Lessons Learned from New York State’s Transition to Value

An approach used by the State of New York in promoting the transition to value-based payment (VBP) provides insights for how providers nationwide should approach VBP contracting.

In recent years, New York state has become an incubator for large-scale VBP reform. Driven by the state’s mandate to move managed Medicaid payments to value-based payment, insurers and providers alike are scrambling to develop strategies for this new world order. The shift toward value has been moving across the country as early adopters recognize the benefits. Because New York has one of the first coordinated statewide VBP approaches, the lessons learned there can be applied to the rest of the healthcare industry still considering the shift.

VBP: Defining Elements

Before diving into the New York specifics, it’s important to define value-based payment. A quick search of the term yields multiple varying definitions that demonstrate why there is some confusion among participants. The Centers for Medicare & Medicaid Services (CMS) has defined value-based programs as follows: a

Value-based programs reward health care providers with incentive payments for the quality of care they give to people with Medicare. These programs are part of our larger quality strategy to reform how health care is delivered and paid for.

CMS also notes that it intends for such programs to support its three-part aim—“better care for individuals, better health for populations, and lower cost”—which is based on the Institute of Healthcare Improvement’s often-cited Triple Aim.

For CMS, a VBP program is one that rewards providers based on the quality of care delivered. The strategy typically is focused on primary care. Indeed, in New York, Medicaid health plans can succeed only when they contract total cost-of-care arrangements with their primary care physician groups.

Years ago, Johns Hopkins University researchers defined four pillars of effective primary care that still ring true today: b

- First contact access for each new need

- Long-term patient-focused (as opposed to disease-focused) care

- Comprehensive care for most health needs

- Coordinated care when it must be sought elsewhere

VBP arrangements should foster and reward these characteristics to transform the healthcare delivery system and ensure value is achieved for patients, providers, and payers.

For providers interested in entering a VBP arrangement, it’s important to understand an insurer’s motivations for moving to this approach. Many provider organizations believe insurers are simply intent on reducing fees and pocketing the proceeds, which may have been true in the past. In today’s world, shifting to value requires insurers and providers to work together as partners. If designed correctly, a VBP model can bring benefits to each entity and to the patient.

The New York Approach

In New York, Medicaid payers will be required to pay at least 80 percent of all medical claims in VBP arrangements by 2020, which places unique pressure on both providers and payers. This requirement phases in penalties over the next two years for health plans that are not hitting the goals laid out by the state.

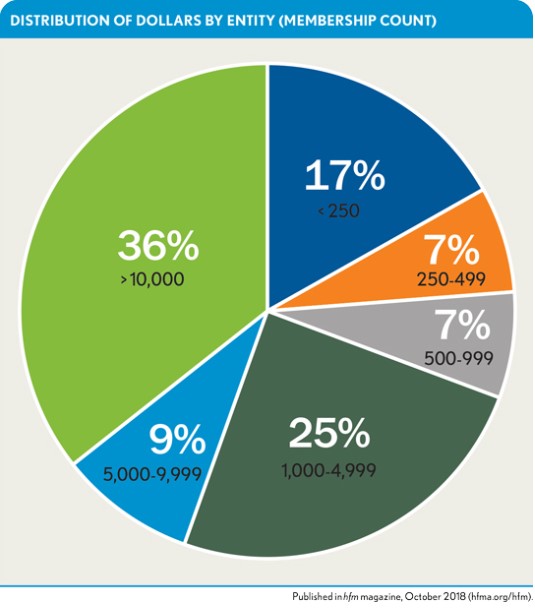

The exhibit below depicts a representative mid-sized health plan’s distribution of total dollars paid to primary care physician groups by the size of the primary care contracting entity. If this health plan were successful at contracting with every primary care physician group that has more than 500 assigned members in total-cost-of-care arrangements, the health plan would still have just 74 percent of the medical expenditures in VBP and fall short of the state’s mandate. For context, this prospect represents around 100 contracts.

To meet the state’s requirement, the health plan would need 90 additional total-cost-of-care contracts with providers who have from 250 to 500 of the health plan’s members.

Now assume that not all 200 primary care physician groups contract with the health plan. This situation would necessitate contracting with some groups that have fewer than 250 of the health plan’s members in a total-cost-of-care arrangement. Aside from contending with the actuarial concerns with provider groups that small, the health plan also would need to negotiate and sign many more deals. The health plan in this example has 2,100 primary care physician groups with fewer than 250 assigned members, each representing less than 1 percent of all the health plan’s medical expenditures.

Consider the ramifications if one of the health plan’s primary care physician groups with 5,000 to 10,000 assigned members were to decide not to enter into a VBP contract with the health plan. Losing a provider group with 7,500 assigned members, for example, would represent a loss of 1.5 percent of the health plan’s total paid dollars. To recover from such a loss and still attain the state’s VBP goals, the health plan would need to contract with an additional 26 providers, each having fewer than 250 assigned members. In other words, this health plan would need to re-contract its entire primary care physician panel on total-cost-of-care arrangements to avoid falling short of the state’s goals and being penalized 1 to 2 percent of its premiums for members not covered under the arrangements.

