October 20, 2023

In the realm of healthcare revenue cycle management, every decision you make can have a profound impact on the success of your organization. As hospitals and health systems grapple with declining revenue and workforce shortages, the significance of having a reliable and efficient claims and clearinghouse partner cannot be overstated. Your organization deserves a partner that goes above and beyond, working tirelessly to optimize processes, secure maximum reimbursements, and streamline operations.

But here’s the thing: It’s not just about having any partner; it’s about finding the right partner—the one that can elevate your revenue cycle management to new heights. Settling for a vendor that is merely “good enough” might seem like a convenient option, but it can hinder your organization’s progress and prevent you from reaching your full potential.

So, how do you determine if it’s time to bid farewell to your current vendor or stay the course? In this article, we’ll explore the critical questions you need to ask. These questions will empower you to evaluate whether your claims and clearinghouse partner is not just “good enough,” but the perfect fit for your organization’s success.

Let’s explore the crucial questions you need to ask.

- Is your vendor’s edit suite advanced enough to ensure successful claim processing? The depth and breadth of your vendor’s edit suite plays a crucial role in claim processing. A comprehensive and advanced edit suite should encompass a wide range of industry-specific, payer-focused, and provider-targeted edits. Furthermore, the experience and tenure of the vendor’s edit team are equally important. A skilled team with years of experience can effectively handle the complexities of the healthcare industry, adapt to evolving payer policies, and address the unique requirements of individual providers. This combination ensures a more efficient claims process and a higher success rate in claim reimbursements for your organization.

- How responsive is your vendor when you need support? Time is money, and delays in resolving issues can significantly impact your revenue cycle. A responsive vendor demonstrates their commitment to your organization’s success by being highly accessible and quick to provide assistance. Evaluate your vendor’s support offerings, including communication channels, escalation procedures, and responsiveness to urgent issues. A vendor with a well-organized support system and transparent communication processes ensures you can rely on them when needed, fostering a partnership grounded in trust and dependability.

- Can your vendor enroll payers in 30 days or less? Efficient enrollment of payers is critical for seamless integration and accelerated claim submissions. Your vendor should have the capability to collaborate closely with your organization to identify and enroll your relevant payers, prioritizing top payers within a defined timeframe. This showcases their ability to meet your organization’s unique needs and adhere to set timelines, ensuring minimal disruptions in the claims process.

- Can your vendor handle the complexities of large, multi-location organizations? While some vendors excel at supporting smaller organizations, the challenges posed by larger, multi-location organizations require specialized expertise. Assess your vendor’s experience in managing workflows, integrating systems, and maintaining consistency across locations. Additionally, inquire about their capabilities in processing remittances and accurately allocating remits to the correct location, especially in complex environments with multiple Tax Identification Numbers (TINs). A competent vendor should have a successful track record in scaling their solutions to meet the diverse needs of large organizations while ensuring streamlined revenue cycle management and optimal financial performance.

- Can your vendor proficiently handle claims for complex cases/patient visits? Partnering with a vendor that can easily manage claims for more complex cases and patients is essential. These claims involve multiple services and various payer requirements, such as out-of-network claims, high-cost procedures, and co-morbidities. Inquire about the vendor’s experience, success rates, and average processing times for these types of claims. A proficient vendor should leverage their expertise, technology, and industry knowledge to handle these claims effectively and ensure regulatory compliance.

- Can the vendor seamlessly integrate or interface with your existing systems? Efficient revenue cycle management relies on seamless integration between the claims management system and the organization’s existing systems. Inquire about the vendor’s capabilities to ensure their solution interfaces or integrates with your health information system (HIS) as extensively as it is capable. This integration enables the effortless transfer of claim information, reducing errors, streamlining workflows, and enhancing overall efficiency. Additionally, the vendor should offer support for implementing and maintaining these integrations, including timely updates to accommodate industry standards and regulatory requirements.

- What measures does the vendor take to ensure a seamless implementation and training process? A smooth implementation and comprehensive training process are vital for a successful transition to a new claims and clearinghouse system. Inquire about the vendor’s approach to onboarding and training your team. They should provide details on training delivery, hands-on guidance, and ongoing support to equip your team with the necessary skills. Flexibility is key, so consider whether the vendor offers live and on-demand training sessions that cater to different learning styles and schedules. A clear project plan with milestones and checkpoints demonstrates their commitment to a smooth implementation. The vendor should also have dedicated support teams to address any issues, maintain ongoing communication, and provide contingency plans to minimize disruptions.

- Can the vendor demonstrate long-standing client satisfaction and enduring partnerships? Assessing the reputation and client satisfaction of a claims and clearinghouse vendor is crucial. Request client testimonials or references, particularly from clients who have been with the vendor for over 20 years. This will provide valuable insights into the vendor’s performance, service quality, and ability to cater to organizations similar to yours. Evaluating feedback from other clients helps identify strengths and areas for improvement. Additionally, consider the satisfaction and loyalty of the vendor’s associates, as it reflects the quality of service and support they provide.

