Tackling the Challenge of Stranded Assets in the Acute Care Hospital Sector

The healthcare industry’s shift in focus from fee-for-service to fee-for-value and concomitant shift of care from inpatient to outpatient settings are compelling hospitals to revisit their investment strategies regarding strategic assets to ensure profitability and long-term sustainability.

As the healthcare industry transforms into a value-based system that seeks to align risk and reward with the goal of transforming health care for the public good, this transformation is likely to pose significant challenges for industry subsectors that will require focused attention and activity. The hospital sector, in particular, is being left with a vast physical infrastructure of strategic assets (i.e., long-lived fixed assets critical to maintaining future business sustainability) that can be now be categorized as uneconomic—or stranded. This phenomenon has been fueled by factors such as the following:

- Emerging payment models with the shift to value-based care

- Clinical and technological advances and the resulting movement of care to lower-cost sites

- A persistent debt burden among hospitals and wealth disparity among patients, coupled with an increase in uncompensated care and consumerism.

The natural response, as in other industries that have experienced transformation and deregulation, has been an accelerating pace of consolidation, closures, and creative partnership models. However, the overlay of debt and difficulty in repurposing strategic assets continues to impede the recovery of stranded assets, ultimately translating to stranded community benefits.

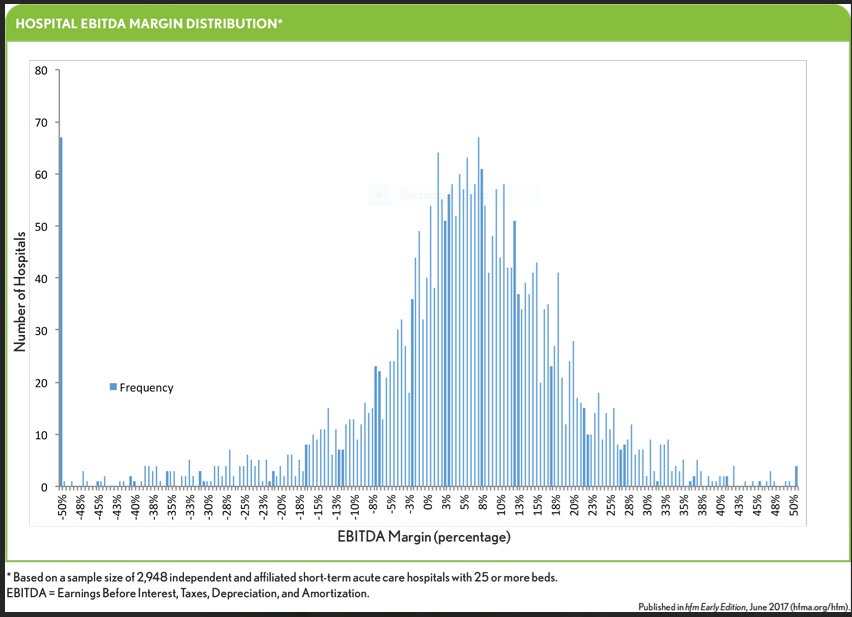

Examining this phenomenon broadly at a high level for the acute care hospital sector can yield valuable insights. To this end, this discussion focuses on findings of an analysis of the impact of stranded strategic assets on a sample of 2,948 acute care hospitals in the continental United States with 25 or more licensed beds. This subset of hospitals appears to have substantial dollars tied up in stranded assets, which by our estimate now make up about $160 billion, or 40 percent of the hospitals’ fixed asset base.a

The intent here is not to comment on evolving regulatory policy or to provide specific case examples; rather, it is to explore the causes and effects of stranded strategic assets for these hospitals and suggest some potential recovery strategies.

Stranded Assets Defined

The term stranded emerged in the electric utility industry during deregulation throughout the 1980s and 1990s. A stranded asset is defined as any set of strategic fixed assets with a book (or GAAP) value higher than its market value. Market value is a proxy for the true long-term strategic value of an asset based on current and anticipated market and policy related factors. In GAAP terms, such an asset is defined as impaired.

