Moving a 340B covered entity’s pharmacy enterprise to an LLC may prove beneficial, but it requires a feasibility study

University of Utah Hospitals and Clinics (UUHC) in Salt Lake City performed research to assess the feasibility of moving its 340B covered-entity pharmacy enterprise to a Limited Liability Corporation (LLC). An important focus was on risks that needed to be factored into the decision.

Other organizations that are considering a similar move can benefit from adopting or emulating UUHC’s approach, which included financial modeling. Although UUHC found the strategy feasible and worth pursuing, other organizations might have different circumstances that lead them to a different conclusion. Recent volatility in the contract pharmacy area of the 340B program has caused UUHC to delay making the move to an LLC, but the approach it used to assess the opportunity remains sound.

Factors prompting UUHC to consider the move

As an academic medical center (AMC), UUHC is a covered entity under the 340B program’s disproportionate care hospital (DSH) designation. The AMC has numerous “child site” clinics (i.e., clinics owned and operated by the covered entity in the surrounding communities), and it operates 17 retail pharmacies, two of which are specialty pharmacies. With this large ambulatory presence, UUHC saw a strong potential for significant 340B savings to better serve the community.

However, recent actions by pharmaceutical benefit managers (PBMs) caused UUHC to consider a different approach. The PBMs asked 340B covered entities to mark 340B-eligible prescription claims when processing them. But the covered entity may not know at that time whether the prescription qualifies for 340B, making compliance extremely difficult. The PBMs also looked to decrease payment on 340B-eligible claims, effectively taking for themselves 340B financial benefit that the covered entities had enjoyed, thereby also reducing the entity’s resources available to help the communities it serves.

The problem of the 340B pricing construct

UUHC had hoped that by growing its retail, specialty and home delivery presence, it could better support the outreach efforts parent company University of Utah Health (U of U Health), which also includes a health plan and other healthcare-related enterprises. U of U Health was seeking to expand its presence within the region through affiliations with other health systems and hospitals. The problem was that the current 340B pricing construct would not allow UUHC’s pharmacy to efficiently service en masse the non-340B patient prescriptions that outreach efforts would generate.

Under the pricing construct, a 340B pharmacy owned by a covered entity must purchase drug products in one of two ways:

- At the discounted 340B price

- At the wholesale acquisition cost (WAC)

WAC is a considerably higher cost than what non-340B pharmacies would pay. For prescriptions not eligible for 340B, drug products would have to be purchased at WAC, and insurers’ payment rates would rarely cover the cost. Thus, when factoring in labor and overhead, covered-entity-owned pharmacies often fill non-340B prescriptions at a loss, severely limiting their ability to care for patients not having 340B-eligible prescriptions.

A proposed solution

UUHC determined it could address this problem by moving its 17 retail pharmacies into an LLC under U of U Health. The move would enable the retail pharmacies to purchase all pharmaceuticals at a contracted rate instead of sometimes having to buy at WAC. The LLC retail pharmacies would sign agreements to become contract pharmacies of UUHC to maintain the covered entity’s 340B benefit.

This new medication procurement model would allow the pharmacies to partner with the U of U Health’s expansion. Medication purchased for prescriptions written by providers outside of covered entity clinics (non-340B eligible prescriptions) would be procured at a less expensive cost than WAC, and PBMs would have a reduced ability to take 340B savings away from UUHC because they would no longer process claims for the AMC as the covered entity.

Research required

But UUHC also recognized that this change in the corporate structure of the 340B retail pharmacies might come with disadvantages that outweighed the benefits. UUHC searched the literature for relevant insights and found no articles related to this topic. Research clearly was needed not only to inform UUHC’s strategy but also to fill this gap in the literature.

The AMC therefore undertook research comprising three parts:

- A financial model based on an ROI analysis

- An analysis of risks from restructuring

- A survey of AMC pharmacy directors

Following are key considerations and findings from each part of the research.

Financial modeling through ROI analysis

Although payment rates would theoretically remain the same, many drug costs would be different. Moreover, the true costs in setting up an LLC would come in the form of time, risk effort and other related factors. Variables considered in the ROI analysis included:

- Current drug costs (340B and WAC)

- Future state drug costs (contracted rate)

- 340B benefit to covered entity (current state)

- 340B benefit to covered entity (future state)

- Loss of access to specialty/oncology medications

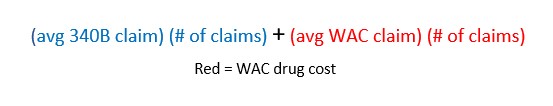

Although 340B pricing is confidential, financial modeling is possible using a two-part formula using these ROI variables rather than using actual numbers, as shown below:

Current cost

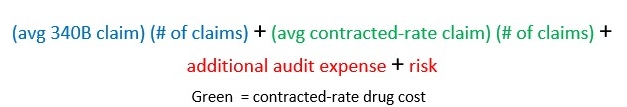

Future cost

Using this formula, any organization can input its own data and draw its own conclusions based on its unique circumstances. The formula shows that if WAC drug expense is greater than the combined contracted-rate drug cost, audit expense and risk, then the move would be financially feasible.