- How effectively does the vendor’s reporting and analytics tool address payer behavior and enable predictive cash flow management? Extracting essential payer metrics from your core HIS/EHR system can be challenging. Consider opting for an advanced claims analytics tool offered by a reputable claims and clearinghouse vendor. Such a tool can uncover payer behavior trends, providing easy access to payer data and actionable insights for informed decision-making. By analyzing claims, remits, and revenue cycle data across multiple payers, you can engage in meaningful conversations both internally and with specific payers. An effective tool should empower you to hold payers accountable and act as a driving force for change. Furthermore, the solution should offer predictive cash flow capabilities, allowing you to anticipate reimbursement values and better manage cash flow.

Choosing the best claims and clearinghouse partner for your organization requires careful evaluation and consideration. By asking these key questions and assessing the vendor’s capabilities, you can confidently select a partner that will support your organization’s revenue cycle management needs, drive successful claim processing, and contribute to your overall financial success.

September 1, 2022

“There are only two types of companies: those that have been hacked and those that don’t know they have been hacked.” – Former Cisco CEO John Chambers.

Healthcare businesses are not taking cyber security seriously. For those responsible for budgeting decisions, duties to clients and patients, and ensuring the long-term viability of a business, protecting your internet-connected and networked software and data is as necessary as finding customers and generating revenue. Despite the reality that bad actors work continually to undermine your security and illicitly access your system, companies fail to address basic IT security issues. Business leaders, it appears, either do not fully understand their vulnerabilities or choose to do nothing to address them. Moreover, companies that employ security measures such as firewalls, security cameras, and monitoring procedures view cybersecurity as a finite problem that they can solve rather than an ongoing battle against would-be intruders targeting you, your business, your bank account, and your customers. Common positions include:

August 19, 2022

5 Best-Practice Steps to Automate Prior Authorization

Preventing no-authorization denials and getting patients timely, quality care is no easy feat. As payers increase prior authorization requirements, providers struggle to hurdle escalating barriers to scheduling care, incurring millions of dollars in administrative costs and lost revenue. Worse, patients are caught in the crossfire. While payers say the intent of prior authorization is to control healthcare costs, nearly one in four physicians surveyed said prior authorization requirements led to a serious adverse patient event. And when no-auth denials come knockin’, guess who foots the bill? The surprise bill, that is. You guessed it. Patients. Why Providers Need Intelligent, Automated Prior Auth Despite the 278 transaction standard readily available for years, and the tremendous cost savings adopting electric transactions would bring, insurers continue to maintain arcane, convoluted prior authorization processes. Hospital groups are calling for government oversight to enforce the use of electronic transactions and to regulate payer response times, but in a time where hospitals are drowning in staffing shortages and managing constricted budgets, they can’t afford to wait for a lifeline. Instead, providers have looked to technology companies to build automation tools using robotic process automation (RPA) and intelligent rules engines to navigate the ever-changing labyrinth of payer portals, rules and requirements. Many EHRs provide work queues for staff to manually complete prior authorization processes, which still rely heavily on human intervention—putting a strain on already short staff. Others solve for parts of the problem, one for determination, one for submission, another for retrieval. None deliver a comprehensive solution. It doesn’t have to be that way. Using intelligent automation, technology can solve for determination, submission and retrieval. Providers need real solutions, not more empty promises or misconstrued artificial intelligence.

August 11, 2022

How do you help healthcare organizations navigate the biggest challenges in healthcare?

Complex Claims (motor vehicle, workers’ comp and Veterans Affairs) represent a very small volume, are extremely manual and are highly unique to all other claims. Revecore gives hospitals the opportunity to outsource these claims to a firm with unparalleled technology and 22+ years of experience, focusing exclusively on complex claims. The result: Hospitals are able to focus on their core revenue cycle while yielding faster, increased recovery on their complex claims portfolio.

Our standardized approach brings compliant best practices to hospitals in almost every state, maintains legal awareness and processes to updated legislation and case law, streamlines insurance identification and billing and follow-up, decreases days to pay and increases revenue. Healthcare revenue cycle teams get the manpower they need for these niche claims thanks to our automation, near real-time insurance identification, workflow processes, client-, state- and insurance-embedded customizable rules and clearinghouse billing to the property and casualty market, as well as working along-side the most tenured team of specialists and attorneys in the industry.

Case in point, our clients experience an ROI of 403% by working with Revecore.

What advice would you offer to healthcare leaders when choosing among vendors?

Revenue cycle executives should work with partners who have objective feedback(HFMA Peer Review, Best in KLAS), quantifiable case studies with numerous clients who are willing to discuss their satisfaction, sufficient tenure in the industry, a substantial and recognizable national client base and superior technology. Healthcare leaders should be shown their vendors’ technology to let them see how it works and how it is unique versus just letting vendors talk about what their technology offers. This technology should be able to manage a large volume of

claims with relatively short notice, include workload balancing, be customizable and deliver quick recoveries. Ideal vendors should have extensive legal expertise with a deep bench of in-house lawyers and an experienced team of professionals who have worked exclusively in this niche with minimal staff turnover. Leaders should expect detailed but not overly broad reporting, including placements and results with trending. Healthcare executives should choose a vendor that focuses their business on these specific claims. Firms with expansive offerings yield less focus, minimal investment and diluted results.

