Historical trends suggest interest rates for hospitals cannot remain for much longer at current very low levels.

For much of the past 10 years, hospitals have enjoyed the luxury of low fixed and variable interest rates. Thanks to a Federal Reserve policy to keep short-term interest near zero, hospitals of all credit qualities have been able to finance and refinance at long-term rates in the 3% and 4% range and short-term rates in single digits. But hospitals should not assume that there is no possible end to these circumstances. They should be prepared for the pendulum to swing back in the direction of higher rates.

Recent trends make future unclear

The long-standing low-interest-rate environment is a byproduct of an economy rebounding from the Great Recession of 2008 and a rather modest recovery in the years that followed, but regardless of its origins, hospitals clearly benefitted from this environment.

With a change in economic policy and a more substantial recovery well underway, the Federal Reserve began to raise short-term rates, increasing its Fed Funds rate nine times between December 2015 and December 2018. Although longer-term rates did not follow in lock step with the Fed actions, there was a discernable increase. At the time of the initial Fed action in 2015, the 10-year U.S. Treasury rate was 2.24%. By November 2018, the rate on the 10-year U.S. Treasury had increased 100 basis points.

Recently, the Federal Reserve announced an end to its policy of gradually increasing rates and even raised the possibility of future reductions. Indeed, on July 31, 2019 the Federal Reserve lowered interest rates for the first time in eleven years. With this action, it has become uncertain whether the low-interest rate environment will be extended indefinitely or whether the recent gradual increase in rates over from 2015 through 2018 will resume. With a presidential election little more than a year away, it is difficult to predict where rates are headed in the near term, but it is reasonable to assume that the prolonged period of low-interest rates will end.

Although each new decade presents its own unique challenges, there are lessons to be learned from seeing how previous generations of managers approached markets with similar interest rates. Assuming 2008 is the starting point for a decade of interest rates that are lower than the long-term average, the decade immediately preceding 2008 offers insight into how healthcare borrowers dealt with the type of market conditions likely to face current borrowers in the years to come.

Comparison of 2 decades

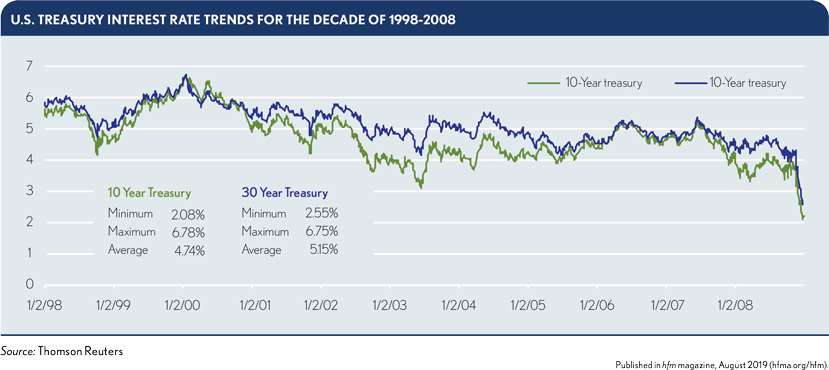

The rates hospitals are seeing today emerged from an environment in which interest rates were much lower, unlike the rates seen in 1998-2008 decade. Today, we have seen rates rise gradually from a very low-interest-rate environment, whereas the rates seen in 1998-2008 were the result of a decline from the wrenching inflationary rates of the 1970s and 1980s. By 1998, interest rate recovery was largely in place, and rates over the next decade were relatively stable, as shown in exhibit below.

A review of larger trends through the two decades also discloses some noteworthy findings. At the start of 1998, the 30-year U.S. Treasury rate was 5.93%, and by 2008, it had declined 154 basis points, to 4.39%, while over the same period, the 10-year U.S. Treasury rate declined 163 basis points, from 5.54% to 3.91%. By comparison, from Jan. 1, 2008 to mid-2019, the 30-year U.S. Treasury rate dropped 186 basis points from 4.39% to 2.53%, while the 10-year U.S. Treasury rate dropped from 3.91% to 2.02%, a decline of 189 basis points. It is important to keep in mind, however, the points from which these trends began in each decade, as alluded to previously (i.e. a high-interest-rate plateau versus a relatively low-interest-rate market, respectively).

