HFMA survey of healthcare finance professionals highlights continuing pandemic-related challenges and some reasons for optimism

- Results of an HFMA member survey show that the industry is still coping with the challenges of COVID-19 but has started to adapt to a post-pandemic future.

- Respondents predict volumes will rebound and revenue decreases will be mitigated, but they expect to maintain conservative approaches to spending and resource utilization for now.

- Technological advances will spur reimagined processes and workflows and a repositioned workforce, according to survey findings.

As healthcare finance professionals grapple with cutbacks triggered by the COVID-19 pandemic, many foresee a turnaround in the short term.

In the latest HFMA Outlook Survey, 56.5% of respondents to a question about elective procedures said volumes at their organization would increase by up to 10% over the next six months. The quarterly survey was sent in March to a cohort of 507 HFMA members to gauge healthcare finance professionals’ views of industry trends.

The volume-related responses were more optimistic than those in the prior Outlook Survey installment, which was sent to a separate panel of HFMA members. In that poll, conducted in November 2020, a plurality (42.7%) anticipated no six-month change in volumes.

Elective procedures aren’t the only services due for a comeback. In the latest survey, 40.8% of respondents to one question said their organization’s patients have been deferring nonelective care, while 37.5% said they weren’t sure whether that had been happening.

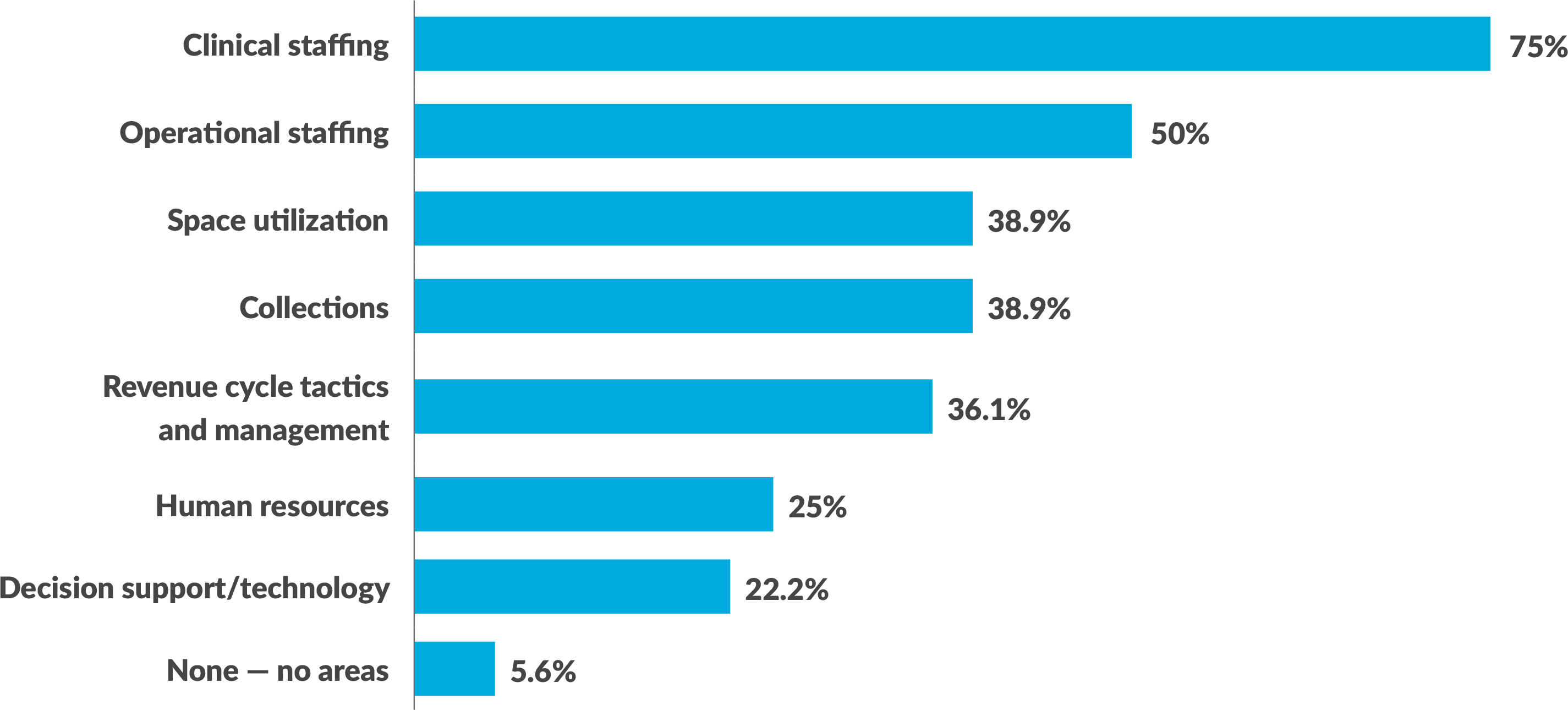

Given the ongoing impact of volume declines, organizations have been evaluating their deployment of resources. Among respondents to one question in the latest survey, 75% said deferred care was affecting clinical staffing, while 50% cited operational staffing. Only 5.6% said resource utilization was not affected (see the exhibit below).

“One area that healthcare finance leaders learned about during the pandemic and will use going forward is the ability to be flexible in their resource planning,” said Rick Gundling, FHFMA, senior vice president of healthcare financial practices with HFMA. “Leaders know they need better future forecast accuracy while also staying flexible in response to rapid changes in the healthcare and economic environments.

“Leaders learned they could shift plans quickly and now will continue to keep those resource planning and deployment skills.”

In what areas is deferred care affecting (or will affect) the deployment of resources?

Source: HFMA Outlook Survey conducted in March 2021. Respondents were asked to select all answers that applied. Number of respondents: 36. Number of responses: 105.

Revenue outlook improves slightly, but spending remains tight

The projected volume recovery likely was a reason for a more optimistic short-term revenue outlook than was seen in the earlier survey, although respondents still expected declines.

The average anticipated reduction in net patient revenue over the next three months at the time of the survey was 0.29%. In the prior survey, the predicted drop-off was 0.47%.