What is some advice you can give providers for a successful implementation of a new product or service?

Beyond an explicitly defined implementation process, providers should be receptive to the vendor’s suggested best practices and rely on its expertise. Vendors should have robust experience working in the client’s host billing system with best practices built around their specific system. As all services need modification at some point, clients should understand in detail how the vendor approaches and documents change management.

About Revecore

Revecore is a leading provider of Underpayment Recovery; Denials Recovery & Prevention; Transfer DRG and Complex Claims Reimbursement. Serving 1200+ hospitals across the country, we offer health systems over two decades of unrivaled technology and expert insight into the most challenging areas of revenue cycle to ensure they are appropriately reimbursed for the care they provide.

Peer Review Stats:

8 years on the Short List

100% of peer reviewers agree or strongly agree they would recommend the service to colleagues

May 19, 2022

Rising traffic of VA patients at non-VA health facilities

As the largest integrated healthcare system in the U.S., the Veterans Health Administration runs over 1,200 Healthcare Facilities, but these facilities alone cannot adequately meet the needs of over 9 million Veterans enrolled in the VA healthcare program. Over the past several years, more non-VA healthcare providers are treating a higher traffic of VA patients. However, the highly complex nature of VA claims makes getting reimbursed for care a unique challenge for providers.

Up to 60% of VA enrollees seek concurrent primary care at non-VA healthcare facilities, especially in rural areas where the nearest VA facility may not be easily accessible. Studies by RAND have found that VA patients get more than half of their care through non-VA sources, especially for prescription drugs and inpatient visits associated with surgery.

Exactly how many VA patients come through your health system depends on the unique environment, location, and population mix of your organization, but the general consensus is that the number of Veterans who rely on VA health benefits is expected to increase over the next five years before leveling off. Data from the Census Bureau also projects the changing demographic distribution of Veterans in the near future: more Veterans concentrated in urban areas, more women, and younger patients overall. Recent legislative changes have also made it easier for Veterans to obtain care at non-VA facilities. The Maintaining Internal Systems and Strengthening Integrated Outside Networks (MISSION) Act of 2018, intended to give Veterans access to healthcare when and where they need it, has led to higher VA traffic at non-VA facilities.

Meanwhile, a landmark Court of Appeals ruling in 2019 paved the way for non-VA healthcare providers to be reimbursed for up to $6.5 billion in emergency care services delivered between 2016 and 2025.

VA claims: A tedious, time-consuming process

With all these factors, healthcare providers must be acutely aware of how to treat VA claims or risk higher proportions of aged A/R and millions of dollars in underpayments — if claims are even successfully resolved at all. While most healthcare providers’ patient financial services and revenue cycle teams are equipped to collect reimbursement from traditional health payers more efficiently, VA claims can be an entirely different ball game altogether — overly complex, extremely time and resource consuming, and requires highly specialized expertise. Rather than develop the necessary training2h a specialized revenue cycle partner for VA claims are:

1. IDENTIFY APPROPRIATE PAYERS AND ENSURE TIMELY FILING

The most important step of getting claims properly reimbursed is complying with the VA’s stringent filing requirements. Depending on your healthcare organization’s status in the VA’s network and how the care was authorized, claims must be filed with the correct third-party administrator. As of March 31, 2021, the VA has transitioned from Patient Centered-Community Care (PC3) to Community Care Network (CCN) with an established transition period for care through PC3 within Regions 5 (Alaska) and 6 (Pacific Islands) through March 31, 2022.

For authorized care in Regions 1-3, providers that are enrolled in CCN need to go through Optum United Health Care, while Regions 4-5 providers should file claims with TriWest Healthcare Alliance for both CCN authorized care and transitory PC3 claims. If your organization has a Veterans Care Agreement (VCA) or are not part of one of VA’s formal networks, claims should be filed directly with the VA.

Source:

https://www.va.gov/COMMUNITYCARE/providers/Community-Care-Network.asp

The deadline for filing claims are as follows:

| Program | Filing Deadline |

| Authorized Care | 180 days |

| Unauthorized Emergent Care (service-connected) | 2 years |

| Unauthorized Emergent Care (non-service-connected) | 90 days |

2. MINIMIZE REJECTED AND DENIED CLAIMS

Unlike other payers, VA regulations differentiate denied and rejected claims, although lack of visibility into the claim status can be a source of impediment for healthcare providers. “Denied” claims declare there is no basis for payment, while “rejected” claims cannot be decided until the additional or corrected information is provided. In either case, intervention is required and more often, appeals become the norm. Unaddressed denied and rejected claims shift the financial burden of care to the Veteran, which then presents a significant financial risk to providers as these medical bills mount and end up as bad debt.

Avoidable errors — even those as small as an additional space or punctuation in the patient’s ID number — can cause a claim to be rejected. According to the VA, these are the top reasons claims are rejected:

- Missing/Incomplete/Invalid Insured ID

- Outpatient Claim has a Missing “Admission Type” Code

- Missing Admission Type when Admission Date is Present

- Referring and Attending Physician NPI are Equal

- Claim Contains a Missing/Incomplete/Invalid Billing Provider Address

Adding to providers’ long list of challenges in processing VA claims, the VA does not provide a traditional route to appeal denied claims. This highlights the importance of filing claims on time and correctly the first time, every time — and the necessity of assigning specialized resources with the necessary experience and expertise to navigate all the piles of paperwork associated with VA claims.

