Return on Analytics: Addressing the ‘Signals’ in the ‘Noise’

Investing in data analytics is a strategic imperative for every provider organization in today’s data-driven world of health care. But understanding the potential value that data analytics can bring to justify that investment also is a crucial concern for these organizations.

The challenges hospitals and health systems face on multiple fronts are significant and well documented. The business environment is exceedingly demanding for management teams as they reposition their organizations for strategic growth, competitive differentiation, and sustained financial health.

Hospitals and health systems must excel across multiple dimensions, including financial performance, clinical performance, talent management, and operational efficiency, while making decisions on the strategies and product lines that will best serve consumers in an increasingly competitive environment. The set of initiatives underway in most organizations has increased, but questions persist. Are we focused on the right things within and across dimensions? Are we achieving the results we expect? Are these results ambitious enough now and going forward?

To address these issues and questions, data flow in from claims systems, electronic health records (EHRs), cost accounting systems, satisfaction surveys, wearable devices, patient portals, pharmacy refill systems, and many more sources. But clarity does not come from data alone. Analytics are required to find the signals in the noise of ever-increasing data loads, producing a “return” on analytics.

At the most basic level, the purpose of analytics is to get the right information to the right people to help them make the right decisions and generate the greatest return on analytics based on the ability to:

- Identify opportunities across the many dimensions in which the organization must excel

- Prioritize opportunities based on their size, their importance to the organization, and the effort and resources required to pursue them

- Realize opportunities by providing information that helps monitor and manage the initiatives that have been implemented to secure the returns the opportunities represent

A healthcare organization’s ability to sustain high-value care delivery and ensure its long-term strategic financial viability increasingly depends on how effectively it can apply data analytics to inform improvement efforts related to quality, cost, and patient experience.

To move from identifying strategic opportunities to executing solutions that can achieve each opportunity’s full potential, an organization’s executives require a framework for unlocking the value of data and a clear understanding of the elements required to determine an effective solution to optimize a return on analytics.

Return on Analytics Defined

The range of “returns” on data analytics that executives must seek is broadened by the sheer variety of opportunities available for realizing value across the multiple areas in which hospitals and health systems must excel. Quantifiable cost savings remain an essential form of financial return, but equally essential are returns defined by improvements in other core performance areas, including quality, outcomes, patient satisfaction, and physician and employee satisfaction.

Returns in these areas create value through improvements that grow the organization’s business, such as improving patient care, avoiding payment penalties, attracting top-notch staff, and reducing staff turnover. In many instances, these returns also will have a positive, quantifiable impact on the financial health of the organization. An effective analytics program also can offer net returns by eliminating the waste of energy and resources expended in pursuing initiatives not critical to the organization’s success.

Unlocking the Value of Data

Although data have intrinsic value, a framework is imperative to facilitate understanding of how to exploit that value. Health systems have invested heavily in data infrastructures—systems for collecting and reporting data—but many organizations still lack a comprehensive comparative framework with analytic tools that enable leaders to effectively and efficiently manage performance across multiple dimensions.

A 2019 survey of senior finance executives examines this imperative and its impact nationwide. a A majority of respondents (94 percent) are experiencing increasing pressure to have greater insight into how financial results impact business strategy. An even greater number (96 percent) believe their organizations should be doing more to leverage financial and operational data to inform strategic decisions. In another survey, senior healthcare executives cited a lack of good data and insights into costs and savings opportunities as the top impediment to their organizations’ cost transformation efforts. b

Although analytics can be narrow, limited only to the data generated within an organization, they also can be broadened through the integration of data from sources outside the organization—for example, peer organizations and market data—which bring comparative capabilities and richer context to an analytics program.

