Optimizing a Health System’s Post-Acute Care Network

As health care’s traditional care silos merge into a care continuum, a critical strategic consideration for health systems is development of effective post-acute care networks that enable them to deliver cost-effective, high-quality care in the right place at the right time.

As hospital and health system leadership teams look to enhance their organization’s delivery networks, they are focusing on post-acute care services as one of the primary means for improving both the quality and cost of the patient care experience. a A well-organized and smoothly functioning post-acute care network that improves care coordination, quality, and outcomes, while lowering costs, is particularly important to health systems in the following contexts:

- Under all types of quality incentives or outcomes-based payer requirements

- When participating in Medicare or Medicare Advantage bundled or capitated payments, ACOs, and other shared-savings arrangements

- For service-line-specific comprehensive offerings, such as total joint replacement programs, which are designed to meet consumer demand, promote physician engagement and collaboration with the organization, and differentiate the organization from regional competition

- For the organization’s inclusion as a highly efficient and effective provider in networks that span the care continuum, from wellness programs to end-of-life care (Network arrangements will “tier-out” or otherwise exclude higher-cost health systems by steering patients to organizations that can offer high-quality services at a lower cost.)

Sidebar 1: Benefits of Close Relationships between Hospital Systems and Post-Acute Care Providers

Creating an enhanced network that ensures the right care is delivered in the right place, as appropriate to the patient’s condition, takes time; it cannot be built overnight. Organizations seeking to develop an optimized post-acute care network should understand the factors critical to successful network development and address all the issues that are important to consider when deciding whether to own, partner, or contract with post-acute care providers.

The National Post-Acute Care Context

Medicare is the nation’s largest single purchaser of post-acute care services, spending nearly $60.3 billion in 2015, according to a June 2017 report by the Medicare Payment Advisory Commission (MedPAC). b For the federal government, post-acute care represents a major savings opportunity, largely due to the high average margins in most post-acute care settings, spending growth in this area, and variation in care patterns cited by MedPAC. c

MedPAC’s June 2017 report notes that Medicare margins in 2015 for skilled nursing facilities (SNFs), inpatient rehabilitation facilities (IRFs), and home healthcare agencies (HHAs) were 12.6 percent, 13.9 percent, and 15.6 percent, respectively. In comparison, hospital overall Medicare margins averaged -7.1 percent in 2015 (with an “all-payer margin” of 6.8 percent). The Institute of Medicine has attributed 73 percent of overall Medicare geographical spending variances to post-acute care utilization variation. d Such variation is associated with increased costs and lower quality and outcomes.

Efforts to improve the overall value of post-acute care generally have not been effective. However, bundled and episode-based payment models are starting to eliminate traditional silos among ambulatory, inpatient, and post-acute care settings, thereby reducing problematic care transitions between settings and improving cost, service, and quality dimensions across all settings.

Health systems are well positioned to improve the overall value of post-acute care for three reasons:

- They are the primary source of post-acute care referrals.

- They have the clinical capabilities to direct patients to the lowest-cost, highest-quality care setting appropriate to the patients’ conditions.

- They play a central role in organizing service offerings, including both network development and contracting.

Four planning activities—market assessment, network evaluation, network design, and consideration of strategic alignment options—are critical to effective post-acute network development and operations.

Market Assessment

A thorough fact-based market assessment sets the stage for future post-acute care initiatives. Top considerations about the network and its current and future performance include the following.

Current utilization patterns and likely trends. Where patients seek care today and how far they are willing to travel are important considerations. For example, an in-depth analysis disclosed that 90 to 94 percent of one health system’s Medicare patients seek post-acute skilled nursing care solely within the zip code where they live. Patients and families typically prefer conveniently located facilities. This preference limits this health system’s choice of potential skilled nursing care partners.

Insights about future use rates can be gained by comparing use of post-acute care services in a health system’s area to that of regional and national norms. Exposure to changes in incentives, such as site-neutral payments, and Medicare Advantage penetration, could put downward pressure on post-acute care use. For example, an organization whose inpatient rehabilitation utilization is found to be 20 percent higher than regional levels can expect significant downward pressure on its utilization. Such a finding would inform the organization’s strategy for the rehabilitation business line; more rehab units would not likely be needed.