3. NAVIGATE THE COMPLEX CHALLENGES OF ALL VA PROGRAMS

In the traditional revenue cycle, health insurance claims ideally can be recovered in no more than one or two touchpoints. VA reimbursement, on the other hand, requires extraordinary effort and multiple touchpoints. Successfully adjudicating VA claims depends on persistent and knowledgeable follow-up. Although the VA stipulates claims will be processed within 30 to 45 calendar days, providers can spend up to a year or more waiting on unpaid claims, leading to aged A/R and a much lower likelihood of collection.

In addition, many providers don’t have the time or resources to follow-up on each VA claim — a tedious, time-consuming task — in an efficient manner. For example, phone access hours are limited, and VA call center staff adhere strictly to the number of claims that can be discussed for each call. Instead of spending hours to follow-up on one VA claim, which leads to overwhelmed staff and higher costs to collect, working with a specialized VA claims partner enables your revenue cycle team to refocus their time and efforts on higher and more viable reimbursing payers.

4. ENHANCE THE PATIENT EXPERIENCE

Finally, one of the biggest advantages of outsourcing your VA claims is an improved experience for Veteran patients. Instead of an overwhelming maze of red tape, patients are guided with personalized advocacy and compassion by experienced VA specialists through every step of their healthcare journey — which greatly increases engagement, enhances the patient experience, and reduces anxiety due to the uncertainty of potential medical costs.

How Kemberton can help

When you partner with Kemberton for your Veterans Administration Claims, you gain access to VA collections specialists and experienced Veteran claims Advocates, comprising of a proficient and focused team, with the knowledge and experience to comply with all of the VA’s complex filing requirements. Working as an extension of your team, we help providers maximize reimbursement, reduce denials, and lower bad debt reserves on VA claims.

May 12, 2022

Bad debt is a chronic issue for hospitals and health systems. Many facilities only expect to recover a small percentage of what patients owe. This trend has only grown with the adoption of high deductible health plans over recent years, which leaves a greater portion of the financial burden on patients rather than payors. Combined with complicated claims such as insurance denials, specialized liability claims including MVA, WC and VA claims only increase AR days, which in turn, reduces revenue and increases provider costs due to special attention needed to recover.

Medical providers must closely scrutinize its aged AR as a percentage of its total AR. The likelihood of collecting the full amount significantly decreases the longer these balances remain in AR, so a considered and efficient approach must be implemented. As a general rule, receivables under 90 days are still highly collectible, while 90 days and above generally indicates a degrading receivable with a lower probability of collecting the full amount, especially so as they continue to age.

With regard to claims, getting them paid depends on a hospital’s efforts in coordinating, following up and moving the claim along the relevant workflows. However, just because claims are “touched” frequently, doesn’t mean the work has been effective. To determine if your revenue cycle processes are efficient, we suggest that you monitor the number of touches on successfully adjudicated claims. This gives you an average benchmark and provides visibility into anomalies, such as drawn-out cases that require too many touches before the claim is reimbursed. It’s also important to monitor the number of claims that have been untouched for more than 30 days, which should be less than 5% of total claims. This performance indicator is crucial in driving payments and keeping aged AR low. This same monitoring process is a critical tool within Armstrong and Associates collection processes.

With regard to uninsured and self-pay balances, a 2021 study was published in The Journal of the American Medical Association, and reportedly based its findings on the largest-ever dataset of medical debt in the United States. It examined all outstanding payments over time and found substantial variation across the country and by income, with debt loads hitting the poor and the South the hardest. The study showed the extent to which medical debt is front and center for many Americans. Medical debt is now the No. 1 source of debt collections, surpassing debt in collections from credit cards, utilities, auto loans, and other sources.

With regard to uninsured and self-pay balances, a 2021 study was published in The Journal of the American Medical Association, and reportedly based its findings on the largest-ever dataset of medical debt in the United States. It examined all outstanding payments over time and found substantial variation across the country and by income, with debt loads hitting the poor and the South the hardest. The study showed the extent to which medical debt is front and center for many Americans. Medical debt is now the No. 1 source of debt collections, surpassing debt in collections from credit cards, utilities, auto loans, and other sources.

However, we submit that the recovery of uninsured and self-pay balances can be further maximized by, once again, reducing the age at time of placement. Certainly, all hospitals strive to reduce their aged AR, so the sooner a medical provider can place this bucket of AR the more likely it can be collected. As stated above, the likelihood of collecting your bad debt diminishes over time so the more hospitals can reduce their bad debt age at placement, the more it can expect its bad debt partner to recover. Of course, hospitals are required to hold this bucket for 120 days, but by reducing placements to as close to that day as possible will increase the likelihood of increased recoveries.

Gordon G. Armstrong, III, is an attorney and 4th generation with Armstrong and Associates, a collection agency in Mobile, AL serving Alabama, the Southeast, and healthcare providers nationwide since 1915.

