News Briefs: Healthcare industry disrupter CVS Health to shell out billions to buy Oak Street Health

As published in the March 2023 issue of hfm, this roundup presents the top news stories for healthcare finance professionals.

A month after stating it hoped to gain a presence in primary care, CVS Health accomplished that goal with a massive deal that could fortify its efforts to advance value-based payment in healthcare.

The proposed $10.6 billion acquisition of Oak Street Health, a provider of senior-focused primary care, adds to a portfolio of assets that have developed reputations for innovative approaches to healthcare delivery.

During the first half of this year, CVS also expects to close its $8 billion purchase of Signify Health, a provider enablement company with a focus on home healthcare. That deal also will bring over Caravan Health, which supports providers in accountable care arrangements and was bought by Signify in early 2022.

The pair of transactions, both of which must pass regulatory scrutiny, will help CVS Health realize its vision of value-based payment as “not just being a contract, but being a platform where we really drive engagement and connect patients to care,” Karen Lynch, president and CEO of CVS Health, said during a Feb. 8 investor call.

Texas court again backs providers in No Surprises Act IDR litigation

For the second time in a year, the Texas Medical Association prevailed in court after arguing that regulations governing the No Surprises Act’s independent dispute resolution (IDR) process do not comply with legislative intent.

Barring a successful appeal, the Feb. 6 ruling by the U.S. District Court for the Eastern District of Texas means the U.S. Department of Health and Human Services (HHS) will need to issue its second rewrite of the regulations. Echoing its ruling from early 2022, the court said the latest regulations maintain an excessive emphasis on the qualifying payment amount as the key factor in IDR cases.

The IDR portal has been hampered by backlogs stemming from a volume of cases that vastly surpasses HHS’s preliminary projections. With the decision-making criteria in limbo until HHS announces how it will proceed, the ruling injects more uncertainty.

On Feb. 10, CMS’s Center for Consumer Information and Insurance Oversight posted a statement that arbitrators should cease issuing payment determinations until receiving further guidance from HHS. (No such guidance had been released when hfm went to press.) They also were instructed to recall any payment determinations that had been issued after the court ruling.

CMS looks to claw back billions in overpayments to Medicare Advantage plans

CMS has confirmed a new approach to its auditing of payments directed to Medicare Advantage (MA) health plans, but the agency says the regulatory burden on providers is not expected to increase.

A recently published final rule on risk adjustment data validation (RADV) establishes that CMS will use an extrapolation methodology to recoup overpayments to MA plans beginning with the 2018 payment year.

$17.1 billion

Amount of overpayments to MA plans in 2021 stemming from discrepancies in coding relative to Medicare fee-for-service, according to the Medicare Payment Advisory Commission

Going forward, MA health plans and their contracted providers must submit a sample of medical records for the validation of risk adjustment data. CMS then will calculate program-wide overpayments using “statistically valid methods for sampling and extrapolation that we determine to be well-suited to a particular RADV audit.”

The rule states that the audits will focus on health plan contracts and hierarchical condition categories that “through statistical modeling and/or data analytics are identified as being at highest risk for improper payments.”

CMS clarified that the rule would not impose new documentation requirements on providers, given that MA plans already must ensure contracted providers meet documentation requirements.

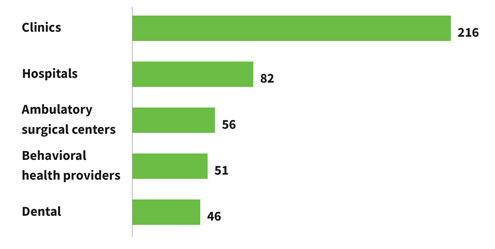

Ransomware attacks on healthcare organizations, 2016-21

A recent study examined ransomware attacks on healthcare providers over a six-year period. There were 374 attacks in the study cohort, exposing the personal health information of nearly 42 million people. Below are the sites of care that were most frequently affected (some attacks affected multiple sites within an organization).

OIG describes how hospitals can use NPs to treat patients without violating the Anti-Kickback Statute

An advisory opinion from the HHS Office of Inspector General (OIG) appears to give hospitals leeway to expand their use of nurse practitioners (NPs) in specific situations without violating the Anti-Kickback Statute.

Responding to an inquiry from an unnamed hospital, OIG said it would not impose administrative sanctions, even though it also stated that the arrangement in question technically would constitute a prohibited form of physician compensation.

OIG noted that the activities described, as performed by NPs, take place in two of the hospital’s med/surg units and don’t relate to care performed in “more lucrative” specialty units such as the OR.

Patients in the scenario described have been admitted as inpatients or are undergoing observation, the hospital said. They need “active evaluation to determine the cause and extent of their illnesses and often require ongoing attention throughout the day,” OIG noted.

The hospital explained that the physicians still are required to make daily rounds and maintain the same level of accountability for their patients.

In addition, they may not bill for the services performed by NPs or use the NPs’ documentation to bill for services. The hospital pays for the NPs’ services and does not bill Medicare or any other payer.

Various data highlight the ongoing labor challenges facing providers

The healthcare labor picture may be stabilizing in some respects, per the latest available numbers, but hospitals and other providers still are scrambling to fill positions.

The industry added 58,200 jobs in January, including 10,900 at hospitals and health systems, according to preliminary seasonally adjusted data from the U.S. Bureau of Labor Statistics. That jump followed an average monthly increase of 49,000 in 2022, up from 9,000 in 2021, according to data compiled by Altarum.

By the end of 2022, healthcare employment was 1.2% higher than pre-pandemic levels, compared with an increase of 0.8% for other sectors. Hospital employment was 0.8% higher, a paltry jump compared with ambulatory settings, where the increase was 5.8%. Nursing and residential care employment was 9.1% lower.

Healthcare employment is 3.9% lower than it would have been based on pre-pandemic trends, while hospital employment is 2.4% lower, according to a data analysis from the Peterson-KFF Health System Tracker. Physician offices are the only sub-sector that is not below trend.

Other data from the tracker show that job openings in the overall healthcare and social assistance sector are 69.9% higher than before the pandemic, compared with 49.3% in the overall economy.