The CFO’s role in driving value in healthcare through informed collaboration

To prepare their organizations for success under value-based payment, provider finance leaders should step up to foster close alignment between their organizations and health plans.

Moving from theory to practice in value-based payment has proven more difficult than was originally anticipated. Although the promise of a focus on value — higher-quality, more cost-effective and efficient care — remains compelling, progress has been hampered by the sheer complexity of the steps required to achieve that promise.

A 2018 survey of health plan executives and physicians suggests that the move away from fee for service may have even lost ground due, in part, to difficulties in forging payer-provider alignment around value.[1] Success will remain elusive without a deeper level of commitment and trust among all key stakeholders. The care process must be more closely aligned with the economics that pay for and reward high-quality care and appropriate utilization and a healthcare organization’s fundamental administrative framework.

The promise of clinical and financial success is what drives payer-provider collaboration under value-based payment models. When providers see the benefits of partnering with health plans, they are more likely to embrace the idea of sharing the risks and rewards of good outcomes and reduced costs. And health plans that have experienced success from collaboration are more likely to work with providers to define the parameters of shared risk, determine how to define and measure success and identify the required tools and resources.

Actions steps for each alignment area

Sustainable improvements in healthcare quality and cost will be possible only if health plans and providers are aligned clinically, economically and administratively. This alignment requires effective communication, commitment, data, action and transparency not only between partners but also with patients. Healthcare finance executives can take the following action steps in each alignment area described below, keeping in mind that the integration of clinical and financial data is key.

1. Clinical alignment

When health plans and providers began their value journey a decade ago, clinical-alignment efforts were focused primarily on two goals:

- Identify the best evidence-based treatments.

- Achieve consensus on what constitutes appropriate care

Today, stakeholders take a much broader view of clinical alignment, seeking to seamlessly coordinate care and decision-making across the care continuum. This coordination requires a data-driven, tightly integrated approach that considers not only claims, quality and outcomes data but also factors that can complicate care management, including social determinants of health (SDOH) that influence patients’ ability to adhere to treatment plans.

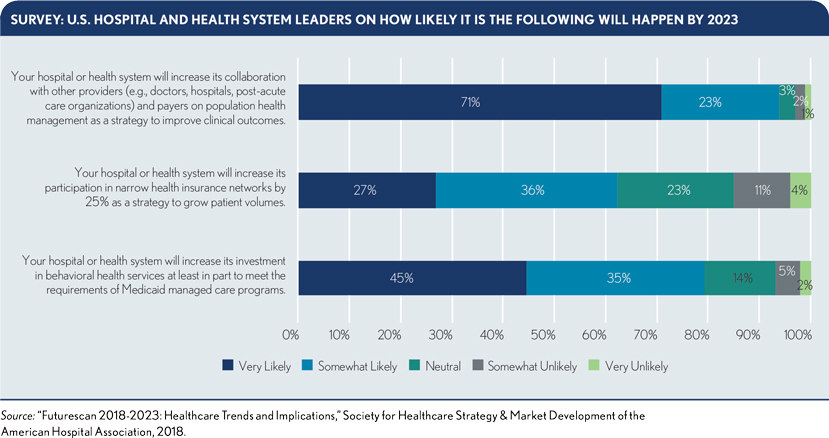

For example, more health plans are taking the lead on care management for complex populations by providing on-site assistance, such as embedded care managers for Medicare Advantage patients.[2] Meanwhile, seven out of 10 hospitals and health systems say they will increase collaboration around population health to improve clinical outcomes (see the exhibit below).

The finance leader’s role. Provider finance leaders should work with payers to develop a tightly integrated approach to care management. They can help bring payers and clinicians together around meaningful quality metrics based on careful analysis of claims data for covered populations, electronic health record (EHR) data and data from employer health initiatives. The goal is to create a care management model that:

- Uses high-tech tools to effectively engage members in managing their health

- Eliminates duplicative efforts by payers and providers

- Maintains open lines of communication when team members encounter hurdles in achieving key metrics or the need to adjust approach

Successful models also engage members in behavior change to more effectively manage their conditions, improve health and reduce their use of high-cost services, as seen in the sidebar.

Ultimately, payers and providers should have a single, shared clinical perspective. They should understand and assess their organizations’ data environment and value to ensure it contributes to providing a single source of truth across all areas of alignment.

To this end, the finance leader should oversee formation of the multidisciplinary team charged with maintaining and applying this single source of truth. The team should include administrators as well as payer informaticists, payer finance executives and other key parties who can help ensure the organization has enough clean, accurate data from various sources to paint a complete, holistic picture of the population, including SDOH and other nonclinical factors.

2. Economic alignment

A decade ago, economic alignment meant agreeing on cost of services through contracting. Bundled payments for episodes of care were in their infancy. So, too, was the idea that payers and providers share accountability for addressing the chronic diseases that account for most healthcare spending. Meanwhile, pay-for-performance models remained focused on rewarding specific actions of the care team.

