Health System-Owned Physician Practices: Are Any Losses Acceptable?

It’s time to address physician practice losses and their associated regulatory and financial risks.

Recent enforcement cases and settlements driven by the U.S. Department of Justice (DOJ) have added significant regulatory concern for health systems that are working to cope with losing money on their physician practices. Indeed, whistleblower and DOJ-led enforcement actions have focused on practice losses as a potential indicator that physician compensation is not compliant with the regulatory requirements for fair market value (FMV) and commercial reasonableness.

Further concerns about practice losses arise when one evaluates their impact on the move toward reducing the cost of treatment as part of the Triple Aim. Such considerations have created momentum for addressing the regulatory and economic issues associated with losses in health-system-employed practices.

Practice Losses as a Health System Phenomenon

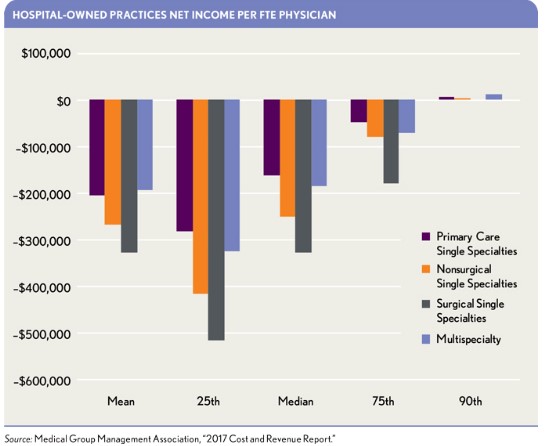

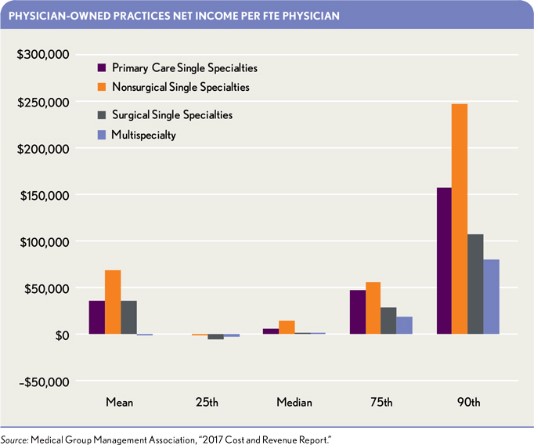

Many health systems are losing money on their employed physician practices.a The exhibit below presents net income/loss per full-time-equivalent (FTE) physician for health-system-owned practices. In contrast, the second exhibit below demonstrates that physician-owned practices have a better financial track record.

The better financial position of physician-owned practices is generally attributable to the fact that compensation for physicians in such practices is self-adjusting to the level of the net practice earnings available.

Health system practices, by contrast, typically operate under a different compensation model. Many health systems base physician compensation exclusively on survey data or other predetermined formulas, with little regard for other economic factors. In addition, health systems frequently attribute losses to various organizational and operational decisions made to benefit the overall enterprise but that have an adverse impact on practice economics. They also may point to significant overhead allocations from the health system as another factor. As long as physicians are paid within the bounds of benchmark data, practice losses are seen as an acceptable “cost” of doing business.

Practice Losses in Government Enforcement Actions

In prosecuting enforcement actions, the DOJ has taken the position that losses in health-system physician practices are a potential indicator of payment for referrals—particularly losses experienced over a long period of time. This position was made clear in the closing arguments and expert valuation testimony in the whistleblower case United States ex rel. Michael K. Drakeford, MD v. Tuomey Healthcare System, Inc. b In that lawsuit, which was settled in two federal trials, the South Carolina-based health system was accused of overpaying part-time employed physicians to benefit from referrals for outpatient surgeries, violating the Stark Law and False Claims Act. The DOJ’s closing arguments in the two trials posed this question: Why would a hospital be willing to lose millions of dollars on physician deals, if not for referrals? c The DOJ’s valuation expert in the case made similar claims about practice losses in terms of commercial reasonableness, stating, “It is not a prudent business practice to enter into business agreements where it is unlikely the enterprise will ever break even or become profitable.” d

Losses on physician practices in and of themselves, however, are not singularly determinative of commercial reasonableness. As discussed in the Tuomey trials, specific factors, such as community need, may necessitate legitimate losses; each arrangement must be evaluated individually to make this determination. The government’s expert applied the same analysis in a case involving Halifax Health in Daytona Beach, Fla., when the health system was accused of Stark Law violations for overpayment of physicians. e

The critical nature of practice losses was further emphasized in three major cases settled in 2015 where qui tam relators focused on the issue of practice losses in their allegations. In a case involving the Florida health system North Broward Hospital District, which settled for $69.5 million in 2015, the relator’s complaint argues practice losses are not commercially reasonable and result from overpayment of physician compensation and that only by taking into account referrals can such losses make commercial sense and be economically sustainable. f Whistleblowers in several other cases have made similar arguments, such as those involving Citizens’ Medical Center in Victoria, Texas, and Adventist Health (involving facilities in Florida, Georgia, Illinois, North Carolina, Tennessee, and Texas), ultimately ending with multimillion-dollar settlements.