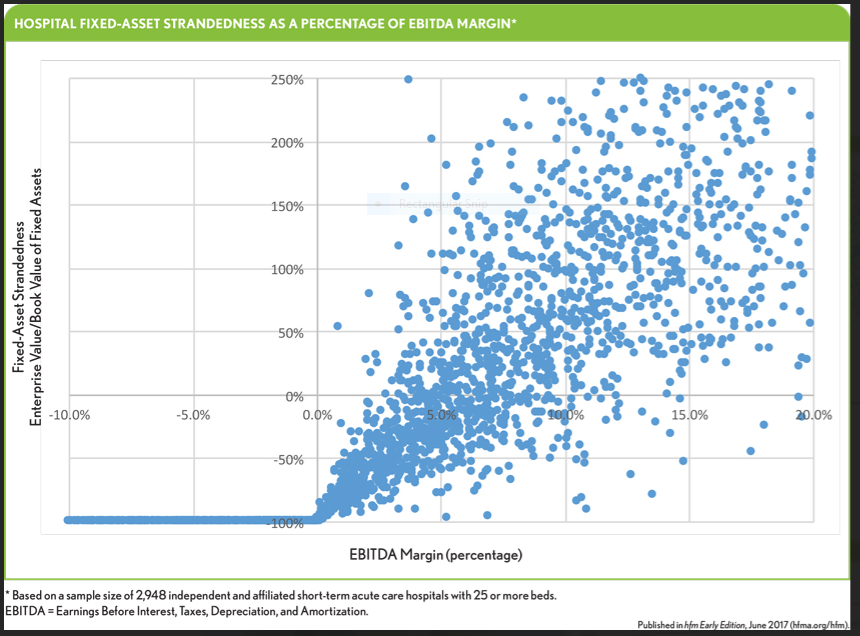

However, a strategic asset can become stranded well before a GAAP impairment test may be required—our analysis indicates that an asset can become stranded when margins on Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), a proxy for operating cash flow, drop below 6 percent.

Study Methodology

Although the impairment of assets can be evaluated from an accounting perspective, the heightened merger activity in the hospital sector provides a rich dataset for identifying a hospital’s true strategic value. Our study therefore looked at the difference between the book value of a hospital’s fixed assets and the hospital’s market value in a potential change-of-control M&A transaction (based on the prevailing median EBITDA transaction multiple of 8.0×). The extent of assets’ strandedness then is expressed as a percentage of the book value of the hospital’s fixed assets. Using a hypothetical correlation between asset strandedness and the hospital’s EBITDA margin (EBITDA/net revenue) allows for a variable evaluation, with a negative value indicating a loss of value from stranded assets and a positive value indicating a surplus of value. A simplifying assumption is that a value of minus 100 percent (i.e., where the hospital has essentially no strategic value because EBITDA is negative) indicates the hospital’s “market” value equals the book value of its fixed assets (an assumed proxy for the assets’ liquidation value).

The Big Picture

The total value of the stranded strategic assets in the sample set of hospitals—again, about $160 billion—is well over 50 percent of the approximately $250 billion hospital bond market.

The data also suggest that a hospital could have stranded assets even with a positive EBITDA margin, as is shown in the exhibit below. Based on an observation of the right quadrants of the exhibit, this threshold appears to be about 6 percent.

The study findings suggest almost half of U.S. hospitals are likely to have stranded assets. The data for the sample group shown in the following exhibit support this assertion. In this sample set, more than 70 percent of the roughly 600 independent hospitals more than 50 percent of academic medical centers (AMCs) have stranded assets.

