HFMA and CareCredit conduct survey on consumer-centric strategies being used to drive patient-centric healthcare

A survey conducted by HFMA and CareCredit provides insight into healthcare organizations’ consumerism approaches and the challenges of moving from theory to practical application.

The survey of nearly 300 healthcare finance leaders shows although consumerism is top of mind in developing strategies for care and service, they continue to struggle to execute on it.

Nearly 87% of respondents to the survey, cosponsored by HFMA and CareCredit, said consumerism is very important or even vital to their organization, with the results holding true across facility types — health systems, hospitals and medical groups or specialty practices — and geographic location — urban and rural.[a]

But barriers to implementation — ranging from technology issues to concerns around staffing; operations, such as processes and oversight; and cost — are holding some organizations back from skillfully deploying patient-centric tactics. As a result, many leaders say their organizations execute only fairly well on consumerism (45.2%), while 14.3% describe their ability to execute as not well. Another 2.4% say they are not executing on consumerism at all.

Feedback from survey respondents and industry leaders offers insight into healthcare organizations’ approaches to consumerism and the challenges they face in moving from consumerism in theory to practical application.

Creating a consumer-centric strategy

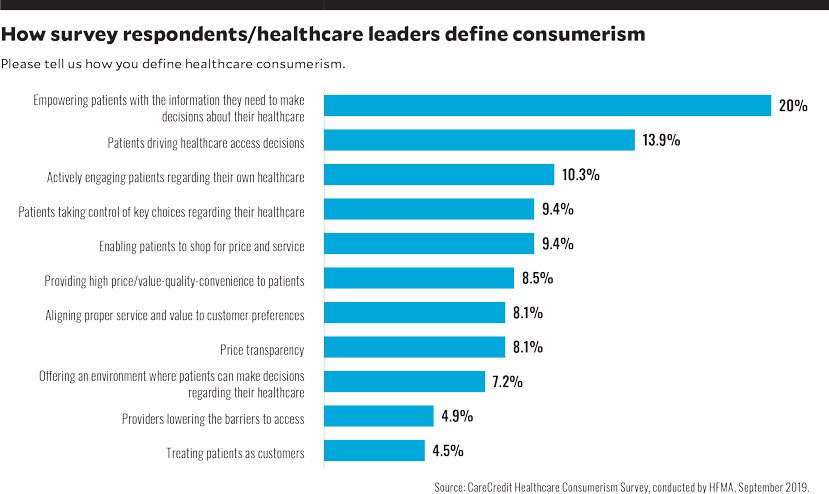

Tasked with defining consumerism as it pertains to their organizations, survey respondents were given several choices, including the option to fill in their own answers. Although specific answers varied, survey results showed that healthcare finance leaders’ definitions of healthcare consumerism are largely aligned, as shown in the exhibit below.

“I was very pleased to see the consistency in the definitions of healthcare consumerism, especially among the top four definitions. They really focused on aspects of patient empowerment,” said Jan Oldenburg, a nationally recognized patient engagement strategist and healthcare technology consultant. Oldenburg said she was pleased to see that price transparency and allowing patients to shop for care based on price and service also received attention from respondents.

“With consumers paying a larger portion for the care and service they receive, patients increasingly are concerned and frustrated about issues related to transparency and the ability to compare services,” said Oldenburg.

When asked about what drives their consumerism strategies, the organizations represented gave similar answers across health systems, hospitals and medical groups or specialty practices. The top drivers, rated on a scale of 1 to 5, with 1 representing no influence and 5 indicating a top driver. include:

- Patient satisfaction (4.6)

- Patient retention (4.3)

- Support organizational goals (4.2)

- Improved financial performance (4.1)

- Patient acquisition (4.0)