May 5, 2022

IN AN AGE WHERE PHI AND CONFIDENTIAL MEDICAL DATA ARE ACCESSIBLE ONLINE OR VIA INTERNET-CONNECTED DEVICES, PROVIDERS, HOSPITALS AND HEALTH SYSTEMS MUST FIND INNOVATIVE WAYS TO SAFEGUARD THEIR NETWORKS AND CREATE A CULTURE OF CONTINUOUS COMPLIANCE.

Since 2010 alone, criminal cyber-attacks have increased by an incredible 125% according to the Ponemon Institute. What’s more, many healthcare organizations remain largely unprepared to adequately ward off hackers and other bad actors. In a recent survey of 733 provider organizations and 2,900 security professionals, Black Book Market Research found that 93% of healthcare organizations have experienced some kind of data breach since 2016. Even worse, 57% also reported more than five data breaches in that same time frame.

However, few healthcare organizations have the manpower, equipment or even knowledge to contend with such sophisticated and frequent attacks. Yet, the need to ensure compliance is essential to prevent hefty violation penalties and damage to the organization’s image, as well as to inspire patient trust and loyalty.

Equally complex is the fact that security compliance and privacy protection laws continue to evolve at a rapid pace. State and federal governments regularly establish new regulations in attempts to protect citizens, and complying with those changes often creates even more data that must be protected, along with another layer of added complication.

Although no organization will ever be completely immune to a cyberattack or data breach, proactive steps can be taken to ensure strenuous compliance standards are met. Here are some actionable ways to create and sustain a culture of compliance within your healthcare enterprise:

- Create a PHI security improvement plan. Assessing the current state of your security compliance and data protection should be your first step. Identify strengths, weaknesses and general areas in need of improvement. Once complete, create a step-by-step plan, timeline, oversight committee and budget for how to address the problem areas identified.

- Implement employee privacy training and education programs. Data security training cannot be a one-time event during employee onboarding; instead, it must be regular and ongoing. Research consistently reveals that most data breaches are the result of phishing emails, hence why regular training and risk assessment are imperative.

- Perform regular security risk assessments. Constantly auditing your risk and preparedness levels can help refine your processes, checks and controls. Also new threats will continue to emerge, so building in flexible controls and checkpoints to account for the long-term is essential.

- Designate SMEs to stay current on the latest state and national regulatory requirements. Healthcare providers must be aware of evolving requirements and various industry certifications. This necessitates having in-depth processes in place to ensure compliance, which can be made easier by assigning certain employees to champion or monitor various state, local and federal regulations.

- Consider outsourcing your data security responsibilities. If your organization doesn’t have the time or resources to devote to meeting compliance and privacy standards, then consult outside vendors. Selecting the right partner is critical, so the vetting process should mirror that level of seriousness. After all, patient safety, privacy protection and the reputation of your organization could be on the line.

April 19, 2022

Automation is not new to healthcare revenue cycle. For several years now companies have begun introducing automation into healthcare. Typically, the slow adoption rate has been caused by limited IT resources and what was sometimes considered lower ROI. “The juice wasn’t worth the squeeze” when considering the IT time required to adapt the automation when so many other areas demanded IT bandwidth. That all changes in 2022.

So what causes the change? Necessity. Most healthcare systems are facing personnel shortages throughout. The revenue cycle is no exception and let’s face it, revenue keeps the lights on. With so many sectors of the economy starving for employees, the trend of increased wages that began in 2021 will continue. Hospitals will be forced to consider anything that can be automated. So, what can you expect to see in 2022 to allow that automation?

Process mining will increase exponentially in 2022 as many healthcare systems move towards Hyper-automation, a holistic approach to automating every aspect possible. Process mining is a review to determine where efficiencies can be gained using technology. Many revenue cycle executives are looking closely at their processes. “We’ve always done it that way” is the most expensive statement is business. Revenue cycle leaders are identifying the areas that can be automated or eliminated as a whole. In many cases, entire processes can be automated and team members can be allocated to other areas where help is needed. Outside vendor partners are available and eager to assist with your assessment for gained efficiency.

Patient Portals and Kiosks have become common in healthcare but many don’t effectively address the financial aspect of a patient’s journey. Look for increasing improvements in these areas. Shifting some of the legacy services to the clients, especially in the Patient Access area will help to alleviate some of the staffing shortages in this area. Additionally, Revenue cycle leaders are looking to provide the patient with more options when it comes to completing their financial obligation. Providing patients one place to view all of their accounts, see their current and historic statements, get help though LIVE chat, set up their own payment plans complete with reminders and make a payment in one place rapidly increases collections in the self-pay area. Patient satisfaction is much higher for those who are unable to take care of their business during the hospital’s normal business office hours and the number of team members needed for customer service is greatly decreased.

RPA Plus is the combination of RPA (Robotic Process Automation; also known as “Bots/Botting”) and AI (Artificial Intelligence). RPA has long been utilized to automate repetitive processes where information was structured and consistent. AI was once known as “Machine Learning” but today is so much more. Automation has historically encountered problems when data was non-structured or needed human interaction. Today, AI includes an intuitive aspect and the ability to understand and adapt. Once trained to capture and interpret actions of specific processes, RPA can then manipulate data, trigger responses, initiate new actions and communicate with other systems autonomously. By combining both RPA and AI, almost any business case can be addressed.