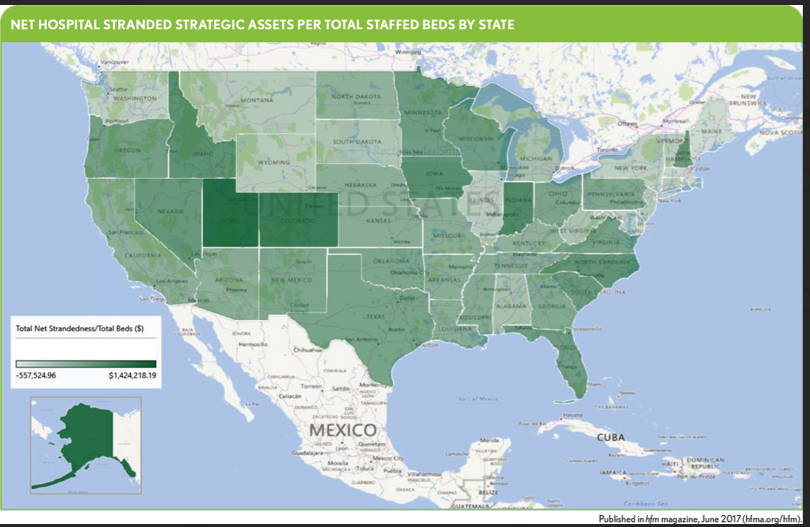

From a geographic perspective, all states have hospitals with stranded assets. Yet, as the exhibit below shows, there is wide variation of net strategic asset strandedness (stranded plus surplus assets per staffed bed) among states. Maine and Massachusetts have the highest net strandedness at –$557,525 and –$382,872 per total beds, respectively, while Utah and Alaska have surpluses amounting to $1,400,065 and $1,424,218 per total beds, respectively. This variation indicates the vast regional differences in factors such as demographics, prevalence of chronic conditions and care delivery models, as well as the effects of federal and state-specific policies that have evolved over time.

Historical Context

There likely are many reasons that strategic assets have become stranded in the hospital sector, and not all of them are well understood. But certain factors clearly have contributed to today’s circumstances.

Revenue pressure. The creation of Medicare inpatient prospective payment system (PPS) in 1983-84 changed the “cost-plus” system of payment to a per-case fixed-payment system based on categories of clinical conditions (DRGs). The PPS was intended to encourage cost efficiency (without explicit quality and outcomes requirements). The Balanced Budget Act of 1997 reduced PPS payments by 7 percent, and in 2011, the Centers for Medicare & Medicaid Services (CMS) introduced a bundled payment system in which all care per episode, including care in the hospital and up to 90 days after leaving the hospital, are paid a flat rate, with quality requirements.

Although there is no absolute cause-and-effect relationship between this series of legislative changes and the current situation, these developments, coupled with the gradual convergence between Medicare policies and commercial payers, clearly have contributed to some extent to a declining demand for available beds (overcapacity) and a concomitant reduction in operating margins. Moreover, evidence suggests that AMCs and rural hospitals have been disproportionately affected.c

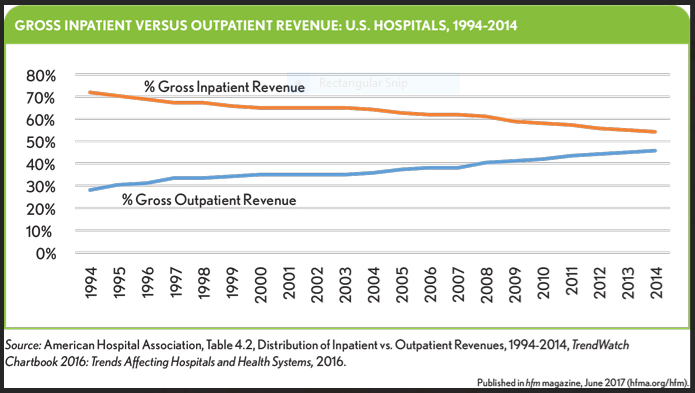

Shift of inpatient care to lower-cost sites—the evolving role of technology. The shift to outpatient care began more than two decades ago, and in recent years has accelerated due to technologies that enable better care coordination and prevention and allow for shorter recovery periods.