Identifying and Prioritizing Opportunities

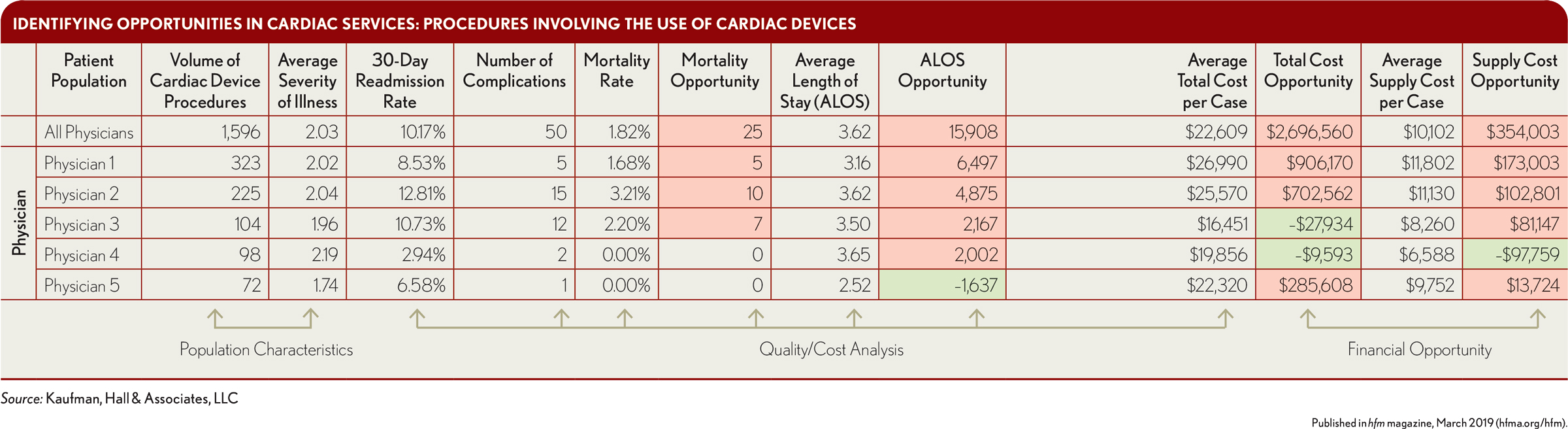

To understand how an organization can begin to realize the potential value of comparative analytics for identifying and prioritizing opportunities, consider the differences in the use of cardiac devices by five physicians in one organization’s cardiac services department, as shown in the exhibit below.

By compiling internal data on patient characteristics and outcomes across the cardiologists who practice at a facility, the organization could construct benchmarks, defined, for example, by the outcomes of its top-performing cardiologists or by an average of outcomes across the group. These metrics, in turn, would identify the opportunities available if all the cardiologists associated with the facility were to perform to the benchmarks. Data on individual physicians would identify which physicians should focus on improving their performance, and which areas (e.g., length of stay, readmission rates, supply costs) would require the most attention.

The top row identifies performance measures of value for the department, including the following:

- Population/patient characteristics (e.g., severity of illness)

- Quality metrics with cost/penalty impact (e.g., complications, 30-day readmission rate)

- Cost metrics (e.g., average cost per case, average supply cost per case)

The first row, “All Physicians,” identifies the performance of department physicians all together across nearly 1,600 cardiac device procedures.

The bottom portion of the exhibit shows data and opportunities for the top five physicians in the department, as defined by volume of cases. The red boxes indicate where performance improvement could yield improvement opportunities with specific related dollars if all physicians performed at the best-practice level; the green boxes indicate where performance is better than average, thereby indicating an opportunity for improvement through adoption by all physicians of the best practices.

Using this analytic tool, the organization’s leaders identified almost $2.7 million of cost-reduction opportunities, about $354,000 of which could come from supply-cost savings, and opportunities to reduce mortality and complications to zero or one. If the organization were to implement a performance improvement initiative based on this information alone, it certainly could realize some return on its analytics as measured by improvements in both quality and cost.

Addressing Unanswered Questions

This analysis would leave several questions unanswered, however, and being able to answer these questions could change the organization’s understanding of both the scope of the opportunity and the value of pursuing it. Examples of considerations that raise such questions include the following.

How the opportunities available for this service line compare with those for other service lines. What if an analysis of opportunities for total joint replacements identified even greater opportunities? Depending on the resources available, the organization may prioritize the total joint replacement opportunities.

The department’s performance relative to other cardiology groups/departments. What if the outcomes for top-performing physicians in this group still trail outcomes for cardiologists at other facilities within the system, or at other peer organizations? If so, the potential opportunities for improvement could be significantly greater. On the other hand, if the lower-performing physicians in this group still outperform other cardiologists within the system, the effort and resources needed to match performance of others to the top-performing physicians in this group might be greater than realized.

The prospect for future market growth of the selected service. If an analysis of market trend data were to indicate the likelihood of increasing demand for the selected service, the organization might want to prioritize an improvement initiative within the service area.

Understanding Opportunities

With each analysis, the organization’s decision-makers gain important new information that helps them understand the nature of each potential opportunity.

The size of the opportunity. If an entity (i.e., group, department, or organization) is underperforming compared with benchmarks derived from peer organizations, the size of the opportunity for clinical and financial gains may be significantly greater than originally realized.

