Effective management of an organization’s capital structure can increase capital access, add flexibility and lower overall cost of capital. It also can create a competitive advantage.

Historically, not-for-profit hospitals have used refundings as a major way to reduce overall borrowing costs for their fixed rate bonds — on or prior to the typically 10-year call date. Although the 2017 Tax Cuts and Jobs Act eliminated one-time advance refundings on a tax-exempt basis (more than 90 days prior to the call date), there are other ways to capture savings. The next opportunity for most borrowers will come during current refunding of their tax-exempt fixed-rate bonds issued in 2010 and later.[1]

Why use refundings?

Refundings remain an attractive tool for capital structure management for three reasons.

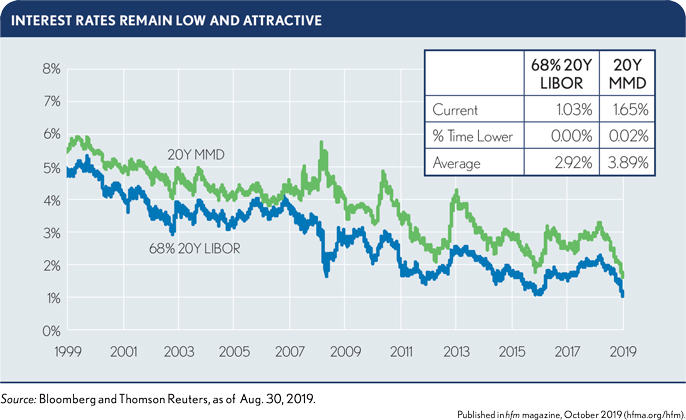

1. Interest rates remain near historic lows. In 2010 and 2011, hospital borrowers issued the majority of their fixed-rate bonds with 5% coupons. Today’s flat yield curve enables borrowers to lock in considerably lower rates, which creates cash flow or present values savings. The exhibit below indicates the downward trend of both the traditional fixed municipal market rate (MMD) and synthetic 20-year LIBOR (floating) swap rate. Both traditional and synthetic rates are at historic lows. Since 1999, lower rates have occurred only 2% of the time for MMD, while LIBOR is at a historic low.

2. Rolling down the yield curve lowers costs. Refunding of a 30-year bond issued in 2010 creates a 20-year bond, and allows replacing with a 20-year yield. For reference, 30-year MMD in 2010 was 4.16%, compared with 20-year MMD of 1.65% in August 2019.

3. Not-for-profit healthcare credit spreads remain attractive. In addition to a decrease in overall interest rates for fixed-rate bonds (MMD index), credit spreads for not-for-profit borrowers have recovered significantly since 2010-2011.

How to capture savings

Hospital borrowers should consider options available to them to capture refunding savings, particularly as borrowers start to think more broadly about new-debt-issuance and debt-restructuring needs and availability. Finance teams should adopt six strategies to capture savings.

1. Wait and refund on a current basis. Hospitals can wait until 90 days before the call date for current refunding on a fixed-rate tax-exempt basis, but should start early with transaction planning. Borrowers continue to carry interest rate risk until the refunding pricing date. Hospital borrowers should begin to map out their market plans for upcoming current refunding opportunities in light of other calendar considerations, such as completion of audit and rating updates.

2. Refund on a taxable basis. Not-for-profit hospitals can advance refund prior bonds on a taxable basis at any time. Depending on the hospital borrower’s credit and prevailing market conditions, taxable bonds may offer attractive present value savings. A taxable refunding eliminates the interest rate risk associated with waiting to refund the prior bonds at the call date and is free from the federal tax code limitations regarding allowable ownership and use. Taxable bonds, however, have different market features that generally restrict some of the flexibility afforded by the tax-exempt fixed-rate market. For example, bullet maturities and a make-whole call feature instead of the level debt amortization and 10-year par calls are more available in the tax-exempt fixed-rate market.

3. Issue a tax-exempt forward delivery bond. This bond is a contract with a capital markets participant (e.g., investment bank, placement agent) to issue a refunding bond at a certain date in the future. The yield curve is driving pricing lower for forward bonds and swaps. The flatter the curve, the lower the pricing. A new forward delivery bond, which borrowers can secure in the public market or privately with a direct lender, is priced with a delivery date sometime in the future and coordinated with the call date of the refunded issue. In this way, a forward delivery bond removes interest rate risk by locking in current rates while waiting for the call date, but at a premium to a standard bond transaction.

4. Issue a forward starting swap. Entering into a forward starting, floating-to-fixed interest rate swap in advance of the call date allows the borrower to lock in today’s interest rates, with swap cash flows that commence on or near the call date. When implementing this strategy, the borrower also plans to issue tax-exempt variable rate current refunding bonds on the call date when the swap cash flows begin.

Risks associated with this approach include those associated with any swap transaction (e.g., collateral posting, counterparty risk, negative mark-to-market valuation) as well as market access risk at the time of the call date. Although this approach changes the risk profile of the underlying obligation, it likely maximizes the economic savings available from a refunding.

5. Issue a “Cinderella” bond. Typically involving a direct purchase from a bank, Cinderella bonds initially are issued as taxable debt, but subsequently convert on the call date to tax-exempt bonds bearing a lower predetermined tax-exempt rate. Some major considerations include: requirements for tax diligence; issuance of a tax-exempt bond opinion at the time of tax-exempt conversion; general availability of this product from banks; and the commitment period offered, which may be shorter than the final maturity of the bond. This alternative may be attractive for borrowers who have no plans to access public markets to issue debt in the next two years but want to capture the economics available in the current market to lower their cost of debt for the period of the bank commitment.

6. Use a rate lock. These tools are available in many forms, allowing organizations to hedge the risk of a rising interest rate while waiting for the call date. Organizations can use different indices — for example, MMD, SIFMA and Treasury rate locks — to accomplish different strategies. Cash settlements occur at the call date.

What savings are possible?

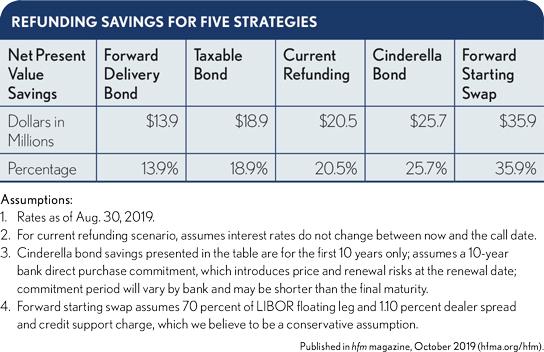

The exhibit below provides an example of refunding savings for five strategies described here, assuming an “A” rated healthcare organization that issued in 2010 a 30-year bond for $100 million with a 5% coupon, final maturity in 2040 and a call date of August 2020.[2] The data is arranged from lowest to highest net present value savings, based on strategy. As discussed earlier, each strategy carries different implications for an organization’s capital structure and specific needs.

How to pick a strategy

As with any capital structure decision, a hospital borrower should employ rigorous analysis of each described option and the implications for the organization’s specific situation and risk appetite. Various factors include whether a solution is suitable, including investor demand, tax-exempt supply, taxable/tax-exempt ratios and concerns about interest rate and other risks.

Options are available to meet refunding needs. However, each comes with different considerations relative to the organization’s current capital structure. We recommend discussing alternatives based on a thorough quantification of savings opportunities and related risks.

[1] This also has application for the still-outstanding, tax-exempt fixed-rate bonds issued in the second half of 2009, with a call date that has not reached the 90-day current refunding window.

[2] The rate lock strategy would not provide an apples-to-apples comparison with other strategies, so it is not included here.