Furthermore, in recent years, a technology-enabled convergence of acute and post-acute care has been transforming the current model of care into a higher-acuity, lower-cost model.d Hospitals are trending toward smaller, higher-acuity facilities with networks of outpatient and post-acute facilities.

Deferred capital expenditures. As hospital and health system operating margins have decreased (notwithstanding some stabilization in margins since the enactment of the Affordable Care Act [ACA]), these organizations— particularly independent hospitals and small systems—have had a diminished ability to fund maintenance and strategic capital expenditures. The ACA’s requirement to provide value-based care and the requirements of the HITECH Act to accelerate investment in healthcare IT, IT staff, training, and process redesign have added new dimensions of challenge that did not exist previously. This shift in capital away from bricks-and-mortar to shorter-lived assets (such as diagnostics and clinical technology) has compounded the problem of strategic assets becoming stranded.

Consumerism and competition. Although consumer choice is not as pronounced in health care (particularly regarding hospitals) as in other industries, it has existed in some form, particularly for high-acuity care at tertiary and quaternary care in distant locations. However, as risk shifts to consumers through evolving health plan design, competition among hospitals on regional and local levels is likely to accelerate. CMS’s introduction of its Five-Star Quality Rating System as a consumer decision support tool is a clear acknowledgment of evolving consumer behavior.

Impacts of Stakeholders and Shareholders

Amid the transformation of the provider end of health care toward a market-based system, an important consideration is the role of stakeholders and shareholders.e Although stakeholder and shareholder theories present nuances and complexities that are beyond the scope of this article, a few essential points are worth noting.

According to stakeholder theory, management and boards of not-for-profit institutions (which constitute about 75 percent of all the nation’s licensed beds) collectively have one overarching objective: balancing the often-conflicting objectives of the constellation of stakeholders—the community, patients, physicians, bondholders, employees, lessors and lessees, among others. Serving all stakeholders is the ostensible goal, sometimes to the detriment of operating performance. In some instances, however, some stakeholders, such as bondholders, may become “more equal” than others. Such bondholders often are focused on repayment and covenant compliance, without regard to some of the operating realities discussed above, thereby making strategic reinvestment difficult.

By contrast, according to shareholder theory, management and boards of for-profit institutions have the overarching goal of serving the shareholders—i.e., maximizing their profit—on the assumption that the shareholders have an “enlightened self-interest” that takes a long-term view ultimately benefiting the interest of shareholders and all the stakeholders mentioned above. However, stakeholders often become means to the shareholders’ short-term profit motive, which, as in the case of overbearing bondholders, constrains a hospital operator’s ability to position itself strategically.

Implications of Debt and Equity

To recover and avoid stranded strategic assets, organizations must look predominantly to capital and its sources. Although debt is a relatively inexpensive and conventional source of capital to fund capital projects, too much debt leverage fuels a vicious cycle of dependency and lack of flexibility, causing the organization to become fixated on ratings and covenants rather than rely on rational strategic planning. Rather than acting as strategic partners, bondholders only engage in disciplined operating oversight (in part because they have no voting rights), and there is a mismatch of risk and reward between borrower and lender, where the former assumes greater risk due to the highly uncertain operating environment.

In contrast, by purchasing equity to fund strategy, shareholders take a vested interest in the organization (with voting rights), and assuming they exhibit enlightened self-interest (which is difficult to confirm at the outset), their priority will be to preserve the organization’s long-term strategic sustainability and growth.

Neither capital source should constitute an outsized component of a hospital operator’s capital structure.

