Change for the Delta: A Process for Strategic Planning in a Challenging Market

A Mississippi hospital is helping maintain its financial viability with a long-range strategy.

The Mississippi Delta, an area that spreads across 19 counties in three southern states, has a populace that is among the sickest and poorest in the nation. The region’s economy historically has depended on agriculture. Few additional job opportunities have materialized over the decades, and the population has undergone a significant and sustained decline. With younger generations moving away, the Delta has declining birth rates and an aging population. These factors have left the area plagued with relentless poverty and disproportionate levels of chronic illness.

Located in Greenville, Miss., Delta Regional Medical Center (DRMC) strives to overcome the region’s economic disadvantages and provide high-quality health care to the area population. This 225-bed county hospital—like many facilities across the nation—is experiencing a shift from inpatient to outpatient utilization. Many people in the Delta access medical services only when they absolutely must, and they often arrive with illnesses that have progressed to such a degree that their care is quite costly. This issue is exacerbated by the fact that DRMC is heavily reliant on government payers, and Mississippi has not expanded Medicaid.

While being constantly challenged by its population and payer mix, and a related need to make operational changes on the fly, DRMC also has had to address its aging facilities and the long-term healthcare needs of the Delta. The healthcare organization was compelled to take deliberate steps to meet these challenges, described below.

Develop a Long-Term Plan

DRMC’s early efforts to tackle its fundamental financial challenges began prior to 2014 with a year-long initiative to reduce accounts receivable days and increase days cash on hand. After this initiative proved successful, DRMC had some financial breathing room to develop and implement a long-term plan to tackle its strategic challenges.

In developing the plan, a fundamental consideration for DRMC was to reconsider how the organization would allocate its capital. Previous strategic decisions allocated DRMC’s very limited capital to inpatient-focused investments, such as an open-heart center and the purchase of the competing hospital in town. In the latter case, financing from the U.S. Department of Housing and Urban Development was used to acquire King’s Daughters Hospital in Greenville, a move that added capacity but limited future financial flexibility. These changes left DRMC with aging inpatient facilities in a market with decreasing inpatient utilization. Facing these challenges, leadership revamped its approach by undertaking the following steps to provide a basis for a new long-term approach.

Reconsider unproductive programs. The open-heart center, opened just three years previously and praised for bringing state-of-the-art technology to the heart of the Delta, needed to be objectively evaluated. The center was averaging only six cases per month, making it both costly and challenging around efforts to maintain quality standards. DRMC recognized that the community could be better served by the larger (and busier) open-heart programs in Jackson, Miss., and Memphis, Tenn., and closed the center, thereby freeing valuable space to better serve unmet needs. Once the politically difficult decision to close the open-heart center was made and the space repurposed, the loss of the significant negative margin provided additional financial flexibility.

Consolidate inpatient space. More accessible outpatient facilities are necessary in the Delta, where lower-cost preventive and wellness care can offset expensive chronic illness care. Administrators realized that a consolidation of DRMC’s inpatient space could help wring out operating efficiencies, thereby freeing resources for outpatient reinvestment. Consolidated facilities also better utilize physician operations and ancillaries in a lower-cost setting. Although investments in a “retrenched” inpatient facility remain a necessity, new construction could primarily focus on outpatient services to better meet the needs of the community.

Migrate to a more affordable electronic health record (EHR). Even though the IT system had brand-name appeal in the eyes of some, it wasn’t the best fit for DRMC, meeting neither the needs of staff or physicians. After conducting an analysis of its IT strategy, DRMC undertook a two-year conversion to a more compatible, productivity-enhancing IT system. The much-anticipated end results will include better EHR management for staff and physicians, with full ROI targeted to be realized within five years.

Invest in the right personnel and infrastructure. By investing in its staff and internal resources, DRMC quickly saw huge increases in quality as well as employee and patient satisfaction. For example, the rate of ventilator-associated pneumonia dropped to zero following a decision to hire an intensivist to manage the ICU. In another instance, an added employee convenience—an on-site retail pharmacy—delivered an objective financial benefit as well: Patients’ pharmacy copayment was reduced by 50 percent, and a new revenue stream was opened for DRMC.

As a result of these changes, DRMC now finds itself comparing favorably in many of the key metric ratios with not-for-profit hospitals of similar size and with service offerings. A hospital that once fought hard just to survive now has a much clearer path forward. The Delta, though, remains an area where new challenges will always arise, requiring a management style that is both nimble and deliberate. Although serious impediments to the viability of DRMC have been addressed, much work remains to be done.

Now positioned to address its capital backlog, DRMC began to explore new strategic opportunities. Instead of managing from year to year, as had been the practice, the hospital began contemplating the future with the development of a 10-year financial projection.

