How healthcare providers can conduct a consumer-focused pricing strategy

As healthcare becomes increasingly consumer-focused, with rising consumerism, transparency, high-deductible health plans, and transitions from volume to value, healthcare providers have a growing need to develop a pricing strategy that improves their market competitiveness.

To realize the market opportunities available in today’s new consumer-driven healthcare industry, providers require a pricing strategy that gives them a competitive advantage in appealing to consumers who can now shop for product and network benefits and make choices among equivalent healthcare services for those with lower price points. (See also the sidebar highlighting seven macro trends that are having an impact on providers, insurers and consumers today.)

A fundamental step in developing a pricing strategy is to perform a strategic pricing assessment, the key elements of which are outlined below.

Questions to answer as part of the strategic pricing assessment

The first part of any strategic pricing assessment should be focused on answering three questions:

- For which services is there a high ability to optimize price?

- For which services is there a moderate ability to optimize price?

- For which services is there a low ability to optimize price?

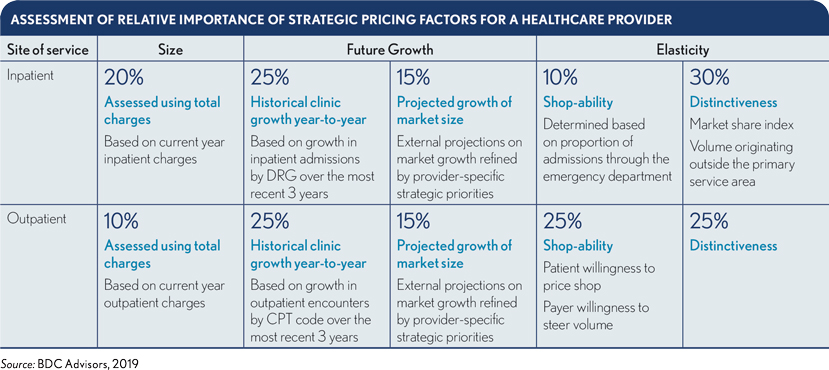

These questions must be answered at a granular level for the assessment to produce actionable findings. For inpatient services, pricing should be evaluated at the DRG or sub-service-line level. Outpatient services should be reviewed at the Current Procedural Terminology (CPT) or Ambulatory Payment Classifications (APC) level.

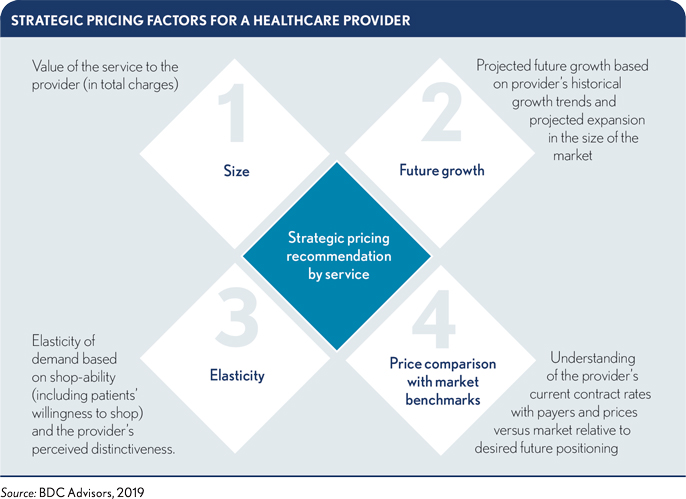

The evaluation invariably should include four foundational factors with respect to each service being analyzed:

- Size and scope

- Growth potential

- Elasticity of demand

- Price compared with market benchmarks

The weighting of strategic pricing factors will likely vary based on important considerations, such as market segment, population demographics, type of service (e.g., inpatient, outpatient, professional) and other external factors. Notwithstanding these variables, the exhibit below provides a general framework for relational weighting among foundational factors.