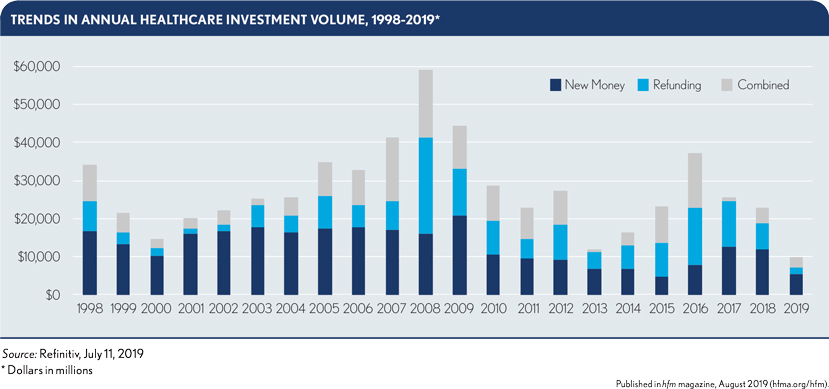

On average, total annual healthcare volume about $25.1 billion per year from 1998 to 2008, compared with $30.46 billion per year from 2008 to 2018, as shown in the exhibit below.

See the sidebar for a historical perspective on hospital financing practices during the period of 1998-2018.

Lessons learned from 1998-2008

Although 30-year U.S. Treasury rates in the 4% to 5% range may seem high by today’s standards, they would look like the norm if one were to consider them in the context of the 1998-2018 timeframe. Over that time, the average 10-year rate is 3.61% and the average 30-year rate is 4.23%. Those levels clearly are higher than today’s current rates, but it is reasonable to assume that rates will revert to these levels in the years ahead. With that in mind, consider the takeaways from the 1998-2008 decade regarding the following four key factors.

Derivative instruments. In 1998-2008, the use of derivatives became widespread among variable-rate borrowers. Typically matched with insurance, hospital borrowers routinely entered into long-dated swaps (up to 30 years) to fix variable-rate uncertainty through maturity. Because the derivative rate was invariably lower than the fixed-rate market, the derivative strategy made sound economic sense. The practice continued after 2008, although the demise of the municipal bond insurers significantly reduced demand.

What many borrowers in the prior decade hadn’t appreciated fully was how long-dated swaps would affect valuation in an environment experiencing a decline in interest rates. Derivatives are financial instruments that are regularly subject to valuation. As rates fell, the value of the long-dated swap fell along with them, thereby presenting a problem for the borrower. The negative valuation of the derivative often created a significant liability on the balance sheet that could be remedied only by either taking the loss on the sale or waiting until rates increased to the point that the loss could be reversed. At that point, of course, the higher-interest-rate environment that prompted the original trade would to some extent have returned.

The lesson from the prior period is to keep in mind the impact that interest rate changes have on derivative valuations and consider shortening expectations to five or seven years to limit the impact of a change in market valuation. The shorter term comes with some interest-rate risk, however, which should be weighed against the adverse impact of derivative negative valuation on the balance sheet.

Some sophisticated borrowers in the market will likely enter long-dated, low-interest-rate derivatives well in advance of when they might be used as a hedge simply to lock up an attractive rate when they can. Institutions savvy enough to dabble in the derivatives market can realize advantages.

Credit transfer — municipal bond insurance/bank direct purchase. The demise of the municipal bond insurance business was a major change in the past decade. Prior to 2008, municipal bond insurers accounted for about 40% of the healthcare bond market, on average. Ten years later, bond insurance accounted for only a small percentage of the market as some insurers stopped writing policies. Previously, the insurance market’s growth was fueled largely by hospitals that already were strong enough to access the market on their own but that were willing to pay a premium and accept more stringent credit requirements in return for the use of an insurer’s AAA rating.