The importance of the opportunity. If the analysis indicates the prospect for strong financial and clinical performance across the service line and growth within key demographics of the market served, a focus on performance improvement within a selected service may contribute significantly to system revenues and business growth.

The effort required to realize the opportunity. If the analysis indicates, for example, that most of the clinicians significantly outperform clinicians at other organizations, the effort to further optimize the selected service may prove difficult, requiring a significant commitment of resources. Comparative analytics can provide a barometer that helps an organization set challenging but achievable improvement goals.

With an understanding of the size, importance, and effort required to realize various opportunities, the organization can compare, prioritize, and decide which to pursue.

Realizing Opportunities

Securing a return on analytics depends on realizing the opportunities that an effective analytics program can identify and define, but putting an initiative into place does not guarantee the initiative’s success. Progress on key indicators must be regularly monitored to ensure the desired outcome is achieved and to course correct, as necessary. An effective analytics program tied to a comprehensive performance management program also enables decision-makers to maintain a view across interdependent indicators to ensure that progress on one front does not have a negative impact on another.

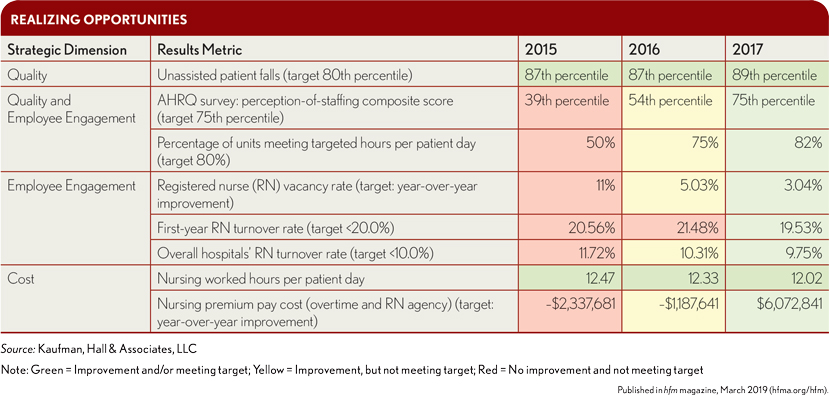

An example from a health system that implemented an analytics-driven initiative for nursing-workforce optimization underscores the need to monitor indicators across a range of strategic dimensions to ensure gains in one area are not offset by losses in another: The health system’s initiative involved applying an algorithm-based, predictive-analytics model to historical patient census data at the hourly level to predict how patient demand for nursing staff would fluctuate across units over the course of the day and to optimize nursing staff levels to meet that demand. The goal was to provide the best patient coverage at the lowest possible cost. The analysis also looked at current constraints on staffing (e.g., a requirement that nursing staff work every third weekend) and modeled the impacts of changes to those constraints (e.g., moving to a model that required nursing staff to work every other weekend).

Dimensions of strategic focus potentially affected by the initiative included quality of care, employee engagement, and cost, with specific metrics and targets assigned to each, as shown in the exhibit below. If reductions in cost from the optimization effort were to negatively affect either quality of care or employee engagement, the potential for cost savings could be significantly diminished, reducing the value of the initiative.

From a baseline in 2015, the health system tracked the impact of the initiative across indicators for all three dimensions mentioned above. With few exceptions, the system saw steady improvement across the indicators, as depicted by the movement from red to green boxes in the exhibit. By the end of an 18-month implementation in 2017, the initiative was a success, with measurable returns across all three strategic dimensions.

The outcomes for this initiative also illustrate the different ways in which a return on analytics can be measured. One return was quantifiable cost savings of more than $8 million from improved spending overall on overtime and agency pay over the two-year period. Another return was an almost 2 percent reduction in overall registered nurse turnover.

Finally, and perhaps most important, improvements in both a key safety metric (unassisted patient falls—improvement to the 89th percentile benchmark) and the staff’s perception of the impact of unit staffing on patient safety (up to the 75th percentile benchmark, which could contribute to lower turnover rates) demonstrated measurable returns on the quality of care and employee engagement.

Optimizing the Return

To fully realize a return on analytics, hospitals and health systems require effective analytics—a requirement that many organizations are still struggling to meet. The following four challenges posed by analytics and performance reporting tools were most often cited by senior finance executives responding to the 2019 survey:

- Creating better dashboards and visuals (67 percent of respondents)

- Pulling data from multiple sources into a single report (64 percent)

- Accessing clean, consistent, and trusted data (52 percent)

- Drilling into reports to understand underlying data (50 percent)

Finance and other administrative executives and managers also struggle with the timeliness of enterprise-level data, which typically range from nine months to two years old, according to the survey respondents.

