Implications of the HFMA-GHX study of risk-based contracting

A December 2020 HFMA study assessing the outlook for alternative payment models (APMs) reinforced earlier findings suggesting that support for the principles of value-based payment is strong among the nation’s hospitals.

The simple fact that two thirds of the optimists in the GHX-sponsored study, whose findings are reported on the previous pages, attribute their current levels of success to planning and preparation points to a widespread continuing commitment to the value focus. This finding harkens back to a key finding in the initial HFMA-GHX study published in April 2020, which found that organizations having the most-developed capabilities required for successful risk contracting also tended to be those with the most revenue at risk, both currently and in their five-year projections.a

Another implication of the December 2020 research is that a combination of two factors may be holding back those organizations that lack the optimism of the first group of respondents: They are simply averse to taking on risk, and they see no reason to move forward with risk contracting if they don’t have to do so. For these organizations, the benefits of value-based care may seem murky, at best. And they could benefit from clear examples of the successful pioneers in value-based care to become more receptive to taking on risk.

Part of the challenge may be that fee-for-service is such a known quantity, while value-based payment is far from a unified and fully coherent concept. That point was highlighted by Kevin Roberts, MBA, CPA, executive vice president and CFO for Geisinger in Danville, Pennsylvania, who shared insights regarding his organization’s long-standing success with value-based payment.

“The exploration of alternative payment methods seeks to be innovative,” he said. “Yet the payment models include the traditional fee-for-service payment, with a back-end reconciliation, which brings with it considerable frictional costs to the process. That is not terribly innovative. I think we really need to come up with a more efficient approach and at some point land on fewer as opposed to potentially hundreds of different payment models.”

That said, the situation has not deterred Geisinger, which owes its long-term success to ownership of a health plan, according to Roberts. “Our commitment is based on our research and premise that when our patients are also our members, they receive better care, the cost is better and the overall quality is better,” Roberts said. “The result is a better patient experience. That’s what our research has shown.”

Two additional findings of the December 2020 research have implications that warrant closer attention.

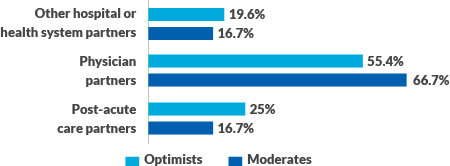

Focus on physicians. Notably, considerable majorities of respondents who were either optimists or moderates believed efforts to promote collaboration and cooperation among APM partners need to be focused first and foremost on physicians. These organizations recognize that physicians are the engine that drive APM success.

Primary focus for improving collaboration and cooperation among partners in alternative payment models (APMs)

Survey question: To what extent do supply chain partners, both internal and external, play a role in helping you succeed under risk-based payments?

Using data analytics to understand physician performance is an important capability for a health system seeking to optimize performance under value-based payment contracts.

Donna Littlepage, MBA, senior vice president, accountable care strategies, Carilion Clinic in Roanoke, Virginia, underscored the importance of data analytics in driving success under risk-based contracts, in general, but she also underscores the important role of analytics for engaging physicians.

“We’re looking at data about the individual physicians and who’s performing best relative to what you would hope they would do with their patients, and who could use a little more guidance on what maybe they could do better,” said Littlepage. “I’m probably in a little better place than some other groups in this area, because most of our ACO physicians are employed. So from a physician perspective, we have good communications with them and opportunities to work directly with them.”

Ensuring physician leadership is part of this process is important, said Littlepage. “I lead our population health work as a dyad partnership with Dr. Michael Jeremiah, the chair of family and community medicine for Carilion Clinic. He has over 140 primary care physicians reporting to him, so you get a lot of collaboration that way. He designs his scorecard for his department to match up with the things we’re trying to do, and he creates guidance for the physicians through that scorecard.”

Steve Oglesby, MBA, CFO, vice president and treasurer for Baptist Health in Louisville, Kentucky, also emphasized the importance of physician leadership for achieving the widely accepted goals of value-based care: “Our goals are to improve the population’s health, to improve patient satisfaction in the way we deliver the care and the way they can access that care, and to reduce costs. And to accomplish those goals, you need to get everybody in the organization involved; it has to be physician led. And you need alignment of incentives.”