Today, incentives have evolved to focus more globally on outcomes. However, greater collaboration between payers and providers is still required around:

- How bundled payment initiatives should be structured

- What constitutes an episode of care

- How patients are attributed to the provider

- How and when to apply novel treatments

- To what extent are payers and providers responsible for addressing SDOH

The complexities surrounding implementation and management of shared-risk models such as bundled payments are one reason why adoption of alternative payment models has hovered around 30%.[3]

Given that risks invariably shift costs, payer-provider transparency is critical to achieving the economic alignment needed for shared-risk arrangements to take root. Although many organizations have struggled to combine claims and clinical data to create a single source of truth, those that succeed gain insight into effective shared-risk arrangements.

This full-data perspective provides a more accurate picture of the quality, cost and efficiency of care for complex populations. Physicians also are more likely to trust the analyses, providing a basis for meaningful economic incentives that drive behavioral change, and for appropriate quality metrics that close care gaps for complex populations. The other result is reduced cost.

The finance leader’s role. Provider finance leaders are uniquely positioned to promote increased data sharing and analysis between payers and providers to help uncover impediments to behavioral change needed to improve financial performance.

For example, payers and providers have long regarded annual wellness visits as a means to create value by identifying and mitigating health risks at their earliest stage. Yet the economic benefits have remained elusive because this strategy often has not been executed effectively. An analysis of Medicare data from 2008 to 2015 found fewer than half of primary care practices offered annual wellness visits and fewer than 20% of eligible Medicare beneficiaries received them.[4] These results suggest a need for new senior wellness models, including telehealth support, with assistance in incorporating new visit types into clinical workflows and appropriate funding models.

Finance leaders and their payer counterparts should collaborate to support analyses that look for such breakdowns in value creation and provide the transparency and insight for closing the value gaps.

For example, many health plans recognize physicians who have a demonstrated track record of appropriate utilization and improved member outcomes in various ways, including listing them as excellent providers in the plan’s network directory and providing them with a better fee schedule and a lower administrative burden.

Meanwhile, leading health plans also use their extensive data to encourage providers who deliver lower value to improve their behavior, comparing their metrics with those of their peers who produce better outcomes.

Key questions finance leaders should ask in the pursuit of economic alignment include:

- What metrics will the organization use to determine and define success? How will the organization gain the payer’s buy-in on those metrics?

- What is the right incentive to accept? What role should the payer play in providing incentives?

- What ancillary benefits will economic alignment with the payer yield? And how will it affect revenue cycle metrics?

Asking the questions from the third bullet above, for example, might show that an initiative aimed at lowering readmission rates would not only reduce excess costs and improve the provider’s readmission numbers, but also likely have a positive impact on other key finance figures such as discharged not final billed, disbursement authorization requests and denials.

3. Administrative alignment

Administrative alignment between payers and providers used to mean providing technology solutions to support adherence to payer guidelines — for example, by automating prior authorization, enabling e-prescribing and removing inefficiencies in claims submission, payment and appeals.

Today, despite technological and operational advancements, physicians still bear a heavy administrative burden. To drive measurable and sustainable improvement, providers should invest in infrastructure solutions such as community health information exchanges with built-in alerts that tell providers and staff when patients have visited the ED or require transitional care, and 24-hour hotlines staffed by nurses to help answer questions from patients who have medically complex conditions before their conditions require emergency treatment.

The finance leader’s role. Provider finance leaders can take the lead in identifying payer-enabled infrastructure investments that could significantly enhance physicians’ ability to improve member outcomes while reducing costs.

The finance leader should start by examining areas of unmet need for the member population. Areas to consider include the organization’s proficiency with post-discharge follow-up and whether the organization is fully capable of managing chronic conditions to support participation in value-based payment models. Then, the finance leader should convene clinical specialists from both the payer and provider sides to brainstorm administrative solutions that could close those gaps, as detailed in the sidebar.

Provider finance leaders also should consider how their organizations might best collaborate with their payer counterparts to identify significant unmet needs or to set priorities for projects. Recommended starting points for these efforts include:

- Easy-to-accomplish tasks that can deliver a quick win.

- The highest-cost items that will yield the most significant savings.

- The highest priority on both the provider’s and payer’s lists.

Other key questions include the following:

- Can any of the new projects be funded out of capital expenditures?

- Do they fit into the long-term development plans of the organization?

- How do projects align with the organization’s other strategic initiatives, whether clinical or related to community, organizational growth, physical infrastructure or quality and efficiency?

Achieving next-level collaboration for value

Moving the industry to the next level in its transition to value, where providers are fully engaged in value-based payment arrangements, will require a new level of payer-provider collaboration, where provider finance executives take the lead in creating clinical, economic and administrative alignment between the organizations.

By identifying the right metrics to gauge performance, participating in multidisciplinary quality improvement meetings to identify resources required to boost performance and acting as champions for clinicians in discussions with payers, finance leaders can effectively guide their organizations to success under value-based payment models.

Footnotes

[1] MarketWatch, “New study reveals stalled progress toward value-based care,” press release, July 17, 2018.

[2] Hostetter, M., “Case study: Aetna’s embedded case managers seek to strengthen primary care,” The Commonwealth Fund, accessed July 10, 2019.

[3] LaPointe, J., “29% of healthcare payments under alternative payment models,” Revcycle Intelligence, Reimbursement News, Oct. 31, 2017.

[4] Tipirneni, R., and Langa, K.M., “A key challenge for Medicare’s annual wellness visits: spreading the benefits to underserved seniors,” HealthAffairs, Feb. 15, 2018.