Strategies for Recovering and Avoiding Strategic Asset Strandedness

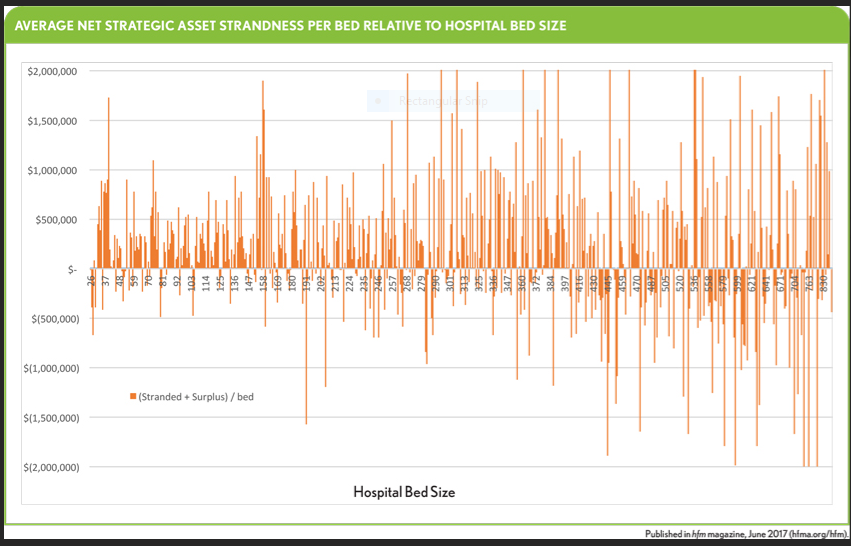

The hospital sector in the United States appears to have become bifurcated into “haves” and “have-nots.” The exhibit below shows the average net stranded strategic assets for hospitals by bed size. Hospitals with more than 400 staffed beds appear more likely to have net negative financial effect due to asset strandedness. The optimal bed size appears to be about 340. Further study is required to determine the factors that contribute to this phenomenon.

A fundamental consideration is that recovery of stranded strategic assets should not be confused with mitigation of the problem. For example, a short-term effort to improve operating margin will likely mitigate strandedness, but it will not fundamentally change the assets’ strategic value (and may actually erode it, if the effort only follows recommendations related to purely intrinsic cost considerations). Such a solution fails to recognize that the asset’s strategic value is largely a function of exogenous factors such as a hospital’s competitive position, the extent of payer leverage and the impact of evolving policy. Therefore, any recovery effort must, by definition, focus on improving strategic value, rather than simply improving short-term operating efficiency without transforming long-term positioning.

Two divergent phenomena are simultaneously at play:

- The unavoidable movement of care out of the inpatient setting

- The equally unavoidable need to maximize the utilization of hospital beds

As demand for beds falls, hospitals too often respond by pursuing what could be considered clinically unsound strategies to replace lost demand. For example, the accelerating trend of acquisition by hospitals of physician practices sometimes results in pressure on physicians to increase admissions and utilize often unnecessary diagnostic tests.f

Obviously, real strategies require capital, which could come from three possible sources:

- Operational improvements that generate capital, if only incrementally

- Remaining capital capacity (both debt and equity, if available)

- The reallocation of capital from non-strategic assets and investments

Recovery almost always involves some degree of transformation.

Recovery Tactics

Hospitals that have a large portfolio of stranded strategic assets can remedy the situation by undertaking the following tactics aimed at creating strategic value.

Improving competitiveness. As discussed above, hospitals appear to require fewer beds even as their level of care is increasing. A possible recovery strategy, for example, might involve consolidating service lines that are noncompetitive due to market saturation and replacing them with new service lines (with their requisite physician complement and diagnostic and post-acute care capabilities) that might attract a larger proportion of high-acuity cases—assuming, of course, that such a strategy would not conflict with the hospital’s mission.

Decommissioning capacity. Forward-thinking hospital leaders have embraced the inevitable loss of bed demand and diverted strategic capital into outpatient and post-acute care, and into technologies that enable value-based care. In a sense, they have sacrificed the ability to meet traditional bed demand to seize new opportunities, and to preempt the effects of declines in inpatient care.

