Find the latest numbers and events shaping healthcare finance

MedPAC backs Medicare changes to increase hospital pay in 2021 by up to 3.3%

Congress’s leading Medicare advisers want hospitals to garner a 2% rate increase and up to a 0.8% quality bonus for 2021.

The Medicare Payment Advisory Commission (MedPAC) recently gave preliminary approval to a recommendation that CMS increase Medicare hospital inpatient and outpatient rates by the statutory 2.8% but use a portion to fund a new value-focused payment system. If Congress does not create such a system, then CMS should default to providing the 2.8% rate increase, the commissioners said.

MedPAC’s recommended Hospital Value Incentive Program would replace four existing Medicare hospital quality payment programs:

- Hospital Inpatient Quality Reporting

- Hospital Readmissions Reduction

- Hospital-Acquired Condition Reduction

- Hospital Value-Based Purchasing

Eliminating the existing quality programs would remove associated cuts that amount to 0.5% of payment, bringing the potential hospital payment increase to 3.3%.

Gap between expenses and revenues narrows for community hospitals

Community hospital expenses inched closer to revenues during a recent five-year period, according to the latest industry survey.

Among the 5,198 community hospitals surveyed, total net revenues (including non-patient-care revenue, both operating and nonoperating) in 2014 outpaced total expenses (including non-patient-care expenses) by 9%, or $75 billion. But by 2018, revenues were only 8%, or $83 billion, higher than expenses. The findings were included in the American Hospital Association’s recently released compendium of 2018 data collected directly from the 6,146 U.S. hospitals.

“Expenses are increasing faster than net revenue, which suggests hospitals aren’t financially viable long-term unless this trend reverses,” said Chad Mulvany, a director of healthcare financial practices with HFMA.

Another key development was the narrowing gap between inpatient and outpatient revenue. Inpatient revenues were $206 billion, or 16%, higher than outpatient revenues in 2014. But by 2018, inpatient revenues were higher by only $55 billion, or 3%.

“This more or less confirms the trend that everyone’s talking about,” Mulvany said. “While most places have relatively good inpatient costing systems, hospitals need to do a better job on costing across the range of outpatient settings.”

Commissioner: Increased FTC scrutiny of hospital deals coming

Federal regulators plan to challenge “a number” of ongoing hospital deals and are considering widening their net to include more such transactions, a commissioner said.

Christine Wilson, a member of the Federal Trade Commission (FTC), said at a Jan. 16 healthcare policy event in Washington, D.C., that the agency is focused on hospital deals and has reexamined its past approaches.

“We are intent on challenging every hospital merger that’s going to produce anti-competitive effects,” Wilson said at the gathering of the Council for Affordable Health Coverage. “We have a number in the pipeline right now that we are looking at.”

The agency also may increase the scope of hospital mergers and acquisitions that it challenges in federal court if an ongoing review of data indicates completed transactions have reduced consumer choice.

“We’re conducing more retrospectives to make sure that we are making the right calls,” Wilson said. “And if we sort of need to change the threshold at which we challenge those deals to preserve competition for consumers, we will do that, absolutely.”

Prominent tracking companies differ on their assessment of 2019 hospital deal volume. For instance:

- Kaufman Hall found total announced deals remained steady in 2019, with 92 transactions, compared with 90 in 2018.

- Ponder & Co. concluded that announced transactions plummeted to 85, or almost 25% fewer than the 116 it found in 2018.

New Medicaid waivers draw concern from hospitals, optimism from others

Hospital advocates were quick to denounce a new Medicaid waiver option that critics liken to “block grants,” while others see it providing benefits, such as increasing the number of states that expand Medicaid eligibility.

Key components of CMS’s Healthy Adult Opportunity demonstration include:

- Establishing spending targets either based on annual total expenses or on a per-enrollee basis

- Waiving requirements for retroactive coverage

Chip Kahn, president and CEO of the Federation of American Hospitals, said the waivers will create roadblocks for patients to access care and will threaten Medicaid coverage for millions more.

But Matt Salo, executive director of the National Association of Medicaid Directors, said that “this could be an attractive option for red states to do the Medicaid expansion” allowed under the Affordable Care Act.

