is clear the idea of expanding the 60-million-person Medicare program will take center stage in the healthcare policy debate. As an alternative to Republican efforts to repeal and replace the Affordable Care Act (ACA), Democratic candidates have put forward various healthcare reform proposals that expand Medicare to various degrees. The proposals have different prospects for adoption, depending on the extent to which Democrats end up controlling both the Presidency and Congress. The crucial concern for the nation’s hospitals and health systems is the potential impact of Medicare expansion on their finances if some version of it were to be adopted.

With this concern in mind, we analyzed the financial impact of three different Medicare expansion scenarios on a hypothetical medium-sized multihospital system. Our analysis reached one broad conclusion: The greater the degree of Medicare expansion, the greater the financial stress on hospitals. With any of these approaches, a health system’s ability to weather the impact will depend on the strength and coherence of its revenue and expense control strategies.

How a Medicare expansion differs from the ACA coverage expansions

The last major health insurance coverage expansion, the 2010 Affordable Care Act (ACA), used two main levers to increase health coverage: Medicaid and commercial insurance. Both were fraught with implementation challenges. The decision whether to expand Medicaid coverage was left to the states by the Supreme Court in 2012. The health exchange experiment – both federal and state – proved technically complex and fragile, falling far short of enrollment expectations.

By contrast, Medicare expansion relies on a popular national program with a largely settled payment methodology. Unlike Medicaid, it does not rely upon the voluntary collaboration of 50 state governors and legislatures. Unlike private insurance, whose competitive structure and costs vary dramatically between communities, Medicare has a relatively uniform and predictable cost profile. Because Medicare pays providers considerably less than commercial insurers, the budgetary “savings” to the federal government from relying on Medicare rates reduces the cost of a coverage expansion. Yet these lower payment rates pose a major concern for hospitals and health systems because, to the degree that Medicare substitutes for commercial health insurance, it markedly reduces hospital revenues and disrupts the already delicate balance of cross-subsidization between higher commercial rates and lower government rates.

A look at the scenarios and assumptions

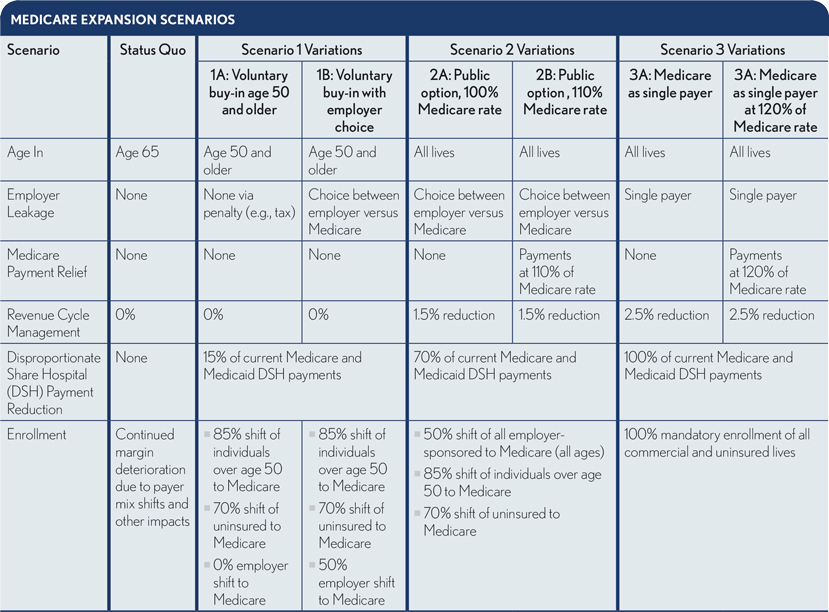

To understand the potential impact of such a policy, we considered three different policy scenarios, each with two variations, on a hypothetical medium-sized, regional, not-for-profit multihospital system, which we call “Excelsior.” Excelsior is a $1.2 billion health system with five hospitals, 1,000 beds and a “pre-expansion” operating margin of +2.3%. Its commercial insurance contracts reimburse about 200% of Medicare rates and represent about 25% of patient volume by charges.