Work Queue Automation follows closely behind RPA Plus as a way to increase efficiencies. By ingesting information, sometimes gathered by RPA Plus but not always, work queue automation can organize and segment that information. Doing so allows workflows to be created that create maximum efficiencies, thus reducing the manhours required to complete the task. A great example is automating insurance claim status. By obtaining the status using a query, the claim response from the payor can be organized into work queues for follow up…or not to follow up. Many hours are spent following up on claims that are already in process/set to pay at the payer. By excluding those claims set to be paid, personnel can follow up on the claims needing attention. Claims to be worked can be segmented into work queues by payer, balance, denial code and many other factors. Denial codes can be interpreted using both CARC and RARC responses to maximize productivity when better understanding the deficiency and what is needed to work the claim.

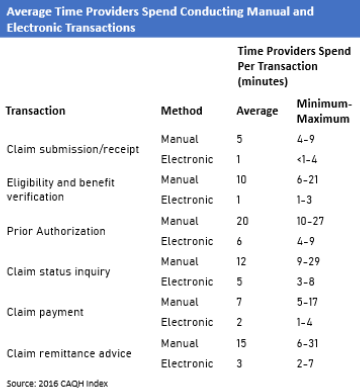

A recent survey by CAQH estimated millions of hours could be eliminated by automating processes in the area of insurance. The average disparity between manual and electronic transactions are shown below. By adding RPA Plus and work queues, the times shown can potentially be decreased even further.

In the current healthcare and employment environment, there has never been a time when automation is more necessary. Successful revenue cycle leaders will mine their processes and partner with companies who are familiar with healthcare revenue cycle and its needs. MedCo provides revenue cycle consulting as well as automation and productivity tools to increase your efficiencies. Call 844-528-4338 today to set up a time to discuss how MedCo can help you reach Revenue Cycle Excellence!

April 14, 2022

Error-prone and outdated patient access processes are prompting many revenue cycle leaders to seek modern digital solutions. The ultimate goal: save time for short staff and move their organization’s patient experience closer to the digital consumer experiences shoppers expect at online retail and travel sites.

But for years, internal budget priorities kept hospitals from advancing self-service patient-facing technology. Often, investments in modernizing patient access and the revenue cycle came second (or worse) to new clinical offerings like the latest MRI machine or the primary care expansion strategy. As a result, underinvestment in patient access and the revenue cycle left many hospitals delivering a subpar patient experience.

That era is behind us. The global pandemic immediately prioritized budget dollars for digital upgrades to enable a safer, optimized patient experience and enable short staff to shift administrative tasks to patients. Hospital leaders quickly realized the byproduct of automation and self-service digital engagement is not just improved safety and satisfaction, but increased staff efficiency and revenue capture.

Digital Self-Service Technology Yields Financial Reward

One reason to implement a digital patient experience strategy is many patients are clamoring for it, says Sue Plank, director of patient access at Goshen Health, a network of 35 healthcare facilities in Indiana, was quick to recognize the benefits. Goshen had already begun its own digital transition when the pandemic hit 18 months ago, but COVID put the strategy into overdrive.

“We had to be more flexible to meet the demands of staffing swings due to illness, to limit contact, and to open up new capacity through streamlining processes under one system,” Plank says.

Plank chose AccuReg’s EngageCare integrated patient access, intake, and engagement platform to implement Goshen’s digital patient engagement strategy. Their objective was to optimize how patients access care, and as importantly, improve workflow and interdepartmental communication.

EngageCare allows Goshen patients to:

- Complete contactless registration online, including verifying demographics and insurance coverage, and e-signing consent forms

- Receive aQQOintment reminders digitally, giving them the opportunity to confirm, cancel or move appointments

- Check-in digitally using their own devices or by scanning QR codes at kiosks to expedite the check-in process and use virtual waiting rooms

- Complete aCOVID screening prior to appointments

Results are strong from the first six months: 65 percent are engaging with the appointment reminders and 39 percent are completing registration online, which far exceeded Goshen’s expectations. Appointment alerts to patients via text and email have led to a noticeable reduction in no-shows, saving tangible revenue that would otherwise have been lost.

Streamlined and centralized access to accurate price quotes have helped staff collect more payment at the point of service and pre-registration, resulting in a 38 percent increase in POS collections year-over-year.

Another major impact from implementing EngageCare has been dramatic improvements in patient wait time, a critical measure of patient satisfaction.

“No patient comes in wanting to wait, and our numbers were in the 25-30-minute range from registration to when their appointment began, which was nothing to be proud of,” Plank says. “EngageCare helped us reduce that wait time for most patients to 7-10minutes, and many fall into the 3-5-minute range.”

Meet Patient ExpectationsAnd Relieve Staffing Challenges

In an era where hospitals are challenged to do more with less, and consumers increasingly have a choice in where they receive care, adopting self-service technology is a win-win strategy for relieving staff burden and increasing patient satisfaction. For more about Goshen Health’s journey toward an intuitive, self-service digital experience, check out the full case study.

