Getting the full value out of a transaction/acquisition plan

As the healthcare industry continues to experience robust consolidation, health system leaders face mounting pressure to aggressively seize growth and scale opportunities that could help meet organizational strategic goals, such as enhancing a competitive profile, adding more clinical capabilities or creating a better value proposition for healthcare buyers. With opportunities including acquisition or divestiture of individual hospitals, health systems and physician practices, the mergers and acquisitions landscape has become increasingly complex. Additionally, shrinking margins and changing payment mechanisms put greater pressure on healthcare leaders to realize the expected value of a transaction through strategic, operational and financial alignment.

Deconstructing the conventional transaction framework

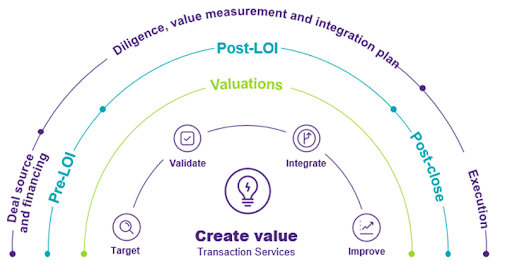

Most transactions require organizations to execute the following four steps to take the project from conceptualization to implementation (See Figure 1 for a visual representation).

- Deal thesis. “This phase begins prior to an organization exploring specific acquisition targets,” said Steven Sparks, a partner in Grant Thornton’s IT Integration practice. “It involves identifying the kind of asset you want to acquire and then developing affiliation objectives to guide potential transactions. As part of this process, you should define the returns your organization needs to see from a transaction, or deal thesis, and clarify and validate any foundational assumptions about the items that must be present and true to achieve your organization’s goals.” This step also involves forecasting to reveal any risks to an overall acquisition strategy or hurdles that should be addressed.

- Due diligence. Once an organization identifies a potential asset, it’s time for due diligence to both validate the deal thesis and identify any unknowns that may impact whether the transaction makes sense. “This step is all about verifying the asset’s current financial, technological and operational situation and assessing risks,” said Sparks. “As part of this phase, you must closely examine all aspects of the entity being acquired and make sure there are no red flags or areas that can either affect the purchase price or raise concerns after the deal has closed.” Organizations should review the asset’s financials and tax returns, operational procedures, regulatory compliance history, staffing and credentialing processes and technology systems. Getting a sense of the organization’s culture is also wise to make sure that any cultural differences between the two entities can be bridged.

- Integration/transition planning. After due diligence is complete and the transaction agreement nears signing, the task of preparing for taking control begins. Organizations should develop a framework that outlines the integration strategy and what is required to close the deal, laying the foundation for day one readiness. Areas to address in this step include defining interim operating processes, methods for ensuring business continuation and how to manage stakeholder expectations.

- Integration implementation. This phase begins after closing when the two entities start executing on the integration plan. “A lot of the work during this step involves monitoring pre-established metrics that demonstrate success and reviewing issues that emerge from the data,” said Stephen Thome, principal for Grant Thornton LLP Health Care Transaction Services.

“The key value drivers that made the deal thesis and financial projections work should become the key performance indicators to track transaction value as the deal becomes operational.”

Figure 1. The Transaction Lifecycle

Source: Grant Thornton

Key success factors

Although the previously mentioned steps give a sense of a transaction’s stages, the nuances within these phases are what make the difference between a lucrative deal and one that falls short of expectations. Organizations must execute the steps in a way that cost-effectively meets their strategic objectives while mitigating risk and strengthening operations. Hospitals and health systems that do this well tend to embrace some key best practices:

- Make sure you have a comprehensive communications plan. There are a multitude of stakeholders involved in a healthcare merger or acquisition, ranging from physicians and nurses to finance and business staff to patients and the community. Organizations must think through how they’re going to communicate with the various parties, so each group knows what to expect and how the change will impact them. This is especially important for employees: They want to know what the transaction means for their jobs. “Communications and engagement activities must provide clarity while appreciating that this could be a stressful time for employees,” said Jennifer Morelli, a principal in Grant Thornton’s Business Change Enablement practice who advises clients on the cultural aspects of mergers and acquisitions. “Engaging with clinical staff and other employees is critical to ensure they are well-informed, well-supported, and feel valued throughout, and well past, the transaction.”

- Don’t underestimate the intricacies of integrating IT. Seamlessly joining technologies is one of the biggest risk points of a transaction. Misjudging the complexity of this aspect can derail a project, preventing it from reaching its full potential. “The earlier you identify risk points the better,” said Sparks. “The central task of due diligence is understanding the systems in use today to deliver care and execute business processes because it helps you get in front of possible issues and have greater clarity around how the execution is going to work post-closing.” Reviewing how the asset’s systems are currently enabling existing business processes is the first step. How are those systems enabling the clinical and business processes of the revenue cycle, supply chain, human resources, financial forecasting, clinical operations, scheduling and so on? “Integrating electronic health records (EHRs) is particularly challenging and important,” said Andrea Mancaruso, vice president of IT strategy at Jefferson Health and a former nurse. “This gets at how care is delivered and how clinicians work while also contributing to the patient experience.

“Basically, you want to expose what could go wrong, or what I refer to as the gotchas in a transaction,” said Sparks. “Consider the example of a health system that was acquiring a hospital, which had the same industry-leading clinical and revenue cycle technology system. At first glance, the technology integration piece seemed straightforward. However, after digging deeper and understanding how the target uses its clinical systems, it became clear that the clinical system in the organization being acquired was highly customized and would present significant challenges in merging data and rationalizing the two systems. Knowing this upfront allowed the acquiring entity to appreciate the complexities and costs of the IT integration and plan accordingly.”

- Organizations should remain vigilant to IT challenges after the merger takes place. “When you have two ways of doing the same business function, such as IT, you must find opportunities to rationalize them to achieve synergies and value,” said Sparks. “While you can identify many risks upfront, there are some you will only uncover post close when you’re making the merger a reality.”

- Manage physician relationships. Physicians drive volume at a health system, and so it is critical that the medical staff understand the reasons behind the acquisition and the advantages of it. “Having a plan to garner their buy-in specifically is important: otherwise the project may be doomed from the start,” said Thome. “Finding a physician champion or group of champions that can promote the benefits of the merger can be beneficial because they can communicate expectations with peers in a way that encourages cooperation and collaboration.”

- You need a team of experts. Using external advisers provides acquirers with timely and knowledgeable advice on deal value and risks, as well as guidance on how to execute the transaction. “Coordinating legal and business diligence not only helped us better understand the risks we were facing, we were able to negotiate and construct the definitive agreement more wisely and efficiently,” said Cristina Cavalieri, chief legal officer of Jefferson Health. Or, as Jennifer Schwartz, general counsel at Christiana Care Health System said: “I have worked as in-house counsel for both buyer and seller. Integrating all the various viewpoints — finance, operations, legal risks and diligence — is essential for achieving a positive outcome for our health system, care givers and patients. It is truly a team sport.

This article is based on a November 2019 webinar and input from health system executives.

Grant Thornton

Our clients take advantage of our collective knowledge, gained from long experience in and with healthcare organizations. More than 400 Grant Thornton health care professionals deliver solutions focused on growth, transformation, and protecting core assets.