A related strategy is to simply replace an institutional asset with one that is aligned with the general clinical and technological direction of the care model (i.e., patient-centered, coordinated, and preventive). In extreme cases, entire inpatient facilities have been transformed into ambulatory facilities that provide a wide spectrum of diagnostics and care, and operate in complement with (and act as funnels to) local and regional acute and post-acute care facilities.

Rethinking capital partners—strategic versus nonstrategic capital. In most cases, long-term capital projects in the not-for-profit hospital sector are funded through the issuance of tax-exempt bonds. Due to the long maturity of these bonds, a transfer of risk from lender to borrower occurs if the strategic value of an acute care facility falls in unforeseen ways (due to competition, changing demographics, or payer consolidation, for instance). Such an occurrence can lead to an irreversibly compressed margin and, ultimately, stranded strategic assets. Simply put, the obligation of servicing the bonds remains the same, regardless of the ability to do so.

In recent years, new partnership models that attempt to balance risk and reward have emerged. Typically, a legal structure (usually a for-profit subsidiary) is created in which the controlling ownership of a not-for-profit hospital does not change, but its capital structure changes through the replacement of some debt with equity, or equity-like capital. Fundamentally, these models seek to create a rational balance between the two extremes of pure stakeholders and pure shareholders.

The ideal partner in such a structure would be an entity that has extensive experience in other markets, with demonstrable success in creating strategic value and accelerating growth. Such structures are relatively new and can be difficult to implement due to a myriad of factors such as organizational inertia, unfamiliarity with or suspicion of non-traditional capital partners (who have board representation), and challenges in dealing with bondholders and other stakeholders. However, as the hospital industry becomes increasingly shaped by technological innovation and market forces, the participation of “investors”—nontraditional capital providers—appears inevitable.

Divesting assets. If none of previously described capital access strategies is viable and external factors are overwhelming, the hospital many need to divest strategic assets to ensure it can continue its mission.

A hospital might be compelled to consider divestiture if any of three conditions exists:

- The hospital portfolio’s EBITDA margin has declined over the past several years but is still above the median of about 6 percent and management and the board believe that the portfolio’s future market position would continue to weaken

- The EBITDA margin has declined to below the median (but above 0) and is unlikely to recover

- The EBITDA margin has declined to stubbornly negative levels (decidedly stranded territory)

Naturally, the level of outstanding debt will have a strong bearing on the decision. According to Moody’s Investors Service, bondholders often exert pressure to divest and, in most cases, are repaid 100 percent.

Under the first of the three conditions, it is likely that no assets are stranded, and therefore, any surplus transaction proceeds from the sale of assets could very likely be placed into a foundation that would continue the divesting organization’s mission. Under the second condition, it would be unlikely that significant surplus funds would be available for the creation of a foundation. And under the third condition, the proceeds might not even cover the organization’s total outstanding long-term obligations, leading to an unavoidable bankruptcy and potential drawn-out negotiation with bondholders and other stakeholders.

Closing and liquidating assets. As an extreme case under the third condition described above, involving particularly unsustainable situations, closure and liquidation may be the only option to recover as much of money tied up in stranded assets as possible. In such a case, the prevailing conditions in the real estate market would be key determinant in the decision. And in today’s market, the pace of closures continues to accelerate.g

How to Avoid Stranding Strategic Assets

Healthcare organizations seeking to avoid the adverse financial impact of stranded strategic assets can do so by adopting the following three approaches and their underlying principles.

Invest in health care, not assets. In 1969, the IRS introduced the “community benefit” requirement which, without getting into specific regarding accountability, required hospitals to serve their communities in return for income tax exemption. Hospitals perceived that the only way they could demonstrate their commitment to the community was to build facilities. So until relatively recently, hospitals tended to adopt the “build it and they will come” doctrine, which was largely enabled by the availability of plentiful and inexpensive debt.

This situation changed with the passage of the ACA which, through the addition of Section 501(r) to the IRS Code, requires hospitals to conduct, every three years, a community health needs assessment and pursue an “implementation strategy” to meet identified needs.