The three policy scenarios are:

- Voluntary Medicare buy-in after age 50

- Medicare as a public option on health exchanges

- Medicare as a single payer (leaving Medicaid intact)

As the exhibit below shows, the second and third scenarios include two Medicare payment rate assumptions, and the first varies the extent of employer shift of their workers over age 50 onto Medicare. Our analysis includes four additional assumptions:

- Because all scenarios reduce the number of uninsured, Medicare disproportionate share payments would be reduced in proportion to the reductions in uninsured in all scenarios.

- The complexity and cost of Excelsior’s revenue cycle functions and administrative expenses would be modestly reduced under the public option and single-payer scenarios.

- Medicaid populations and payment levels would remain constant.

- All care for new beneficiaries will be paid based on the current Medicare fee/rate schedule (setting aside the complexities associated with Medicare Advantage, which presently enrolls about a third of Medicare’s beneficiaries).

How Medicare expansion would affect hospital revenues and margins

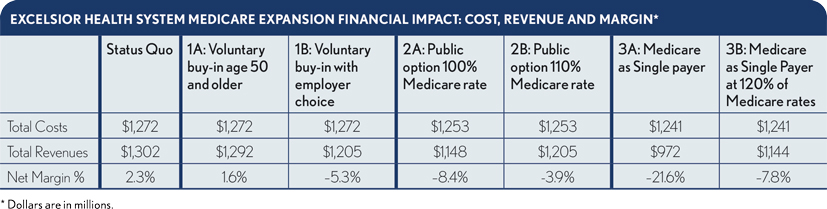

The effects of these scenarios on Excelsior vary dramatically, as shown in the exhibit below. These scenarios represent the total impact in a single year, rather than phased in over a period of years.

Scenario 1A and 1B (voluntary Medicare buy-in). Scenario 1A option presents an option tovoluntarily buy into Medicare, but the option is available only to the uninsured persons 50 years old and healthcare exchange users over the age of 50. This scenario produces a negligible effect on Excelsior’s finances. Write-offs for self-pay patients are reduced but offset by a reduced payment for the portion of the exchange-eligible population that shifts from exchange-plan rates to Medicare rates. For the single year, Excelsior’s revenues drop by $10.o million, leaving the system with a 1.6% positive operating margin. This policy scenario would require that mechanisms be written into the legislation that ensure members of the employer-insured population age 50 and older do not shift over to Medicare plans.

Scenario 1B is the “leaky” version of Scenario 1A, resulting from ineffective barriers to employers shifting their older employees to Medicare. This scenario assumes 50% of employed workers over age 50 shift to Medicare. This leakage reduces Excelsior’s revenues by $97 million and moves Excelsior’s operating margin from +2.3% to -5.3%. The mechanisms that determine the difference between leaky and leak-proof “Medicare-for-more” scenarios may become a crucial factor in the intensity of hospital industry concerns about the policy.

Scenario 2A and 2 (public option). In the public option scenarios 2A and 2B, Medicare is offered as an option on federal and state health exchanges. The negative margin impacts of these scenarios on Excelsior are greater than the Medicare buy-in impact. In Scenario 2A, given the enrollment assumptions and holding Medicare rates at current levels (i.e., 100% Medicare rate), Excelsior’s revenues drop by $154 million, resulting in a -8.4% margin. If, however, Congress were to raise Medicare’s current hospital payment rates by about 10% (i.e., 110% current Medicare rates), Excelsior would see a revenue decline of “only” about $97 million, for a -3.9% margin. This rate adjustment would increase the cost of the expansion to the federal budget yet only modestly alleviate the significant financial pressures on our hypothetical system.

Scenario 3A and 3B (single-payer). The effects of the Medicare as a single-payer scenario are, predictably, much more dramatic. Under Scenario 3A, Excelsior’s operating margins are eviscerated, with a revenue loss of about $330 million and a -21.6% margin. Under scenario 3B, however, where Congress yields to political pressures to increase Medicare payment to 120% of the current Medicare rates, Excelsior loses “only” about $158 million in revenue, resulting in a -7.8% margin. These levels of revenue reduction would have a catastrophic effect on hospitals that are less fortunate than Excelsior, and strain the health system’s capacity to respond meaningfully without layoffs, program cuts or both.