Changes in medical technology also could lead to substantial reductions in skilled nursing and home care usage. For example, less-invasive techniques can enable additional orthopedic procedures to be performed in outpatient settings with outpatient physical therapy follow-up.

Referral sources and the health system’s relative importance to post-acute care providers. Major referral pathways differ by provider type and primary service area. SNFs typically rely more heavily on referrals from acute care facilities; home health agencies draw more heavily from physician referrals. Conversations about whether a health system should establish a “preferred” relationship with a post-acute care provider should be informed by a clear understanding of the organization’s importance to key regional post-acute care providers and analysis of competitors in the region.

Quality and costs of regional providers. Performance of a health system’s owned assets can be compared with that of regional post-acute providers using criteria such as collaboration with the health system, quality, outcomes, costs, communication, ease of access, responsiveness, and other measures. An opportunity analysis typically includes financial quantification of post-acute care improvements in each dimension. For example, a partnership with an effectively operated HHA can reduce the number of patients that need to be readmitted to the hospital. Projections can quantify savings from lower hospital penalties for 30-day readmissions.

Network Evaluation

Data-driven network evaluation typically includes the following items.

Identification of needs and gaps in the current post-acute network. Gaps may include care of particularly vulnerable individuals, such as older patients with psychiatric diagnoses and needs, and “pain points” such as long-term ICU utilization. Challenges may include care management of patients with high-acuity clinical conditions, standardization of care pathways, appropriate use and distribution of services, quality and consumer experience, financial and operational performance, and willingness of local post-acute care providers to collaborate. Modality gaps in the current network may include an aligned skilled nursing network and/or other post-acute care modalities. IT connectivity typically is a significant consideration due to the need to monitor results and identify areas requiring continued improvement.

Appropriate patient placement. The objective should be to place patients in the lowest-cost setting appropriate to their conditions, without barriers or delays; achieving this objective requires consistent and comprehensive discharge planning and coordination with post-acute care providers. Care navigators ensure that care planning commences upon hospital admission and that, overall, the patient and family experience, quality of care, and use of assets are optimized. It is important to identify patient and family support needs and to provide education to the family. For example, some families may not be aware that home healthcare personnel can perform many of the functions provided in SNFs, thereby allowing patients to receive care at a lower cost in their homes. The level of success of hospital discharge planning for the right level of care in the right place can be assessed against benchmarks.

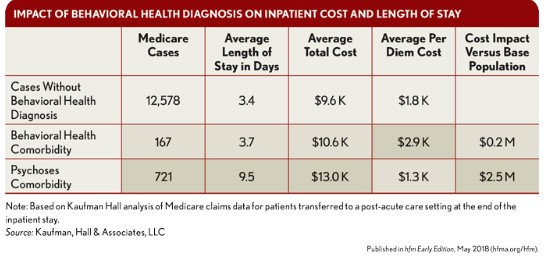

Active management that directs utilization to the appropriate post-acute care setting can yield significant opportunities to reduce post-acute care spending. The exhibit below illustrates how one health system identified the cost differential between patients with secondary behavioral health diagnoses and those without such diagnoses. The former’s cost in the inpatient setting exceeded those of the latter by $2.7 million. In short, organizations can achieve material savings from having the ability to place such high-cost patients in more appropriate settings such as a long-term acute care hospital or SNF, in a timely manner.

Numerous private equity-sponsored companies operate a business model focused on delivering the right care in the right place. In a role similar to that played by a pharmacy benefit manager with prescription drugs, these firms function as post-acute care managers, contracting with hospitals and insurers to coordinate their post-acute care needs. They typically embed care managers and use analytical technology to connect patients to the most appropriate care at a reduced cost. Average costs per member per month for long-term acute care, skilled nursing, and inpatient rehabilitation can be 50 percent lower than the national fee-for-service average. Numerous highly advanced, forward-thinking health systems are achieving such results, as well, through use of care managers and analytical technology.

