Bank failures highlight importance of measuring counterparty risk

The recent failures of Silicon Valley Bank and Signature Bank have focused attention on an often-overlooked issue: bank counterparty risk.

From a treasurer’s perspective, banks are much more than account-holding institutions. They provide an array of critical payment and collection services, and the impact of losing access to these services cannot be overstated. The Federal Reserve’s decision to intervene in the recent bank failures to give depositors full access to their funds provides some relief, but it does not fully address the problem of interrupted financial services. These bank failures serve as a reminder of the importance of properly measuring counterparty risk and ensuring that business continuity plans include scenarios in which a banking partner is no longer able to provide key treasury services.

Measuring counterparty risk

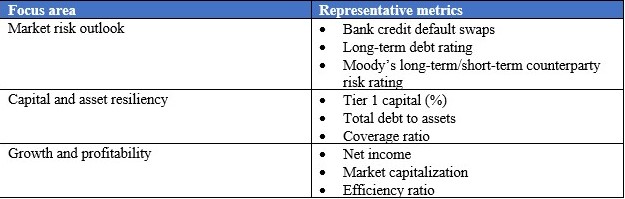

Various methods are available to measure counterparty risk. Within a changing macroeconomic environment, analysis of three primary focus areas will provide the most comprehensive view of risk.

1 Market risk outlook. This outlook combines debt ratings and long- and short-term counterparty risk metrics along with an understanding of country risks for banks not headquartered in the United States.

2 Capital and asset resiliency. The quality of bank assets and liabilities is evaluated to measure balance sheet strength throughout the business cycle.

3 Growth and profitability. The overall performance of the banking partner is measured to understand the systemic importance of the institution and how well it is positioned for long-term growth.

Representative metrics for these three focus areas are provided in the exhibit below.

Metrics for measuring counterparty risk

A strong counterparty risk model will account for these primary drivers of financial health and provide a weighted score for evaluating banking partners and understanding their overall financial health. In some instances, an organization may wish to do additional research on factors such as the bank’s long-term growth strategy or its Federal Reserve stress test results to ensure it has a complete picture of the banking partner’s financial health.

Concentration risk and business continuity

Beyond the financial health of individual banking partners, healthcare organizations should also consider how well they have mitigated concentration risk by dispersing activities across a group of banking partners. Banking partners represent the financial circulatory system for healthcare organizations, enabling the efficient movement of funds across the organization. Because of the potentially disastrous impacts of an interruption in that flow of funds, the ability to rapidly switch treasury operations among a group of banking partners provides a critical safeguard against the failure of any one partner.

Even before the recent bank failures, healthcare organizations were moving to diversify their banking partners for any number of reasons, including their current credit needs and the desire to generate new ideas from a diverse range of partners. Now, with the possibility of bank failures again in the news, there is another compelling reason to create a diverse banking group. Even in the best of circumstances, it can take days, and sometimes weeks, to open accounts and establish basic services. In the flurry of activity that surrounds a major bank collapse, these implementation timelines may be significantly extended.

Vendor risk

Bank counterparty risk is not limited to the healthcare organization; it also can extend to vendors that perform key treasury activities on behalf of the organization. Common examples include payroll service providers and vendors that provide account payable solutions. These vendors will hold funds on their client organization’s behalf at a third-party bank before settling disbursements. Understanding the risk these vendors face with respect to their own banking partners contributes to the healthcare organization’s understanding of its own overall risk and can influence decisions on which vendors the organization chooses as its partners.

Understanding counterparty risk helps ensure business continuity

Bank failures are not common events, but when they occur, they provide a reminder of how fragile business continuity plans can be. By monitoring the financial health of banking partners, assembling a strong and diverse banking group, and understanding the counterparty risk facing key treasury service vendors, healthcare organizations can avoid or mitigate any impacts from unanticipated events that could disrupt treasury services. In the process, they also are likely to form a stronger network of banking partners that will serve them well throughout the business cycle.