Not-for-Profit Hospitals Demonstrate Value

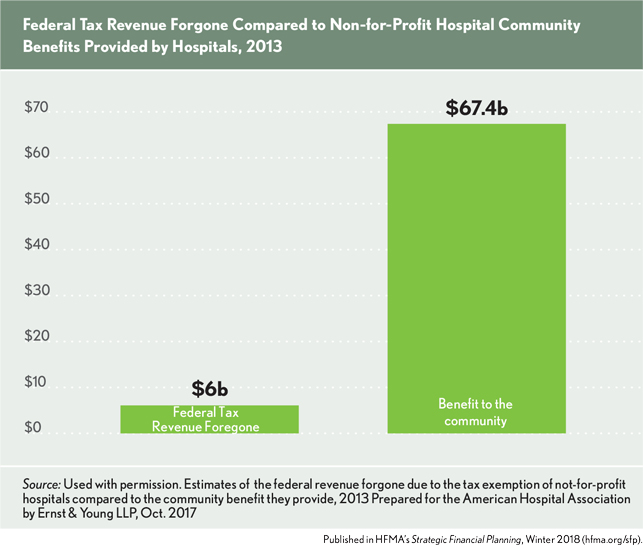

In 2013, the estimated tax revenue foregone to hospitals with not-for-profit tax-exempt status was $6 billion, while the benefits provided to communities by such hospitals total approximately $67 billion, according to a study by EY for the American Hospital Association.

The benefits were calculated using hospital reporting on Form 990 Schedule H. The total community benefit provided by tax-exempt not-for-profit hospitals was calculated based on financial assistance and means tested government programs and other benefits, community building activities, Medicare shortfalls, and bad debt attributable to charity care.