In a higher-interest-rate environment, improved valuations on fixed payer swap positions may provide an opportunity to terminate those positions. That decision will depend upon considerations related to capital structure goals and impacts on profit-and-loss statements and the balance sheet.

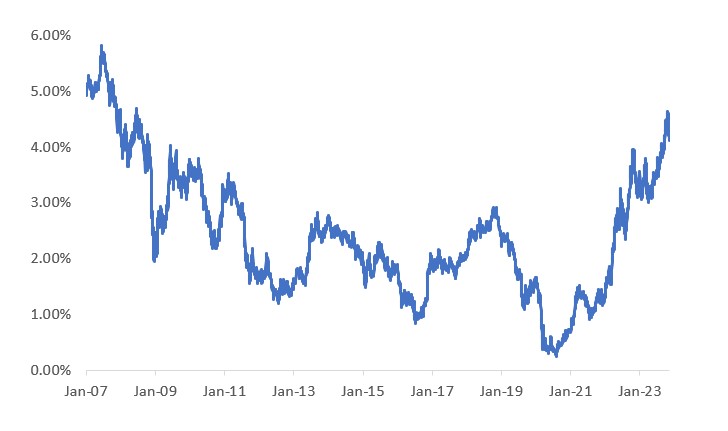

Fixed payer swap rates are higher by about 100 basis points so far in 2023, 400 basis points above the low point reached in 2020 and at their highest level since 2008 (as shown in the exhibit below), Mark-to-market (MTM) valuations for fixed-payer swaps have improved dramatically, and in many cases have turned positive. Organizations are now questioning whether they should terminate their interest rate hedges, and if so, when?

10-year Secured Overnight Financing Rate (SOFR) swap rates at highest level since 2008

Why now?

Most fixed-payer swaps were put in place to hedge interest-rate risk on specific variable-rate debt. In many instances, this relationship became disconnected, but swaps still provide a general hedge on an organization’s broader variable-rate portfolio. Swap positions have often remained in place because the cost of terminating those positions was prohibitively high. Most recently, there was a period beginning in late 2017 when interest rates appeared to be on an upward trajectory and swap terminations were an option.a But that window closed as interest rates plummeted following massive Federal Reserve intervention to mitigate the economic impacts of the COVID-19 pandemic.

With the Fed reversing its course, higher long-term interest rates have led to improved valuations — and therefore lower termination costs — and even to termination gains on some swap positions.

Considerations in deciding whether to terminate a swap

The decision to terminate a swap position should be grounded in management’s point of view on the right long-term debt mix for the organization. This point of view can be informed by several factors, including:

- What rating medians suggest

- How peer organizations are responding

- Most important, the organization’s risk appetite and the amount of the risk “budget” it is willing to spend within its capital structure

When evaluating these factors — especially the first two — it is important to remember that historically low interest rates in recent years have skewed many organizations’ debt portfolios heavily toward fixed-rate debt. Both rating medians and peer organization responses might change if a higher-rate environment persists.

Organizations should also consider how the accounting treatment of swaps might affect their decision.

If an organization has pursued an integrated approach to accounting for swap payments, a current positive cash flow from the swap is showing “above the line” and is contributing to operating margin. A decision to terminate the swap might — from an accounting perspective, at least — increase liquidity at the expense of a lower operating margin.

If the accounting approach has not integrated swap payments, termination of the swap will not impact the operating margin or “below the line.”

It would also be worthwhile to consider whether a gain/loss on termination would be accounted for with respect to accounting treatment and for the purposes of calculating income available for debt service as a component of relevant covenant calculations. Organizations should consult with accounting experts before making final determinations with respect to the impact of a swap termination on its financial statements and covenant calculations.

Organizations should consider several additional factors in deciding whether now is the right time to terminate a swap position:

- Dealer spread to terminate a position

- Reduced MTM volatility associated with fixed-pay swaps

- Reduced collateral posting risk if interest rates decline in the future

- Reduced counterparty exposure risk if interest rates continue to climb, an issue that three Kaufman Hall experts have have addressed in a recent article

- Use of bank credit, given that termination may free up bank capacity for long-term capital

Conclusion

A changing interest rate environment has reopened the opportunity to consider terminating an organization’s swap position. Organizations should take a measured approach in determining whether they wish to pursue this opportunity. Key considerations include whether termination will help the organization meet its capital structure goals and objectives and the impact to both profit-and-loss statements and the balance sheet. Ultimately, the decision will rest on management’s point of view on the risk-bearing ability of the organization and the place of its current swap position within that broader context.

Footnote

a. Jordahl, E.. “Terminating swap positions,” hfm, Nov. 30, 2017.