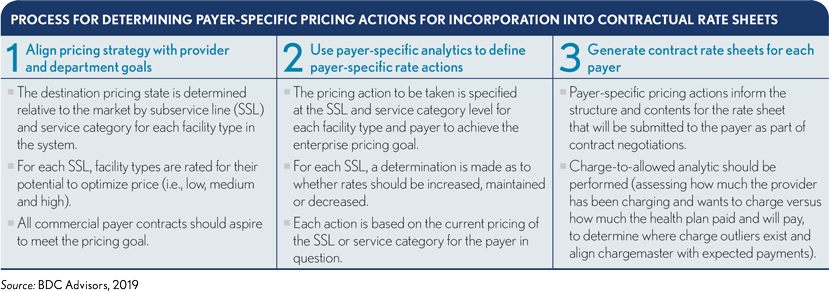

Once a strategic pricing algorithm has been applied to determine the provider’s ability to optimize price at a granular level, pricing actions should be developed at a payer-specific level. These pricing actions should subsequently be incorporated into contractual rate sheets to be negotiated with each payer as outlined in the exhibit below.

To be able to seize strategic pricing opportunities, providers must build value using data and analysis. Today’s huge growth in the availability of healthcare information for analytics is greatly improving providers’ ability to harness data to drive innovation and predictability in clinical and business models. Those that can use data analysis may develop a distinct competitive advantage by rationalizing variable costs and shifting sites of care delivery to manage total cost of care.

Objectives to meet for successful pricing strategy

In addition to developing a pricing strategy that responds to strategic market imperatives, providers should pursue the following objectives:

- Ensure the pricing structure is logical

- Furnish patients with estimates before delivering care

- Understand the organization’s cost to deliver services (i.e., basing contract preparations and negotiations on margins, not revenues)

- Ensure pricing is visible and understandable

- Establish a proactive process for applying pricing strategy to maintain margin

Elements of a comprehensive approach

The specific elements of any comprehensive, consumer-focused pricing strategy should be tailored to the organization’s particular market, market position, and financial and operational objectives. Following, for example, are key actions some health systems have used to develop a comprehensive pricing strategy in their increasingly consumer-focused markets,

with steps required to complete each action.

Perform a market analysis. The analysis should include the following steps:

- Profile evolving patient benefit design, price, network and quality positions, especially high-deductible offerings, in the market.

- Identify consumer-driven, market-responsive issues and opportunities in the market.

- Develop standardized tools and reports to capture market-based and margin-based information.

Conduct a financial analysis. Two steps are required to complete this action:

- Leverage database tools to inform actions based on operating margin, not on revenue.

- Identify financial contributions from care delivered at alternative sites of service (e.g., using hospital-level profitability data and sub-service line level data to compare costs of surgery at a hospital outpatient department versus a freestanding ambulatory site).

Set pricing strategy. This action requires a four-step process:

- Develop overall pricing principles and strategy (e.g., cover direct and allocated costs, and set prices with a range of competitors, as long as competitors are not buying market share).

- Identify tactics to shift revenues from services vulnerable to consumer shopping to other areas, with special attention to tertiary and quaternary service volume and pricing, secondary care premium pricing, commodity services and regional differences.

- Conduct sensitivity analysis around future market scenarios to test pricing strategy and tactics.

- Finalize pricing by service, by site.

Implement and realize pricing. The chargemaster must be aligned and maintained to be in sync with updates to payment rates and market tactics.

Benefits of a pricing strategy

Deploying the pricing strategy approach outlined above, and accounting for unique features of their markets and organizations, some health systems realized the following improvements in both patient volume and payer contracts:

- A New York academic health system increased its incremental lives in preferred provider organization and point-of-service plans by 300,000, thereby achieving $360 million in revenue among a network of 3,500 physicians, 32 hospitals and 12 post-acute care facilities.

- A 400-bed academic medical center in California gained $10 million in new volume and $26 million in its payer contracts.

- A Florida academic health system implemented managed care rate benchmarking and increased operating margin by $34 million.

- A southeast health system identified rate improvement opportunities of up to $30 million across major payer segments and improved its payment yield by $65 million to $85 million annually.

Keep step with the evolving consumer focus

Insurance product design will continue to move toward consumer-driven elements, and managed care elements will be reshaped into forms in which consumers choose but are subject to incentives, largely structured by insurers. Providers that develop effective pricing strategies and focus on data collection, aggregation and analysis to support patient choice and evaluate provider and service delivery performance through registries, observational studies and clinical epidemiology will emerge as winners in a more consumer-focused universe.

(See also the sidebar on the origins of healthcare’s new consumer focus.)