For most health plans, such a penalty would amount to millions of dollars. Moreover, this scenario is all too common, and it’s a challenge faced by every health plan in New York. Although the state’s objective is to encourage innovation in VBP, the strict goals and tight timeline are forcing a relatively homogenous environment for VBP. Therefore, to be successful in such an environment, providers must clearly understand and define the VBP parameters with which they’re willing to contract, including total-cost-of-care financial targets—a point that is relevant to providers not only in New York, but also nationwide.

Contracting Challenges

The New York scenario creates unique leverage for providers as they consider engaging in VBP arrangements. Although New York has an accelerated approach to value, providers in other markets also can benefit from such leverage as health plans move toward value-based contracting to reduce costs and improve quality. Payers will need to look at alternative payment models as they grapple with sustainability. High-performing primary care physician practices should approach payers to share in the savings their practices generate, with both entities benefiting as the patients receive more comprehensive care.

Although most health plans face ongoing challenges in contracting for VBP with the largest primary care physician groups, some are focusing on how to negotiate a sufficient number of contracts with small groups to reach New York’s goal for contracting under VBP models.

The problem is that, although the health plans surely will need primary care physician groups with fewer than 250 members to reach that goal, panels that small are not suited on their own for VBP contracts. Their small cell sizes make it impossible for them to accurately set and measure value targets; beyond the actuarial challenges, the logistics for both health plans and provider groups this small become unsustainable. Evidence suggests 500 members is the minimum threshold for such practices to succeed under VBP contracts. Smaller provider groups simply lack the legal resources to entertain every VBP contract with every health plan, and health plans have all too often not accounted for the host of resources required for re-contracting an entire primary care physician network.

Contracting Options

Two potential options available to providers for addressing these challenges are medical ecosystems and consolidation.

Medical ecosystems. Through data analysis, health plans can bring together small primary care physician groups with similar practices in terms of total cost of care and utilization. Although these groups may not be geographically near one another, the similarity in practice patterns allows the health plan to reliably set and measure value targets across the entire ecosystem. Each provider in that ecosystem has an incentive to help the ecosystem meet or exceed those targets because the plan is required to share a portion of those savings with the contracted providers. This approach creates a critical mass necessary for VBP, and it could help to reduce further consolidation in the marketplace. These small provider groups have the potential for upside savings with no risk and minimal overhead. The biggest hurdle in this approach is that health plans will need to contract individually with each entity.

Consolidation. Large providers have the option to consolidate the market by either purchasing smaller primary care physician groups or granting contractual relationships with them. Given the relatively small window remaining to meet New York’s objectives, the latter is likely a better option. Consolidation gives providers contracting leverage with the potential to drive costs up rather than down, which is an unintended consequence of the state’s strategy. Health plans and providers working together, however, can set up programs that manage cost trends, improve quality of care for their population, and share in the recognized savings. This scenario places providers participating in value-based contracts in a unique position of leverage: Health plans will be penalized for not reaching the state’s value goals, but providers face no penalty.

Large providers with existing independent physician associations (IPAs), for example, should consider approaching smaller primary care physician groups to join their IPAs. Risk-adjusted analytics will help them understand which of the smaller groups are a good fit for the IPA.

For example, an IPA may elect to approach only primary care physician practices that effectively manage total cost of care. On the other hand, high-performing IPAs may consider inviting primary care physicians who are struggling with doing so, because they represent the greatest opportunity for improvement and shared savings. This point underscores the critical need for health plans and providers to partner around VBP. Providers lack the data to effectively understand the longitudinal performance of their own populations, much less that of potential partners. Health plans have the data and, often, the analytic tools to make these data available to providers. In New York, health plans and providers working together can help existing IPAs expand to reach the state’s goals and benefit from shared savings. Across the nation, if designed appropriately, this approach can continue strengthening the primary care physician infrastructure to improve care for individuals and reduce the overall burden on the system.

Financial and Quality Measurements in VBP

VBP programs generally center around cost and quality components. In fact, New York requires VBP contracts to include both components to qualify as VBP Roadmap compliant.

Financial components. The New York State VBP Roadmap requires health plans to contract in one of three financial tiers:

- Level 1—shared savings, upside only

- Level 2—shared savings and risk

- Level 3—full risk

Although some mature shared-risk and full-risk contracts do exist, many health plans have been most successful at closing the Level 1 goal. Given the general lack of experience in VBP, it’s not surprising that providers are reticent to assume any of the risk for their population. Regardless of the level, there are two primary models for measuring cost performance: total cost of care and medical loss ratio (MLR).

Under the total-cost-of-care model, a VBP entity is measured against a predetermined per-member cost. The health plan and VBP entity agree upon a per-member-per-month (PMPM) average cost for a given performance period.

Under the MLR approach, a target ratio (i.e., 85 percent) is set rather than PMPM cost. The underlying principles and decisions to achieve the target MLR are essentially the same as those used to calculate a target total cost of care.

Several decisions must be negotiated for both the target and measurement. The following are key questions that must be addressed:

- How will the total-cost-of-care target be calculated and measured over time?

- Will outlier costs be excluded from targets and measurement?