Examination of the arguments made in qui tam, or whistleblower, filings can be instructive as to key regulatory enforcement issues. Because whistle-blowers seek government intervention in the cases, studying relator complaints—especially those that actually result in DOJ intervention—provides critical insight into relevant enforcement concerns as relators’ counsel use arguments they believe will be persuasive for DOJ intervention.

In a post-Tuomey world, moreover, health systems generally settle enforcement cases rather than litigate through trial because of the risk of significant financial consequences associated with losing at trial, including large fines under the False Claims Act. This settlement strategy shifts questions of FMV and commercial reasonableness away from what a health system believes is defensible to what the government sees as appropriate. The DOJ’s views of FMV and commercial reasonableness are highly determinative in this context, because of their impact on the government’s decision about whether to intervene and set financial penalties. g

Unfortunately, most of the industry focuses exclusively on physician compensation relative to survey data. Consequently, many health systems have a significant risk for regulatory enforcement because they are not prepared for potential scrutiny of their practice losses. If a qui tam relator emerges, one can expect that practice losses will be used against the health system as an economic indicator of excessive compensation.

The Financial and Organizational Risks of Practice Losses

In addition to regulatory enforcement risk, health systems face a secondary set of business concerns resulting from ongoing losses in their physician practices. The first issue is whether the health system can afford to underwrite such losses as downward payment trends continue to put financial pressure on hospitals and health systems. Some health systems are now starting to question whether such losses are sustainable and to consider what actions they can take to reduce the losses.

Some hospital financial executives dismiss practice losses as a matter of mere intercompany accounting, focusing alternatively on overall enterprise earnings. Such thinking, however, could run the risk of being used against a health system in qui tam litigation, where offsetting of practice losses by hospital profits is highlighted frequently. Whistleblowers could contend “enterprise earnings” is simply code for earnings from referrals.

Another factor is the long-term organizational impact of perennial red ink for physician practices. Such losses can create a culture of underperformance in which losing money is the norm, thereby impeding efforts toward financial improvement. If expectations are that “we’ll always lose money,” there is little impetus for appropriate financial stewardship in operating practices.

Continual practice losses also can impede the pursuit of the Triple Aim: the highest-quality care for the whole population at the lowest possible cost. It may be difficult to promote a cost-reduction mindset for the physician enterprise when losses are viewed simply as a cost of doing business.

Identifying the Sources of Practice Losses

The time has come for health systems to address the issue of losses in their physician practices. The first move in addressing practice losses is to identify and quantify the reasons a health system loses money on an individual physician, practice, site, or group basis. This approach, called loss sourcing analysis, seeks to identify each contributing source of practice losses and to quantify the specific amount of the loss from this source. This analysis includes the following four major areas of review.

Practice-specific revenues and operating expenses. The loss sourcing process begins with preparing a practice performance evaluation of revenue cycle and operational costs. If underperformance in these areas has contributed to practice losses, the amounts should be quantified and reasons noted in sufficient detail to identify potential solutions.

System-level decisions affecting revenues and expenses. This review identifies decisions that have negatively affected the practice as a distinct operating entity and profit center. The loss sourcing analysis then quantifies the economic impact of those decisions. Examples include seeking to serve greater numbers of Medicaid or charity patients and practicing in a low-volume market to achieve the health system’s mission and goals.

Intercompany transaction pricing. Many health systems employ physicians who provide significant professional services for the support and management of hospital service lines, as opposed to the physician practice. Examples include hospital-related call coverage, medical directorships, and co-management services. Frequently, compensation for these services is included in the physician’s employment agreement, and the cost of the service is captured at the physician practice level. The hospital entity, however, does not “pay” for the services directly, but through an intercompany transaction. When an intercompany payment or allocation is made, the amount may be below the full independent contractor rate. The net result is that the practice bears all or a portion of the cost of the hospital-related services, resulting in a cost shift between hospital and practice operations that contributes to practice losses.

Physician compensation and benefits. Most health systems focus on FMV compensation defined by general survey data. However, exclusive use of survey-based methods, without reference to other economic factors, can be a major source of losses in health system physician practices. There are two primary reasons. First, survey data are a reflection of compensation for a general physician market as represented by respondents to the survey. Popular physician compensation surveys are compiled using voluntary responses and are not based on statistical sampling methods. Although they provide a high-level view of compensation for responding practices, such surveys are not designed to indicate the actual range of compensation for physicians nationally, regionally, and more important, in the local market. Valid sampling methods need to be used for these data reports to have statistical representation of a local market.