When the insurance business crashed in 2007-2008, many of its former users simply reverted to their own credit to support their borrowing needs. At the same time, another credit source, the commercial banks, stepped in to offer support. As banks saw their near-term credit deteriorate, they largely stopped writing letters of credit and standby bond purchase agreements and simply shifted their practice to making direct loans that had the characteristics of bonds. These direct purchases were even more attractive than insurance because the documentation was far less strenuous and the fees a fraction of a typical bond issuance premium. Unlike bond insurance, bank lending introduced credit risk because bank loans rarely matched the asset lives of the assets being financed with the term of the loans. Borrowers were, however, willing to accept the risk because of the ease of access, the low cost and the willingness of the banks to lend.

It is difficult to see a rebirth of the bond insurance business given the changes in the municipal market. The elimination of the ability to advance refund debt previously issued has reduced the size of the municipal bond market in general, and the presence of commercial banks in the market shrinks it even further. Municipal insurance will continue to be a factor for BBB-rated hospitals, but it is highly unlikely that insurance will ever again have the penetration of the market it had in the 1998-2008 decade.

The practice of direct purchase by commercial banks, however, can be expected to continue as long as banks can make profitable loans while providing flexible terms.

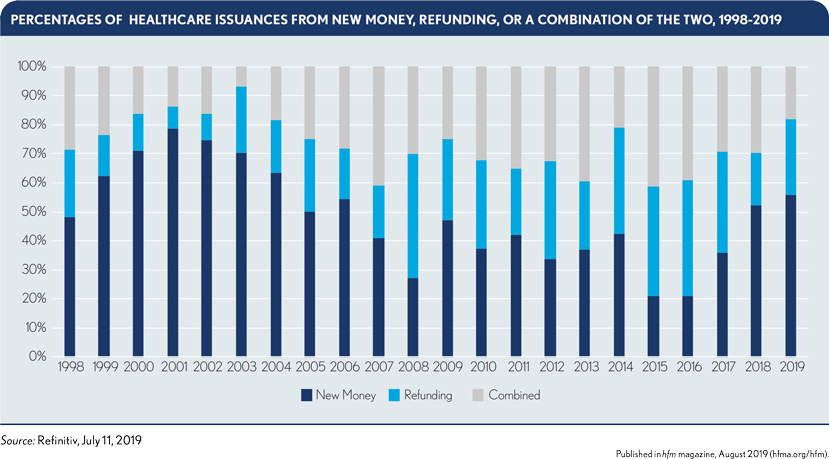

Advance refunding. Advance refunding has traditionally been a major source of issuance in the municipal market. Between 1998 and 2008, advance refunding issues for healthcare borrowers, including issues with a refunding component, represented about 42% of the market, on average, compared with about 62% of the market between 2009 and 2018, as can be seen in the third and fourth columns of the exhibit below.

With the Tax Cuts and Jobs Act of 2017, advance refunding of municipal bonds has almost been eliminated. Bonds can now be refunded within 90 days of their call date and still be considered a current refunding, which means the high volume of advance refunding, such as occurred between 2008 and 2017, will be a thing of the past or at least as long as the present law remains in effect.

Without question, the elimination of advance refunding had a major impact on 2017 volumes as hospitals rushed to the market in advance of the tax law change. The law also clearly had an immediate effect in 2018: Total municipal bond volume dropped almost 22% as a result of the tax law change while healthcare volume dropped from $34.7 billion to $22.8 billion, a decline of 34% (Source: Refinitiv, Jul 11, 2019). Year-to-date results in 2019 regarding the use of advance refunding suggest that the 2018 results, especially when considering refinancings both alone and in combination with new money, may be the new norm.