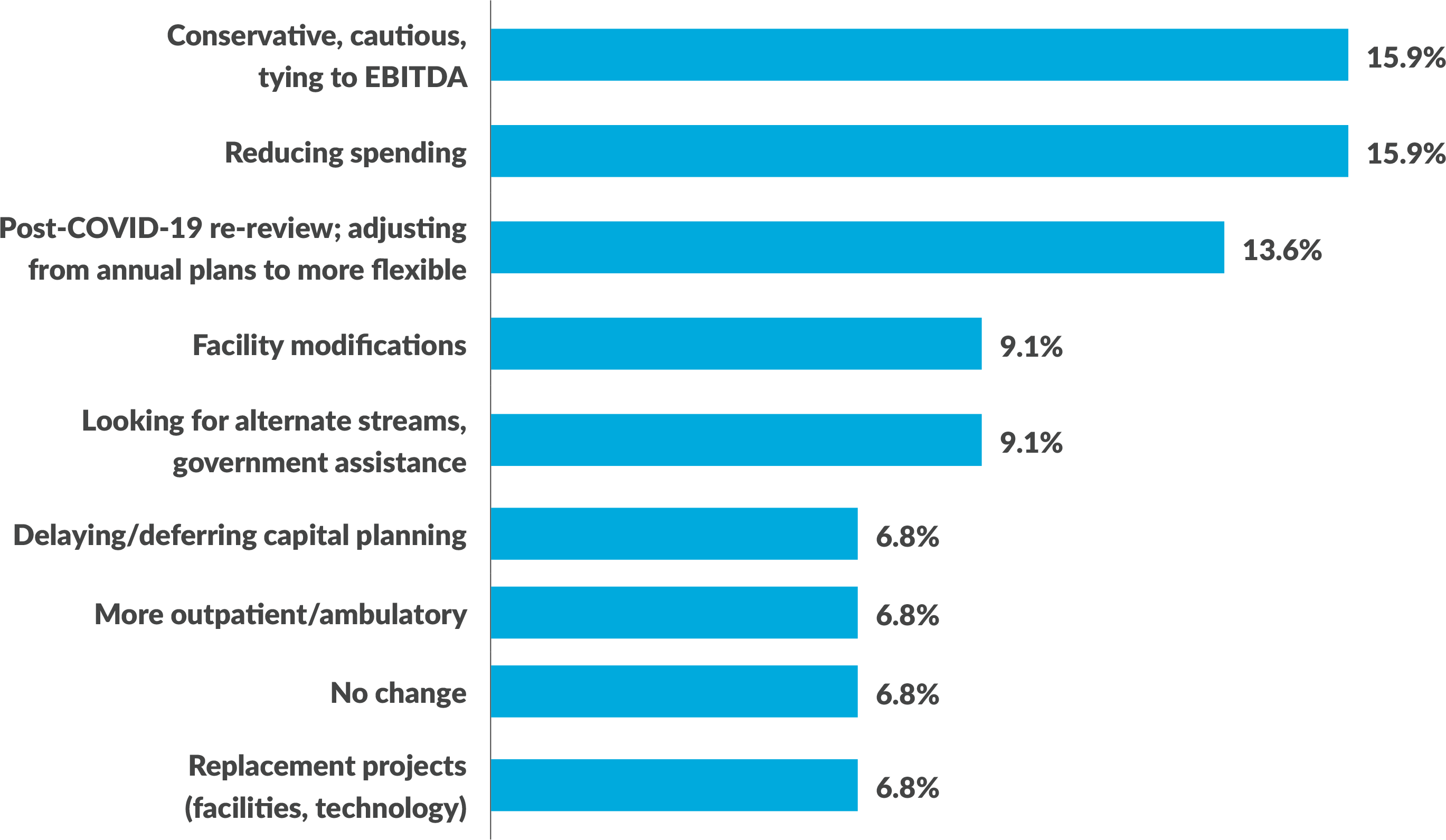

As shown in the exhibit below, HFMA members have been taking a conservative approach to spending in response to the uncertainty around revenue.

In what ways are you changing your capital planning?

Source: HFMA Outlook Survey conducted in March 2021. This question was open-ended. Number of respondents: 44. Number of responses: 57.

Some investments nonetheless seem increasingly viable. For example, investment in facilities was projected in the latest survey to rise by 0.27% over the next three months, whereas the earlier survey cohort said such investment would decrease by 0.14%.

The more recent set of respondents also was more likely to be looking at major investments in IT, projecting a 0.9% increase, compared with 0.31% in the first survey.

When planning investments in equipment, the latest cohort is focused on the clinical side. The estimated investment increase was 0.59%, whereas investments in nonclinical equipment were forecasted to decrease by 0.24% (equivalent questions about clinical and nonclinical equipment weren’t asked in the first survey).