It is only recently that the “build it and they will come” doctrine has given way to the concepts of patient-centeredness, care coordination, and prevention. Such concepts do not always require costly fixed assets, and although the processes and technologies for their implementation and measurement are evolving, there is broad agreement as to their effectiveness in delivering lower-cost, higher-quality care.

In effect, the best way to avoid future asset strandedness is to avoid over-investing in long-lived, fixed assets that pose a risk of becoming stranded. However, given the direction of the industry, new investment is required in areas that could easily and quickly become obsolete (IT, for example), and the shorter lives of such assets require more frequent reinvestment.

Tailor investment decisions to the needs of the consumer. Today, we are seeing the rise of a long-forgotten stakeholder in health care: the patient, or consumer. One key requirement of Section 501(r) is that the hospital must incorporate “input from persons who represent the broad interests of the community served by the hospital facility, including those with special knowledge of or expertise in public health.” This clearly is a requirement to bring back to the forefront a hospital’s main reason to exist—namely, to serve the community of healthcare consumers. The public health element presumably is included to enable a competent and objective representation for the consumer.

Rethink governance structure. The principle underlying the first two approaches provide additional guideposts to management and boards in allocating (and reallocating) increasingly precious capital. This in no way implies that management and boards are ultimately not well-meaning in their duty, but there appears to be a disparity in how they view key factors of decision-making. For example, in a survey of 1,000 hospital board chairs assessing the influence of boards on Hospital Quality Alliance (HQA) scores, only about half rated clinical quality as a top priority.h Those who assigned top priority to quality had significantly higher HQA scores than those who did not.

This point has a strong bearing on management and board recruitment and training. Management and boards require individuals who have the appropriate knowledge, are inclined to regular and rigorous continuing education and training, are not focused on self-preservation, and are proactively attuned to rapidly developing market and policy trends.

Conclusion

The high prevalence of stranded strategic assets in the hospital sector is a strong potential indicator the future unsustainability of the sector’s effectiveness as a delivery channel. Its prevalence of stranded strategic assets is the result not only of investment decisions made in the relatively distant past, but also of those made more recently (including accelerated construction activity in Medicaid expansion states). The sector did not arrive at an estimated $160 billion total in stranded assets overnight; rather, this situation emerged incrementally over a period of several decades. And the pace at which the healthcare industry is shifting to a value-based model is likely to accelerate this and related challenges.

Footnotes

a. The study was conducted using data from Framingham, Mass.-based Definitive Healthcare, a company that maintains proprietary databases serving the healthcare industry.

b. Smith, M., and Varghese, R., “Hospital Bond Rally Undeterred by Latest Threat to End Obamacare,” Bloomberg, July 25, 2016.

c. Phillips, R.L. Jr., Fryer, G.E., Chen, F.M., Morgan, S.E., Green, L.A., Valente, E., and Miyoshi, T.J., “ The Balanced Budget Act of 1997 and the Financial Health of Teaching Hospitals, The Annals of Family Medicine. January-February 2004; and Wishner, J., Solleveld, P., Rudowitz, R., Paradise, J., and Antonisse, L., “ A Look at Rural Hospital Closures and Implications for Access to Care: Three Case Studies,” Issue Brief, The Henry J. Kaiser Family Foundation, July 7, 2017.

d. Advisory Board, “How Top Hospitals Improve Post-Acute Care Coordination,” Daily Briefing, Nov. 29, 2016.

e. Smith, J.H., “The Shareholders vs. Stakeholders Debate,” MIT Sloan Management Review, July 15, 2003.

f. Creswell, J., and Abelson, R., “A Hospital War Reflects a Bind for Doctors in the U.S.,” The New York Times. The New York Times, Nov. 30, 2012.

g. Evans, M., “Hospitals Face Closures as ‘a New Day in Healthcare’ Dawns,” Modern Healthcare, Feb. 21, 2015.

h. Jha, A., and Epstein, A., “Hospital Governance and the Quality of Care,”Health Affairs January 2010.