David Johnson: Cracks in the foundation (Part 4): Overcoming a brittle business model

U.S. health systems’ reliance on centralized, high-cost platforms (e.g., hospitals) to deliver routine care is baffling to me. Sure, this approach optimizes revenues under fee-for-service (FFS) payment, but it is inefficient and asset-heavy. It fragments service delivery and promotes overtreatment. It makes their business model brittle and exposes them to market failure.

Hospitals largely go dark on nights and weekends. No other capital-intensive industry uses its facilities on such a limited basis. Underused assets add to operating costs and dilute value.

Given their expansive facility investments and high labor costs, health systems do not adapt quickly to shifting market dynamics.

To build less brittle, more consumer-centric delivery platforms, health systems must decant procedures to more convenient, lower-cost locations as they pursue full-risk contracting.

Consumers vote with their wallets. So a health system’s long-term sustainability depends on providing services that consumers want and need at competitive prices.

It also requires full engagement with Big Tech to optimize consumer experiences. As other industries have demonstrated, adaptive, omnichannel platforms are the most effective channels for engaging consumers.

Massive investment in digital health technologies is fueling development of omnichannel capabilities inside, outside and beyond provider networks. The marketplace is reorganizing to disrupt commodifiable healthcare services. New competitors are emerging to steal customers.

An irresistible consumer force confronts immovable hospital business practices. Something is going to give. For resistant health systems that cling to a brittle FFS-driven business model, that something is customers.

Commoditized services

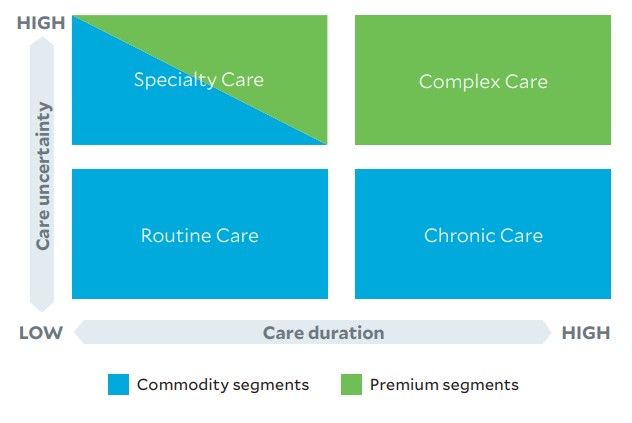

Whether health systems realize it or not, their service mix is relatively mature (as depicted in the exhibit below) and subject to commodity pricing. The evolving healthcare marketplace is tailor-made for companies expert at delivering high-volume, low-margin, high-quality services.

Care delivery matrix: right care, right time, right place and right price

High-volume, low-risk treatments constitute a substantial majority of healthcare treatments. Retail providers are positioning to capture market share for routine, nonacute chronic and some specialty care through convenient, low-cost, customer-friendly service offerings.

Mature industries with commodifiable services typically decentralize to improve customer access, convenience and affordability.

Nonetheless, despite having a maturing service mix, most health systems still prioritize centralized service delivery.

New competitors

This situation has made traditional health systems vulnerable to more-efficient, customer-friendly competitors, including those offering virtual, ambulatory and home-based care services.

COVID-19 has accelerated the adoption of these remote and virtual modalities. Meanwhile, payers are giving consumers incentives to receive routine care outside of acute care settings, including palliative care to improve end-of-life well-being and reduce end-of-life care interventions, which are a major revenue source for health systems.

Competitors are lining up in this environment. Retail giants Amazon, CVS, Walgreens and Walmart are expanding their platforms to encompass routine healthcare services. Newer competitors like Teladoc, GoHealth Urgent Care, RAYUS Radiology and dozens more are emerging to standardize and commoditize routine diagnostic and treatment services. Consumer-oriented market plays by disrupters thrive when they encounter the following:

- Frustrated customers

- High levels of routine/commodity goods and services

- Low entry barriers for new competitors

- Excessive numbers of suppliers/providers

- Inefficient and inconvenient service delivery

- High-friction, low-transparency transactions

- Entrenched status-quo operating practices

- Underdeveloped technology platforms

Healthcare has these characteristics in abundance. With massive private equity and venture investment flowing into healthcare services, health systems can anticipate increasing competition for routine service provision, which will limit their capacity to charge premium prices for routine services.