These principles are well-reflected in Baptist Health’s leadership structure. “Two of our C-suite representatives are physicians,” Oglesby said. “Importantly, one of them is our chief clinical integration officer, and he’s also the president of our medical group. So the leader of clinical process in our medical group is a physician. And the other is our strategic officer. So our strategy for the future — what we call ‘creating the next generation health system’ — is led by a physician because we know our future will be driven by our physicians and mid-level providers.”

Roberts similarly stressed the critical role physician leadership plays in achieving success under value-based payment arrangements, citing the importance of physician leadership in Geisinger’s owned health plan: “Keep in mind, 85% of the costs are medical costs. Physicians are in the best position to understand and relate to their physician and other provider counterparts on how to best deliver care to the patient and do that in the most efficient and effective way.”

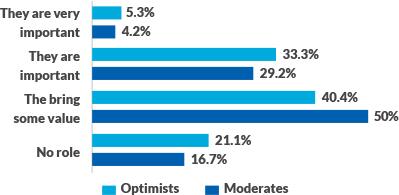

Role of supply chain partners. Both optimists and moderates tend to see a role for supply chain partners, internal and external, in helping drive success under value-based payment.

Perceived role for supply chain partners in alternative payment models

Survey question: To what extent do supply chain partners, both internal and external, play a role in helping you succeed under risk-based payments?

Karen Conway, vice president, Healthcare Value, for GHX, associates the heightened role of the supply chain with several other findings, from the impact of the pandemic to the trend toward a more clinically integrated supply chain.

“With COVID-19, clinicians and supply chain leaders had to work in a highly collaborative manner to quickly identify clinically acceptable alternative supplies in the wake of critical shortages,” explained Conway.

Even before the pandemic, she said, supply chain leaders had been supporting physician-led care redesign efforts by providing data on the variation in physician product utilization, and associated quality and operational measures such as length of stay, infection rates, readmissions, procedure time, product price and, to the extent possible, revenue and total cost of care.

By linking data in the electronic health record (EHR) and its enterprise resource planning (ERP) system, Duke University in Durham, North Carolina, provides physicians with data on variation in associated costs and quality measures and offers suggestions for improvement. The university’s president, Thomas Owens, MD, has said, “Supply chain leadership should play a key role in clinical variation management by creating partnerships with clinicians, operators, analytic teams and finance.”b

Oglesby pointed to the supply chain as a key component in Baptist Health’s strategy.

“What we’ve developed within our supply chain world is not just people to deliver supplies and get them there on time and what the doctor wants,” he said. “We’ve developed an analytics team. And what they bring is an expertise on supplies and implants and other items that physicians value. These teams look at how we can we get the same quality or better quality and outcomes at a lower cost. So they are bringing this information to physicians and allowing them to make these kinds of decisions. It sends a powerful message to physicians that the health system is providing them with the data that they need to make decisions, instead of telling them what to do.

This analytic team is one of two teams that help to inform physicians. “The other group of analysts we bring in front of these physicians is what I could call our cost analysts,” Oglesby said. “They are the ones who are slicing our service line data down to the physician level, looking at care variation and saying, OK, this doctor is doing this, and here’s why. Then they drill down and show the physicians, and can determine if the variation is due to the cost of an implant or it’s due to other preference items, or if something else is causing the variation. And then they’ll work with the vendors. This is another area where the supply chain is important, because we can integrate cost data with outcome data.”

For additional comments about key success factors for APMs and risk contracting, see the online sidebar accompanying this article.

Footnotes

a Reese, E.C., “Survey: Providers have work to do on the journey to value,” hfm, April 2020; Examples of these capabilities include care coordination across care settings, application of business intelligence and analytics to reduce variation in care, physician engagement in risk-management activities and clinical pathway redesign.

b AHRMM, 2018 AHRMM CQO Report on the Clinically Integrated Supply Chain, August 2018.

About the HFMA-GHX survey

Among organizations reporting numbers of beds:

- 38.4% have fewer the 500 beds.

- 33.3% have between 500 and 2,000 beds.

- 15.0% have between 2,000 and 5,000 beds.

- 13.3% have greater than 5,000 beds.

Among respondent reporting total physicians:

- 52.5% employ more than 300 physicians.

- 12.5% employ from 100 to 299 physicians.

- 35.0% employ fewer than 100 physicians.

Among respondents reporting annual net patient service revenue (PSR)

- 27.9% reported PSR exceeds $3 billion.

- 37.7% reported PSR is between $500 million and $2.9 billion.

- 29.5% reported PSR in the range of $100 million and $499 million.

- 4.9% reported PSR is less than $100 million.