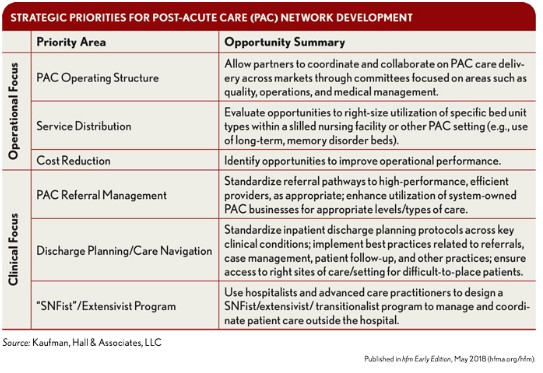

Identification of strategic priorities. An organization can use market, network, and internal fact bases to identify and quantify strategic priorities. In one case, for example, the market assessment and planning process of a health system that owns numerous SNFs and IRFs identified three strategic priorities in clinical and operational areas, shown in the exhibit below. The organization determined it would be particularly important to standardize referral pathways to high-performance providers in post-acute care modalities across the submarkets, and to right-size utilization of specific bed types, such as memory care beds in SNFs.

In any case, expectations of post-acute care partners for matters such as protocols, patient placement guarantees, and communication should be articulated and can be incorporated in alignment agreements.

Strategic priorities must be based on a strong business case that will best position the organization for success under current and proposed value-based care and payment initiatives.

Network Design

Proactive network design and performance management planning builds on the market assessment and evaluation. The first building block involves quantification of the size, scale, and geography required for the health system’s post-acute network. This calculation should be based on current and projected utilization/demand trends, which influence the size and scope of network components.

Network design is further informed by analyses of patient flows, competition, and how competitive dynamics may influence the distribution and strategic position of network components. For example, value-based exposure in the marketplace, consumerism, and managed care design (i.e., Medicare Advantage versus a commercial ACO) will impact utilization of network components.

Regarding distribution and strategic positioning of specific network components, a range of strategic options should be considered. Health systems should not allow their networks to form haphazardly; rather, they should identify priorities and gaps early to direct resources to where they are most needed.

Consideration of Strategic Alignment Options

As with partnership possibilities in all healthcare sectors, a range of alignment options are available to health systems and post-acute care providers. An organization’s overall strategy for improving its post-acute network should be shaped by competitive dynamics in its local market, the strength of the existing post-acute care services, and the extent to which the organization is essential to its market.

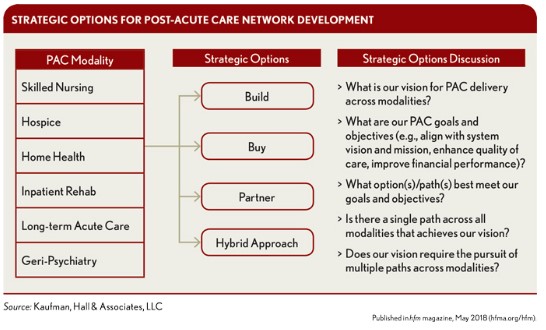

Most health systems will need to pursue a hybrid of arrangements (see the exhibit below). Options include ownership and management of post-acute care assets, joint venture/management services partnerships with external post-acute care providers, development of a preferred/affiliated network, and sale of post-acute care assets to another provider. The broadest possible range of potential partners should be identified, and their capabilities should be evaluated for how they might complement and supplement the health system’s abilities.

Health systems can pursue multiple options simultaneously, depending upon the post-acute business. Owning everything typically is not desirable or even viable. The business case for a health system venture with a post-acute care provider must be based on quantitative and qualitative analyses of the following:

- Geographic coverage and access offered by the post-acute care provider

- The post-acute care provider’s ability to ensure the efficient delivery of required care

- Management factors, such as depth and breadth of the management team

- The strategic-financial impact of a collaborative or ownership arrangement

Whichever alignment option is pursued, these selection criteria will apply.

Ownership options. As previously noted, health systems would be best advised not to pursue ownership of all post-acute care assets. Incentives will change as payment models evolve, but to manage post-acute care utilization in the emerging environment, it is clear that health systems will require an effective home health/hospice business, either through ownership or a joint venture partnership. As appropriate to the needs and conditions of patients, health systems may be able to use home health services to reduce utilization that would otherwise go to a more costly SNF or IRF. Such a capability could create significant value for payers, providers, and patients.