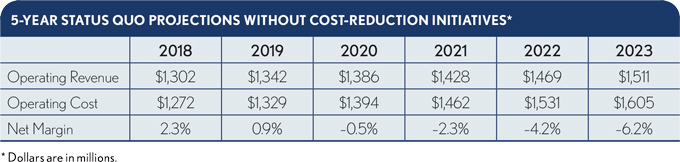

Hospitals face challenges even if there’s no Medicare expansion

Medicare expansion is not the only potential future threat to U.S. hospitals’ finances. Our analysis determined that even if none of the expansion scenarios are adopted, the continued migration of baby boomers from employer-based coverage to Medicare, along with other contributing factors, will have a financial impact comparable to the more adverse Medicare buy-in scenario. That is, demographic pressures expand Medicare, all other things being equal. Spread over a period of five years, the result would be a $94 million decline in operating margin.

In 2016, the latest year for which data was available for our analysis, U.S. hospitals lost almost $50 billion treating Medicare patients because of the disparity between the delivered cost of care and Medicare’s current payment rates.1 Hospital losses in treating Medicare patients accelerate significantly under Medicare expansion. Even if Medicare is not expanded after the 2020 elections, hospitals must improve how they manage their costs of serving Medicare patients or face increasing financial losses.2

The proposed savings of the most ambitious Medicare expansion scenarios – Medicare as the single payer – rely upon some challenging premises, including that it will be politically feasible to sunset the vast health insurance industry, while dramatically reducing the income of the equally large hospital industry.

How would hospitals respond to Medicare expansion?

In scenarios where private insurers continue to exist, hospitals likely would attempt to shift the cost of the lost revenues onto private insurers to the extent possible. Clearly, this cost shifting would pose a major business risk for insurers and their employer customers, which would likely respond with strategies to tier or narrow their hospital networks and to offer patients incentives to reduce hospital use.

Notably, there is little evidence of major cost shifting after the ACA coverage expansion. If hospitals had successfully shifted the ACA Medicare rate reductions onto private health plans, hospital margins would not have plummeted as they did from 2015 to 2017.3

If hospitals find cost shifting fails to mitigate the effect of Medicare payment shortfalls, their only recourse would be to reduce costs through non-incremental means. They would likely be forced not only to reduce FTE employment but also to cut salaries of remaining clinical and management personnel and make dramatic reductions in contracted services outlays, including outsourcing and clinical staffing firms and technology and pharmaceutical suppliers. Ripple effects could expand the circle of layoffs into the broader community and its economy.

Hospitals also would likely attempt to reduce duplicative clinical services in neighboring facilities and collaborate with their clinicians in rigorously examining care patterns for Medicare beneficiaries, reducing both excess variation and care defects that result in avoidable hospital expense.

Ratings agencies would likely react to the uncertainties created by Medicare expansion by downgrading existing hospital tax-exempt debt. Debt markets would likely demand higher rates (e.g. cost of capital) for those systems fortunate enough to be able to continue borrowing in tax-exempt markets.

The actual extent to which costs can be reduced will determine the level of harm to the industry and the political challenges of achieving expansion. A hospital’s current Medicare cost coverage (i.e., loss) ratios are a direct indicator of a hospital’s vulnerability to any political decision which expands Medicare coverage expansion.

Unfortunately, the capacity to reduce and manage cost will vary markedly from health system to health system and hospital to hospital, to the point that many organizations could find themselves no longer financially viable. Depending on the policy course chosen, Medicare expansion could compromise hospital access to capital and potentially force closure of essential hospitals.

Some of the most dramatic expansion scenarios, such as Medicare as a single payer, appear to have financial effects that exceed the capacity of hospital management to reduce expenses. Under all but the leak-proof Medicare buy-in scenario, without substantial increases in current levels of Medicare payment, increased Medicare enrollment could have a destructive ripple effect on the nation’s hospitals and health systems.

Footnotes

1American Hospital Association, “TrendWatch chartbook 2018: Trends Affecting Hospitals and Health Systems,” 2018.

2Goldsmith, J., and Bajner, R., “5 ways U.S. hospitals can handle financial losses from Medicare patients,” Harvard Business Review, Nov. 10, 2017.

3Goldsmith, J. Stacey, R., and Hunter, A. , “Stiffening headwinds challenge health systems to grow smarter,” September 2018.