Growth in healthcare spending garners little attention

Growth in U.S. healthcare spending has become a trend, according to recent statistics. This trend is noteworthy in itself, but what’s more noteworthy is how little attention it has attracted.

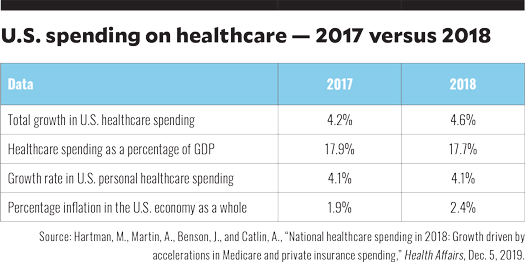

According to available data, total healthcare spending in the U.S. grew faster in 2018 than it did in 2017 — 4.6% versus 4.2% — but at the same rate as in 2016.a This growth rate resulted in total health expenditures in the U.S. of $3.6 trillion. However, because the nation’s economic growth rate is robust, the actual share of GDP going to healthcare declined — from 17.9% in 2017 to 17.7% in 2018.

Possible reasons for unconcern

The acceleration in healthcare spending may have garnered little attention because of its occurrence amid strong economic growth, with record low unemployment — making consumers less concerned about healthcare spending than they likely would be in the face of economic uncertainty. It may also reflect an understanding that a substantial portion of the increased growth represents the introduction of the insurance tax, which was implemented in 2018 as a strategy to fund a portion of the Affordable Care Act, after having been postponed for a year.

Personal healthcare spending remains constant

The growth rate of personal healthcare spending — that is, healthcare spending on goods and services — remained at 4.1%. This component accounts for the largest share of healthcare spending and includes spending on hospital care, physician care and clinical services, home care and nursing home care. Spending growth rates for most of the components remained at about the rates from the previous year. Whether that should be seen as an acceptable outcome is debatable. As long as the spending growth rate in healthcare is less than the growth rate of the economy, especially if the growth rate for the economy remains strong, healthcare spending is not causing additional stress in the aggregate. Components of spending growth may deviate from that generalization.

2 areas to watch

At least two growth rate areas should be regarded as raising potential concern:

1. Medicare Part A Trust Fund. The Medicare Trust Fund is predicted to run out of funds by 2026. The use of the Trust Fund mechanism, financed by a portion of the social security wage tax and the Medicare tax on high-income individuals, is in part an accounting gimmick, but one that is an event-forcing strategy because the fund cannot pay for hospital care and other Part A expenditures if it is depleted.

2. Retail prescription drug spending. Another area of concern is higher growth rate in retail prescription drug spending in 2018 than in 2017 — 1.4% in 2017 and 2.5% in 2018. Nonetheless, this concern is tempered by the fact that the growth rate in both years was substantially less than the growth rate in healthcare spending overall.

Cause of spending growth

The primary reason for the quickening growth rate in spending is also interesting to note. The overall increase in spending on medical care was largely driven by the growth rate in medical prices, despite a slower growth in the use and intensity of healthcare goods and services. Slightly more than half (53%) of the 4.1% growth in the per capita spending was caused by medical price growth, and only 1.3 percentage points of that growth was due to use and intensity increases.

The higher medical price growth is in part attributable to a faster growth in inflation in the economy as a whole (2.4% versus 1.9% the previous year). In addition, the price growth rate for the medical-specific sector declined less in 2018 than it had in 2017. Taken together, even though the medical price growth for 2018 was the fastest it has been since 2011, at 2.1%, it was still much slower than the average rate during the period of 2004-07, the run-up to the period right before the 2008 recession. And it was the same as during the slow spending growth period experienced during 2009-13.

Prospects for the future

So what will happen going forward? So far, it seems likely the drivers of the current slight increase in spending growth are the health insurance tax going into effect and the small uptick in retail prescription drug spending, as suggested. Add to that the possibility of increased healthcare spending in the five states that expanded their Medicaid coverage, which could be offset, however, by slower spending associated with the removal of the mandate penalty and any drop in insurance coverage that may be associated with it.

In general, however, so long as the economy and economic growth remain robust, healthcare spending growth rates are likely to remain under the radar as far as the public is concerned. Should that change, we would likely see a return to the nation’s intense focus on healthcare spending, and particularly increases in medical prices.

Footnote

a. Hartman, M., Martin, A., Benson, J., and Catlin, A., “National healthcare spending in 2018: Growth driven by accelerations in Medicare and private insurance spending,” Health Affairs, Dec. 5, 2019.