Perhaps even more threatening is the emergence of disruptive health-oriented businesses, such as Oak Street Health and Oscar Health. These companies develop robust primary care relationships with their customers that position them to coordinate and channel care delivery. In their purest form, enhanced primary care companies accept full financial risk for their members’ care costs. They emphasize holistic care delivery to drive better outcomes and reduce the need for acute care treatments.

Integrated platforms

The ability to deliver such customer-friendly services requires an integrated platform.

For example, Marriott’s Bonvoy website is an expansive and engaging omnichannel platform that entices customers to book all their travel arrangements in this one convenient location. Bonvoy offers 30 hospitality brands tailored to personal preferences. It augments hotel choices with aligned partner offerings (car rentals), unique experiences (jungle dinner, anyone?), credit-card perks and a robust loyalty program.

Marriott and other big hotel chains developed these omnichannel platforms to counteract the competitive threats posed by travel exchange companies such as Travelocity, Hotels.com and airbnb.

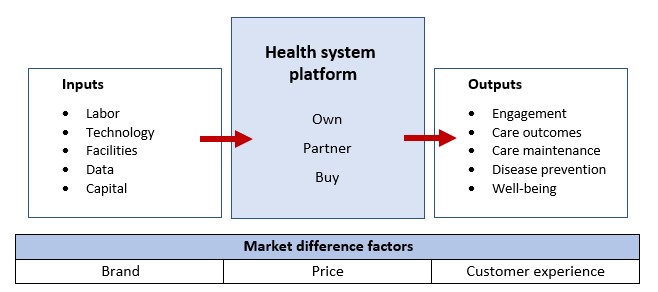

Like hotel chains, health systems need robust platforms to maintain market competitiveness. These platforms link capabilities within integrated service delivery networks to off er products and services seamlessly to consumers, as shown in the exhibit below.

How integrated platforms link capabilities within integrated service delivery networks to deliver products and services to consumers

As health systems shift strategic focus from volume and revenue optimization to value and profitability within a commoditizing marketplace, they must reconfigure owned, partnered and outsourced capabilities to achieve the best outputs at the lowest cost.

In consumer-oriented marketplaces, health systems will differentiate themselves through brand strength, price and customer experience. Their performance, cash flow and profitability will depend on delivering superior outputs at lower costs with great customer service.

That’s why leading health systems are expanding their service lines and delivery channels to decentralize care delivery. For example:

- Mayo Clinic and Kaiser Permanente have invested in Medically Home Group to bring robust hospital-at-home capabilities into their care networks.

- Hartford HealthCare has reorganized its services within a seamless, consumer-friendly digital platform, producing some of these services internally and offering others through strategic partnerships (e.g., with GoHealth for urgent-care services).

As these examples illustrate, integrated platforms enhance the value of health systems’ offerings by assembling, curating and aligning the right mix of owned, partnered and/or outsourced services. They overcome existing business model brittleness by reorganizing to deliver the right care to consumers at the right time in the right place at the right price.

They win by giving consumers the care services they need at affordable prices. It’s not complicated, but it takes commitment and perseverance to design and run retail business models that do so effectively.

7 strategies for a healthcare system transformation

Here are seven strategies health systems can undertake to develop more robust and decentralized care delivery modalities:

- Determine which service components require full ownership and control, and invest in them to create market differentiation.

- Identify vulnerable and salvageable business segments, and reconfigure these to compete within transparent, decentralized marketplaces.

- Sell assets to third-party owners, such as real estate investment trusts (REITs), to reduce ownership risk and liberate investment capital, and where appropriate, enter sale-leaseback arrangements.

- Develop comprehensive virtual, retail and home-based delivery capabilities within consumer-friendly, omnichannel platforms.

- Partner and/or contract with specialized service providers to amplify and expand care offerings, build brand strength and engage consumers.

- Develop enhanced primary care capabilities.

- Position to undertake full-risk contracting.