Get in Touch

[email protected]

Main: 251-338-0970

Fax: 251-633-3632

Sales: 866-872-7498

April 12, 2022

As we approach the sixth anniversary of Universal Health Services, Inc. v. United States ex rel. Escobar, most healthcare providers and their business associates remain unfamiliar with the unanimous U.S. Supreme Court decision that conceptually and doctrinally transformed the False Claims Act. The Escobar decision validated the implied certification theory and effectively expanded the scope of potential liability under the False Claims Act. In the unanimous opinion drafted by Justice Thomas, the Court held that a healthcare provider could be liable when it submits to a federal payor a claim for payment that makes representations about goods or services but fails to disclose material noncompliance with a statutory, regulatory, or contractual requirement. Additionally, the ruling clarified the knowledge requirement authorizing the Government to recover under the implied certification theory if the defendant knowingly violated a requirement that the defendant knows is material to the Government’s payment decision. The Court then described the materiality requirement and the method for enforcement.

In Escobar, a Massachusetts mental health facility treated a minor diagnosed with bipolar disorder. The patient had an adverse reaction to medication that the facility asserted was prescribed by a physician. As a result of the reaction, the patient suffered a seizure and died. Subsequently, the patient’s parents discovered that most of the mental health facility’s employees were not properly licensed. Only one of the five treating providers was properly licensed. For example, the diagnosing practitioner identified herself as a psychologist with a Ph.D. However, the practitioner did not disclose that she earned the degree from an unaccredited online college and that the state rejected her licensure application. The practitioner asserted to be a psychiatrist but, in reality, was a nurse who lacked prescriptive authority.

Furthermore, the facility submitted claims to Medicaid while misrepresenting employees’ qualifications and licensing status to the Government. As a result, the state Medicaid program was unaware of the misrepresentations and paid the claims. Then, after learning of the misrepresentations, the parents brought a whistleblower action under the False Claims Act.

The Court established two conditions required for pursuing a liability claim under the implied certification theory. First, the claim must not only request payment but must also make specific representations about the goods or services. Second, the claimant must fail to disclose noncompliance with a material statutory, regulatory, or contractual requirement making the representations false or misleading. Furthermore, the requirement must be material to the Government’s payment decision.

Here, the defendant made representations about the services it provided. Universal Health Services submitted claims containing payment codes that corresponded to services rendered by specific types of medical professionals. Regarding materiality, the Court stated that a misrepresentation is not material simply because the Government has the authority to deny payment if the misrepresentation becomes known. Instead, the defining element is whether the defendant knowingly violated a requirement that the defendant knows is material to the Government’s payment decision. Therefore, there are two layers\ to the knowledge requirement. First, the Government or the whistleblower must demonstrate that the defendant knowingly failed to disclose a violation. Second, the defendant must have known that the disclosure would likely affect the Government’s decision to pay.

Whistleblowers have explored the boundaries of the materiality element in the years since the decision. The Escobar Court held that the Government’s actual behavior is relevant when determining whether a false claim is material to the Government’s payment decision. The Court offered a practical example. When the Government pays a claim in full despite its actual knowledge that the provider violated requirements, the Government’s action indicates that the requirements were likely not material. To that end, numerous whistleblowers have successfully sought to convince courts that essentially any reimbursement paid by a medical provider to the Government is sufficient to raise a triable issue of fact that an alleged infraction is material to the Government’s payment decision. The resulting contention is that the payment demonstrates the provider’s knowledge that the applicable infraction was material to the Government’s payment decision. Additionally, whistleblowers use such payments in other claims to show that such infractions are material to the Government.

The Escobar decision and the Court’s adoption of the implied certification theory transformed the enforcement of the False Claims Act. The decision has led to new risks, expanded liability for providers, and created new strategies and incentives for whistleblowers. While the Court did heighten the burden for showing materiality, the Escobar decision will likely continue to be a source of risk for future litigation.

March 24, 2022

Jeff Nieman

CEO

Meduit

Across the country, we’re seeing a trend in the number of hospitals that are realizing the comprehensive strategic value in improving the patient financial experience. This article provides a playbook for developing a broad patient financial engagement strategy that drives the end-to-end revenue cycle and motivates full and timely patient payments.

The Big Picture

The rising cost of healthcare and prescription drugs, along with increasing health insurance deductibles, have put growing pressure on patients. Almost a third of working Americans have some kind of medical debt, with approximately 25% of those with outstanding balances owing $10,000 or more on their bills, according to a recent report by CNBC. 1

A staggering 81% of patients say they experience frustration related to their medical bills. Patients are less inclined to pay their bills when they don’t understand them. These patients also tend to give lower scores on patient satisfaction surveys. 2

For providers, patients have become the new payers, and they are struggling. Having a robust patient financial engagement strategy in place can help patients understand their medical bills and pay them in a convenient, efficient manner that supports a positive patient financial experience.

The Patient/Provider Disconnect

Let’s take a look at the some of the factors causing a disconnect between patients and their healthcare providers.