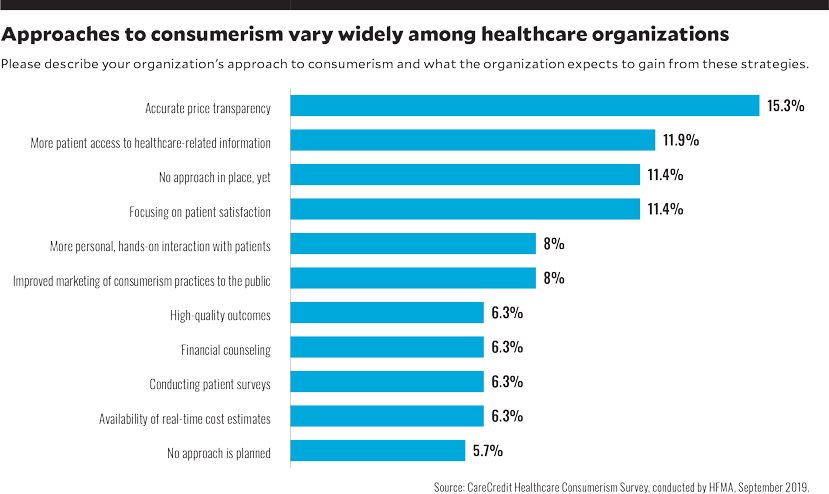

Although leaders’ definitions of consumerism show strong similarities, there are differences between their perception of what it means to be consumer-centric and the types of consumerism initiatives their organizations are rolling out, as shown in the exhibit below.

For example, although price transparency ranks eighth among leaders’ definitions of consumerism, efforts to achieve accurate price transparency rank No. 1 on the leaders’ list of consumerism priorities.

Consumer expectations around price transparency

Price transparency has indeed proven a significant challenge for the healthcare industry. And it’s more important now than ever, as the patient financial responsibility is increasing. A 2018 survey conducted by InstaMed reported that 69% of providers saw an increase in patient responsibility from the previous year.[b] Today’s consumers are looking for the same clarity and seamless experience from healthcare organizations that they get from other companies they patronize, Oldenburg said. “The really difficult part of price transparency is determining what a procedure or service will cost a patient out of pocket — especially when you factor in insurance contracts and patient deductibles — and presenting that information in a way that is informative and useful,” she said.

“It’s interesting to compare the data around how leaders define healthcare consumerism versus their priorities,” she said. “For example, ‘accurate price transparency’ is essential to giving consumers the information they need to shop for care. It’s also a driver of patient loyalty and retention — top drivers of consumerism for healthcare organizations.” Studies show price transparency has a powerful impact on loyalty and retention: One analysis shows 75% of patients research healthcare costs and use the information to determine where to seek care.[c]

Grading execution efforts

The ability to turn consumerism into strategy is a competitive differentiator for healthcare organizations, given increased expectations for convenience, affordability and quality and dissatisfaction with traditional aspects of care. Comparison shopping is one key area in which these expectations come together across generations, a recent Accenture study shows.[d] For example, 65% of baby boomers and older seniors want transparency around out-of-pocket costs — equal to the percentage of Gen Xers, millennials and Gen Zers (those born in the mid- to late-1990s) — suggesting that all generations have a desire to find the best prices on the care they need.

It’s clear that healthcare leaders understand the importance of convenience, transparency and patient-to-provider relationships, based on their definitions of and approaches to consumerism. But there are disparities between how highly they prioritize efforts that have the potential to strengthen the patient experience, including the financial experience, and how well they execute on these priorities.

The reasons for failure to implement are varied among organizations, according to the survey conducted by HFMA and CareCredit. Leaders cite a variety of barriers, including:

- Technology concerns, from systems to security (19.7%)

- Staffing concerns (16.3%)

- Operational concerns (16.2%)

- Cost (16%)

- Competing priorities (10.6%)

Another possible reason for failure to implement, which could encompass several of the above, is that the steps healthcare organizations are taking toward consumer-centric innovation may have exposed weaknesses in existing processes, and such weaknesses can be difficult to overcome, Oldenburg said.

“One thing that happens during any widescale digital implementation effort is that you discover that systems and processes that were working well enough when consumers weren’t directly exposed to them — such as manual transfer of data from one system to another — are now holding organizations back from the types of initiatives they hope to launch,” Oldenburg said. “All of a sudden, leaders have a bigger-picture view of the behind-the-scenes work taking place. [That view] can bring to light issues the organization didn’t realize existed and that takes time to resolve.”

With pressure continuing to mount legislatively, and in the press around price transparency, medical account resolution and improving patient experience, the focus on consumerism will continue to increase in importance. It will be critical for organizations to seek out best practices and guidelines for these, as well as determine where to focus their internal and external efforts.

4 value-based approaches tocreat consumer-centric initiatives

Here are four approaches finance leaders should consider when looking to create consumer-centric initiatives that bring value to the organization and its stakeholders.