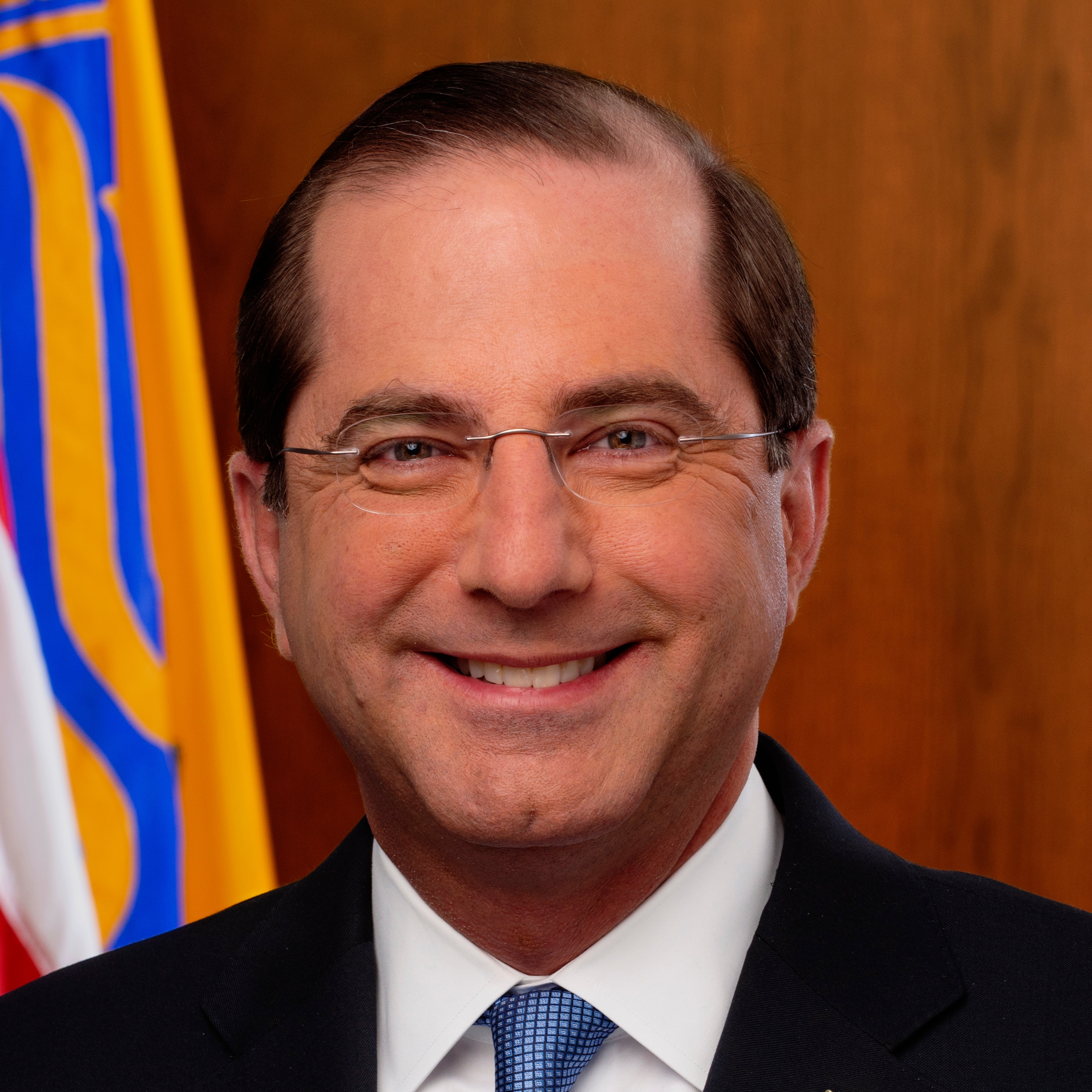

HHS Secretary Azar urges healthcare providers to watch for patients who have traveled to China

As part of the federal response to the novel coronavirus, the Trump administration is urging providers to check whether patients have traveled to China, where the outbreak started.

Alex Azar, secretary of the Department of Health and Human Services (HHS), outlined various steps the administration is taking in response to the first U.S. cases of the virus (2019-nCoV) and urged vigilance by the provider community.

“Healthcare providers should be on the lookout for patients with travel history to China, especially Hubei Province, and relevant symptoms,” Azar said.

In February, the Centers for Disease Control and Prevention updated its guidance and resources for U.S. healthcare personnel working in environments possibly exposed to the novel coronavirus.

Trump administration details hospital spending plans in FY21 proposed budget

In what could be a 2021 preview if Republicans take control of Congress and retain the White House, the Trump administration included a range of sweeping healthcare policy proposals targeting hospitals when it released its proposed budget Feb. 12.

Although the current Congress may ignore the budget, the proposals could come back as last-minute funding sources for big-budget packages or as part of major healthcare policy changes in the next Congress.

The budget includes policies that would directly affect hospital revenue in widely varying ways, including:

- Limiting uncompensated-care bad debt payment increases to the consumer price index for all urban consumers ($87.9 billion in savings over 10 years)

- Requiring site-neutral payments between on-campus hospital outpatient departments (HOPDs) and physician offices for services, such as clinic visits, commonly provided in non-hospital settings ($117 billion in savings)

- Eliminating Medicare bad debt payments for disproportionate share eligible hospitals, exempting rural hospitals ($33.6 billion in savings)

- Requiring all off-campus HOPDs to be paid under the Physician Fee Schedule ($47.2 billion in savings)

- Allowing increased Medicaid copayments for nonemergency use of emergency departments ($1.8 billion in savings)

How Cigna aims to limit healthcare-spending increases to mirror the consumer price index

Cigna officials say they are on track to reduce increases in total spending on healthcare delivery to the increase in the consumer price index (CPI).

Cigna continues to aim to reduce spending increases to CPI by the end of 2021, although they are not there yet, executives said recently.

A key to expanding such savings to all enrollees will be to “wring low-value care out of the system,” said John Keats, MD, national medical director for affordability and specialty partnerships with Cigna.

The low-value care that the health plan will target includes:

- Diagnostic services and imaging for low-risk patients prior to surgery

- Population-based vitamin D screening

- Prostate-specific antigen screening in older men

- Acute imaging for lower back pain in the first six weeks in patients without neurological symptoms

- Use of branded drugs instead of generics for specific drugs or drug classes