Second, in many U.S. markets, commercial and governmental payer rates for physician services are insufficient economically to sustain commonly used compensation levels from survey data, such as medians or the 75th percentile. Practices simply cannot pay median rates or higher and stay out of the red; they will lose money if they do, as several studies have demonstrated. h

Converting or moving in-office practice ancillaries into hospital outpatient departments also may contribute to practice losses. The compensation for many independent physician specialties is underwritten in part by profits on practice ancillaries. When practice ancillaries are moved or converted, the profits from these services are relocated out of the practice entity and into the hospital. Physician compensation levels, however, are not generally adjusted for the loss of net earnings due to sole reliance on survey data for FMV, thereby creating practice losses for health-system-employed practices. i

Many health systems ignore such losses because they can achieve higher profits under provider-based payment rules for the ancillaries. Thus, the health system’s overall enterprise earnings are higher, despite practice losses. As noted previously, however, an analysis that offsets practice losses by hospital profits creates significant regulatory enforcement risk, as evidenced in cases such as Tuomey and others.

Addressing the Financial and Regulatory Risks of Practice Losses

A clear first step to addressing the risks of practice losses is identifying sources of losses that can be remediated or eliminated. For example, losses resulting from poor revenue cycle performance or operational inefficiencies should be corrected. The organization not only is incurring financial risk for such losses, but also is inviting regulatory risk given the high level of scrutiny practice losses are given in enforcement cases.

Another area for remediation is intercompany transactions. Hospitals should pay affiliated practices for physician services related to hospital operations at arm’s-length rates reflecting the full cost of the service. Although doing so may lower hospital margins, the reduction in practice losses mitigates regulatory risk and right-sizes the true earnings outcomes of both the hospital and physician operations.

The final step in addressing practice losses involves preparing a justification for those loss sources the health system cannot remediate or change and that are defensible in terms of community need. These defenses should be framed with an eye to documentable facts and circumstances-based analysis, rather than positing generalities. For example, claims about physician retention need to be factual and well documented. Rigorous and factual evaluation of loss sources can mitigate government scrutiny should an enforcement action emerge against the system.

Physician practice losses pose both regulatory and financial risk for health systems. The DOJ’s enforcement approach views practice losses as a potential indicator of noncompliant physician compensation. Moreover, whistleblowers have shown a strong predilection for claiming practice losses as such an indicator. At the same time, health systems face financial concerns in incurring ongoing losses. Loss sourcing analysis, coupled with remediation of curable losses and documented justification of defensible losses, provides a way to manage the risks practice losses pose for health systems in today’s marketplace.

Footnotes

a. Medical Group Management Association, 2017 Cost and Revenue Report. Based on the reported metric “Net income, excluding financial support (all practices),” grouped by specialty type.

b. U.S. Dept. of Justice, “ United States Resolves $237 Million False Claims Act Judgment Against South Carolina Hospital that Made Illegal Payments to Referring Physicians,” Oct. 15, 2015.

c. Transcript from the first Tuomey trial (Tuomey 1 Trial Transcript), pp. 1943-44 and transcript from the second Tuomey trial, (Tuomey 2 Trial Transcript), Closing Remarks, p. 15.

d. McNamara, K., Rebuttal Report-Amended, U.S. ex rel Michael K. Drakeford, MD v. Tuomey Healthcare System, Inc., May 18, 2009, amended May 22, 2009 (Tuomey Rebuttal Report). See also Tuomey 1 Trial Transcript, pp. 979, 982, 1092, and Tuomey 2 Trial Transcript, pp. 1155-56.

e. McNamara, K., Expert Report, United States of America ex rel. Baklid-Kunz v. Halifax Hospital Medical Center, et al., Dec. 12, 2012.

f. Relator’s Second Amended Complaint Under Federal False Claims Act, filed Sept. 29, 2011. See paragraphs 66, 111, and 135.

g. Smith, T., and Dietrich, M.O., “ BVR/AHLA Guide to Valuing Physician Compensation and Healthcare Service Arrangements,” Business Valuation Resources, LLC, Oct. 2017.

h. For a more detailed discussion of the points raised in this and the previous paragraph, see Smith, T., and Dietrich, M.O., BVR/AHLA Guide to Valuing Physician Compensation and Healthcare Service Arrangements , Business Valuation Resources, LLC, October 2017.

i. Gans, D.N., “Why Hospital-Owned Medical Groups Lose Money,” MGMA Connexion, April 2012.