Elements of an Effective Analytics Solution

Key elements of an effective analytics solution include:

Structure and cleanliness of data. Health systems receive data from multiple sources and systems, and it is important systems be in place for accurately classifying and standardizing the data to ensure the data are credible and comparable. Much of this work can be automated using machine learning and algorithms. Data that have been appropriately classified and standardized should then serve as a “single source of truth” for analytics within the organization.

Timeliness of data. The timeliness of data will vary depending on different analytic needs, which can include retrospective, real-time, and prospective analyses. Historical data are valuable in analyzing trends and predicting future needs. At the same time, year-old data will not be sufficient because more current data are required for monitoring the progress and impact of ongoing initiatives to support real-time decision-making. Although quarterly or monthly scoreboards and dashboards have been used by leadership teams for decades, an effective analytics solution should transform these tools into living documents to provide detailed and up-to-date information, refreshed monthly, to ensure initiatives stay on track.

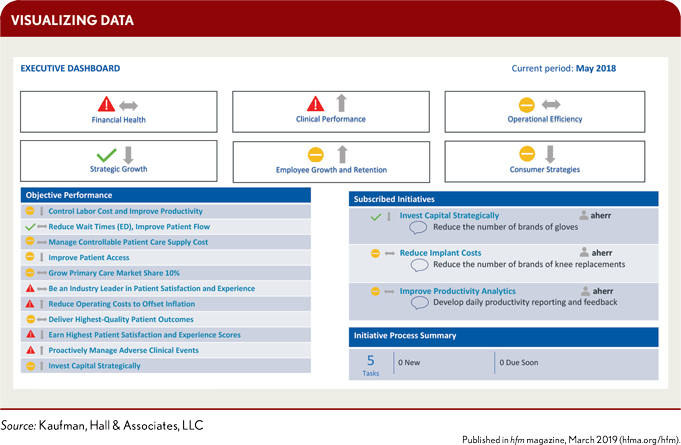

Appropriateness of data. Depending on an individual’s role within the organization, data needs can range from broad and general to narrow and specific. Members of the senior executive team require a broad view across the organization and the ability to quickly discern general performance trends in key strategic dimensions. The labels for these dimensions will vary across health systems, but they typically include financial health, clinical performance, operational efficiency, strategic growth, employee growth and retention, and consumer strategies. At the managerial level, a more focused and deeper view into specific initiatives is required. The managers who are accountable for these initiatives will require data on specific metrics and indicators to inform them of how the initiatives are progressing.

Accessibility of data. Individuals at all levels of the organization should be able to easily drill down into their reports for details about initiatives, such as who is accountable for specific targets or goals, whether goals are being met, and what execution risks exist. As a complement to data appropriateness, data accessibility enables users to pursue questions arising from their review of initial reports.

Visualization of data. Data should be visualized in a way that enables users to quickly identify areas requiring attention. For example, the exhibit below shows a simple dashboard solution that color-codes progress on initiatives as green (on target), yellow (at risk), and red (in trouble). Further information is provided by arrows that indicate whether progress is trending up (positive), steady (neutral), or down (negative). In addition to providing an overview of performance across the organization’s four strategic dimensions, the dashboard provides immediate access to initiatives the user is monitoring, and clear reminders of tasks that need to be completed. Consistent use of these features throughout a system’s report ensures users can easily access and comprehend information as they drill down through layers of reporting.

Generating a Cycle of Returns

The ability to identify opportunities for improvement, prioritize opportunities of greatest potential return to the organization, and monitor the progress and impacts of initiatives implemented to realize those returns helps executive and management teams find the signals in the noise of data. Organizations can perform at their fullest potential by excelling in the continuous cycle of strategy to execution, as shown in the exhibit on page 57, with the support of context that robust, comparative analytics can provide.

Important too is an analytics approach that addresses organizational and user needs for timely, accurate, accessible, and actionable information. They then will be positioned to generate a cycle of returns across the strategic dimensions defining success for hospitals and health systems today.

The authors would like to thank Brian Cole, assistant vice president at Kaufman, Hall & Associates LLC, for his assistance with this article.

Footnotes

a. Spence, J., and Sussman, J., 2019 CFO Outlook: Performance Management Trends and Priorities in Healthcare , Kaufman, Hall & Associates, LLC, 2019.

b. Robinson, L., Seargeant, D., Goetz, K., and Fitz, T., 2018 State of Cost Transformation in U.S. Hospitals and Health Systems: Time for Big Steps, Kaufman Hall, 2018.