Create a Baseline Projection

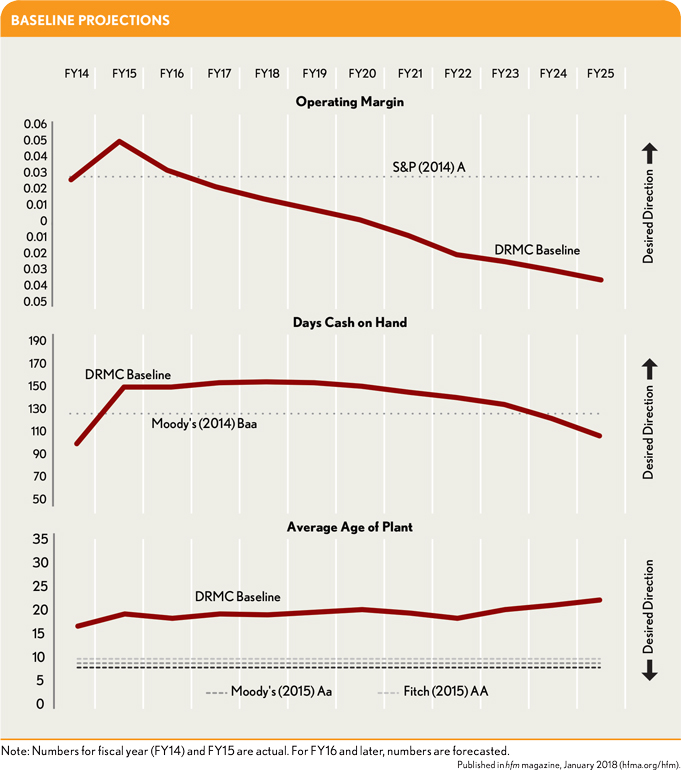

DRMC formulated a baseline projection using the best available information for volume, payment, fixed and variable labor, employee benefits, drugs and supplies, other expenses, and routine capital. The projection also included the current investing and financing activities to provide a clear picture of DRMC’s capital capacity on a 10-year horizon. The baseline scenario included all current initiatives, but not the new projects or any other management interventions.

A scenario of this sort can be called a “do nothing” scenario. By evaluating the baseline on its own, DRMC gave stakeholders the ability to see the impact of declining payments, increasing costs pressures, and aging facilities. These data underscored the need for investments in infrastructure and programs to reduce the erosion of capital capacity in the baseline scenario.

Creating a baseline projection is as much art as science. The first few years typically are clear, but the outer years become very uncertain as payment and regulatory trends cannot be known. These years also become ultra-sensitive to the compounded impact of assumptions. Yet for purposes of strategic planning, a three-year projection is not enough. Most of the initiatives that were being evaluated by DRMC were not ramped up until the fourth year after initial investment. Therefore, it was necessary to focus on the longer term with the appropriate disclaimers.

DRMC administrators avoided the common temptations to create too optimistic an outlook or to “burn the platform”—where every assumption is a worst-case scenario—in its baseline development. In the end, and after much deliberation, they presented what they felt to be a realistic baseline projection, considering the intermediate-term outlook for population growth, payment trends, expense inflation, and routine capital needs. This projection is shown in the exhibits below.

Define Parameters for Strategic Options

At any given time, there could be a dozen projects or replacement capital needs competing for the same scarce financial resources. However, some of these projects were not mutually exclusive, and others were only to be considered sequentially. For example, the development of a new site for outpatient services and the construction of a facility was one project, and the backfill of the space potentially cleared by those outpatient services in the current facility was a related, sequential project.

The worthiness of any prospective strategic initiative was evaluated against DRMC’s four strategic pillars established by management and the board:

- Increase net revenue, as defined by new programs, market share, revenue cycle, or health plan initiatives

- Decrease expenses, as defined by new supply contracts, labor management, or other reengineering

- Care for patients, through investments that improve quality outcomes and patient safety

- Care about patients, by investing in employee and community wellness, thereby serving as a compassionate and valued member of the Delta community