Potentially big changes are afoot

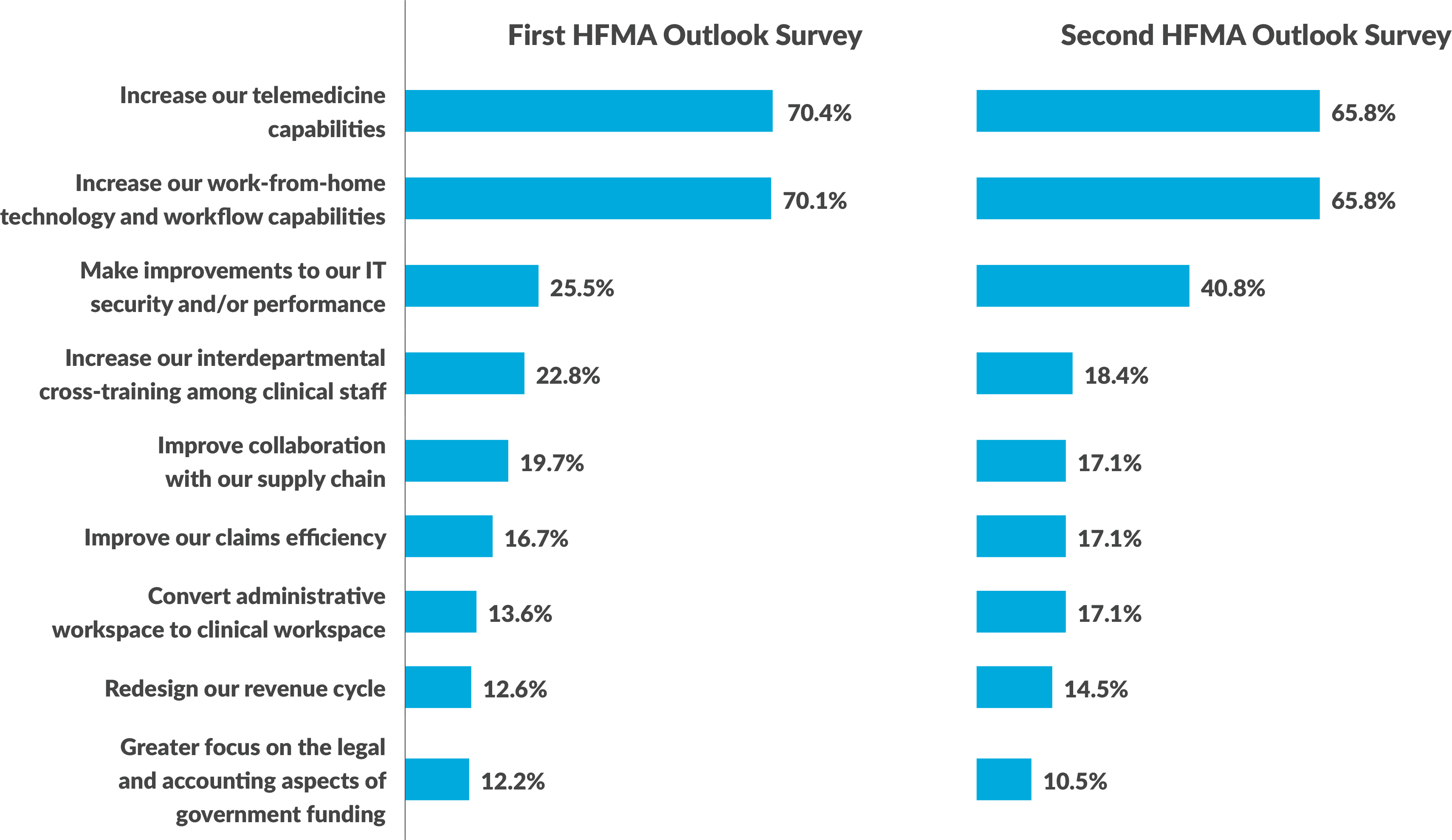

Regarding changes envisioned in response to the pandemic, two trends got the most traction: Increasing telemedicine capabilities and improving work-from-home technologies/workflow capabilities. Both were cited by 65.8% of the respondents who replied to the question in the latest survey, and both exceeded 70% in the previous survey (see the exhibit below).

“HFMA members are addressing and incorporating telehealth and other means of virtual care into their entire care process,” Gundling said. “The lessons learned from the pandemic on how patients and clinicians use telehealth will be used to improve in the future. The tools around virtual care will also be redesigned with the clinician in mind. Patients trust telehealth and virtual tools better when their clinicians embrace those tools, too.”

Making improvements to IT security and performance was selected by 40.8% of respondents in the latest survey, up from 25.5% in the first survey. The increase may reflect the rising attention on cybersecurity threats in healthcare, among other industries.

What are the 3 most important changes your organization will make in response to COVID-19?

Source: HFMA Outlook Surveys conducted in November 2020 and March 2021. Respondents were asked to select three choices out of 12. Total number of respondents: 370. Total number of responses: 1,047.

Open-ended survey questions about future trends affecting healthcare finance likewise offered notable insights.

One question asked about “the next big thing” that will revolutionize the profession. When combining 375 answers from the two survey cohorts, the most popular response was telehealth and in-home monitoring (23.1%), followed closely by technology such as machine learning, AI and robotic process automation (22.6%).

“Cost savings and improvements to the patient experience will be derived from greater use of artificial intelligence, machine learning and robotic process automation in many areas of the revenue cycle and administrative areas of the care process,” Gundling said. “Eliminating waste — which is different than solely cutting costs — will allow for resources to be redeployed in ways to increase quality and safety and to make care more affordable.”

In a question about which future trends require the attention of healthcare finance professionals, the top choice among 386 respondents across the two surveys was changes to reimbursement models, including the potential for less reimbursement due to issues involving cost and affordability (23.8%).