Omicron, swelling expenses characterize end of another challenging year for hospitals, physician groups

Matthew Bates

Erik Swanson

The nation’s hospitals, health systems and physician groups closed the second year of the pandemic amid ballooning expenses exacerbated by nationwide labor shortages and global supply chain challenges.

Many providers ended 2021 in a stronger financial position relative to the first year of COVID-19 in 2020, because they learned to better navigate pandemic volatility. Yet overall performance remained down compared with pre-pandemic levels, according to Kaufman Hall’s latest National Hospital Flash Report and Physician Flash Report.

Omicron drives hospital volume increases, but operating margins remain thin

For hospitals, volumes rose throughout December as rapid spread of the Omicron variant led to a sharp increase in COVID-19 cases. The spike in cases drove a 98% increase in COVID-19-related hospitalizations, according to the Centers for Disease Control and Prevention. Compared with November, adjusted discharges rose 5.5%, and adjusted patient days increased 3.9%. Emergency department (ED) visits also jumped 7.3%, a trend consistent with earlier surges as more patients showed up in EDs with potential COVID-19 symptoms. Compared with the first year of the pandemic, 2021 saw an increase in severely ill patients requiring longer hospital stays, but key volume metrics remained below pre-pandemic 2019 performance.

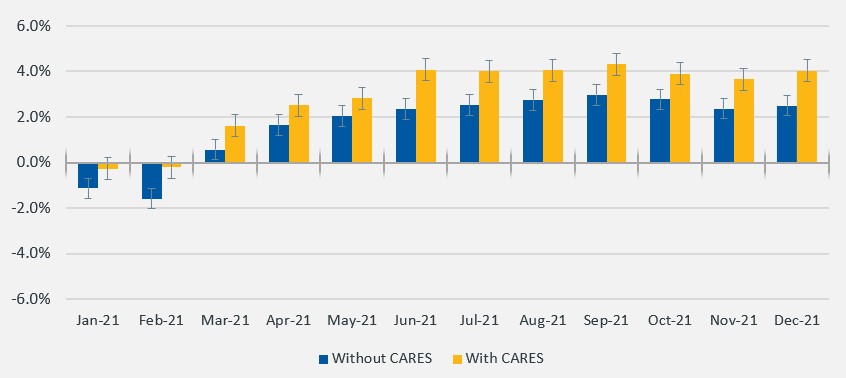

Actual hospital margins remained thin, but above 2020 levels. The median Kaufman Hall operating margin index for the year was 2.5% versus –0.9% for 2020, not including federal CARES Act funding. With the aid, it was 4.0% in 2021 compared with 2.8% in 2020. Increased volumes contributed to month-over-month margin increases. From November to December, the median change in operating margin rose 38%, not including CARES. With the aid, it increased 49.5%. Compared with December 2019, however, the median change in operating margin was down 14.7% without CARES.

Kaufman Hall hospital operating margin index 2021, by month

Source: Kaufman Hall, National Hospital Flash Report, January 2022.

Tight competition for healthcare workers pushed expenses up despite lower staffing levels. Total expense per adjusted discharge was up 20.1% for the year versus 2019 and labor expense per adjusted discharge was up 19.1% over the same period. Non-labor expense per adjusted discharge increased 19.9% for 2021 versus pre-pandemic levels.

As they enter the third year of the pandemic, hospital and health system leaders face worsening labor shortages that are driving up costs across healthcare. Organizations are having to pay high salaries to attract the workforce they need, while also paying more for drugs and other supplies. Managing through these challenges will require organizations to build new levels of agility and efficiencies.

Physician productivity gains offset by mounting expenses, high investments/subsidies

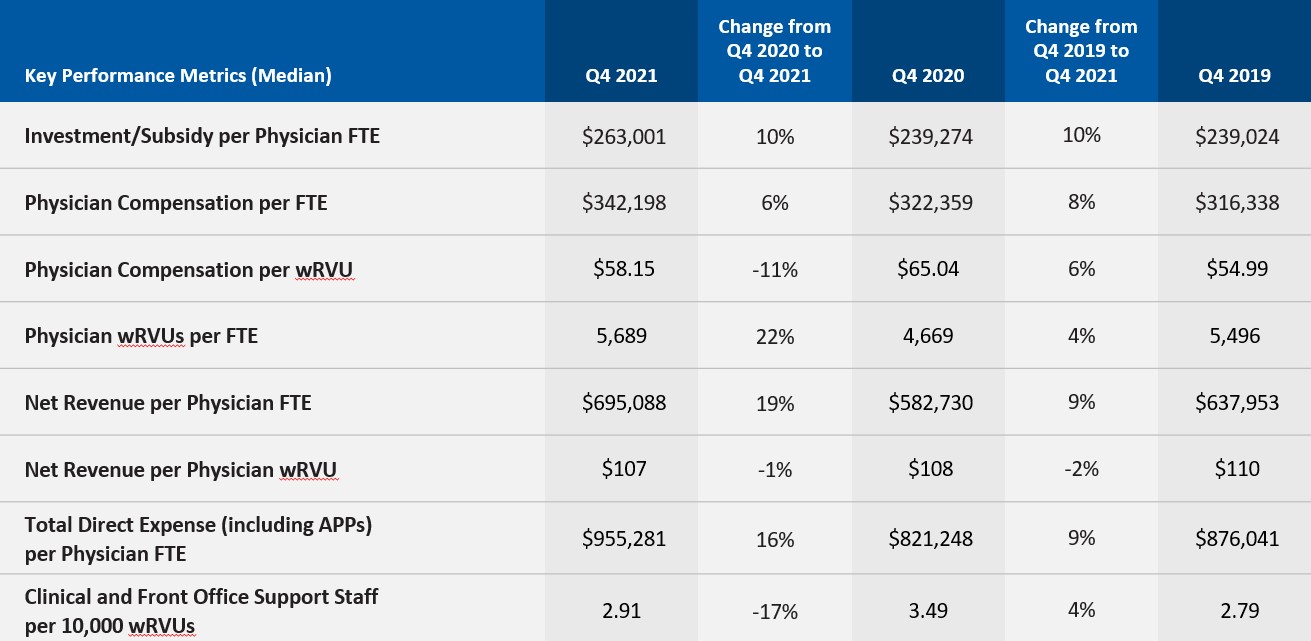

Employed physician groups ended 2021 with sizeable gains in physician productivity and revenues relative to the fourth quarter of 2020, but with mounting expenses and high levels of investments/subsidies required to support practice performance (see Figure 2). The median investment/subsidy per physician FTE was above late 2019 and late 2020 levels throughout 2021, rising to $263,001 for the fourth quarter. The metric was up 5.9% relative to the third quarter of 2021, driven in part by high expenses that mitigated physician revenue and productivity gains.

Total direct expense per physician FTE rose to $955,281 in the fourth quarter, up 9% versus Q4 2019 and up 16.3% versus Q4 2020. Expenses rose even as clinical and front desk staffing levels declined. Support staff FTEs per 10,000 work relative-value units (wRVUs) were down 16.6% from the first year of the pandemic in Q4 2020, with staffing level decreases particularly pronounced in primary care.

Physician expenses rose in the fourth quarter across all specialty cohorts, reflecting widespread challenges. Higher volumes, coupled with labor shortages, are contributing to rising costs. Healthcare leaders will need to take a hard look at their direct expenses and find ways to bend this cost curve moving forward.

Key physician performance metrics summary

Source: Kaufman Hall, Physician Flash Report, January 2022.