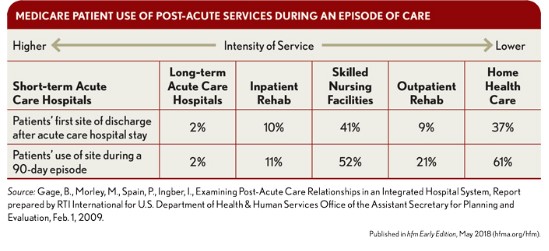

For example, approximately 40 percent of Medicare beneficiaries who are discharged from an acute-care hospital use post-acute services. e One study found that 41 percent of a system’s Medicare patients entered SNFs as the first site of care after hospital discharge, while 37 percent accessed home health services (see the exhibit below). In its June 2017 report, MedPAC notes that Medicare payment per discharge from freestanding SNFs averaged about $16,000 to $22,000 in 2015, whereas the average payment per episode for home health care was about $2,700. Thus, with every discharged Medicare patient who accesses home health services instead of entering a SNF, a hospital could reduce Medicare costs by $13,300 to $19,300.

Many health systems own a piece of a home health business, often through a joint venture arrangement whereby the health system retains a minority interest. When organizations first adopted this approach, the goal typically was to improve the financial performance of the home health business, but with many such arrangements today, the existing business still lacks the operational expertise to deliver services efficiently

The current rationale for ownership is more strategic: Health systems want to control the home health business to ensure they have the intellectual capital and capabilities necessary to reduce higher-cost, facility-based utilization and drive quality improvements and outcomes.

For example, in November 2014, the eight-hospital Allegheny Health Network (AHN), which operated its own home health and hospice assets in western Pennsylvania, entered a partnership with Celtic Healthcare, a comprehensive home health and hospice organization, to form a comprehensive home health and hospice organization. f The two organizations created a fully integrated post-acute service provider, operating under the AHN brand and managed by Celtic’s nationally recognized support service and leadership team. The newly formed joint venture became the second largest provider of home care and hospice services in western Pennsylvania. One year later, a program launched by AHN, Healthcare@Home, announced a 5 percent decrease in hospital readmissions within a month of discharge among AHN’s home care patients—from 19 percent to 14 percent. This improvement yielded approximately $5 million in savings from avoided hospital readmissions. g

Sidebar 2: Own, Partner, or Contract?

Future Action

Post-acute services must be included in the strategic-financial plans of hospitals and health systems going forward. Health systems should perform detailed market assessments and planning to determine which areas of post-acute care can have a material effect on the quality and cost of post-discharge patient care in their communities. Then, through a proactive network design process, they should focus on those areas to develop and maintain aligned post-acute networks. Building a sustainable network involves detailed analyses, coordination of program development and contracting initiatives, due diligence in evaluating potential partners, and exploration of an appropriate range of alignment options. Partnerships with post-acute care providers likely will be the most viable and fiscally smart option health systems pursue over the next decade.

Footnotes

a. For the purpose of this article, post-acute care includes skilled nursing facilities, long-term acute-care hospitals, inpatient rehabilitation facilities, home health care, and hospice and palliative care.

b. Medicare Payment Advisory Commission: Health Care Spending and the Medicare Program: June 2017 Data Book. Section 8: Post-Acute Care. www.medpac.gov/-documents-/data-book.

c. MedPAC. Report to Congress: Medicare Payment Policy, March 2014.

d. Institute of Medicine Variance in Health Care Spending: Target Decision Making, Not Geography. Washington, D.C.: National Academies Press, 2013.

e. Carter, C., Garrett, B., Wissoker, D., “A Unified Medicare Payment System for Post-Acute Care Is Feasible,” Health Affairs Blog, Sept. 28, 2016.

f. Celtic Hospice & Home Health, “Celtic Healthcare, Allegheny Health Network Announce Joint Venture to Combine Home Health and Hospice Assets in Western Pennsylvania,” Press release, Nov. 11, 2014.

g. Liepelt, K., “Health Network Saves $5 Million Through Home Care Program,” Home Health Care News, Nov. 30, 2015.