UUHC found that, although 340B drug expense remained constant in a move from internal to contract pharmacy, the WAC would be greater than a contracted-rate drug cost. The exhibit below shows two examples of applications of the financial formula depicting how 340B/non-340B eligible prescription mix can influence drug cost savings.

Financial model examples

|

Example 1: 50/50 Mix | ||||||||

|

340B drug cost |

WAC drug cost |

Total drug cost | ||||||

|

Current cost |

$10,000,000 |

+ |

$10,000,000 |

= |

$20,000,000 |

| ||

|

340b drug cost |

Contacted-rate drug cost (-25%) |

Total drug cost |

Drug cost savings |

Additional audit expense |

Risk | |||

|

Future cost |

$10,000,000 |

+ |

$7,500,000 |

= |

$17,500,000 |

$2,500,000 |

$200,000 |

? |

|

Example 2: 80/20 mix | ||||||||

|

340B drug cost |

WAC drug cost |

Total drug cost | ||||||

|

Current cost |

$16,000,000 |

+ |

$4,000,000 |

= |

$20,000,000 |

| ||

|

340b drug cost |

Contacted-rate drug cost (-25%) |

Total drug cost |

Drug cost savings |

Additional audit expense |

Risk | |||

|

Future cost |

$16,000,000 |

+ |

$3,000,000 |

= |

$19,000,000 |

$1,000,000 |

$320,000 |

? |

Added expense under the LLC model. The formula shows the new model also carries additional auditing expenses, given that claims from a contract pharmacy require additional auditing oversight to ensure compliance. UUHC estimated this expense at 2% of the 340B drug cost, as shown in the exhibit.

One-time expenses. Converting an entity-owned retail pharmacy to the LLC model requires work from many different departments, including legal, finance, contracting, supply chain, 340B oversight and leadership. An organization must consider whether it can make the change with existing personnel and consider it a sunk cost (although also an opportunity cost) or would need to add personnel to complete the transition. It also should consider whether to assign a project manager to the project. The formula did not consider such one-time expenses.

Risk analysis

Also assessed were five areas of risk associated with the move to LLC-owned pharmacies:

- Maintaining the 340B benefit during the calendar quarter required to make the move

- Licensing, registering and contracting all retail pharmacies to avoid a lapse in service during the transition

- Ensuring the seamless continuation of all operational aspects, including employees, systems and operations support

- Maintaining access to all medications, especially oncology, specialty and limited-distribution medications

- Avoiding political risk, either within the institution or in the larger healthcare regulatory landscapea

UUHC would have to develop a detailed plan to address each of these risks, which would work their way back into the financial modeling formula as risk expenses. If any risk could not be resolved, the move would not be feasible.

Planning and timing risks. Impeccable planning and timing in making the move to an LLC is necessary to ensure it is seamless in the eyes of both patients and the organization.

Health Resources and Services Administration (HRSA) requires that covered entities register new LLC contract pharmacies three months in advance of their effective date. Before registration is possible, however, a fully executed agreement must be in place between the covered entity and the LLC. The LLC must be set up well in advance, before the change in pharmacy ownership.

During registration, the covered entity’s current Drug Enforcement Agency (DEA) numbers would be used, and the entity should maintain close contact with HRSA to explain the anticipated change of ownership. The entity also should develop a close relationship with the state pharmacy-registering body concerning change-of-ownership and licensing requirements based on individual state regulations.

Contracting with PBMs through an ownership change is an additional obstacle to avoiding a quarter-long 340B benefit gap. A change in ownership requires new licenses, National Provider Identifier numbers and National Council for Prescription Drug Programs numbers, in a process that could take months. A possible solution might be to stagger the move of individual pharmacies to the LLC. The organization then could spread the workload, minimize PBM contract disruptions with creative use of other pharmacies in the organization, and better identify and correct transition issues encountered along the way.

Sample timeline of key events

|

Jan. 1 |

|

|

Jan. 1 – March 1 |

|

|

March 1-15 |

|

|

June 1 |

|

Risk related to specialty medication access. An organization’s class of trade determines what products its pharmacies can purchase under 340B. An organization in the hospital class of trade can access most specialty and oncology products for its patients. Moving the pharmacies away from being hospital-owned into a separate LLC would change the class of trade to retail.

