- Pricing transparency is still important.

- The industry may have reached a level of fatigue on this subject, based on the low response rate.

- The effect of posting prices online has had little positive or negative impact on most hospitals.

A recent survey by Cleverley & Associates on healthcare price transparency shows insight into changes in industry attitudes and actions compared to a similar survey the firm conducted in 2016.

Having several months in an environment where all hospitals have been required by the Centers for Medicare & Medicaid Services (CMS) to post on their websites their chargemaster prices for all services in addition to inpatient charges by MS-DRGs, the survey’s goals were the following:

- Whether posting of prices has had much impact on how hospitals price services.

- Community reaction to posted prices.

Survey timing

The survey of about 2,500 U.S. hospitals and health systems wrapped up just before President Trump signed an executive order on June 24, directing the secretary of Health and Human Services to propose a regulation requiring not just the posting of prices but negotiated rates with payers.

The Trump Administration’s hope is that the order will not only provide up-front cost information to patients, but also foster competition that would ultimately lower the cost of healthcare. Had the survey return date been extended beyond the issuing of this order, survey authors indicate they believed more feedback from hospitals would have been received.

Only 26 responses to the current survey on price transparency were received compared to 77 in 2016 as well as 100 responses earlier this year to questions about the implementation of the CMS requirement to post chargemaster prices.

Three key survey findings

Based on the responses received, there were three key findings:

- Pricing transparency is still important.

- The industry may have reached a level of fatigue on this subject, based on the low response rate.

- The effect of posting prices online has had little positive or negative impact on most hospitals.

Survey results

The survey focused on the importance of price transparency, community reaction to posted prices and the impact on pricing.

Has the importance of price transparency changed compared to two years ago for your organization? The majority of 2019 survey respondents (58%) said the importance of price transparency for their organization had not changed while 42% indicated it was more important now. When asked the same question in the 2016 survey, 83% of respondents said it was more important at that time compared to two years earlier.

Several factors may have contributed to the decrease in those saying it is more important.

- Because 2016 was an election year, healthcare and the cost of healthcare was a hot topic.

- The 2016 survey followed a few years of news coverage about high

patient bills and hospitals being the core of the problem - Now that hospitals have complied with posting their prices and CMS did not propose any new requirements with the proposed FY20 IPPS rule, many organizations may have turned their attentions to other concerns.

The impacts on external stakeholders of hospitals posting prices online. The majority of 2019 survey respondents (58%) said that it created more confusion. Only one respondent said that it had improved transparency and the remainder indicated the rule had no impact.

Community reaction to prices being posted and available online. The majority of 2019 survey respondents (65%) said that posting prices online has created little interest. Only four respondents indicated high interest. One of those respondents noted the interest was high at first but had since diminished, while the other three indicated continued high interest.

The impact of price transparency on hospital pricing strategies. Interestingly, more respondents (50%) in the current survey acknowledged that price transparency is not a factor considered when setting prices while only 20% in the 2016 survey indicated the same. This increase in respondents saying price transparency is not factored into price setting could be due to many hospitals feeling as though they already have remedied any pricing concerns through past actions.

What have hospitals done in response to price transparency? All 2019 survey respondents indicated the hospitals they represented have taken some course of action in response to price transparency. Respondents, who were asked to identify all actions regarding price transparency, indicated the following in order of popularity:

- Freeze prices for certain areas (i.e., highly shoppable services) — 46%.

- Create lower retail outpatient prices — 35%.

- Promote value and/or quality of services as a differentiator for higher prices — 27%

- Build, purchase or enter into a joint venture with competition to retain volume in a lower-priced location —19%.

- Reduce prices for both inpatient and outpatient services — 8%.

When respondents answered a similar question in 2016, 49% indicated the top action was reducing both inpatient and outpatient prices in response.

What was the impact of having taken the actions indicated? A strong majority, 62%, responded that they had little or no impact on revenue. When asked if hospitals have had to restructure contracts in response to price transparency, the overwhelming response, 96%, said no. Unless a hospital was making a major overhaul to its pricing structure, such as a 25% overall price drop, it is likely that it would have been able to absorb any negative impact through increases to other areas of its chargemaster that are not quite as shoppable.

Pricing pressures

Another segment of the survey inquired about where the external pricing pressure was coming from and what areas of the chargemaster received the most scrutiny.

On the question of where the pressure is arising from, there was consistency in responses between the 2016 and 2019 surveys. A strong majority of respondents (84% in 2016 and 58% in 2019) identified patients with high-deductible health plans as the top source of pressure followed by statutory requirements and free-standing centers as the next highest sources of pressure in both periods.

