How health systems can adapt their approach to credit management and debt capacity to marketplace changes

Shifting trends in health system revenue require healthcare organizations to rethink their credit positions and debt capacity.

The business model

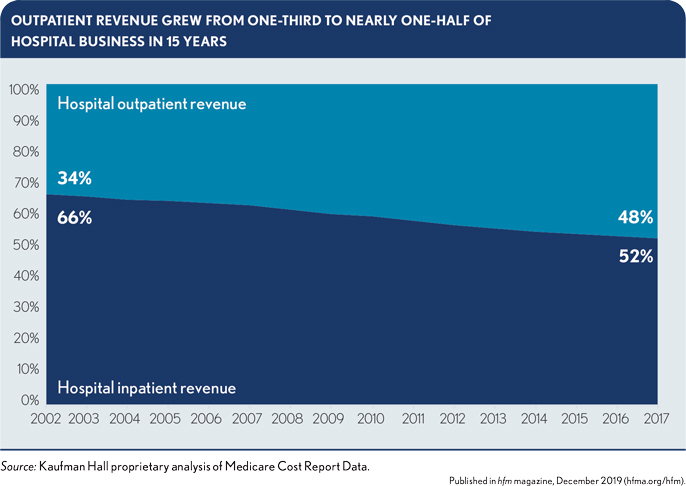

Care delivery is shifting from inpatient to outpatient services. In Medicare, the amount of revenue derived from outpatient services almost equals revenue from inpatient services. Adding commercially insured patients to this mix would bring most revenue from outpatient services. As this shift continues, the healthcare business model also will shift from a wholesale to a retail orientation. These factors require rethinking an organization’s credit and its ability to take on debt.

The competition

As the healthcare business model changes, health systems become more vulnerable to new market entrants unburdened by legacy inpatient service costs and often backed by private-equity investors or the capital resources of large national companies, such as CVS Health, Amazon and Walmart. As these new competitors move into the market, health systems will have to reconsider their definition of peer organization and the metrics they use to evaluate performance and define success.

The investors

Investors and capital markets have responded to these changes with increased sophistication. The rating agencies view their credits through the perspective of refined qualitative and quantitative reviews that bring both greater transparency and greater complexity to rating analyses.

The need to adapt

To survive, health systems within the evolving marketplace need to adapt, which will require the following.

A more sophisticated understanding of the organization’s story. Rating agency efforts to bring greater transparency to their methodologies have sparked debate on what is truly important for an organization’s credit and have reinforced the significance of qualitative factors.

A more sophisticated understanding of the organization’s market. This requirement includes the need for a clear understanding of the organization’s position within the market.

Better data and analytics. Health systems need real-time data and analytics to better understand organizational and environmental trends as they happen and to better inform the organization on how credit, debt and capital capacity will be affected over the near and medium term.

A developed point of view. The ability to tell the organization’s story also depends on a point of view that incorporates positions on its relative strengths within a dynamic market, its need to achieve or maintain a certain credit rating, its most significant operational risks, its short- and long-term strategic priorities and its appetite and tolerance for capital and credit risk.

Organizational perspectives on debt capacity

Debt capacity also must evolve to reflect a more nuanced understanding of internal risk management and external access and cost considerations.

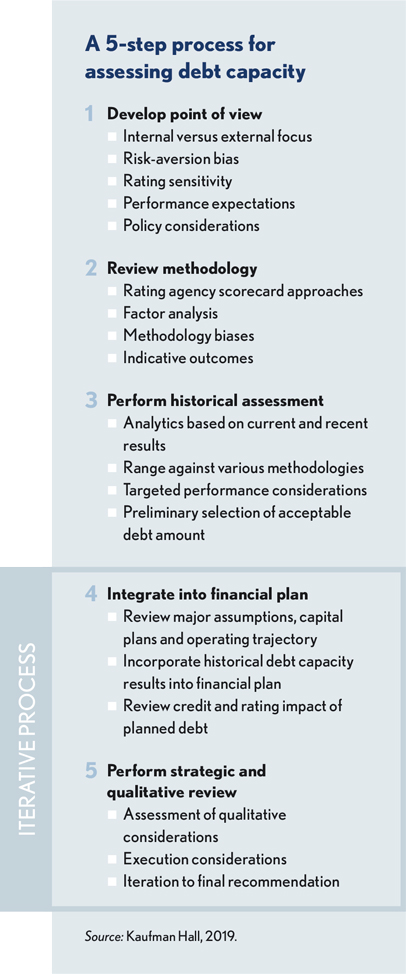

A reassessment of organizational debt capacity requires a five-step process.

Step 1 — Develop point of view on external debt. A full and frank assessment of the organization’s position on external debt is required. Key questions include the importance of achieving a certain credit rating, the level of sophistication of organizational leaders and board members on debt capacity and external factors that could strongly influence debt decisions, such as community image or sponsorship.

Steps 2 and 3 — Balance external investor perspectives with internal risk management. Organizations should understand how a change in debt capacity would be viewed by external investors and the credit rating agencies. Each rating agency has its own methodology to determine credit ratings. Using guidance from the rating agencies, the organization should estimate the point when additional debt would negatively impact its rating or take the rating below the minimum level it wants to maintain. Rating agency perspectives should be balanced with internal risk parameters, as defined by key indicators of coverage, liquidity and capitalization. Beyond credit scorecards, the organization is ultimately responsible for its debt and must understand its own comfort level.

The results of the debt capacity analysis are then run against the organization’s historical financial performance to highlight an existing range of debt capacity. Because it is based on historical performance, this number should be treated as a starting point, reflecting what is possible today but not yet accounting for projected future performance.

Step 4 — Test capacity for additional debt against near- and long-term plans. From a starting point of historical debt capacity, debt issuance assumptions should be flowed through the organization’s financial projections. This step incorporates the organization’s capital plans, perspectives on future market position and profitability, and corresponding changes to the balance sheet. This iterative process balances organizational risk tolerance, cost and access considerations and other uses of the funds required to support organizational strategy. Adjustments will likely be necessary to determine an optimal future debt capacity range.

Step 5 — Consider qualitative factors to risk-adjust assumptions based on an ability to bear incremental debt. The final step considers other qualitative factors that could affect the results of the analysis and projected impacts on credit outcomes, modeling the impact of multiple scenarios. Factors could include the competitive environment, management stability, relative risk of strategic plans and any other factors that could have a material impact on the organization’s ability to bear incremental debt.

Additional considerations

Health systems must leverage all available resources to maintain their competitive advantage as the healthcare market evolves. Credit and capital capacity are critical resources as health system leaders strive to adapt. An approach that balances real-time quantitative measures with deep qualitative insights — and external perspectives with internal points of view — is necessary to produce an outcome that addresses the specific credit and capital needs of specific organizations in a changing environment.