CONSUMERS

- 86% of consumers want to make all their healthcare payments in one place

- 71% of consumers are confused by explanation of benefits (EOBs)

- 72% of consumers want e-statements for health plan and premium bills, yet 42% cannot receive e-statements from their health plan

HEALTHCARE PROVIDERS

- 90% of providers fall back on paper and manual processes for collections

- 77% of providers say it takes more than one month to collect any payment

Consumers are increasingly using their smartphones and tablets to pay for purchases and are looking to healthcare providers to offer convenient mobile options to access and pay their medical bills. 3

COMPONENTS OF COMPREHENSIVE PATIENT ENGAGEMENT

How do you provide patients with an integrated and seamless financial experience that incentivizes timely payments? Consider these elements of a best practice solution model:

- Providing patients with digital statements, texts and live representatives allows patients seamless communication regarding their bill and the option to make payments online 24/7

- Offering a complete patient call center with live representatives who can talk with patients, review their bill, answer questions and take payments delivers the support that patients need

Best practices dictate having a blended solution with the best of the above options. In our internal analysis, the Meduit team has found that 45% of patients prefer self-service and online payment options. However, 55% request a live person to answer their questions. 4

Going deeper, here are steps your organization can take to drive positive patient financial engagement:

- Standardize billing statements in one holistic, easy-to-understand bill that empowers patient communication across the health system. Include ways to pay and where and when to call along with where to access financial assistance guidance. Combine a summary of each service, date of service, cost of service, insurance adjustments and patient payment responsibility in the statement.

- Structure digital communications to be available 24/7 without the necessity of talking to anyone. Include multiple payment options that are simple and easy to set up. Note, digital communications must include patient consent language in order for text, email, etc. to be deployed.

- Determine who will handle incoming patient calls. Many of the new digital vendors do not provide a call center to address patients with questions with a real human being, throwing the responsibility back to the healthcare system, which often increases the cost of the overall RCM service.

- Offer patient financing options that allow patients to set a monthly payment that fits their budget. Best practices dictate allowing patients to qualify with no credit check, no fees and no prepayment penalties. The lender should pay the healthcare provider what the patient owes upfront at no cost to the provider.

Conclusion

Digital solutions have already swept consumer practices across multiple industries. By adapting to these new technologies, healthcare providers can positively impact the patient financial experience to increase collections, shorten the time to collect and improve overall patient satisfaction.

- https://www.cnbc.com/2020/02/13/one-third-of-american-workers-have-medical-debt-and-most-default.html. Accessed 12.17.21.

- Meduit RCM data, 2021.

- https://www.digitalcommerce360.com/2019/05/06/consumers-want-more-online-payment-options-for-healthcare/. Accessed 12.17.21.

- Meduit internal analysis of patient behavior for self-service vs. access to a human, 2021.

March 3, 2022

When your mission is to maximize reimbursement, it pays to be persistent and refuse to take no for an answer on submitted claims. Successful Medicaid eligibility (ME) representatives also learn that they sometimes need to go beyond their usual area of concentration to serve both the patient and the provider.

Recently, a patient’s application for retirement benefits was denied on a technical basis, presenting a challenge for Parallon’s ME team. As it turned out, incorrect Social Security processing had led to the denial of Medicare benefits when the patient applied before turning 65 years old. The team advocated on the patient’s behalf and got the Social Security Administration (SSA) to review the case. The review determined that the patient was indeed eligible for retirement benefits—but that’s not all! Through the spouse, the patient also qualified for Medicare benefits. The SSA reversed its initial decision and made Medicare Part A coverage effective retroactively to June 2020, when the patient turned 65.

Although Parallon’s ME team typically doesn’t handle Medicare, in this case we were able to provide that service to the hospital, which received a payment of $257,768. Meanwhile, the patient got financial relief in addition to the necessary healthcare. Because Medicaid would have paid only $97,000, the end result was a revenue net increase of more than $160,000 for the provider.

Multiple Opportunities for Financial Relief

In spite of its name, the ME landscape is not always just about Medicaid. Eligibility in any form means looking at multiple opportunities to qualify a patient for financial relief. Depending on the state and sometimes the county, various programs are available. Several managed care entities could be operating within a given Medicaid program, for example. Share-of-cost opportunities, which involve a monthly amount (like an insurance deductible) paid for healthcare before Medicaid kicks in, may also be available to different degrees.

Beyond traditional Medicaid, there’s also Medicaid disability along with other programs, including Medicare on the federal level. Many patients have disabling conditions but don’t realize it. Because disability is bigger than simply the physical conditions that people can see, a successful eligibility advocate can find opportunities to qualify patients who aren’t visibly disabled yet have disabling qualifiers. Certain psychiatric conditions and medical histories can make a patient eligible for such a qualifier.

While we tend to think only of “standard” Medicaid, a government program for patients who are living below the poverty level, there is much more to it than that—and ME representatives should be aware of these opportunities and adept at figuring out when they are viable options.

COBRA, the Affordable Care Act, charity programs and more are also potential reimbursement sources to be pursued, when appropriate, by ME representatives who know the needs of the patients they serve and continuously look for the opportunity to qualify them for the right financial relief. Armed with knowledge, analytical tools, determination and a passion for helping providers and patients, these representatives provide the customer service that allows healthcare providers to do what they do best: care for the patient.