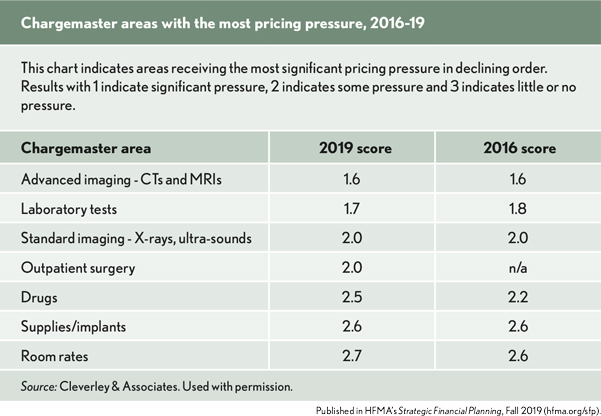

The chargemaster areas where hospitals are receiving the most pressure has also remained consistent between 2016 and today, emphasizing imaging and lab tests.

Because the areas of the chargemaster receiving the most pricing pressure have remained mostly unchanged, one goal was to find out how prices have changed for some of the top volume imaging, laboratory tests and outpatient surgeries.

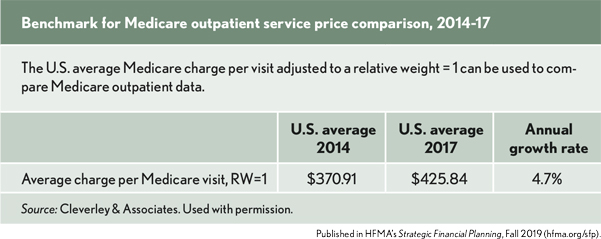

The latest Medicare outpatient comparative data that is available publicly is 2017 so researchers compared those prices to 2014 prices to see if those areas have been treated differently by hospitals. The benchmark used as the standard rate of increase over the period for all outpatient services was the U.S. average Medicare charge per visit adjusted to relative weight = 1.

The average charges per Medicare visit over a period from 2014 to 2017 are as follows:

- The annual growth rate in outpatient charges was 4.7%.

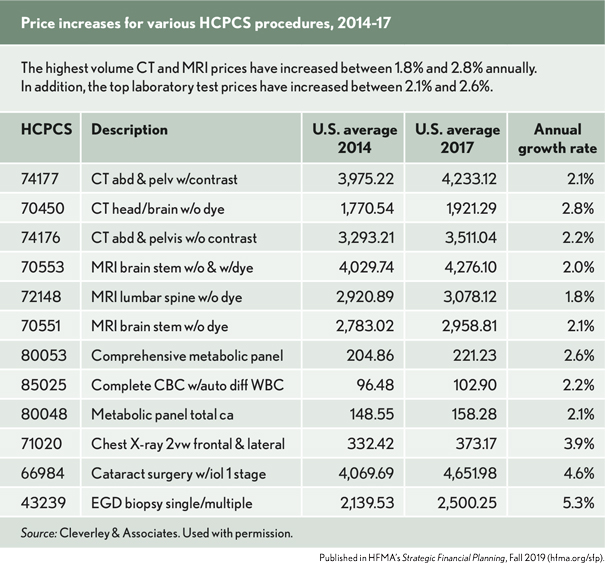

- The highest volume CT and MRI prices have increased in the range of 1.8% to 2.8% annually.

- The top laboratory test prices have increased between 2.1% and 2.6%.

These rates of increase are well below the average outpatient rate growth for the period. The annual growth rate in price for chest X-ray 2 view was also below the outpatient average.

However, the top two outpatient surgical procedures — cataract surgery and EGD biopsy — were closer to the overall average. Though this sample of services is small, it does indicate that hospitals have treated the areas of highest pressure, especially CTs, MRIs and lab tests, more conservatively than other outpatient areas when applying price changes.

Priorities

One of the final survey questions probed where the topic of pricing ranks on each organization’s priority list. Results for 2019 show no one identified it as a top concern, two respondents stated it was not a priority, 54% indicated that it was low priority and 38% said that it is among top concerns.

In 2016, two-thirds of respondents listed it as among their organization’s top priorities. This change in view about price transparency correlates to many other responses we have seen in the current survey: Fewer consider price transparency as a factor in their pricing strategies and the vast majority believe the posting of chargemaster prices has not been useful to their communities and created little interest.

Future requirements

Overall, the survey on price transparency found the following results:

- There has been little impact on external users from hospitals posting prices on their websites.

- Hospitals have made changes to reduce prices or limit increases in areas where they are receiving the greatest pricing pressure (i.e., CTs, MRIs and lab tests).

- The topic of price transparency is no longer as much of a priority for the healthcare industry as it was three years ago.

While price transparency may have peaked as a concern, the industry could experience a significant pivot if the details of negotiated rates with commercial payers becomes a requirement as a result of President Trump’s recent executive order. It will be a topic that generates angst and discussion as more details become known.

What is apparent is the issue of greater transparency continues to gain national attention and hospitals will once again be asked to provide additional information to patients in a complex environment.