- Will stop loss be applied to account for outlier costs? If so, will the health plans charge the provider a reinsurance?

- Are historical trends used to project future expenses?

- Will risk adjustment be included?

Health plans have a strong advantage over providers in this conversation. Tracking total cost of care over time is a core competency for them, and they have data on hand to do so.

For this reason, providers should require transparency. Many providers require claims data prior to signing VBP contracts, but they then struggle to understand and act on the information. Regardless of the mechanism, the provider must receive the information necessary to thoroughly understand how target costs were calculated, including longitudinal claims data for the provider’s assigned population.

Once financial targets are set, the health plan and provider must agree on how the targets will be measured. There are two primary decisions in this regard.

The first decision is whether the providers participating in the VBP contract will be measured against their historical performance (attainment) or against a standard benchmark (achievement), such as a network average. To inform this decision, providers should request a model of each scenario. Providers that struggle to manage total cost of care tend to be more successful under an attainment model where they are given incentives to improve performance over previous periods. Providers that have demonstrated success in managing total cost of care generally prefer an achievement model, because there is less room to improve beyond their previous experience.

The second decision is whether to employ risk adjustment in measuring financial performance. Risk adjustment increases the financial targets for providers managing more complex populations and reduces the target for providers managing less complex populations. Because risk adjustment may prove to be an essential component in VBP success, providers would be well-advised to require it in the measurement of financial performance. This recommendation is particularly relevant for hospital- and clinic-based primary care practices that tend to care for more complex populations.

Health plans benefit from risk-adjusting VBP contracts because risk adjustment ensures the payment of incentives has been earned by the providers. Risk adjustment also motivates primary care groups to engage their members and accurately code all acute and chronic conditions. For such a group, such accurate coding guarantees an accurate risk score and measurement of financial performance. Improvements for the health plan include the accuracy of the overall risk score and premium payment by the state. The same holds true for VBP arrangements in the Medicare Advantage space.

Quality components. Although New York state recommends quality measures for VBP through its Clinical Advisory Groups, the state allows for considerable leeway in the selection of these measures. Most health plans rely partially or entirely on the National Committee for Quality Assurance’s Health Effectiveness Data and Information Set (HEDIS) measures, which are calculated from claims data. There’s little evidence to support a correlation between HEDIS and Triple Aim objectives, but it’s not surprising that health plans often select these measures because the state continues to include them in the health plans’ quality score calculations and financial bonuses. Other measures are being developed that are expected to correlate more closely with the Triple Aim objectives of reducing cost, improving health, and improving patient experience.

Providers need to understand their own strengths and weaknesses related to quality before entering into VBP arrangements. Because financial incentives are generally tied to quality triggers, the provider should agree to metrics that it knows it can effectively impact.

Conclusion

The New York Department of Health has created a mechanism to drive contracts between health plans and providers into VPB, and it aims to accomplish this transition through setting aggressive goals and instituting penalties on health plans that do not achieve those goals. With this approach, the state will move the needle on VBP and likely improve costs and quality for the Medicaid population. New York also anticipates that this approach will be a catalyst to move the commercial and Medicare populations into VBP. Although the VBP arrangements that emerge from New York’s approach will initially look similar, the arrangements are expected to evolve over time, allowing for more creativity.

The New York state mandate clearly is unique, but all providers can benefit from the lessons learned by peer organizations in New York. Across the country, health plans are looking to VBP contracts to reduce costs and improve quality. It’s important that providers understand this motivation and recognize that health plans need to partner with providers in their networks to remain sustainable. Often, this partnership takes the form of a VBP arrangement. Providers should be prepared to enter VBP arrangements of mutual partnership, structured so that both the payer and provider can be successful.

Providers have leverage that can be used to their advantage in negotiating partnerships with health plans. A provider can enhance that leverage and set itself up for considerable shared savings by creating a network of high-performing primary care physicians. A provider should target health plans whose visions align best with its own, building a critical mass of membership with those health plans and proactively seeking VBP arrangements.

In evaluating health plans for VBP partnerships, providers should look to those health plans that are willing to share longitudinal claims data on their populations. Providers can use this information to understand their past performance along with strengths and weaknesses. Although New York health plans find themselves in a position of having to share data to meet the state’s goal, any health plan interested in being a good partner should be willing to make data accessible, because providers cannot effectively manage a population without access to longitudinal information on that population.

Partnerships require give and take from both parties. Providers must demonstrate they have implemented strategies to effectively manage their populations. In particular, primary care physicians must provide access and total-person comprehensive care with coordination of care outside of their practice. Large, high-performing primary care physician practices are uniquely positioned to become valuable partners in the pursuit of the Triple Aim. Working together, insurers and providers can share in savings while reducing overall cost and improving the patient experience.

Footnotes

a. CMS, “What are value-based programs?, ” www.cms.gov/Medicare/Quality-Initiatives-Patient-Assessment-Instruments/Value-Based-Programs/Value-Based-Programs.html, page last modified on July 25, 2018.

b. Starfield, B., Shi,L., and Macinko, J., “ Contribution of Primary Care to Health Systems and Health,” The Milbank Quarterly, September 2005.