Looking forward, the period 1998-2008 may provide insight as to what to expect with the future volume of refinancings. The developments during this decade were attributable to a provision of the 1986 Tax Act that also affected the practice of advance refunding. Before the passage of the 1986 Tax Act, municipal borrowers could advance refund tax-exempt issues twice. After 1986, municipal borrowers were limited to one advance refunding.

Given the high-interest-rate environment of the 1980s, a high volume of refunding occurred in the late 1980s and 1990s when rates returned to more acceptable levels. Because these bonds, many of which were insured, were not eligible for a second advance refunding, the level of advance refunding as a percentage of the total market was lower than in the 2009-2018 period. In other words, the lower volume of refunding in the 1998-2008 might provide some insight on the impact of the change in refunding options.

The key point to consider is that rates remained relatively stable in the 1990s and early 2000s, so there was a reduced incentive to refund. Likewise, the low-interest-rate environment of the past ten years will have a similar effect on the need to refund, thereby neutralizing some of the immediate impact of the loss of advance refunding.

Variable-rate debt. An emergence from today’s lower-interest-rate environment to a higher one would almost certainly spark a renewed interest in variable-rate debt. Between 1998 and 2008, variable-rate debt represented, on average, about 20% to 30% of total debt, with the total reaching a high of over 60% in 2008. By comparison, variable-rate debt has constituted about 20% of the total since 2008. Part of the problem with our current data is capturing the information from the banks, which are major providers of variable-rate lending via direct purchases. Banks will be less inclined to write letters of credit or standby bond purchase agreements, which are somewhat constrained by Basel III limitations, and instead will continue to be a major source of variable-rate funding via direct lending.

A higher-interest-rate environment also will make hybrid variable-rate products more attractive. For example, tender option bond programs are likely to appeal to borrowers seeking a nonbank variable-rate solution. Hospitals also can expect more nonbank variable-rate products such as self-liquidity, floating-rate notes of various kinds and other hybrid securities.

Market prognosis

A decade-long period of low interest rates may be coming to an end. As rates move higher, hospitals likely will revert to some familiar forms of financing and lenders will be poised to offer new products to meet the demand. It is reasonable to assume that conventional fixed-rate financing will remain the prime source of funding for hospitals. But it also is reasonable to expect that many borrowers will rely on variable-rate debt to a much greater extent than in the prior decade, if for no other reason than that they already have locked in fixed rates at reasonable levels and, thus, can afford to take on variable-rate risk.

How that variable-rate debt will be structured remains to be seen. Highly rated hospitals will be able to use their own credit to support variable-rate initiatives. Others will continue to rely on bank placements for their variable-rate needs.

It is not clear whether banks will revisit the use of letters of credit and standby bond purchase agreements. As long as reserve limitations imposed by Basel III continue to make credit facilities costlier to offer, bank lending will continue to be a major source of variable-rate financing for hospitals. If that proves true, the use of derivatives could be limited. Moreover, derivatives are likely to be scrutinized to a much greater extent than they were during 1998-2018 period, and they are likely to have shorter terms.

With no prospect of a new generation of bond insurers, hospitals will continue to rely on their own credit or those of the banks supporting them. Without external credit support, it is reasonable to assume that the hospital consolidation that has occurred over the past 10 years will continue as smaller facilities find it difficult to absorb the debt burden necessary to keep pace with evolving operational requirements.

With the elimination of advance refunding of tax-exempt bonds, it is also reasonable to assume that the volume of healthcare bond financing will diminish at least for much of the next decade. Consider 2018 as a harbinger of things to come in the public arena when it comes to future issuance of tax-exempt debt. Volume dropped from $34.7 billion in 2017 to $22.82 billion in 2018 (Source: Refinitiv, Jul 11, 2019). Of course, 2017 could be considered an aberration because of the rush to refund before the tax law change took effect.

On the plus side, larger hospitals and systems will rely to a greater extent on the taxable market as mixed-use (taxable and tax-exempt) projects become more commonplace. That practice may offset some of the lost volume from refunding projects.