This change might cause a specialty oncology pharmacy to lose access to many oral oncology products it had been dispensing as a hospital-owned pharmacy, for example. To maintain specialty product access, this pharmacy might best be excluded from the LLC and allowed to continue operating as an entity-owned pharmacy. The same situation holds true, but to a much lesser extent, regarding specialty drug access for a specialty pharmacy. This risk expense should be represented in the financial formula.

Political risk. Key “political” considerations include a not-for-profit organization’s appetite for moving part of its business to a for-profit LLC and for expanding its business with non-340B eligible prescriptions, which could be filled for a positive margin.

Another political risk, however, lies with the federal government and how it might yet change the 340B program, as it did with contract pharmacy expansion several years ago. Starting in mid-2020, six pharmaceutical companies excluded contract pharmacies from obtaining 340B pricing, with another restricting 340B pricing in 2021. The actions taken are currently being discussed in the courts. These types of changes must be monitored, as they could completely alter the financial formula regarding the feasibility of an LLC approach.

The survey

UUHC sent an online survey to a sample group of pharmacy directors to identify the different models and structures they were using for retail pharmacy networks and to find out whether they were looking to make a change. Responses are shown in the exhibit below.

Responses from pharmacy director survey

|

Questions |

Yes N (%) |

No N (%) |

|

Is your organization a 340B ‘covered entity’? N = 23 |

23 (100%) |

0 (0%) |

|

Does your organization have retail pharmacies? N = 23 |

22 (96%) |

1 (4%) |

|

What model does your organization use with their retail pharmacies? N = 22 | ||

|

Organization-owned pharmacies |

17 (77%) |

|

|

Rent to external pharmacy provider |

0 (0%) |

|

|

LLC/Owned by parent organization |

4 (18%) |

|

|

Other |

1 (5%) |

|

|

Are you currently looking at changing how your retail pharmacies are set up? N = 22 |

4 (18%) |

18 (82%) |

Making the case for change

The rationale for making this type of business reorganization may seem straightforward to those who understand 340B and how it works. But those less familiar with 340B, including C-Suite executives, may question the idea of moving the 340B benefit away from the covered entity. Advocates for the change should point to the importance of the agreement between the LLC and the covered entity, which determines how everything looks on future financial statements. The future LLC’s strategic purpose also should be considered, whether it is to unleash the retail pharmacies’ potential to promote business expansion, to create a more nimble business group that can truly compete in the retail pharmacy world, or simply to reduce drug expense while keeping existing oversight structures in place.

Since 2010, when HRSA authorized expansion of contract pharmacy use and the subsequent increase in 340B benefit to covered entities, PBMs and pharmaceutical companies have sought to claw back some of that benefit.b Although making business structure adjustments and voicing concerns to local government representatives may help to keep 340B benefit intact, covered entities can expect to see more aggressive means used to lessen the benefit. Given that contract pharmacies have been the key target for pharmaceutical industry’s recent takeback strategies, another key feasibility consideration is that reversing the LLC change would take as much time as moving to an LLC in the first place.

In the end, the risk/reward decision is not an easy one and can be determined only through financial modeling and due diligence, following UUHC’s approach, in coordination with the organization’s top leadership and visionaries.

Footnotes

a. A state-owned LLC entity could be seen as politically tenuous if business-competitiveness concerns were raised around its expansion.

b. HHS, “Notice regarding 340B Drug Pricing Program—contract pharmacy services,” Federal Register, March 5, 2010.

About 340B

The 340B program was enacted as part of the Veterans Health Care Act of 1992 to enable covered entities to stretch scarce federal resources to reach more patients and provide more comprehensive services.a Organizations that can qualify for the 340B program include critical access hospitals, children’s hospitals, cancer facilities, disproportionate share hospitals (DSHs), federally qualified health center clinics and hemophilia treatment centers among others.b DSHs are hospitals serving a significantly disproportionate share of low-income patients.c A DSH must have 11.75% of Medicare and Medicaid admitted inpatient days to qualify and be registered and enrolled to participate in the 340B program.d When participating in the 340B program, covered entities (i.e. qualified and registered health systems) can order medications at a discount for 340B eligible outpatient administered medications and retail prescriptions. To qualify for eligibility, orders and prescriptions must be:

- Written for a patient of the covered entity

- Written by a provider of the covered entity

- Written at one of the locations falling under the covered entity

Covered entities are closely monitored both internally and externally. The Office of Pharmacy Affairs, under the Health Resources and Services Administration, oversees the 340B program and conducts audits of covered entities.

Footnotes

a. Health Resources & Services Administration, 340B Drug Pricing Program, updated May 2021.

b. 340B Health, Overview of the 340B Drug Pricing Program, accessed July 1, 2021.

c. CMS, Medicare Disproportionate Share Hospital, MLN fact sheet, March 2021.

d. Health Resources & Services Administration, 340B Eligibility, last updated May 2018.