Level the Strategic Playing Field

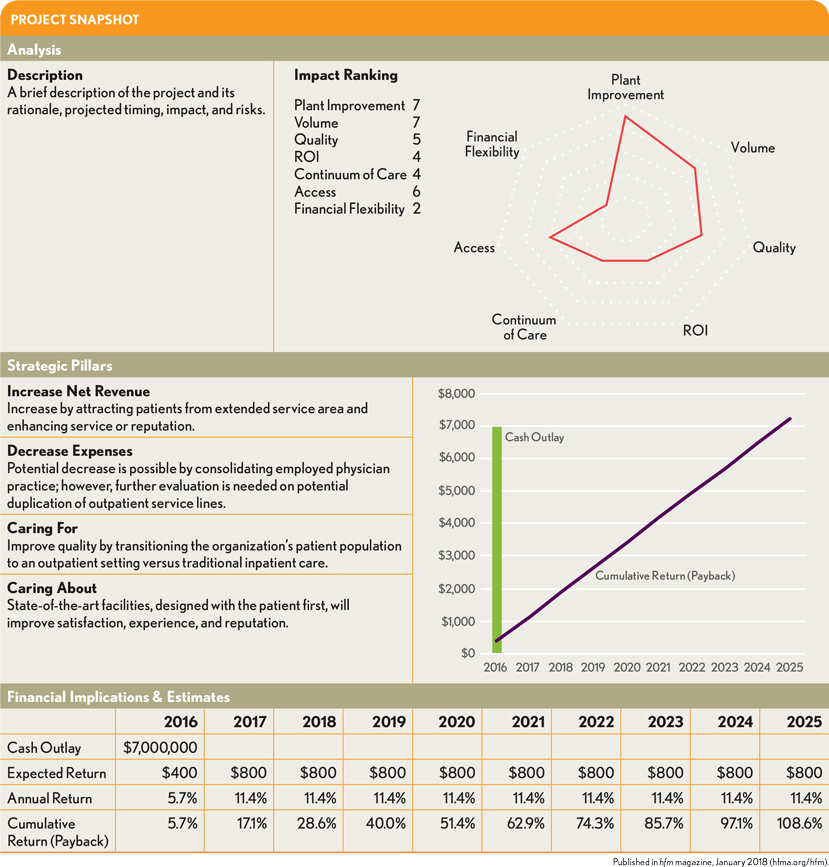

Board members were presented with one-page project evaluation reports on each proposed project, all laid out the same way. References to each project’s relative strengths, weaknesses, rewards, and risks were included. The goal of this practical and repeatable one-page project evaluation framework for detailing strategic projects was to simplify the review, comparison, and evaluation process by highlighting key fundamentals for each project and their comparative impact on key drivers. The objective of this approach is to provide some detail, yet not so much that it overwhelms the reader.

The project evaluation report effectively levels the playing field because strategic options can be objectively presented in terms of impact, timing, rationale, and risks. Key report components include:

- A spider chart showing how each project would impact key drivers: plant improvement, volume, quality, ROI, the continuum of care, access, and financial flexibility

- Brief descriptions of how the given specific initiative relates to the four strategic pillars

- Project-specific pro forma projections to quantify cash outlay, anticipated return in dollars, and annual return and cumulative return percentages over the ensuing 10-year period

- DRMC’s mission statement.

- A project disclaimer, much as one would see in an investment prospectus, to warn the reviewer of the inherent risks in the assumptions.

A sample project snapshot showing some of these components can be seen in the exhibit at left.

DRMC’s Strategy in Action

With the four strategic pillars and the project evaluation framework in place, DRMC’s board members and leaders scheduled a retreat where they would begin laying out concrete plans of action that would proactively shape the future of DRMC. There, they would evaluate the viability and relative potential of many promising projects.

At the retreat, board members received each of the project snapshots, as well as more comprehensive information about each project, and project sponsors led discussions about their proposals.

Reaching decisions on any of the initiatives was not on the agenda. Instead, retreat objectives were met through educating the board on the baseline (no intervention) projection as well as on the goals, merits, and risks of each potential strategic initiative. Decisions would be made in the months to come during regular committee and board meetings. DRMC leadership has been using this process for about a year and a half now, and doing so has created a greater degree of buy-in and reduced any perceptions that decisions are made in a vacuum. DRMC has moved forward on some issues and taken others “back to the drawing board” as a result of this process, but all were analyzed using common parameters. Although it’s too early to tell if any initiatives have significantly exceeded or fallen short of expectations, the organization has a good feel for its ability to sustain any “worst case scenarios” because of this process. The leadership for DRMC is now focused on managing healthcare for the Delta, not just within the walls of the hospital itself. With DRMC’s financial turnaround, and the approach to strategic planning fully revamped, the medical center has incorporated 10-year financial projections into its annual budget process.

Going forward, new initiatives will continue to be evaluated using this process, a common format that delivers a simple but effective methodology for comparative analysis. The administration and the board are confident that daily stewardship, as well as deliberate and consistent long-term planning, will allow DRMC to adapt to the constant challenges and changing healthcare needs of the Delta.

Scott Christensen is CEO of the Delta Regional Medical Center, Greenville, Miss.,.

John Mallia is principal, The Mallia Group, Tampa, Fla.,.