1. Intensify focus on the patient financial experience. According to a survey conducted jointly by CareCredit and HFMA, nearly 37% of healthcare finance leaders say their organization’s execution around the patient financial experience is inconsistent, and about 7% rate their efforts as “poor” or worse.[e] At a time when patient loyalty and satisfaction depend on an organization’s ability to articulate out-of-pocket costs and provide affordable payment options, engaging patients in financial discussions before care is delivered is critical.

At Henry County Health Center, an HFMA MAP Award winner for revenue cycle excellence, staff provide out-of-pocket estimates for nearly all services scheduled through the central scheduling department. The Mount Pleasant, Iowa-based health system also has intensified efforts to collect a portion of the out-of-pocket costs due for all physical therapy appointments.

“We are considered an outpatient physical therapy services provider, so our patients don’t have a copay, so to speak, but they are responsible for a percentage of care costs. We’ve started collecting a portion of the coinsurance payment at the time of each appointment so patients can spread these costs out over time,” said Charlie Hammel, the health system’s revenue cycle director and centralized scheduling project manager. Today, the health system collects a $25 to $30 coinsurance payment for each visit. This initiative significantly reduces bad debt associated with these visits while eliminating surprise bills. “This past October, we collected coinsurance payments for 17% of visits, our best month ever,” Hammel said.

2. Elevate your ability to respond to patients’ concerns in real time. Addressing patient issues as they occur can help an organization create an exceptional patient experience and open the doors to discussions about resources, such as payment plans, that could ensure a patient gets the care they need at the right time. At New York’s Rochester Regional Health System, an HFMA MAP Award winner, staff reach out to patients by text during their emergency department visit or inpatient stay, asking them to rate their experience on a scale of 1 to 5.

“Depending on the topic or the type of complaint, we’re able to send staff in to address the complaint in the moment,” said Tiffanie Ball, director, patient access. “In one instance, my team spoke with a patient who was at risk of having a heart attack and who nearly left our facility because she was concerned about the expense associated with an observation stay. We were able to pair the patient with a patient financial services representative who spoke with the patient’s insurance company, walked her through the out-of-pocket estimate, and convinced her to stay and receive the care she needed.”

Patient financial services staff also conduct rounds with patients admitted for observational stays to discuss out-of-pocket costs of care, a move that often helps reduce the financial stress of the visit, Ball said.

3. Use data to inform your consumerism approach. More than 53% of healthcare finance professionals surveyed say they use data analytics to inform their consumerism efforts, including 62.5% of medical groups and specialty practices. The focus on the use of data analytics is prevalent in all locations (urban or rural) and sites of service (medical practice, hospital or health system). The types and areas of use will be a focus of upcoming research. Organizations that rate consumerism as vital are much more likely to use data analytics to inform their approach than those that rate consumerism as very important (48%) or somewhat important (32.4%). They also are more likely to rank execution as excellent or very good (54%) than those that do not (9.1%).

4. Look for ways to keep patients connected between visits. According to a survey by Accenture, most patients across generations place high importance on providers’ responsiveness to follow-up questions after an appointment.[f] “Providing ways to maintain connections with patients between visits shifts the focus of visits from episodic to collaborative encounters of care,” Oldenburg said. A majority of survey respondents said they already have implemented functions that allow patients to:

- Access test results (77.8%)

- Pay bills (78.3%)

- Access EHR (68.4%)

- Communicate with medical staff (60.8%)

With the focus on consumerism in healthcare only expected to increase, healthcare organizations should make every effort to implement as many consumer-centric practices as possible.

This content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/or other advisors with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) make no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. Your receipt of this material constitutes your acceptance of these terms and conditions.

Footnotes

a. HFMA, “Embracing the shift to consumerism to improve the patient financial experience,” September 2019.

b. InstaMed, “Trends in Healthcare Payments Ninth Annual Report,” 2018.

c. “News Reports about a Weakening Economy Impacting How Some Patients Seek Medical Treatment,” TransUnion, Sept. 17, 2019.

d. “Today’s Consumers Reveal the Future of Healthcare,” Accenture 2019 Digital Health Consumer Survey: U.S. Results, 2019.

e. HFMA, “Embracing the shift to consumerism to improve the patient financial experience,” September 2019.

f. “Today’s Consumers Reveal the Future of Healthcare,” Accenture 2019 Digital Health Consumer Survey: U.S. Results, 2019.